If we as traders don’t know how to accurately calculate our trading profits and losses, then we have no idea where we stand and if what we are doing is actually working. We also have no idea if what others is doing is actually working.

Profits and losses can very often be deceptive and in this quick guide we will go through the most accurate way to work out profit and loss and how to stay away from being deceived.

Table of Contents

Should You Use Pips to Calculate Profit and Loss?

Traders will often calculate their profits with what are known as “PIP”.

The large issue with pips is that they can often be deceiving and not give you the true picture of whether you are making money or not.

As a trader, you should know that pips do not actually determine if you are profitable or not. You cannot eat pips and you cannot buy anything with pips.

You can buy things with money. At the end of the day, week and month you need to know whether you are winning or losing in cold hard cash because that is what you have deposited into your trading account and is that is what you will be withdrawing.

You Can be Positive in Pips, but Losing in Money

Ever wondered why so many signal sellers and sales people who are selling their systems, show their profits in ‘pips’ and not real dollars?

Pips do not show that you are making any real profit. You can be positive many pips, but losing a lot of real dollars.

On the flip side, a trader can still make a profit, even if their pips count is negative – and that is the key. For this reason, traders should stop figuring out profit and loss in pips and instead in money.

The first step to doing this is to work out your trade position size before each and every trade.

Why Position Sizing Every Trade is So Important

If a trader enters the same trade size regardless of stop-loss or pair/market, then they could be risking either far more or far less than they want to on each trade in real money terms.

Having the same trade size amount on every trade does not mean you are risking the same amount of money on every trade. This a common mistake made by novice traders.

Stop size can drastically change on each trade. If you have a 20 pip stop on a 1 hour chart and a 200 pip stop on the weekly chart, then the loss of the trade on the weekly trade is 10 times the size of the loss of a 1 hour chart (if trading the same Forex pair).

The Forex pair and market can also change the amount at risk by an incredible amount. That is the reason why you should think about dollars and not in pips.

Trade sizing is a very important aspect of every trader’s plan and risk management. If trade sizing gets out of hand and gets too large, then all market analysis would be deemed worthless. For that reason, you should always discipline yourself to risk the same percentage of your trading account on each and every trade.

Then, the only thing that will change each trade is your stop size.

Determining how big the trade amount you need to put on depends on how big or small your stop size is and the market traded. No matter how big the stop loss is in pips, you will still be risking the same percentage of your account every trade.

This will normally mean different amounts will be entered into each trade.

How to Correctly Calculate Position Size

One of the most common methods of working out risk per trade is by using the fixed percentage method.

For example; you may decide to risk 1-3% of your trading account each trade. This means that no matter what the pair or stop size, you are willing to risk the same percentage of your total trading account capital each trade.

For example; you decide to risk 3% of your account each trade. On the first trade you are trading with a 30 pip stop and then on a second trade you have a 150 pip stop.

In both trades, you are risking the same 3%. The amount you enter each trade will change, but in each case you are risking 3%.

If you win both trades your account will rise and the 3% risked will be worth more. On the flip side, if you lose you would now be risking less.

For example; you start with $1,000 and risk 3% of your account or $30. You make $100 in profits and your account is now worth $1,100. For the next trade you risk 3% again, but this time that 3% is worth $33. If however, the first trade lost and you lost $30 (3%), your account would be worth $970 and the next trade risking 3% would be risking $29.

In short, you will continue risking the same percentage as your account either rises or falls.

How to Calculate Trade Size

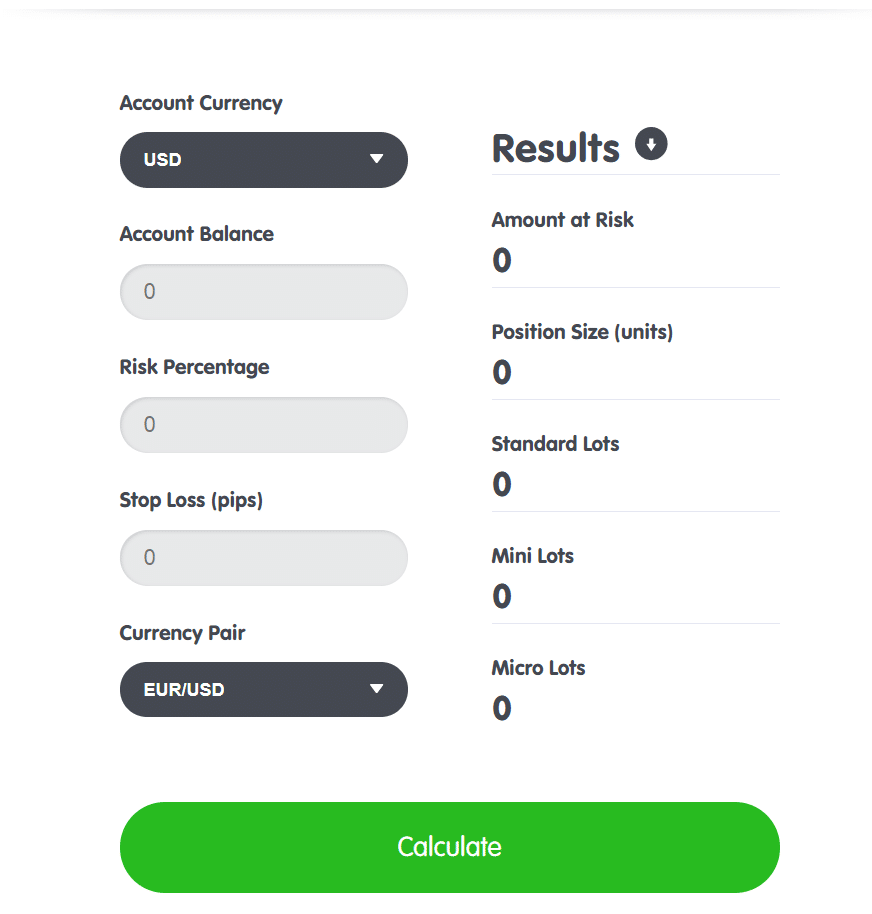

The easiest way to calculate your trade size for each trade is with an online trade calculator.

There are many of them and they are as easy as filling out the fields and getting the answers you need. You can find a position size calculator from Babypips here.

Before filling out the calculator you will need to know your base currency (currency of your trading account), current trading account balance, how much in percentage you want to risk, how large your stop loss will be and the pair you are trading.

Important Note: After selecting your currency pair the calculator will often ask you for a current price. Please take careful note of the pair it asks you for and enter it’s price. This will often not be the pair you are trading and it is incredibly important you add the price that the calculator asks for.

Conclusion to Calculating Profits and Position Sizing

Thinking in terms of money and not pips is crucial for knowing where exactly you are as a trader. Pips can be a solid helper, but they can also be incredibly deceptive and don’t give us the full picture.

As traders we need to know if we are making profits and cold hard cash. We also need to know that when we put on our next trade it will not be so large that it may blow our whole account, or so small that it will not cover any losses.