Unexpected losses will always happen to the trader who is unprepared.

It can be crushing to a trader and their strategy when these losses happen and throw up all sorts of questions, such as ‘should I change my method?, ‘should I add or take away more indicators?’, ‘should I trade at a different time?’.

Once you understand the reasons why traders win and lose, then profitable trades can happen more and more consistently.

Why Traders Lose Money?

Why do traders lose money? Is it about their system or strategy? Is it the way they act on their trades?

There are countless questions and answers to why traders lose money. According to a study of 43 million trades on the 15 most heavily traded Forex pairs FXCM found out what really causes traders to take overwhelming loses.

Want to add this infographic to your own site or blog, get it here.

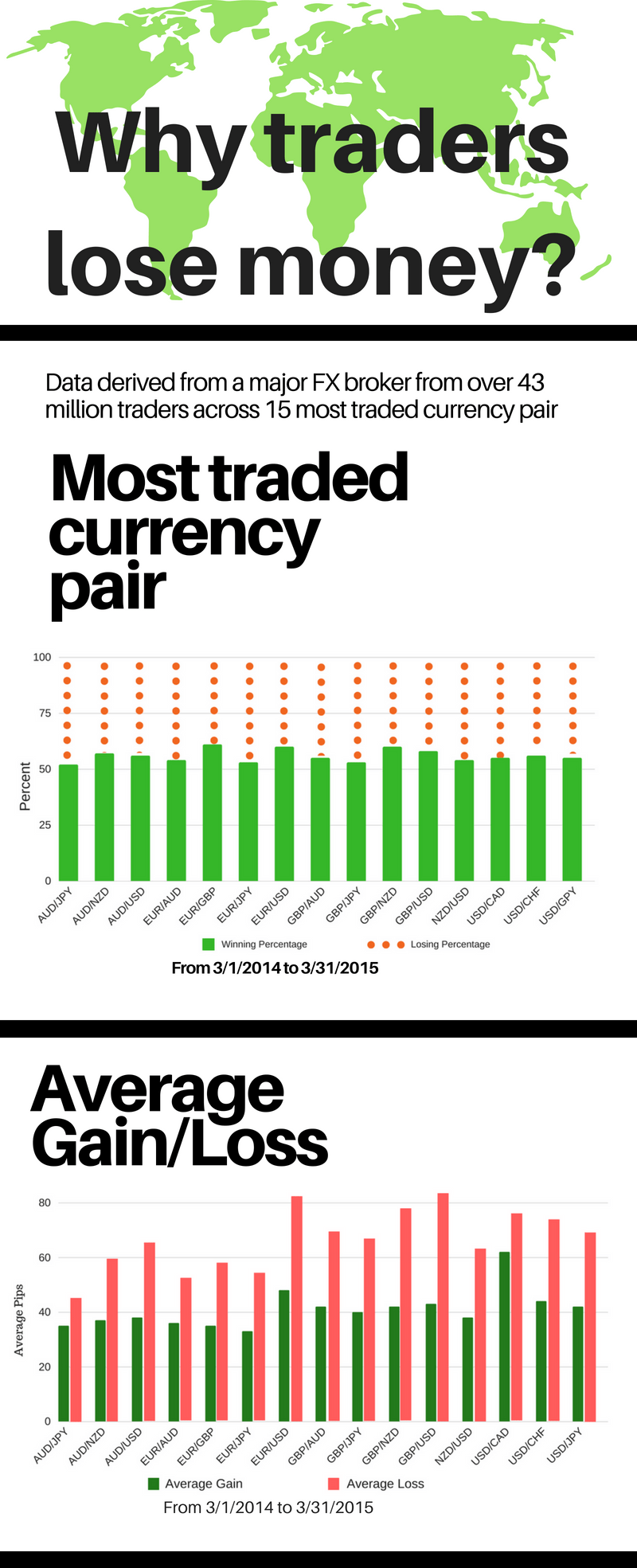

Data derived from major FX broker FXCM shows traders make a profit most of the time as over 50% of trades are closed out at a gain. Let’s take a look at the data.

As you can see from the chart, the green bar shows the percentage of trades that ended with a profit and the red dots indicates the losing percentage of a trade.

Based on this chart, every single instrument had an average 50% winning trades or higher.

So, why do most traders still lose money in their trading overall if they are right more than half of the time? Is there an avoidable mistake?

#1: Traders Win Small and Lose Big – You Need to do Opposite

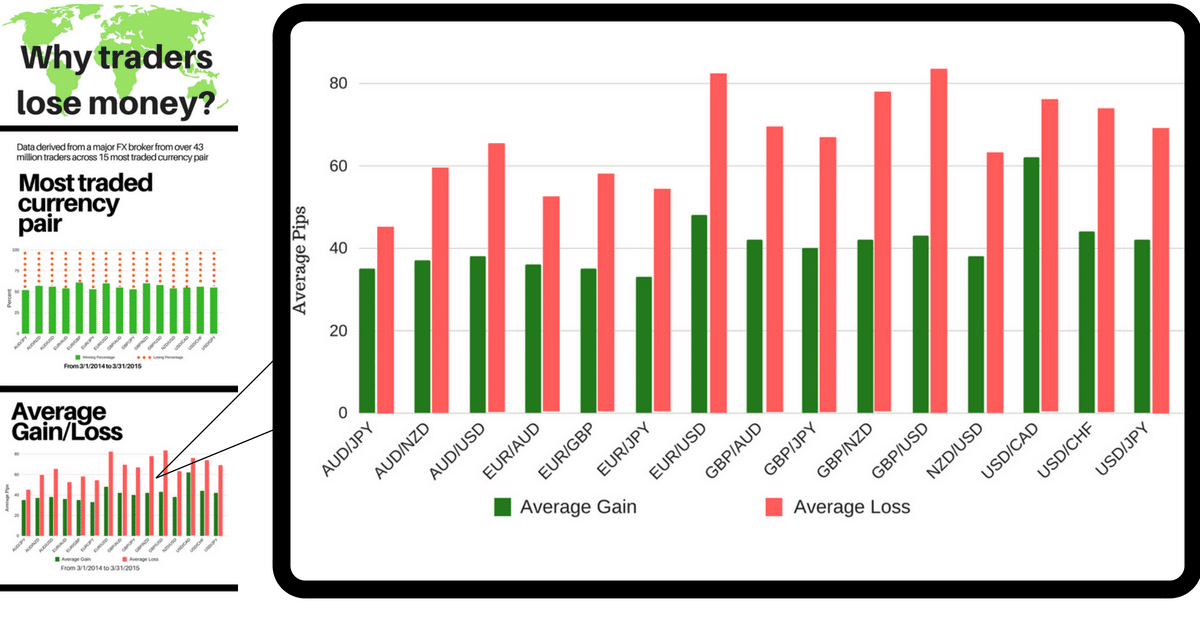

The chart above is also from data of the most traded currency pairs from 3/1/2014 to 3/31/2015. The green bar shows the pips earned on profitable trades.

The red bar shows the number of pips lost on a losing trade. As you can see; the graph clearly indicates that a trader loses more money on their losing trades than they profit on their winning trades – in EVERY PAIR!

Looking closer at the individual pairs we see a winning trade on the EUR/USD pair is worth 48 pips while the losing trade is worth 83 pips!

The pair that did the worst was the GBP/USD. The winning trade was worth 43 pips while the losing trade was worth 83 pips.

Before we go to the solution, you must first understand what causes traders to lose more money on their losing trades than make in profit from their winning trades.

The Root of The Problem

Every trader wants profitable trades. Though the study suggests that traders were good at looking for trading opportunities, their losses were far bigger than their gains. This is a big problem.

If you have ever read any trading book, or articles or watched trading videos you will always see the same advice “cut losses, let profits run”.

This is a simple solution right? But, it is far from easy to accomplish in real trading and there is a human psychological reason for it.

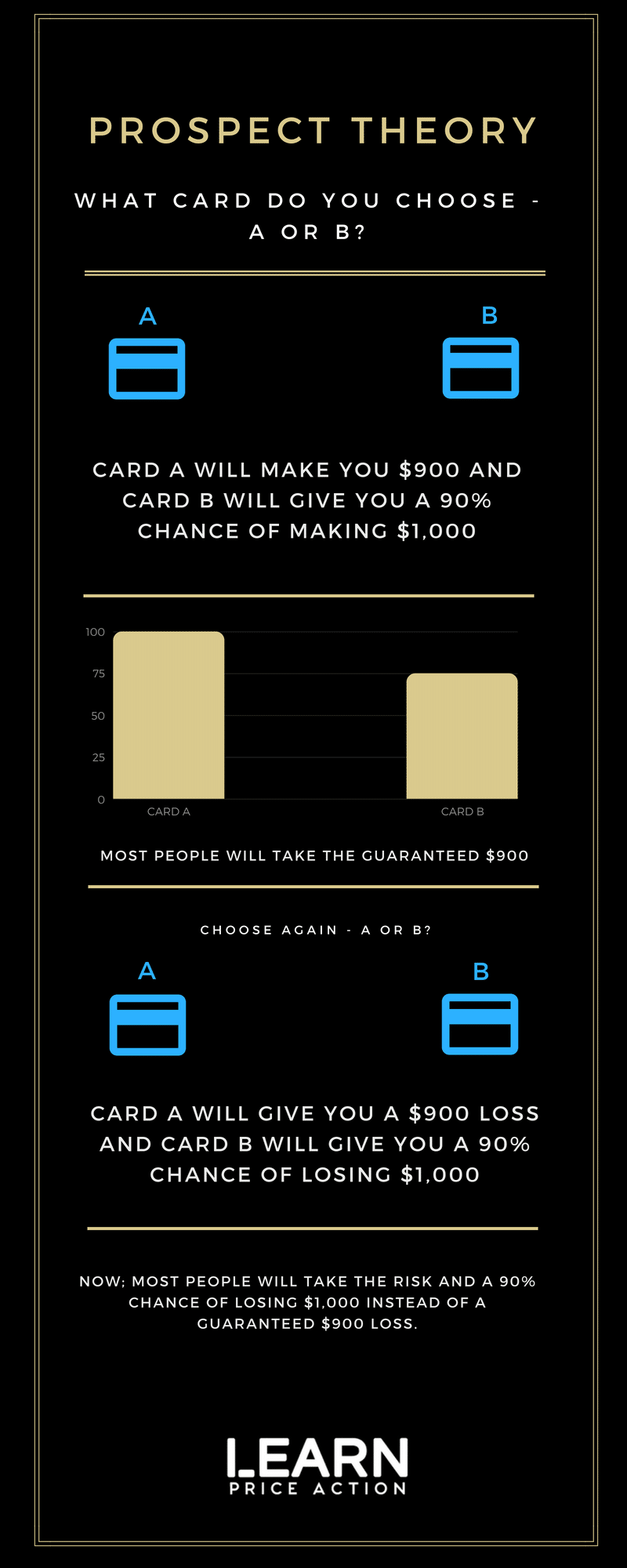

The answer is simple, “human nature”. What if you were offered a simple card game? You have to pick one from both cards and you were given two choices.

Want to add this infographic to your own site or blog, get it here.

As you can see above, it is human nature that makes trading complicated. We engage in risk to avoid pain or loss when logic and probabilities indicate other actions are far better for us.

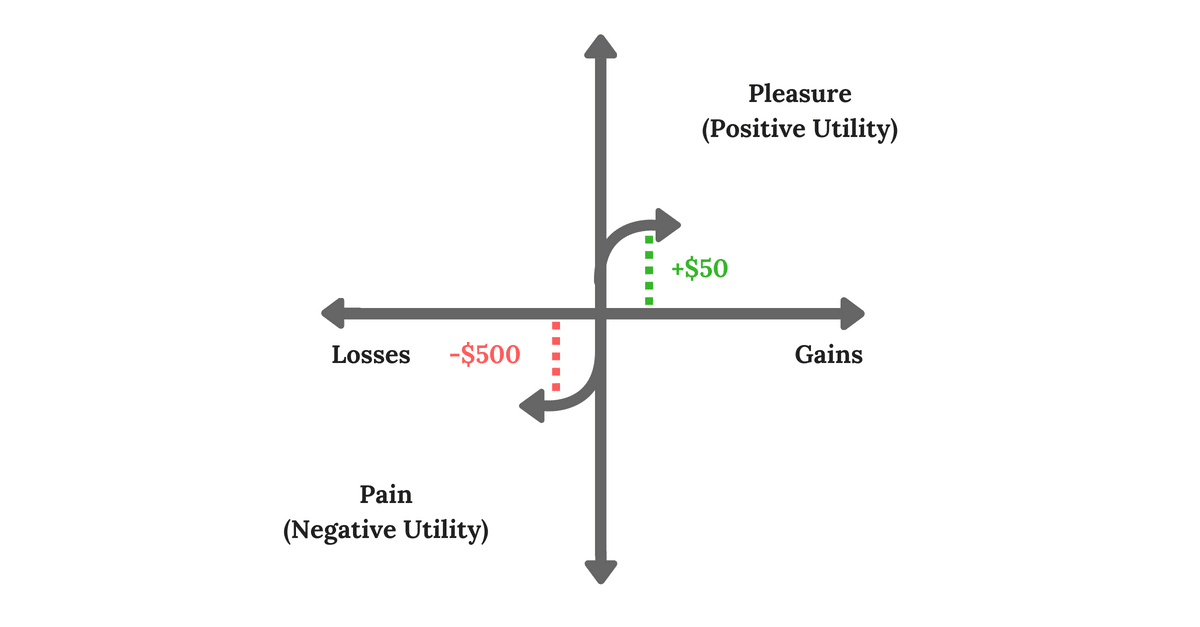

#2: The Prospect Theory – Trade For Results Not Feelings

The prospect theory is a behavioural economic theory that describes the choices people make that involves risk and rewards, where the outcome is unpredictable.

Most people will take more pain from losses than the pleasures from gains. Think rationally and not emotionally. Treat a 50-point gain as equivalent to a 50-point loss. See the infographic above for more on how this works.

How to Avoid the Loss-Making Problem?

We can see from this study we should gain more from our winners, than what we lose on our losers.

To do this correctly, follow a strict rule of “seek bigger rewards > loss you are risking”. This is typically called a “risk to reward ratio”.

The risk to reward ratio is the formula used to compare the unexpected returns of an investment against the risk of your loss.

You can determine and set your risk using a stop-loss order. Your risk is the price difference between the entry point of a trade and the stop loss order. On the other hand, you use the profit target to establish an exit point if the trade moves in your favour.

The profit of the trade is based on the price difference between the profit target and entry price. Investors use the risk-reward ratio to determine the worth of a trade or investment.

If you risk losing the same number of pips you want to gain, then your reward/risk ratio would be 1-to-1 (written as 1:1).

For example: If you want to target a profit of 100 pips with a risk of 50 pips, then it would be 2-to-1 (written as 2:1). If you follow this simple rule, then you can make more profits on your winning trades than your losing trades, but always making sure your rewards are higher than your risk.

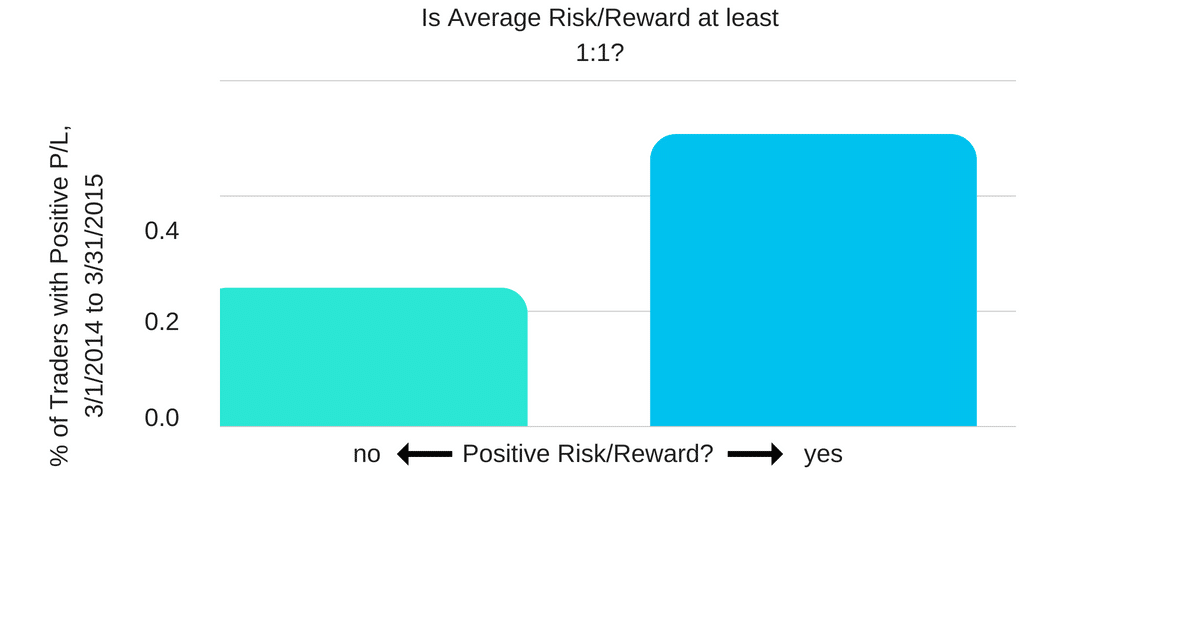

#3: Set Minimum Risk Rewards

The most commonly recommended ratio to use is the minimum 1:1 ratio. This way you can at least break even if you are only right on half of your trades.

If you want lower probability trading, a higher reward/risk ratio of 2:1, 3:1, or even 4:1 is recommended to ensure you make profits.

The data from the FXCM study suggests that 53% of traders who operated with at least 1:1 reward/risk ratio made a positive return over a 12 month period, compared to just 17% of those traders who did not.

[bctt tweet=”Data suggests that 53% of traders who operated with at least 1:1 reward/risk ratio made a positive return” username=”_priceaction_”]

Conclusion

Placing a stop-loss order whenever you are placing a trade is crucial and has been shown to not only protect from losses, but also help with emotional trading decisions.

Always be sure that your target rewards is at 1 x what you are risking when looking at every trade you may enter.

Whilst smaller rewards are possible, you will need more winning trades to compensate your losses to remain profitable.

Always look at your trading from a logical and high probability point of view and what will make you the most money overall, not just what you are trying to avoid right now.

All data is drawn from FXCM Inc. accounts excluding Eligible Contract Participants, Clearing Accounts, Hong Kong, and Japan subsidiaries.