Fixed time trading has emerged as a captivating arena for both novice and seasoned traders, offering a structured approach to navigating the complexities of the financial markets. By leveraging effective trading strategies, traders and investors can unlock the potential of diverse instruments like crypto, stocks and forex trading.

Table of contents

In this guide, we will delve into the essentials of risk management and profit targets, shedding light on how these elements can enhance your trading acumen. We’ll also explore the nuances of trading psychology, providing insights that empower you to make informed decisions with confidence.

Join us as we unravel the intricacies of mastering fixed time trading, equipping you with the tools to transform your trading journey into a successful venture.

NOTE: Get your Fix Time Trading Strategies PDF Guide Below.

Introduction to Fixed Time Trading

Fixed time trading offers a structured approach to financial markets, providing traders with defined time frames and potential outcomes. This section explores the fundamentals of fixed time trading and its advantages for market participants.

Understanding Fixed Time Trading

Fixed time trading is a method where traders predict asset price movements within a specific timeframe. This approach offers a predetermined expiry time and potential payout, providing clarity and simplicity in trading decisions.

Traders select an asset, choose a direction (up or down), and set an expiry time. If the prediction is correct at expiry, the trader receives a fixed payout. This structure makes fixed time trading accessible to both novice and experienced traders.

The key components of fixed time trading include the underlying asset, strike price, expiry time, and payout percentage. Understanding these elements is crucial for developing effective trading strategies and managing risk.

Benefits for Traders and Investors

Fixed time trading offers several advantages that appeal to a wide range of market participants. The defined risk and reward structure allows traders to make informed decisions based on their risk tolerance and investment goals.

One of the primary benefits is the ability to trade in various market conditions. Whether the market is trending, ranging, or volatile, fixed time trading strategies can be adapted to suit different scenarios.

Additionally, fixed time trading provides opportunities for diversification across multiple assets and timeframes. This flexibility allows traders to spread risk and potentially increase their chances of success in the financial markets.

Key Strategies for Success

Successful fixed time trading requires a combination of technical analysis, market understanding, and strategic decision-making. This section outlines essential strategies and explores the role of binary options in fixed time trading.

Essential Trading Strategies

Effective fixed time trading strategies rely on a combination of technical analysis and market insight. Traders often use chart patterns, indicators, and price action to identify potential trading opportunities.

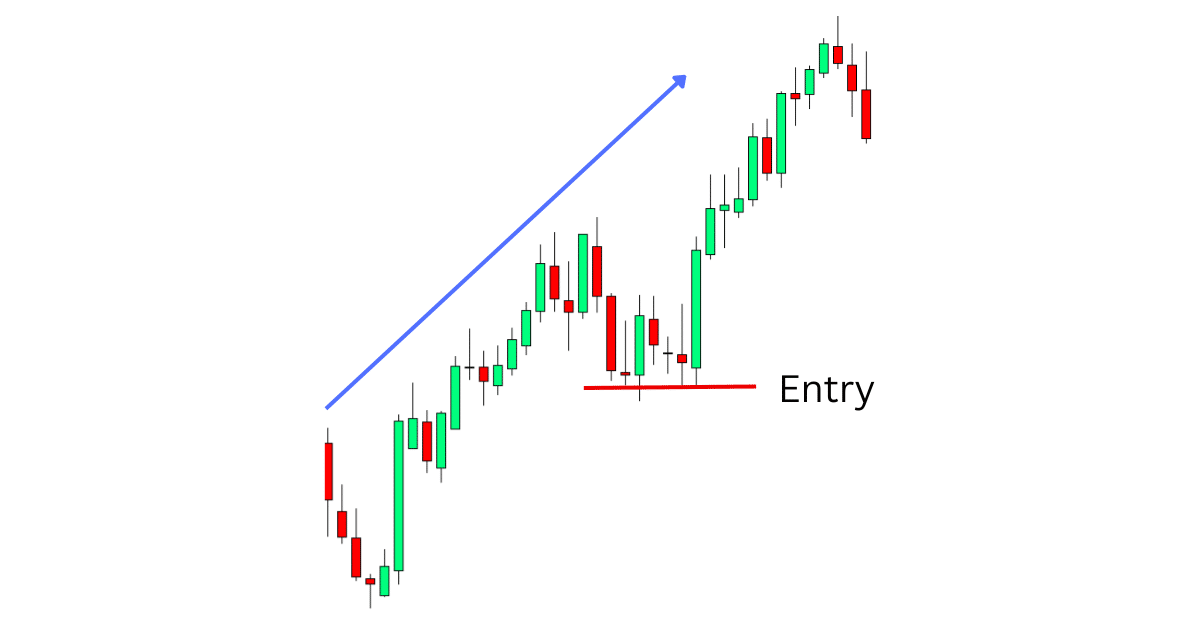

One popular strategy is trend following, where traders aim to capitalize on strong market movements. This approach involves identifying the overall market direction and placing trades in line with the trend.

Another key strategy is range trading, which focuses on assets that are moving between support and resistance levels. Traders look for opportunities to enter trades when the price reaches these key levels.

Support and resistance breakouts offer another strategic approach. Traders watch for price breaks above resistance or below support, which can signal the start of a new trend or continuation of an existing one.

It’s important to note that no single strategy works in all market conditions. Successful traders often combine multiple strategies and adapt their approach based on current market dynamics.

Leveraging Crypto Strategies

Crypto’s are popular instruments for fixed time trading, offering a straightforward yes/no proposition. Traders predict whether an asset’s price will be above or below a specific level at expiry.

One advantage of crypto’s is their defined risk and reward structure. Traders know exactly how much they can gain or lose before entering a trade, which aids in risk management.

Crypto markets can be used with various strategies, including trend following, range trading, and news trading. The key is to align the option’s expiry time with the chosen strategy and market analysis.

It’s crucial to understand that while crypto trading can offer high returns, it also carry significant risk. Proper risk management and a well-thought-out trading plan are essential for long-term success.

Risk Management Techniques

Effective risk management is crucial for sustainable success in fixed time trading. This section explores strategies for setting profit targets and managing risk to protect your trading capital.

Setting Profit Targets

Setting appropriate profit targets is a critical aspect of fixed time trading. It helps traders maintain discipline and avoid the pitfalls of greed or fear in their decision-making process.

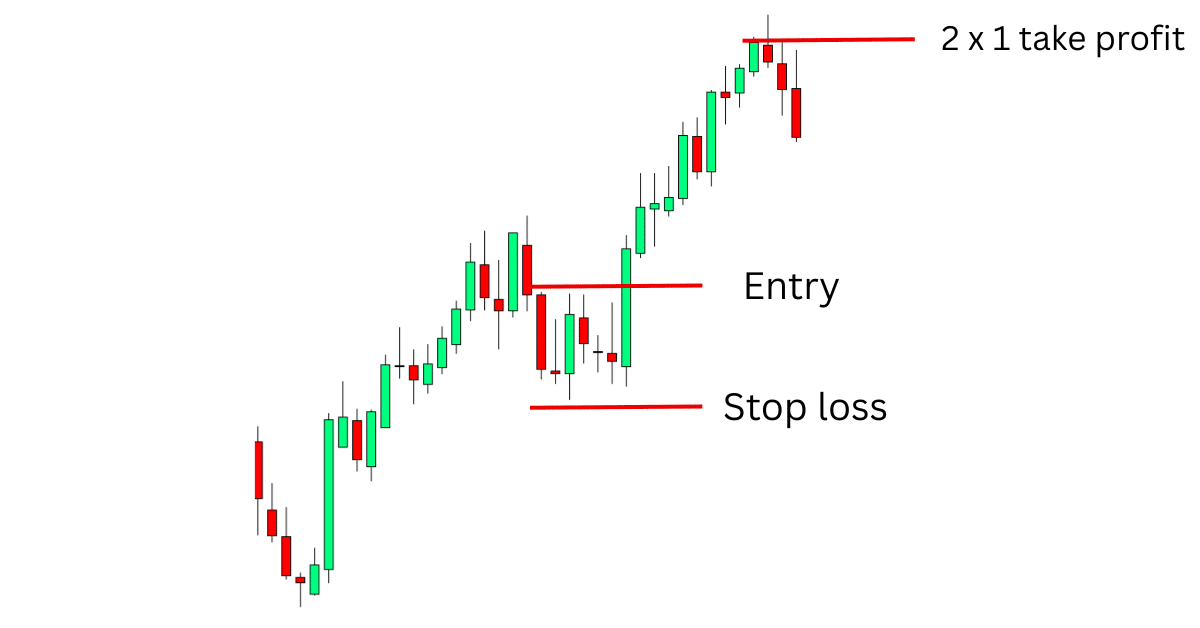

One common approach is to use a risk-reward ratio, such as 1:2 or 1:3. This means aiming for potential profits that are two or three times the amount risked on each trade.

Traders should also consider the win rate of their strategy when setting profit targets. A higher win rate may allow for smaller profit targets, while a lower win rate might require larger targets to remain profitable over time.

It’s important to regularly review and adjust profit targets based on market conditions and strategy performance. Flexibility and adaptability are key to long-term success in fixed time trading.

Effective Risk Management

Risk management is the cornerstone of successful trading. In fixed time trading, it’s crucial to limit exposure and protect trading capital through disciplined risk management techniques.

One fundamental rule is to never risk more than a small percentage of your trading account on a single trade. Many professional traders limit their risk to 1-2% per trade, ensuring that a string of losses won’t significantly deplete their capital.

Diversification is another key risk management strategy. By spreading trades across different assets and timeframes, traders can reduce the impact of poor performance in any single market or strategy.

Stop-loss orders, while not always applicable in fixed time trading, can be used in some platforms to exit trades early and limit potential losses. This can be particularly useful in volatile market conditions.

Regular review and adjustment of risk management strategies is essential. Traders should analyze their performance, identify areas of weakness, and make necessary adjustments to their approach.

Trading Psychology and Discipline

The psychological aspect of trading is often overlooked but plays a crucial role in long-term success. This section explores techniques for building a strong trading mindset and overcoming emotional challenges.

Building a Strong Mindset

Developing a resilient trading psychology is essential for navigating the ups and downs of fixed time trading. A strong mindset helps traders make rational decisions and stick to their strategies.

One key aspect is maintaining emotional balance. Traders should strive to remain calm and objective, regardless of whether they’re experiencing wins or losses. This emotional stability allows for clearer thinking and better decision-making.

Setting realistic expectations is another crucial element. Understanding that losses are a normal part of trading helps prevent overreaction to individual trade outcomes. Instead, focus on long-term performance and continuous improvement.

Developing a growth mindset is also important. View challenges and setbacks as opportunities to learn and improve your trading skills. Regularly review your trades, both winners and losers, to identify areas for improvement.

Lastly, maintain a healthy work-life balance. Trading can be intense and all-consuming, but taking time for rest and other activities helps maintain perspective and prevents burnout.

Overcoming Emotional Challenges

Emotional challenges are common in trading and can significantly impact performance. Recognizing and managing these emotions is crucial for long-term success in fixed time trading.

Fear and greed are two primary emotions that often lead to poor trading decisions. Fear can cause traders to exit profitable trades too early or avoid taking valid trading opportunities. Greed, on the other hand, can lead to overtrading or holding losing positions too long.

To overcome these challenges, develop a structured trading plan and stick to it. This plan should outline your entry and exit criteria, risk management rules, and overall trading goals. Having a clear plan helps remove emotion from the decision-making process.

Practice patience and discipline. Avoid the temptation to overtrade or chase losses. Remember that there will always be new opportunities in the market, and it’s often better to wait for high-probability setups.

Consider keeping a trading journal to track your emotional state alongside your trades. This can help identify patterns and triggers, allowing you to develop strategies to manage your emotions more effectively.

Advanced Trading Tactics

As traders gain experience, they can explore more advanced tactics to enhance their fixed time trading approach. This section discusses integrating forex trading and provides real-world examples and case studies.

Integrating Forex Trading

Forex trading can complement fixed time trading strategies, offering additional opportunities and insights into market dynamics. The forex market’s high liquidity and 24-hour nature provide unique advantages for traders.

One approach is to use forex analysis to inform fixed time trading decisions. For example, identifying key support and resistance levels in forex charts can help pinpoint potential entry points for binary options trades.

Traders can also leverage forex economic calendars to anticipate market-moving events. This information can be valuable for timing fixed time trades around high-impact news releases.

It’s important to note that while forex and fixed time trading can complement each other, they require different skill sets and risk management approaches. Traders should thoroughly educate themselves on both markets before attempting to integrate them.

Case Studies and Real-World Examples

Real-world examples and case studies provide valuable insights into the practical application of fixed time trading strategies. Let’s explore a few scenarios to illustrate key concepts:

Case Study 1: Trend Following Strategy

-

Trader identified a strong uptrend in EUR/USD using moving averages

-

Placed a series of “call” options aligning with the trend

-

Result: 7 out of 10 trades were successful, yielding a net profit

Key Takeaway: Aligning trades with the overall trend can increase the probability of success in fixed time trading.

Example: News Trading

-

Major economic data release expected for USD

-

Trader placed a short-term binary option just before the announcement

-

Outcome: Significant market movement resulted in a profitable trade

Lesson Learned: While news trading can be profitable, it’s also high-risk. Proper risk management is crucial when employing this strategy.

Case Study 2: Range Trading

-

Asset price oscillating between clear support and resistance levels

-

Trader placed “put” options near resistance and “call” options near support

-

Results: Strategy showed consistent profits over a month of trading

Insight: Identifying and trading within established ranges can provide reliable opportunities in fixed time trading.

These examples highlight the importance of strategy selection, market analysis, and risk management in real-world trading scenarios. Traders should use these insights to refine their own approach and develop a personalized trading style.

NOTE: Get your Fix Time Trading Strategies PDF Guide Below.