If you trade more than one Forex pair, then understanding how correlation works is crucial.

Forex currency correlation could either help you or see you risking far more than you were prepared for.

In this post, we go through exactly what currency correlation is and how to use it in your own trading.

NOTE: Get your free Forex currency correlation PDF guide below.

Table of Contents

What is Forex Currency Correlation?

Some currency pairs tend to move very closely inline with other pairs. This is known as correlation when two Forex pairs are correlated in their movements.

It is so important to understand correlation because you can quickly start risking more than you wanted to if you trade two or more pairs.

If you enter two trades where the pairs are closely correlated, you risk having two large winners or two large losses.

For example, if you entered long trades on both the GBPUSD and the EURUSD, you would be entering two highly correlated pairs. The GBPUSD and EURUSD can have up to 90% correlation on the daily time frame. If the price was to move lower against you on one pair, then it is highly likely that the other pair would also move against you, and you would face two losses, not just one.

Whilst there is a positive correlation when two pairs move in the same direction, there is also an inverse or negative correlation. This is where one pair moves higher, and the other pair moves lower.

Correlated Forex Pairs List

Below is a list of some of the most highly correlated Forex pairs.

Positive Correlation Pairs

- GBPUSD and EURUSD

- AUDUSD and EURUSD

- USDCHF and USDCHF

- AUDUSD and NZDUSD

- EURUSD and NZDUSD

- EURJPY and CADJPY

- EURJPY and GBPJPY

Negative Correlation Pairs

- EURUSD and USDCHF

- USDJPY and GBPUSD

- AUDUSD and USDJPY

- EURJPY and AUDCAD

- EURJPY and USDCHF

EURUSD Correlation

One of the most popular Forex pairs to trade is the EURUSD. However, if you like trading this pair, then you need to understand the other pairs that are highly correlated with it.

EURUSD Positive Correlation Pairs

- EURUSD and GBPUSD

- EURUSD and GBPJPY

- EURUSD and NZDUSD

- EURUSD and EURJPY

- EURUSD and CADJPY

EURUSD Negative Correlation Pairs

- EURUSD and USDCHF

- EURUSD and USDCAD

- EURUSD and USDCAD

- EURUSD and AUDCHF

Currency Correlation Calculator

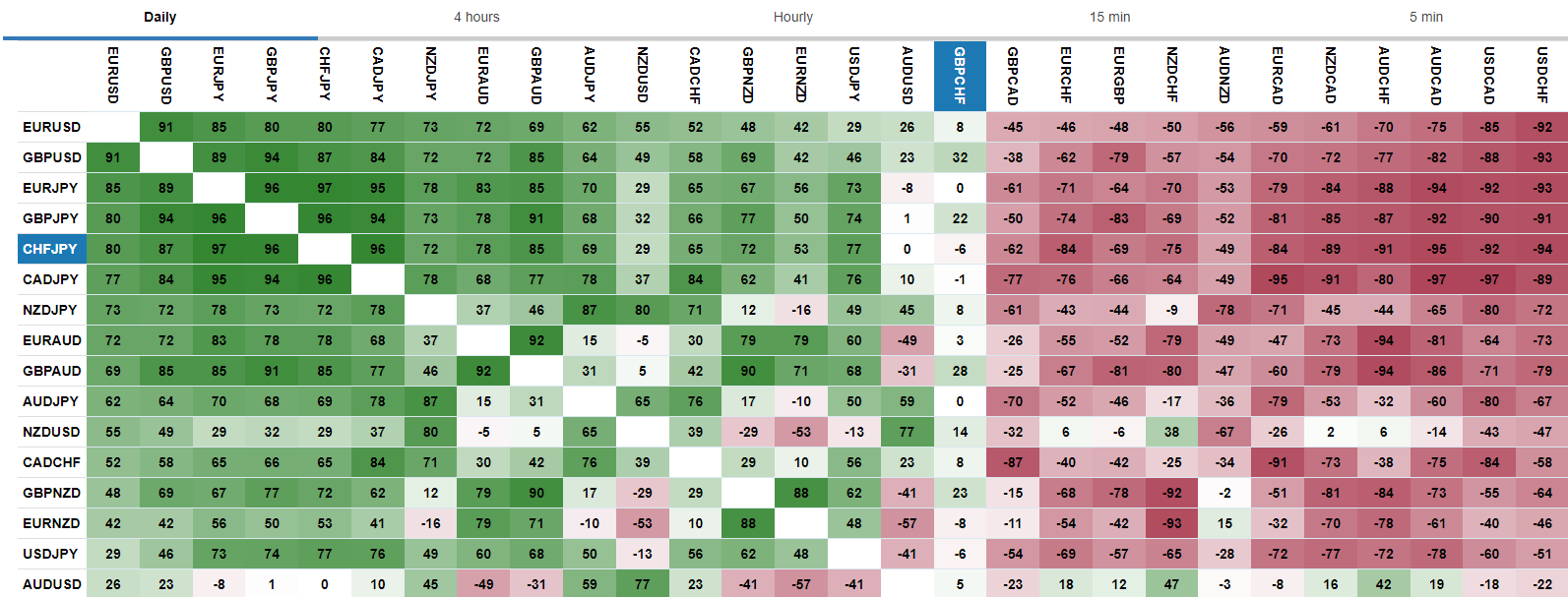

One of the easiest ways to see the potential positive and negative correlation for your Forex trades is by using a calculator.

The currency correlation calculator at investing.com quickly shows you either the positive or negative correlation your positions could have.

After entering the pair you are trading, the time frame you want to see correlation levels for, and how many periods to calculate, you will quickly see the other pairs that are most likely aligned.

Checkout the free currency correlation calculator here.

Forex Correlation Cheat Sheet

If you quickly want to see a large range of positive and negatively correlated Forex pairs, then using a quick cheat sheet can be very handy.

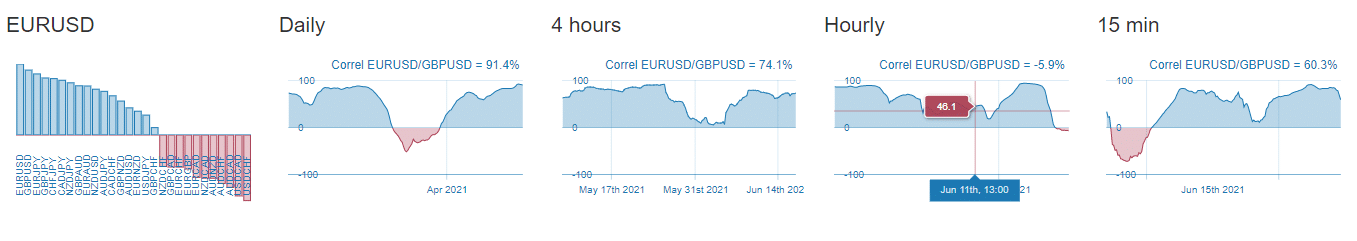

Mataf provides an up-to-date currency correlation graph that is easy to use with a lot of features.

You have the option to select the time frame you want to see the correlation for and the pairs you want to include or exclude.

The other super handy feature is that you can use your mouse to scroll from pair to pair, and it will highlight the correlation for other pairs.

Checkout the free Forex correlation cheat sheet here.

Currency Correlation Indicator

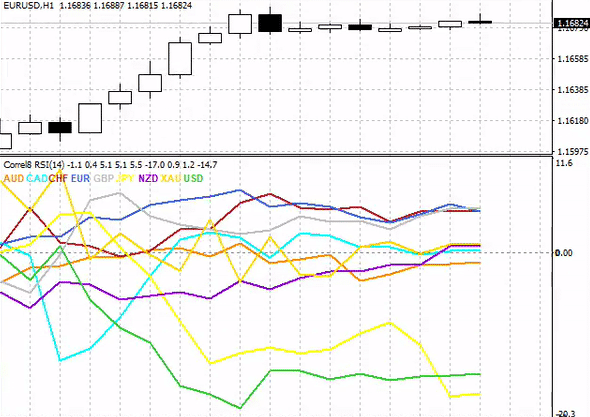

This currency correlation indicator for MT4 is a powerful indicator that shows you correlation in real-time on your trading charts.

This MT4 indicator at MQL5 shows the strength and weakness in the correlation between different indicators.

You have the option to see correlation levels using a range of different indicators that include;

- Moving averages

- Stochastic oscillator indicator

- Relative strength index

- MACD

- Money flow index

- Commodity channel index

- Relative vigour index

- DeMarker

You can get the free MT4 currency correlation indicator here.