If you have traded any type of CFDs, you would have probably heard of the Forex carry trade strategy.

Whilst this strategy is harder to make money with at the moment because of widespread low-interest rates, it has now been a popular method to make money for many years.

When using the carry trade strategy, you are looking to profit from the different interest rates each currency offers.

As we go through in this post, you need to take some positives and negatives into account if you want to use the carry trade strategy.

NOTE: Get your free carry trade strategy pdf guide below.

Table of Contents

What is the Forex Carry Trade?

The basic mechanics of the Forex carry trade is that you are looking to buy a high-interest currency compared to another currency with a low interest.

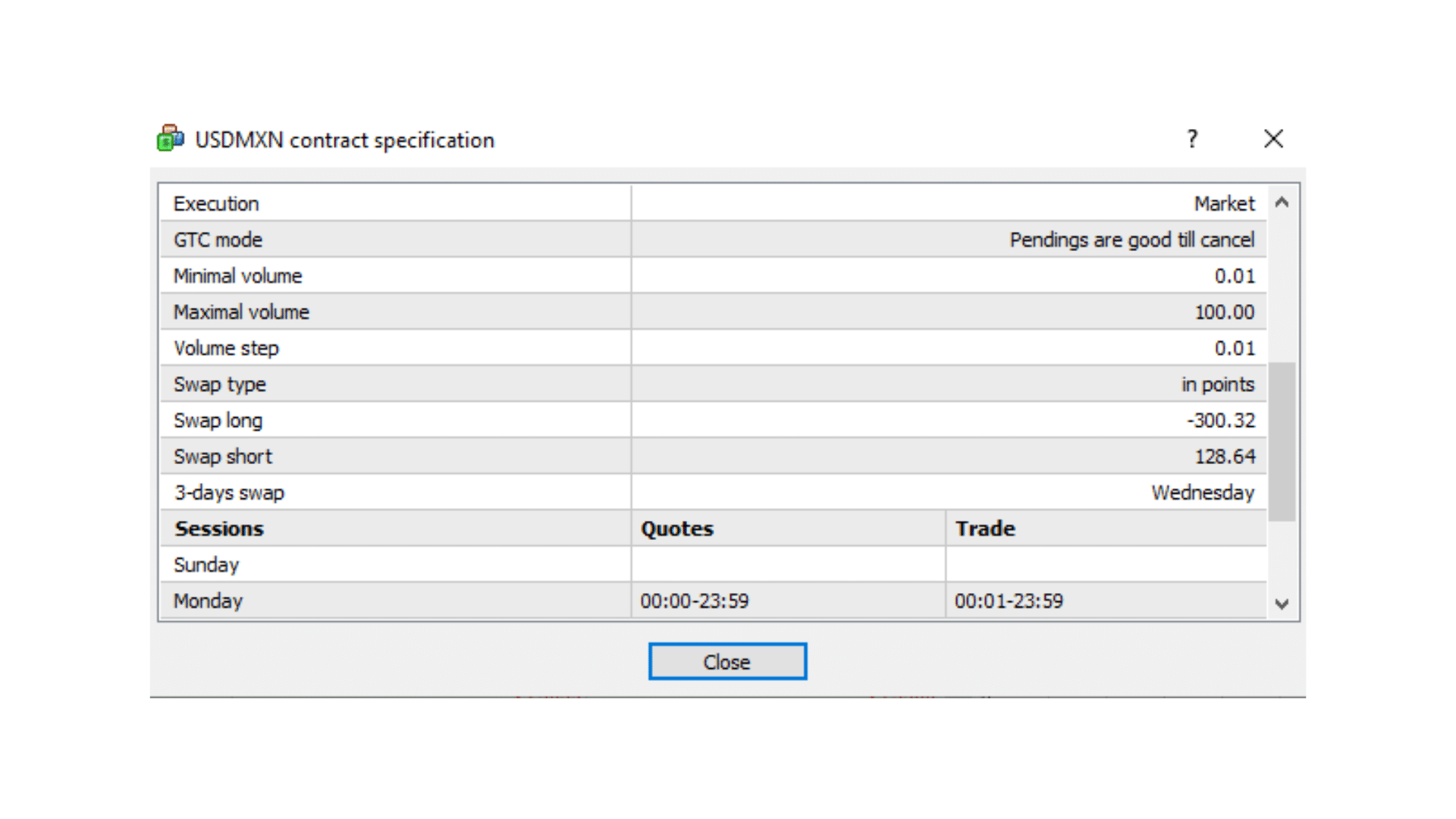

The difference in this interest will be paid to you from your broker. Normally the interest payments will be made once each weekday with a triple payment on Wednesday to cover the weekend period.

An example of a carry trade could be as follows; if the EURO has a 3% interest rate and the USD has a 1% interest rate, you could look to buy the EURUSD. The difference in interest rates which is 2%, would then be paid to you by your broker.

The reason that carry trades have been so popular over the years is that many currencies have offered high interest rates that allow for very profitable carry trades. These profits could then be compounded with the use of leverage.

In years gone by, the most popular currencies to make the carry trade have been currencies such as the Australian Dollar and New Zealand dollar because of their higher interest rates.

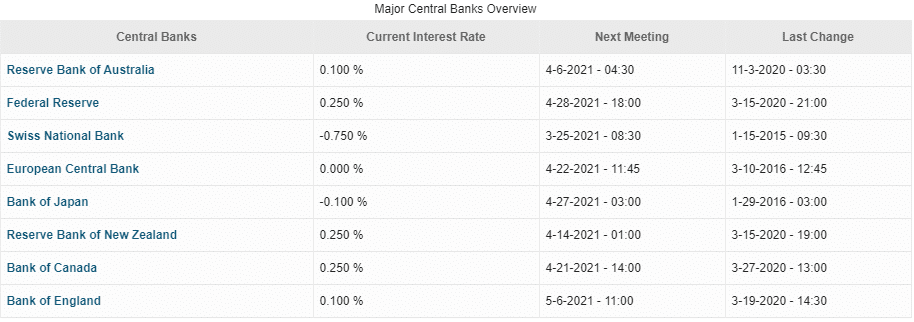

At the moment, the carry trade is far tougher to make money from because interest rates around the world from most major economies have been falling.

You can find an up-to-date list of all the different interest rates from FXStreet here.

Something to keep in mind is that if you are in a negative carry trade, you will pay this interest and not receive it.

The carry trade will only affect if you hold your trade for longer periods and during the rollover period from your broker. Scalp and day trades that are not held during this period will not face any swap charges or interest.

Benefits to the Carry Trade

Carry trade work the best when the central bank for a certain currency is raising interest rates. In this scenario, you can often get the best of both worlds.

As a currency has its interest rates hiked, more and more will look to buy that currency to profit from the carry trade.

Because more people are looking to take advantage of the carry trade, the price will often go higher, and you will also profit from your trade’s capital gain.

This is why you will often see a currency make strong moves higher as their central bank increase their interest rates.

Are There Risks to Carry Trading?

Whilst earning interest on your trade can be an easy way to make money, there are some risks that can bring the carry trade apart.

Interest Rates Changes

Carry trades are highly dependent on the interest rates offered by each currency.

When a currency with high-interest rates starts to have its interest cut, the carry trade will be less profitable.

Because the carry trade is now less profitable, more traders will move out of their positions and into other higher-yielding positions.

It is essential you keep an eye on interest rate levels and anything that could change them in the near future.

Price Moving Against You

As a currency continues to move interest rates higher, the strength of that currency will normally increase as more traders flock to it.

This can give you a win-win situation of profiting from the interest and also from the gain in the price.

The flip side to this is if the price moves against you.

The losses that you could incur from price moving against you could far outweigh the profit from the interest.

What are the Best Pairs for Carry Trading?

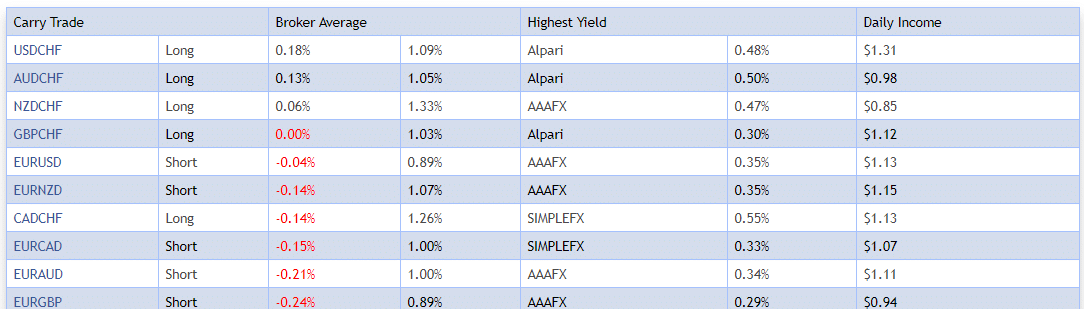

Staying up to date with the latest interest rates and the currency trades that offer the highest yield is crucial to a successful carry trade.

The image below shows the interest rates from each currency and the average yield offered. Each broker will offer different amounts of yield for each currency, so if you are looking to use the carry trade, it is important you choose your broker carefully.

The best pairs are those that are paying higher rates of interest. Something to keep in mind is that these will often be offered by the smaller currencies and currencies prone to wild fluctuations in their price.

Using a Carry Trade Calculator

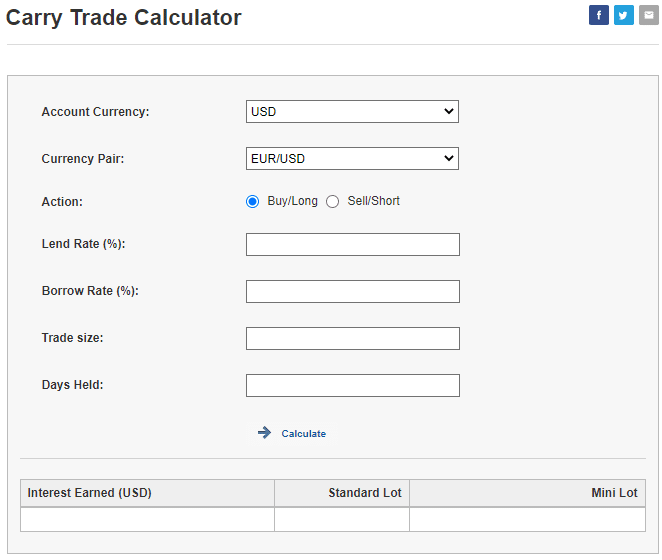

The easiest way to work out if a carry trade could potentially profitable is by using a carry trade calculator.

The image below shows one of the carry trade calculators.

After you have selected your currency pair, entered whether you are going long or short, and the interest rate levels, you will be given an amount that you could potentially make or lose with the carry trade.