How to Scalp the Markets

A note before we start: These particular strategies and trading styles will be discussed more in-depth as we move through the course. However, it is important you first understand the basics at the start so we can move on to other examples and systems more in-depth.

What is Scalping or Scalp Trading?

Scalping is a higher risk trading strategy that if when carried out correctly can offer you higher rewards in faster time.

The reason scalping is so attractive to so many who want to trade the smaller time frames like the 5 minute and 1 minute charts is because there are a lot of opportunities to make trades.

You can scalp in many different markets and you will have trade opportunities opening up every for minutes.

You will be able to jump in and out of trades in minutes. You will also be able to make profits from very small movements that price makes higher or lower.

When trading markets like Forex or Gold with CFD’s you will be able to trade long and short. You will also be able to find trades where price is making a sustained strong trend for a long period.

Scalping can open the way for high reward trades using some very simple strategies.

Why are the Benefits of Scalping?

Scalping is definitely not for every type of trader and you may be suited to other type of trading strategies.

Scalping will often have higher risk levels and you will need to be switched on and watching your charts at all times.

Not only will you need to glued to your screen and watching for potential trades, but when you are in a trade you will need to be monitoring it constantly because the markets can change rapidly.

Think about the following for whether you should use scalp trading;

Scalping is for you if:

- You want to make fast trades

- You want to know if you won or lost quickly.

- You want to find and trade many trades.

- You don’t want to hold your trades overnight.

- You are happy with smaller pip gains (but still healthy dollar profits).

Scalping is not for you if:

- You don’t want to be glued to your computer screen.

- You don’t want to be jumping in and out of trades every few minutes.

- You are more suited to swing trading.

- You are not comfortable with riskier trading strategies.

Is Scalping Day Trading?

In many ways scalping is similar to day trading.

Both scalping and day trading involve getting in out during the one session and not holding your trades.

The major difference between scalping and day trading is that as a day trader you will be finding one or two trades, picking their direction and then holding them for the session.

As a scalper you will be finding and making many different trades often entering and exiting in minutes.

As a scalper you rely on making profits from very small price movements. You are doing this in short amounts of time.

A day trader can often be holding their trades for hours with far bigger pip gains.

Make Trades With Scalping

The best and most successful scalping trading strategies all have the same things in common.

The best scalping strategies have;

- Small stop losses, and very tight risk management.

- The potential to make big running reward profits.

- Markets and / or Forex pairs with small spreads that are not going to eat into your profits.

- Volatility that give you a lot of of trading opportunities.

- Markets that trend on smaller time frames for long sustained periods of time.

The best scalping strategies allow you to find many potential trading opportunities.

These strategies give you the chance to make many different types of trades in many different markets.

It is important you keep in mind your trading costs such as the spreads you will be charged. High spreads will quickly eat into your profits and can make your scalping strategy unprofitable.

When scalping you will be using small stops and the best strategies will allow you to find large risk reward winning trades that will cover your losses and make you profitable.

Scalping With Indicators

One of the best indicators to scalp the markets is the expoential moving average or EMA.

The EMA will help you find the trend in the market and can also help identify just how strong the trend is moving.

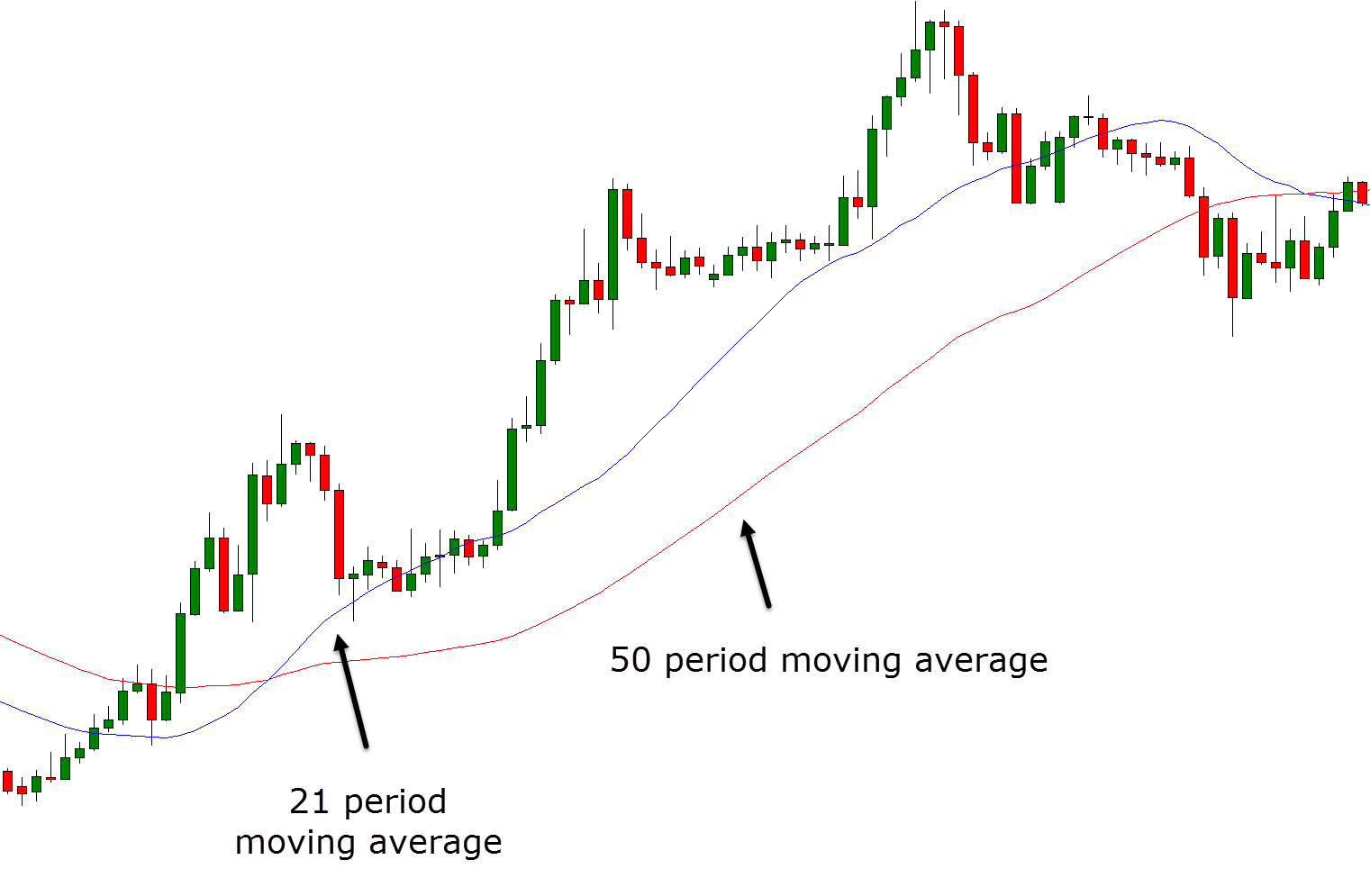

The example below shows two EMA’s added to the chart. These EMA’s are the 21 and 8 period.

When using other trading styles such as swing trading you will use longer period moving averages like the 50 or 200 period, but when scalping you need shorter period EMA’s to find the rapidly changing momentum.

In the example below, the 8 period EMA has crossed the 21 period EMA and price is strongly trending higher leading to bullish long scalping trades.

Trend Trading Scalping Strategy

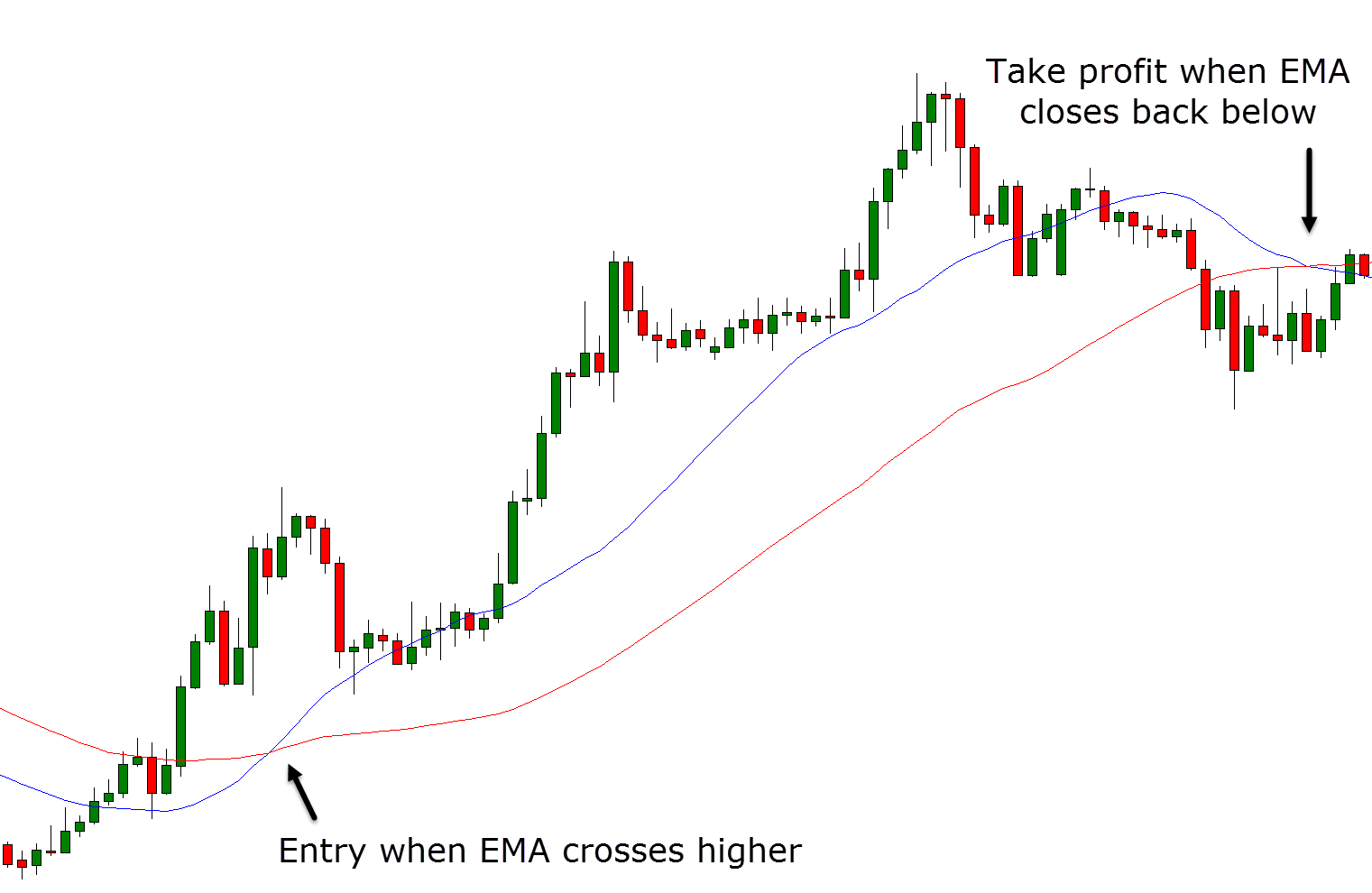

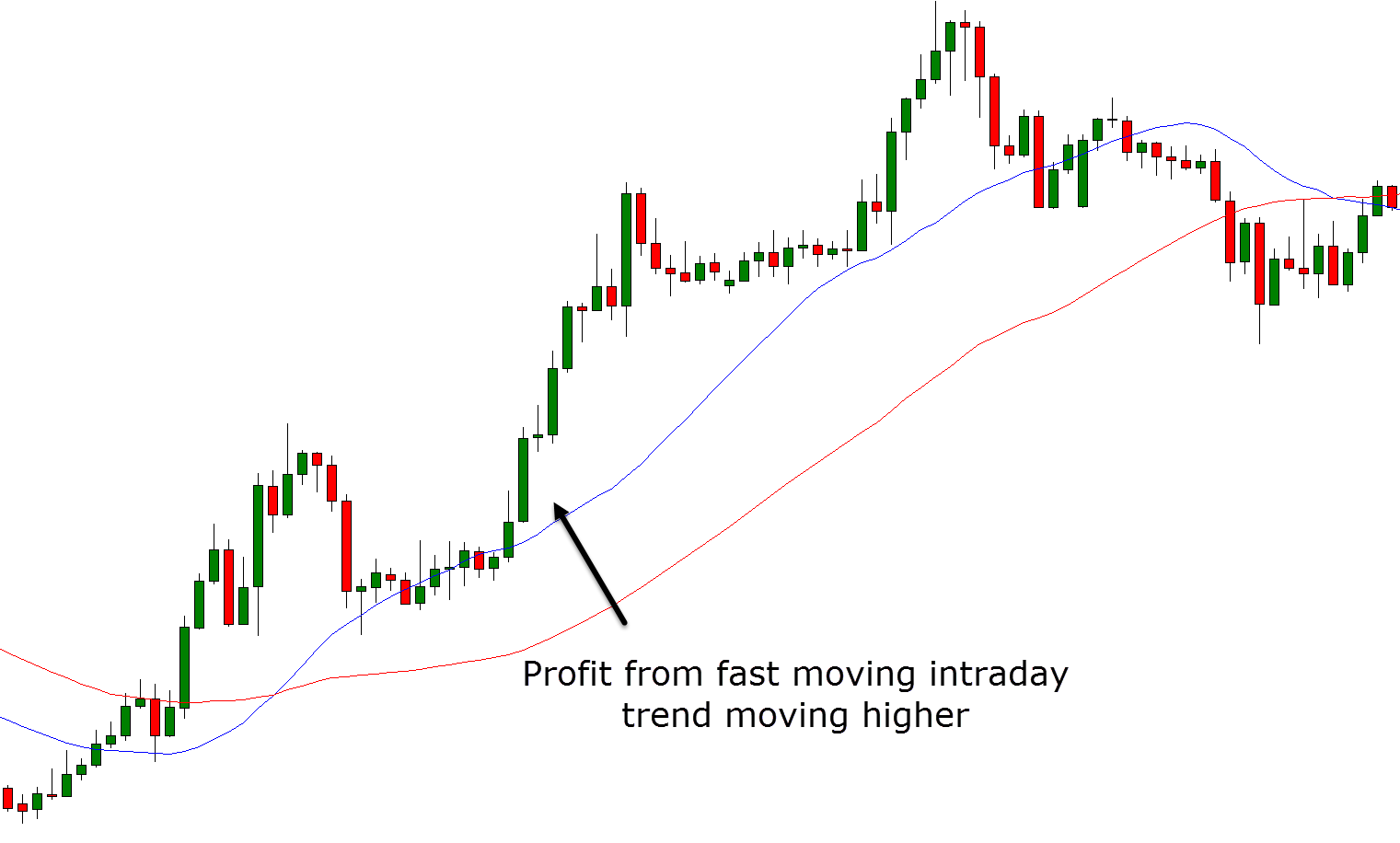

The key to this trend trading scalping strategy is finding a strong trend with a moving average crossover.

When the 8 period moving average crosses the 21 period moving average and begins to widen we can begin to look for trades in the direction of the trend.

For example; the 8 ema moves above the 21 ema and the ema’s begin to widen.

In the example below; the 8 period exponential moving average crosses above the 21 period moving average and starts a strong trend higher.

Trades could then be found using other confluences such as using Japanese candlesticks for entry points or major areas of supply and demand (support and resistance).

The stop loss could be trailed behind either the 8 or 21 period moving average depending on how aggressive you are with your trade management as we discuss later in the course.

Breakout Scalping Strategy

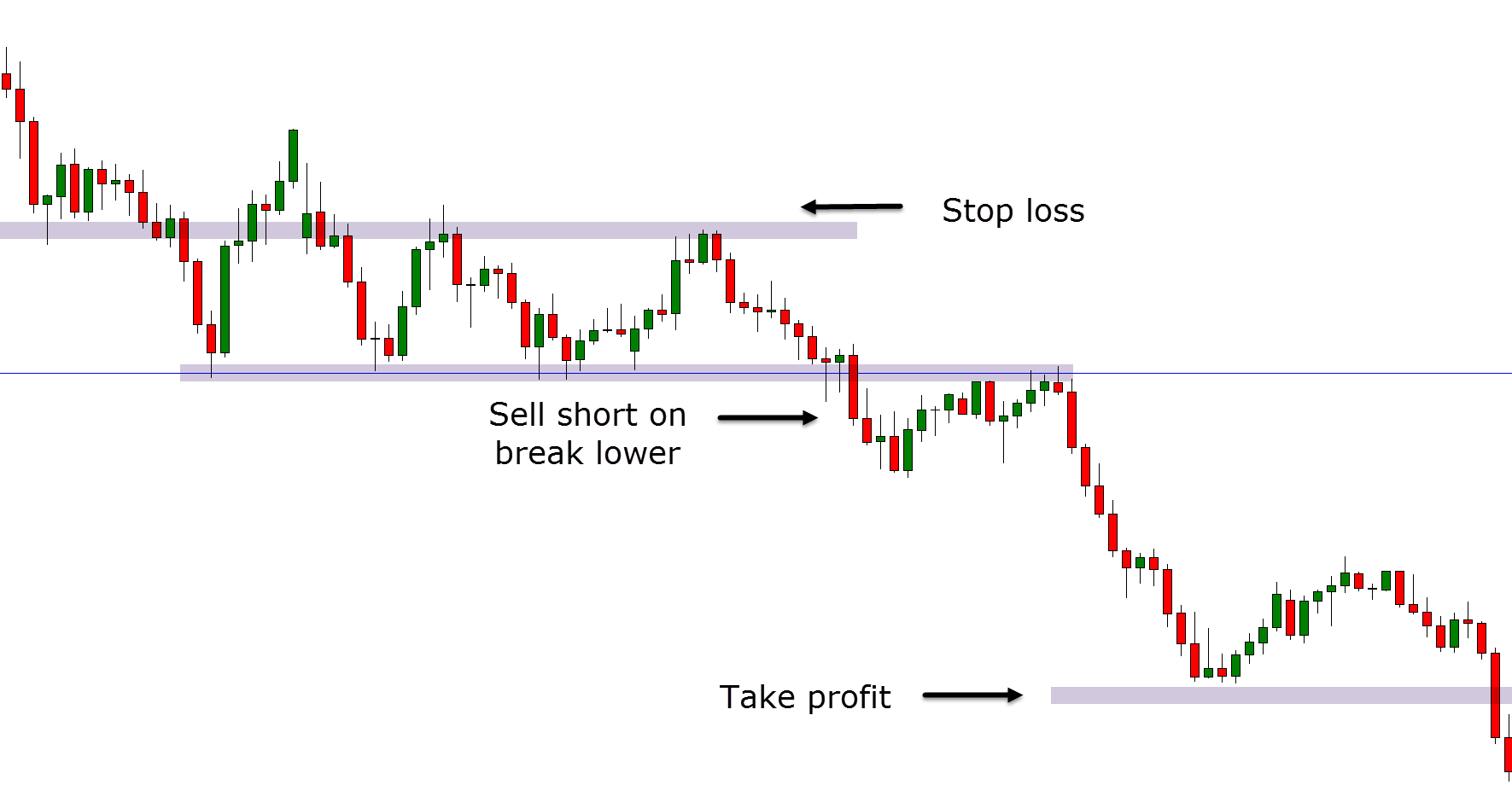

The key to this strategy is first identifying an obvious trend either higher or lower.

Once you have found a trend you are then looking for price to pause or consolidate. This is shown on a chart as price moves sideways.

In the example chart below you can see price was in a strong trend lower before moving into a sideways consolidation pattern (it started to move sideways).

We could then look to play the breakout trade inline with the existing downtrend when price breaks through the support level.