Forex volatility is a significant factor you have to take into account with your Forex trades. The amount individual markets and Forex pairs move will greatly affect your trading strategy and success.

In this post, we look at exactly what Forex volatility is, how you can identify it with an indicator and how you can use it in your trading.

Table of Contents

What is Volatility in Forex Trading?

Forex volatility is how much and how quickly price moves. The more volatile price is, the quicker it will move.

Forex volatility can be both positive and negative for your trading, and there are a few things you want to take into account.

When prices are more volatile, it gives you more chances to make trades. Volatility equals more movement in price. The more prices move, the more opportunities there are to make trades and potentially bigger profits.

On the flip side, the more volatile price is, the higher chance you have of being stopped out or losing your trades due to the fast-moving price.

A few main factors can cause volatility. The main factors are large news and economic announcements and when the liquidity becomes thin.

When trading levels slow down, and the liquidity in the markets is thin, it can cause a market where larger spikes with higher volatility levels are formed.

What Times is Forex Most Volatile?

It is important to understand when and how the Forex markets operate.

The Forex markets are open 24 hours a day and five days a week. However, they have individual trading sessions. For example, within the 24 hour trading day, each major region has its own trading session. These include the UK, US, Europe, and Asia.

The heaviest volume in the markets will be seen when the two biggest regions overlap. These are when the UK and the US trading sessions overlap each other. The vast bulk of currency exchange trading for the 24 hour period is carried out during this window.

The other time to keep in mind is when the Syndey and Tokyo sessions overlap. Whilst not as large as the UK and US sessions, there are still some major moves during this time.

What Forex Pairs Have the Most Volatility?

The most volatile Forex pairs, according to DailyFx, are as follows;

The most volatile currency pairs are:

- Australian Dollar / Japanese Yen: AUD/JPY

- New Zealand Dollar / Japanese Yen: NZD/JPY

- Australian Dollar / US Dollar: AUD/USD

- Canadian Dollar / Japanese Yen: CAD/JPY

- Australian Dollar / Pound Sterling: AUD/GBP

Something to note is that some of the more emerging exotic Forex pairs are also extremely volatile and may be pairs you want to have on your trading watchlist. Some of these include; USD/ZAR, USD/KRW, USD/BRL, and the USD/TRY.

What is the Best Forex Volatility Indicator?

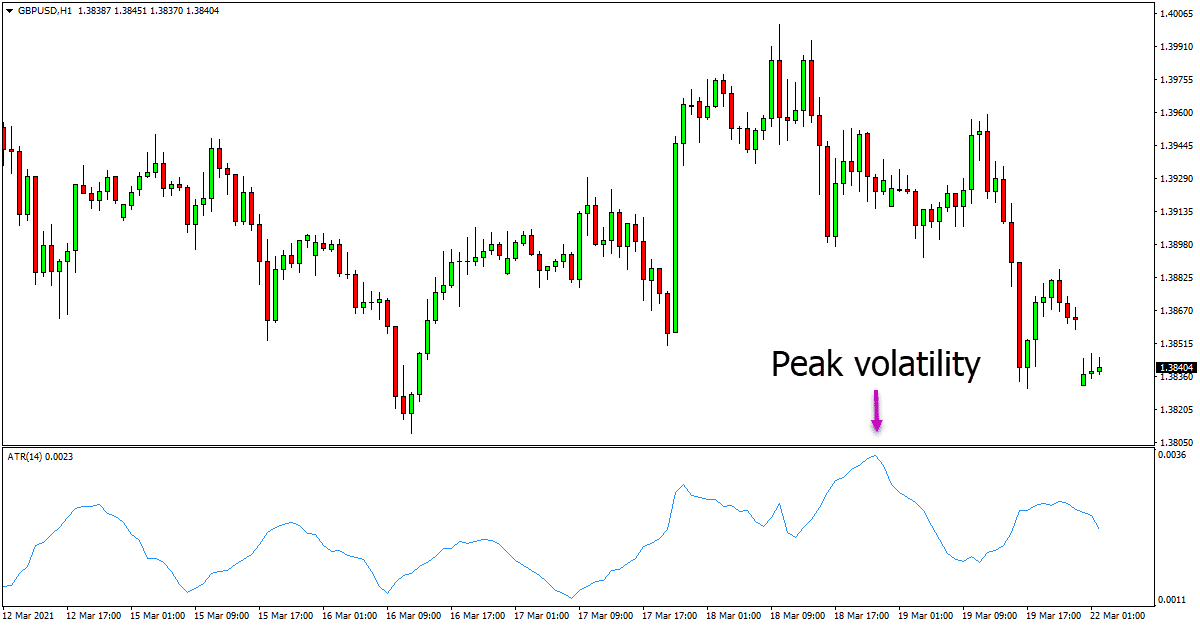

One of the simplest and most commonly used indicators to judge volatility by technical analysis traders is the average true range or the ATR.

The ATR is normally tracked over the previous 14 periods for any given time frame you have chosen.

As price becomes more volatile, ATR will spike higher, and as volatility slows down, the ATR will move lower.

You can use the ATR in several different scenarios. You can use it to help you find potential trades. You can use it to know when to avoid certain Forex pairs or time frames, and you can also use it to help you set stops and profit targets.

Traders will often use the ATR to guide exactly how far their stop or profit target should be away from the current price. The average true range can help with this because you can see how far the price has been moving each session in recent times.

Forex Volatility Trading Strategies

Volatility is a key measure you want to be thinking about when both making and also managing your trades. Three simple ways you can use volatility in your trading include;

Higher Risk Trades When More Volatile

The more volatile a Forex pair or asset is, the more trades you will find, but the riskier those trades will be.

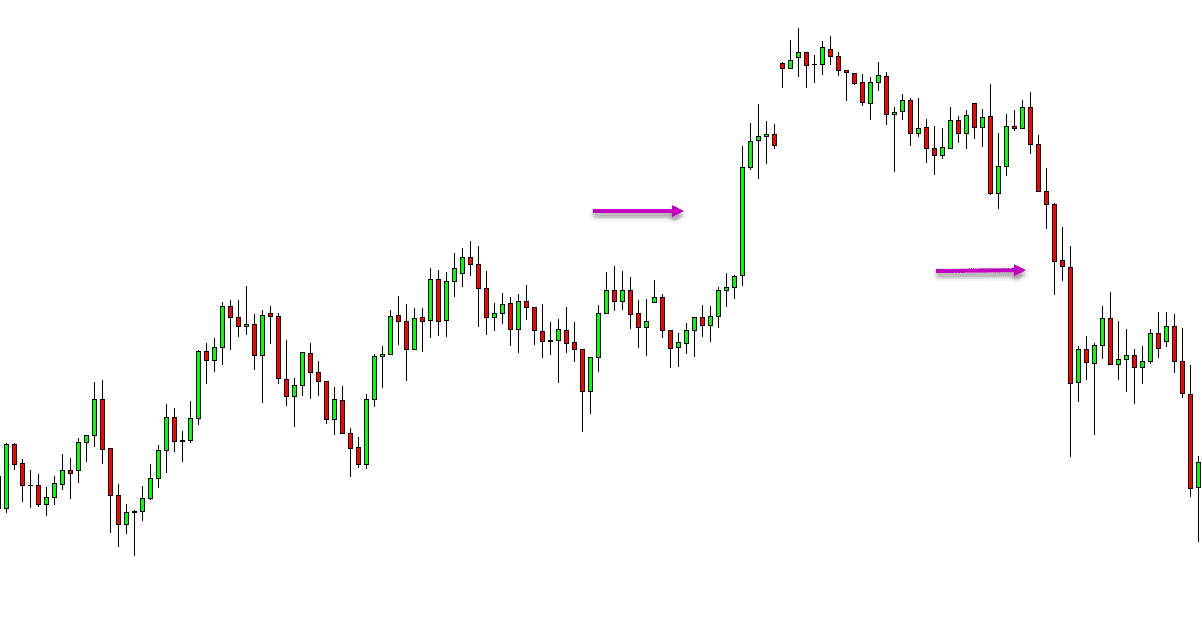

Take the chart of Bitcoin below as an example; Bitcoin has a huge amount of volatility. There are many opportunities to make both long and short trades.

Price also makes large moves and swings in both directions. This gives you many chances to make trades, but there is also added risk when the price is making such large and fast movements.

Take Into Account Volatility When Setting Profit Targets

You can use volatility when setting your profit targets. As discussed above, when using the average true range, you can get a guide of how much a certain Forex pair has been moving over each different time frame. You can use this information to help you set your profit targets.

For example, if you know that price has been making larger moves, you can set larger profit targets. As volatility begins to slow down, you could start to make your profit targets smaller.

Take Into Account Volatility When Setting Stop Losses

Similar to setting your profit targets using volatility, you can do the same thing when setting your stop loss levels.

If the price has been making larger and more volatile moves, you will want to have your stop further away than you normally would to give your trades a chance to work out.

As the volatility levels start to get lower, you could start to make your stop-loss levels lower.