Are you wondering if your trading strategy is profitable, or do you want to find out if a new system or method could be successful? Then, you need to know how to quickly backtest your trading strategies.

In this post we go through exactly what backtesting is and how you can do it in MT4, MT5 and TradingView.

Table of Contents

What is Backtesting?

Backtesting will quickly help you know if the trading strategy or system you are using is profitable.

This is obviously very important because you don’t want to be wasting months or even years on a strategy that is never going to make you any money.

Whilst there are many ways to automatically backtest indicators and EA’s, in this post we are going to look at how you can manually backtest your trading strategy. This is suited to trading styles such as price action and technical analysis where your trading is not automated.

The best results when carrying out a backtest will come when you are methodical and follow a clear trading rule set. That is the only way that you will know whether a system or strategy actually works or not.

Why Backtest Your Trading Strategies?

There are literally thousands and thousands of trading styles, systems and strategies you can use. Not to mention there are even more ways you can combine them to create your own strategies.

For example; whilst one trader may use clean price action, you could be using price action along with moving averages.

The quickest way to filter out any strategies that don’t work is to backtest them. This will give you a very good idea of whether the strategy involved is worth investing more time in and perfecting, or if you should just move to the next system.

How to Backtest on MT4 and MT5?

If you are using MetaTrader, then you have a very easy way that you can start backtesting your trading strategies.

The first thing you will need is a trading journal so you can journal your trades as you go through your backtest.

Then, on your MT4 or MT5 charts you will want to choose your market and time frame that you want to carry out your backtest.

It is very important you make sure that price does not continue to roll back to the live and up to date price. You will need to make sure the ‘scroll chart’ button is off. You can see the image below for what this looks like.

Once the scroll chart button is off you are going to move to the point where you want to start your backtest. This can be as far back as you like.

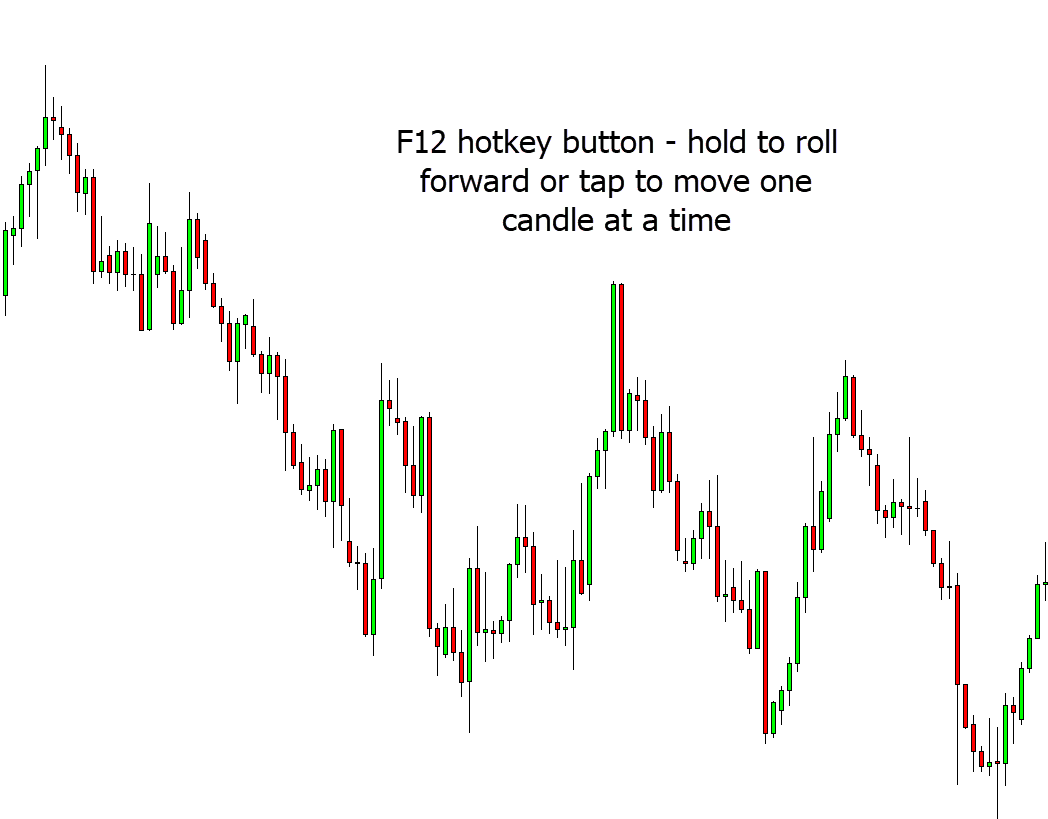

The trick now is to use the inbuilt MetaTrader hotkey of F12. If you tap this hotkey price will move forward one candlestick at a time. If you hold F12 down, then price will continually roll forward.

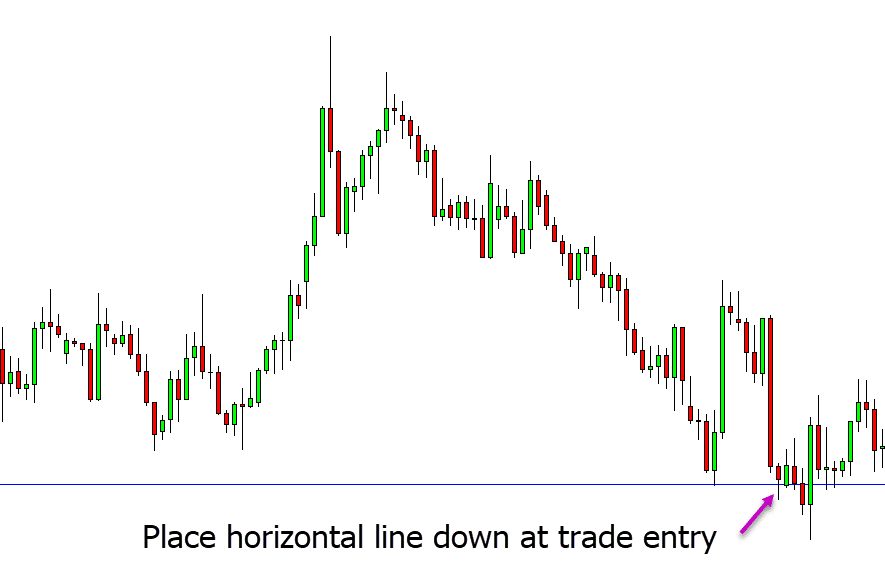

To start your backtest you need to find a trade that meets your trading strategies rule set. As an example see the chart below. In this example we have marked the chart with a horizonal line where we are going to enter a long trade.

You could then use further horizontal lines to mark your stop loss and take profit levels. You would also enter these into your journal.

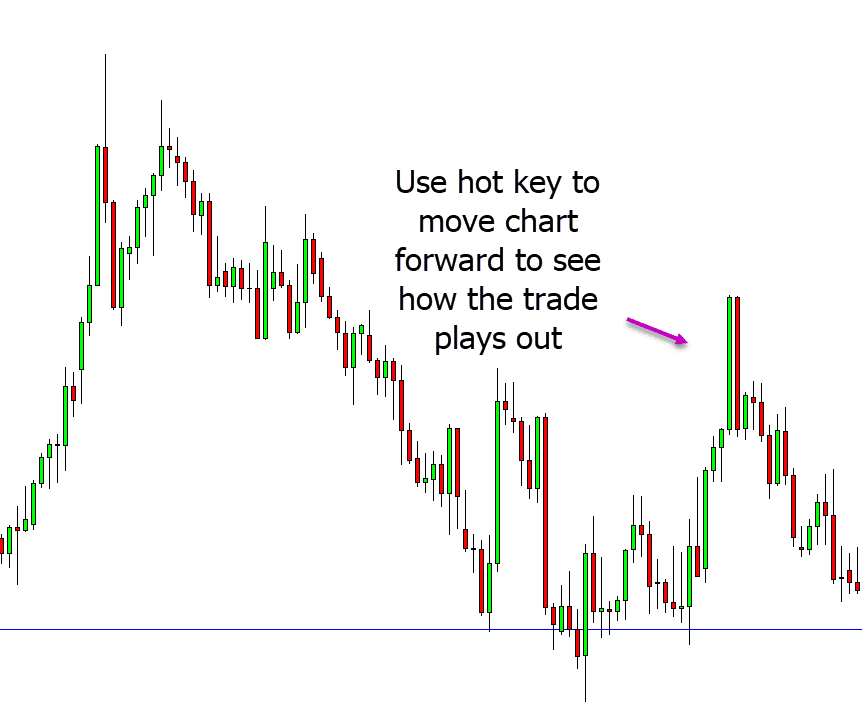

To see how the trade plays out you are going to either tap or hold the F12 hotkey. Once the trade has played out you are going to enter the result into your journal.

Using this method you could quickly get through hundreds of trades to see if a strategy really is profitable or not.

How to Backtest on TradingView?

Whilst TradingView does not have as many features as MetaTrader it does have a very nice backtesting tool that is easy to use.

To start backtesting on TradingView simply choose the market and time frame you want to carry out the backtest on.

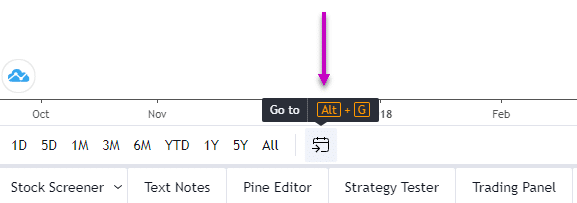

Then down on the bottom left of the charts you will want to hit the ‘Go to’ button.

Hitting this button will bring up a box where you can enter in the date and time in history you want to move your charts back to.

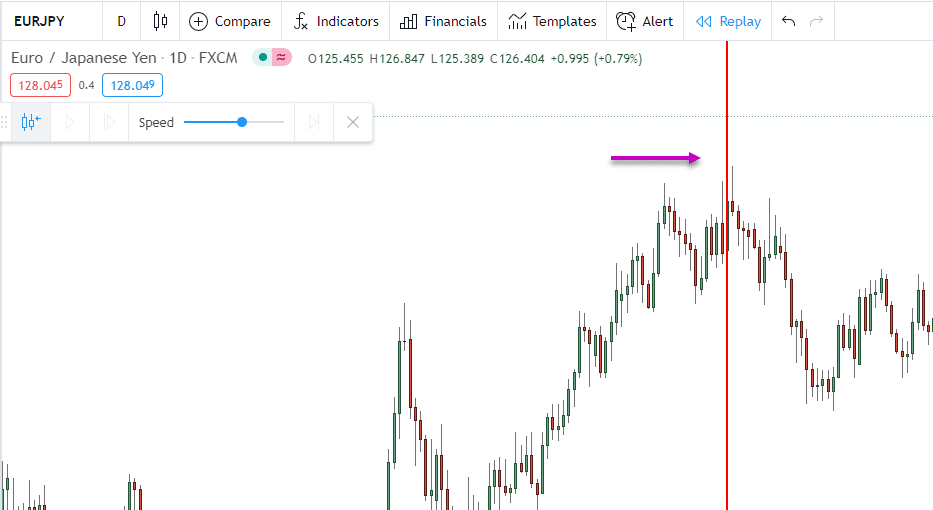

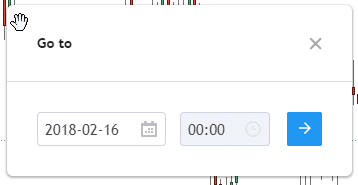

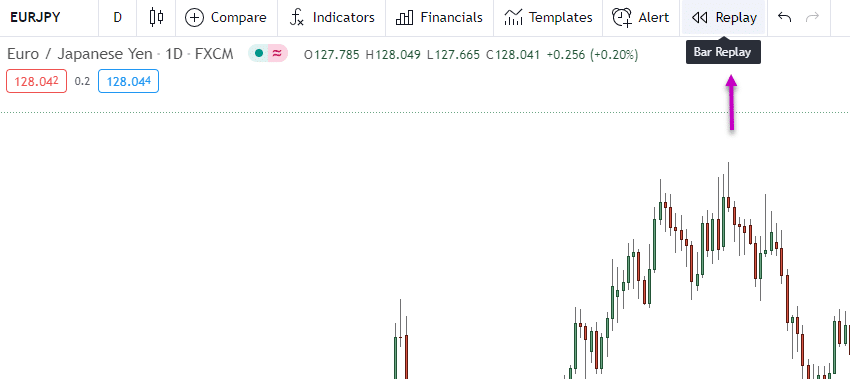

Once you are on the spot of the chart that you want to start the backtest from hit the ‘Bar Replay’ button. See the image below showing where this button is located.

TradingView will now popup a red bar on your charts. You can use this red bar to select on your charts exactly where you want to start your backtest from. Once you have selected this on your charts a play button with a speed timer will popup.

When you hit the play button the charts will start rolling forward allowing you to carry out your backtest. You can slow down or speed up how fast the charts roll forward using the speed dial.

Lastly on Backtesting

Backtesting can be an incredibly powerful tool to help you become a better trader. Not only can it help you find out whether a certain strategy is profitable or not, but you can use it to practice your trading.

You can practice hundreds of trades and perfect your strategy when the markets are closed or when you are waiting for live trades to form.

Backtesting your trading strategies this way will speed up your learning curve and increase the amount of trades you can practice to help you become a successful trader.