Candlestick patterns are one of the oldest forms of technical and price action trading analysis.

Candlesticks are used to predict and give descriptions of price movements of a security, derivative, or currency pair.

Candlestick charting consists of bars and lines with a body, representing information showing the price open, close, high, and low.

It dates back to the 16th century when Homma Munehisa used this to trade rice contracts. He was also thought to have developed the candlestick charts that were later brought to the Western world by Steve Nison.

Steve Nison introduced candlesticks to the world in his 1991 book “Japanese Candlestick Charting Techniques,” and they are now very popular because of their simplicity and unique insight into the sentiment of the market.

Candlestick charts are most often used in the technical analysis of equity and currency price patterns, and in this post, we go through exactly how you can use them in your own trading.

NOTE: You can get your free candlestick patterns PDF guide below.

Table of Contents

What are Candlestick Charts?

Candlesticks are visual representations of market movements. Traders use candlesticks to help them make better trading decisions by studying patterns that forecast a market’s short-term direction.

A candlestick is a chart that shows a specific period of time that displays the prices opening, closing, high and low of a security, for example, a Forex pair. It is a fundamental component of technical analysis because it can help you understand the movement of the market at a glance. It is a very suitable technique for trading liquid financial assets such as Forex and futures.

What is the Difference Between Candlestick Charts and Bars?

Bars and candlestick charts are both used for technical analysis to study the supply and demand of a security or commodity in a marketplace and represent the trading range of a security.

Bar charts have a small tick symbol on the left side to represent the opening price and a small tick on the right side to indicate the closing price.

As for a candlestick chart, it has a body and shadows or what are also called wicks. Bodies are defined as the range between the opening and closing price. Shadows represent the range of the day outside of the opening and closing of the prices.

As you can see in the example below, there are bar charts on the left and candlesticks on the right.

Mastering Candlestick Charts

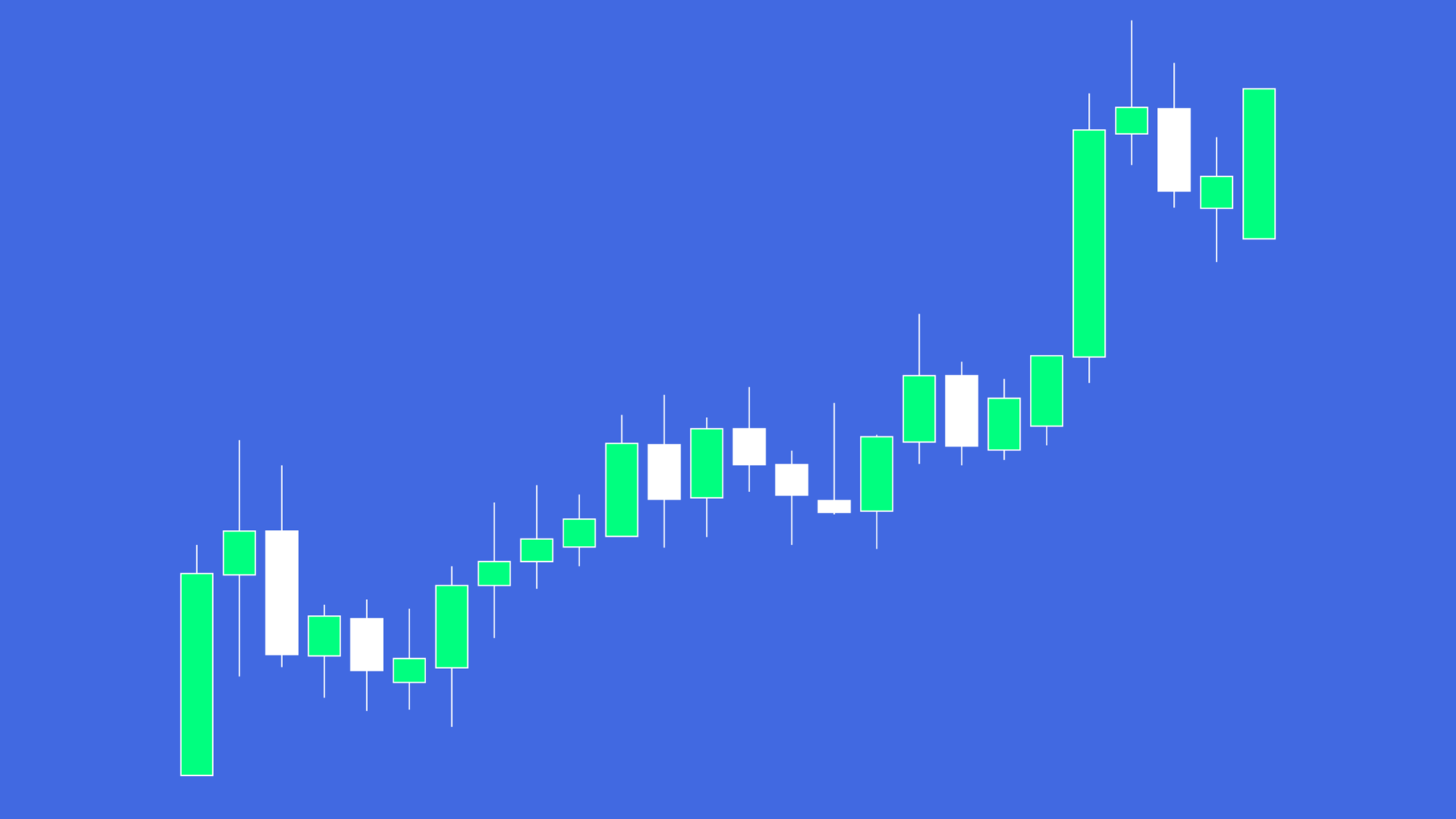

Candlestick patterns are an efficient way for you to view an asset’s price chart. It shows you which way the price moved during a specific period of time using colors and how far the price moved during that period.

Time frames are shown for the time frame you are using or have selected. For example, if you are using a 5-minute time frame, a candle will show the HIGH, LOW, OPEN, and CLOSING in 5 minute intervals.

Bullish Candle and Bearish Candle

Bullish and bearish represent buyers and sellers.

The intra-session high represents bulls, and the intra-session low represents the bears. If the close is closer to high, then the bulls are in control. If the close is closer to the low, then the bears are in control.

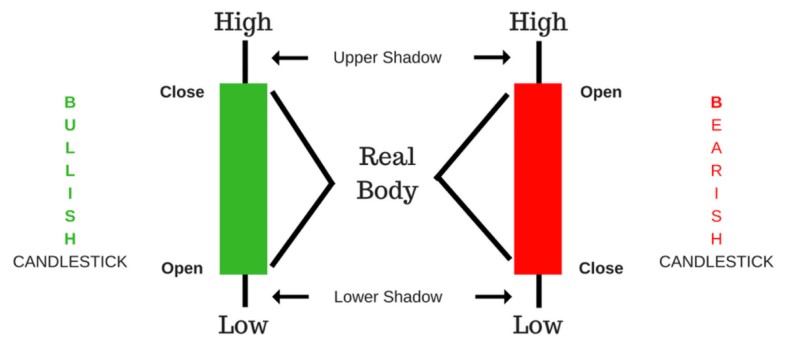

A bullish candle shows that the price has increased over the set time period. For the bearish candle, it shows that the price has decreased over the time period. Each fully formed candle represents the price action of a specific time period.

Candlesticks have two parts, a real body and a wick (tail). The open and close prices are the first and last transaction prices of that time frame. If no real body was shown or the real body is tiny, then it means that the open and close are almost the same. Also, real bodies have color but differ in every charting platform.

The most common color of real bodies is green, red, white, and black. However you can change this to your liking.

A green or white candle means the price finished higher or the closing price is above the open price. A red or black candle means that the price has decreased over the time period, or the top of the real body is the open price, and below is the closing price.

The bullish candle and the bearish candle similarly reflect the difference between the open and close price during that period.

Most charting platforms allow you to make adjustments to your candlesticks to be visually appealing and easily identifiable.

You can alter the colors of your up and down candles to make the contrast distinct.

NOTE: You can get your free candlestick patterns PDF guide below.

What are Some of the Best Candlestick Chart Patterns?

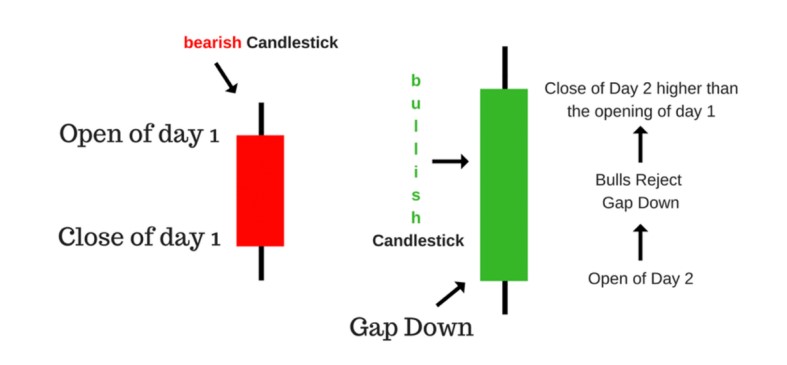

Bullish Engulfing Candlestick

Quite a name for a candlestick. This pattern consists of two candles and shows when the price of a security moves beyond the high and low of the previous

sessions range. This candle is your signal for a sustained upward move or trend change back higher.

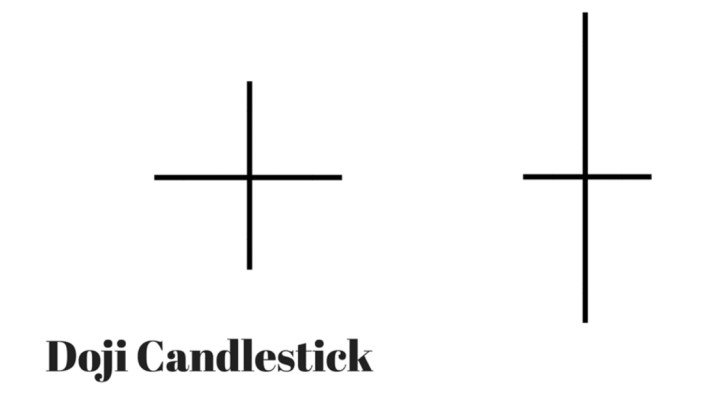

Doji Candlestick

A Doji candlestick is one of the most popular candlestick patterns. The Doji pattern usually has a very small body with a close near the open price. It also has a long wick formed to the high and low. This candlestick offers a heads up that the sentiment may be changing.

Harami Candlestick

The bullish and bearish harami is a two candlestick pattern that is considered a reversal pattern.

For a bullish reversal, the first candle needs to be a large bearish candle. A small bullish candle then follows this.

For a bearish harami, the inverse needs to occur. The first candle needs to be a strong bullish candle followed by a smaller bearish candle.

Bearish Engulfing Candlestick

This pattern is the opposite of the bullish engulfing candle.

This can be a precursor to a sharp, sustained drop and indicate potential reversal, or trend change back lower is about to occur.

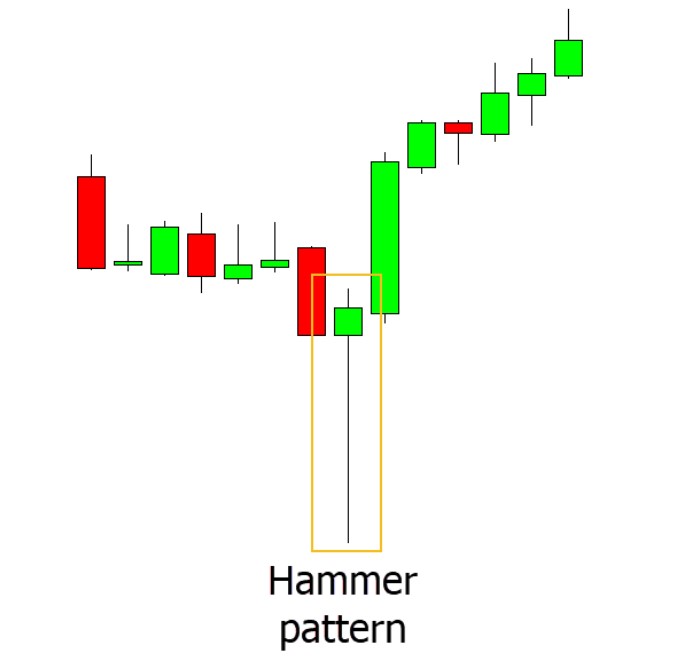

Hammer Candlestick Pattern

The hammer candlestick pattern signals a potential reversal higher after the price has recently been making a swing lower.

A hammer is formed with;

- A small candlestick body

- A long wick or shadow that points lower

- Price finishes in the top quarter of the candlestick.

See the example below of how price formed a hammer pattern right before reversing back higher.

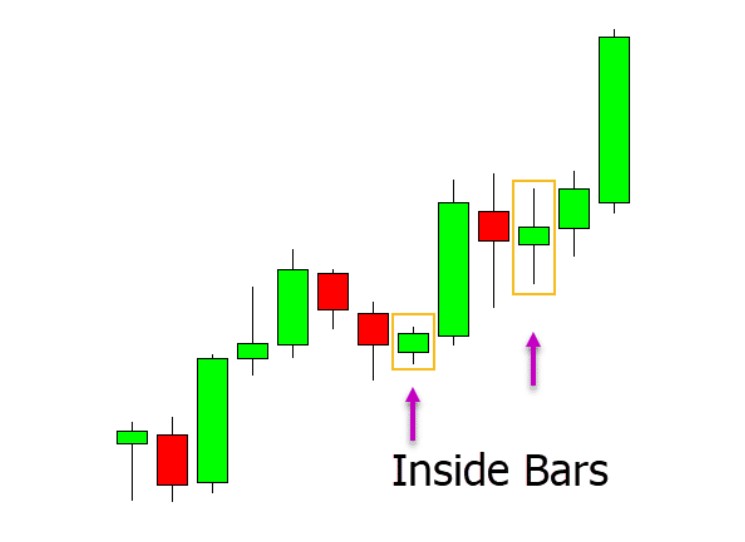

Inside Bar Pattern

The inside bar pattern is a pattern you will see on all of your different markets and time frames. It is very common and can be traded in a few different ways.

For an inside bar to be valid, you will need to see the candlestick form completely within the previous candlestick.

This candle can signal both a potential reversal or a continuation depending on where and how it is formed within the price action.

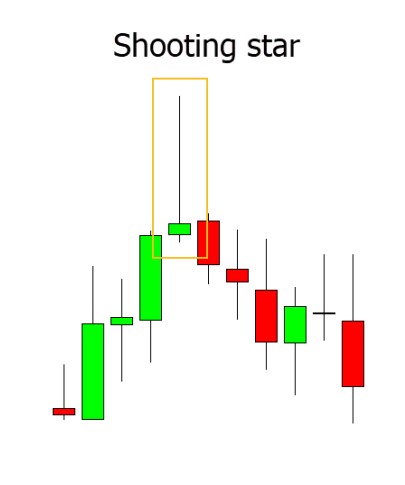

Shooting Star Candlestick Pattern

The shooting star pattern is not as common as some other candlestick patterns, but it is one of the more powerful.

This pattern signals a potential reversal back lower after the price has been rising higher.

The example below shows a shooting star example and how price forms a large upper wick and a small real body. Price then sells off back lower, completing the reversal.

Using Advanced Candlestick Patterns

One of the best features of candlestick charting is that it helps you visualize market movements without overpopulating your monitor with numbers or complicated indicators and news feeds.

Because of the candlestick, you can quickly understand what’s going on with a security price at a single glance.

You can also tell whether the sellers or buyers have dominated on a given day along with the sense of the trend. It is an excellent way for traders to identify and decide when is the best time to buy, sell, or wait.

After learning how to use and read the candlestick basics, you can easily start to spot the opening and closing price of a security and see patterns forming.

You can then begin using more advanced patterns like the hanging man candlestick pattern in your trading.

One of the major bonuses of using candlesticks in your trading is that you can start to use more and more advanced patterns as you start to become better at using them. Whilst one and two candlestick patterns are commonly used, you can start to use other patterns like the head and shoulders pattern and the 123 reversal pattern.

NOTE: You can get your free candlestick patterns PDF guide below.

High-Profit Candlestick Patterns

As we are about to go through, some of the most high profit candlestick patterns and trading strategies are when you use confluence.

Whilst candlesticks can be successfully used by themselves; they are often far better when combined with other strategies and indicators. These can include using your other favorite indicators or technical analysis tools to confirm high probability trades.

Candlestick Patterns Trading Strategy

Whilst there are endless ways you can use candlestick patterns with other indicators and price action methods, you will often find that the simplest strategies will work the best. These strategies include finding and trading with the obvious trends and trading from key market support and resistance areas.

Using Candlestick Patterns With the Trend

As the old saying goes, the trend is your friend until it bends. This is the same when using candlesticks in your trading. You can use the trend to find and make very high probability trades.

After you have found a clear trend, you can use your favorite candlestick patterns to fine-tune your entry signal.

An example of how you could do this is on the chart below. Price has been in a strong trend lower. When we notice price pullback higher into a value area, we start to look for short trades. Short trades could then be entered when price forms a bearish engulfing bar signaling a reversal back lower.

Using Candlestick Patterns at Key Support and Resistance Levels

Another successful way to use candlesticks in your trading is with key support and resistance levels.

In the example below, price has repeatedly rejected an important resistance.

When price moves up to this level again and forms a bearish engulfing bar, we could make short trades and profit as price moves away from this resistance level.

NOTE: You can get your free candlestick patterns PDF guide below.