In a previous lesson discussing why traders lose money, we talked about why most traders fail in the Forex market.

This lesson showed how poor management techniques and incorrect use of leverage can dramatically affect a trader’s success.

In this lesson we’ll take a look how you can fix these issues using statistics from millions of trades. In particular, we will look closely at how you can find the very best times to trade Forex and enter trades to put the market on your side and what kind of strategy you could apply.

Based on the data, there is a clear best time to trade Forex to give you a higher chance of profits.

Table of Contents

The Best Time to Trade

As shown in the study below, Foreign exchange traders do the worst during fast-moving and volatile market hours.

If a trader opens a position at a certain trading hour, it can potentially bring a greater chance of profits.

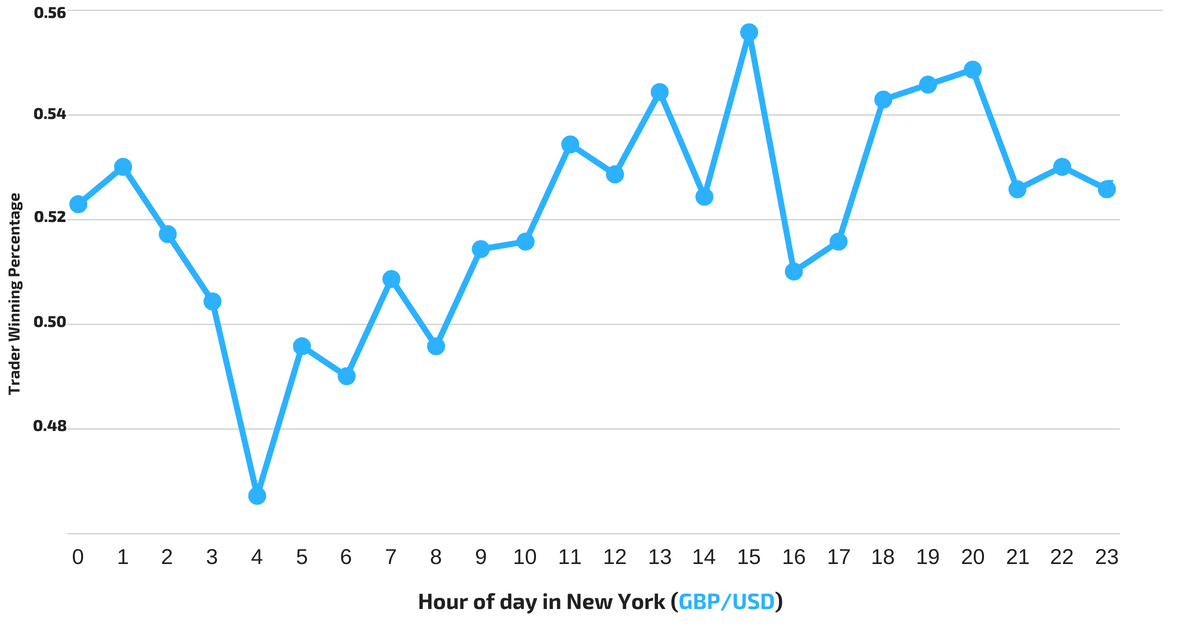

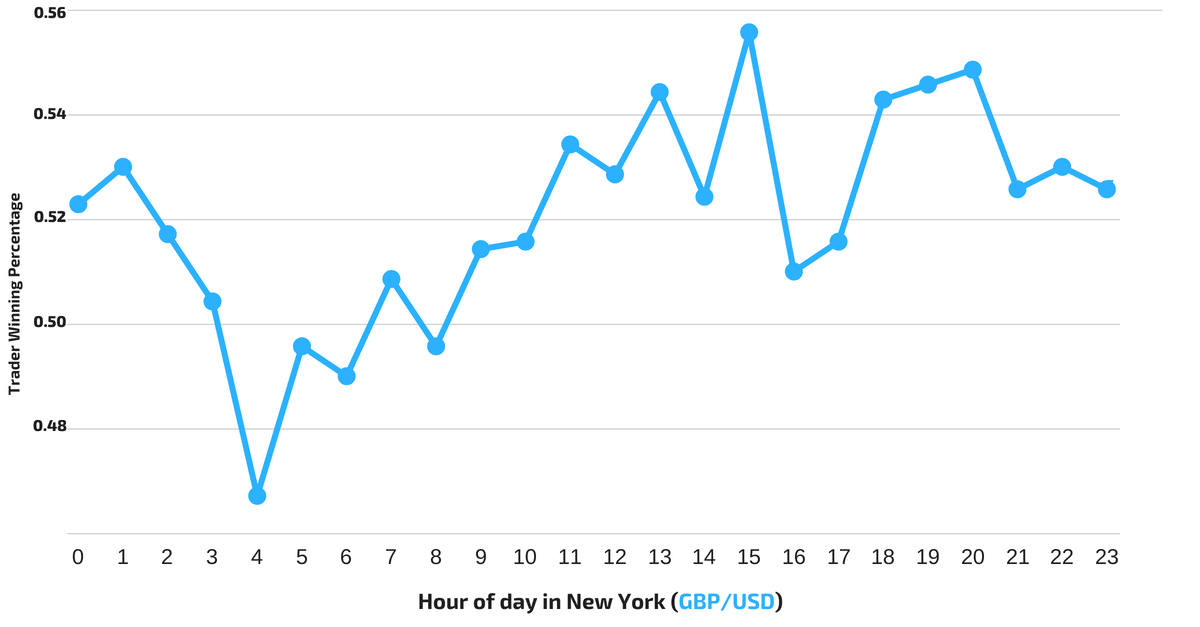

The chart below is from a major FX broker’s 24 million trades placed across 5 popular currency pair. It shows that performance can vary by the time a trader opens a trade.

Based on the charts above, you can see that traders have a higher chance of making profits at certain market hours over others.

There are 5 currency pairs above, but we will only focus on the currency pair of GBP/USD as a relevant example.

Based on the hour-to-hour graph, you will likely turn a net-profit only 47% of the time if you opened a trade on the GBP/USD between the hours of 04:00 and 5:00 New York Time.

On the contrary, if you opened a trade between 20:00 and 21:00, the profitability rate jumps to 55%. Quite a difference!

The overall success is 20% higher as the time runs. You are probably wondering why this happens. To further explain, let’s see how GBP/USD behaves in the market.

The Best Times to Trade GBPUSD

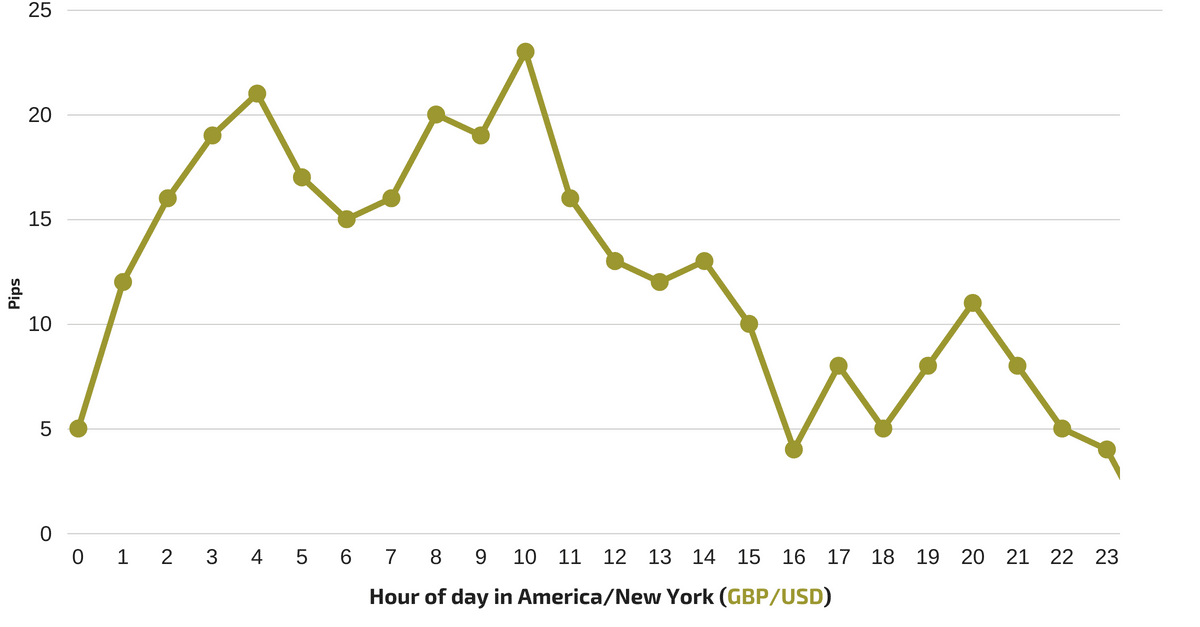

In this graph, you can see the changes per hour in volatility for the GBP/USD.

You can see the difference in volatility of 4:00 a.m. to 5:00 a.m. and 23:00 to 0:00 as the pips move from 22 to less than 4. As you can see, traders are more profitable when the market is far less active.

This equates to traders have a higher end result in the Asian trading session.

Reversion to The Mean

Traders often follow a certain strategy styles called Range Trading or Reversion to the Mean.

Buy Low, Sell High

Reversion to the mean is a strategy where a trader identifies support and resistance areas (or overbought and oversold). A trader would buy at the oversold area (support) and sell at the overbought area (resistance).

This strategy works well in markets that are meandering up and down. It can also work during the Asian trading session as long as major price levels are not breaking and continue in a constant range.

Time in Trading Matters

As just discussed, the time you enter your trade is critical and this becomes more important with the type of strategy you choose to use.

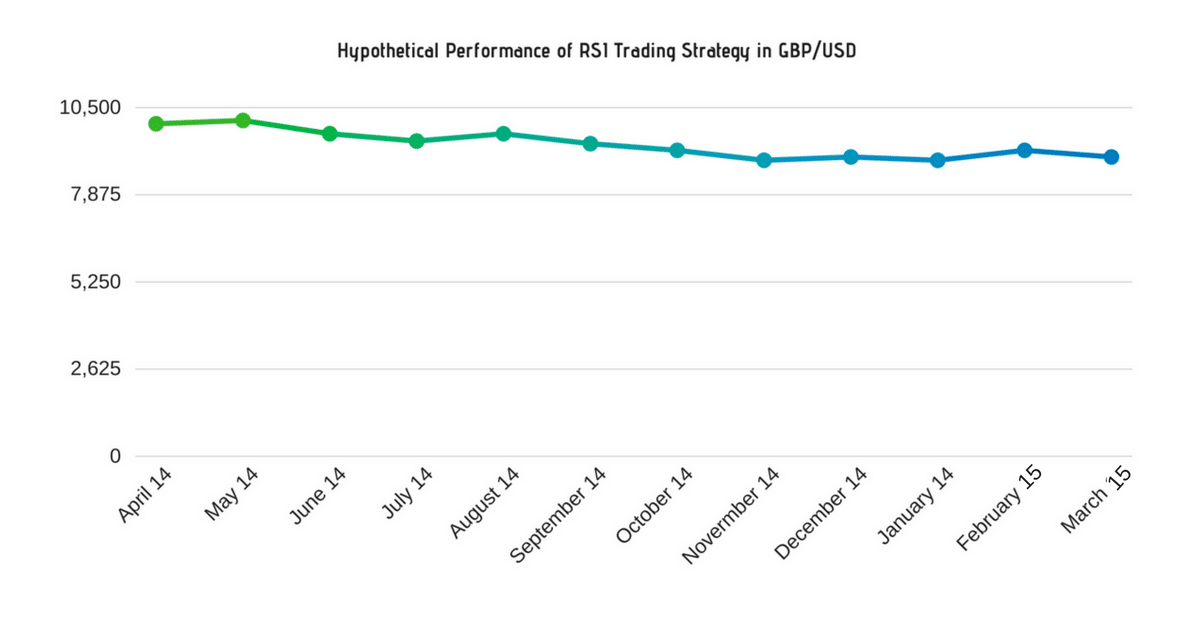

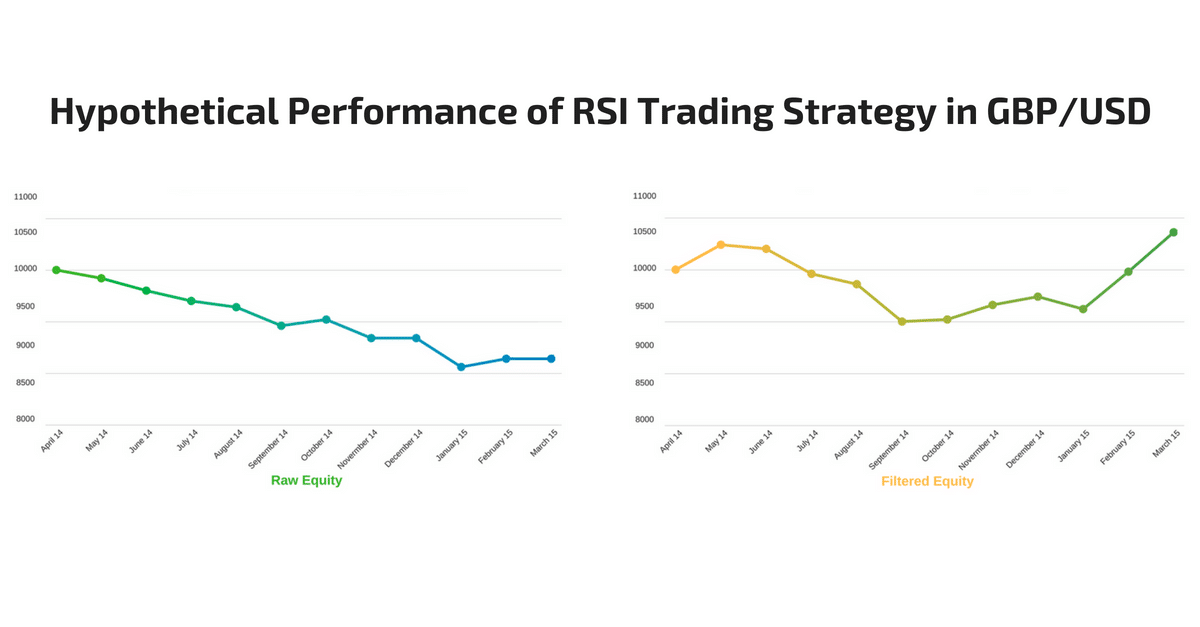

There has been a strategy that approximates a trader’s performance and simulated that strategy’s performance on GBP/USD. The results are very poor.

RSI Trading Strategy

Rule: Buy when the 14-period RSI crosses above 30. Sell when RSI crosses below 70.

Let us factor the time. This trade moves less at certain hours. Take it to your advantage and practice trading when the market’s volatility is low.

RSI Asia Range Trading Strategy

In the chart below, the system did not open any trades when the market is active at 6:00 a.m. to 2:00 p.m. Eastern Time. It shows the same strategy over the same window.

Using the same simple strategy, but adding the time filter, the results were far more positive.

Rule: Buy when the 14-period RSI crosses above 30. Sell when RSI crosses below 70. Only open trades before 6:00 and after 14:00 Eastern Time.

With this strategy, your trades will turn into your favor.

Other Currency Pairs

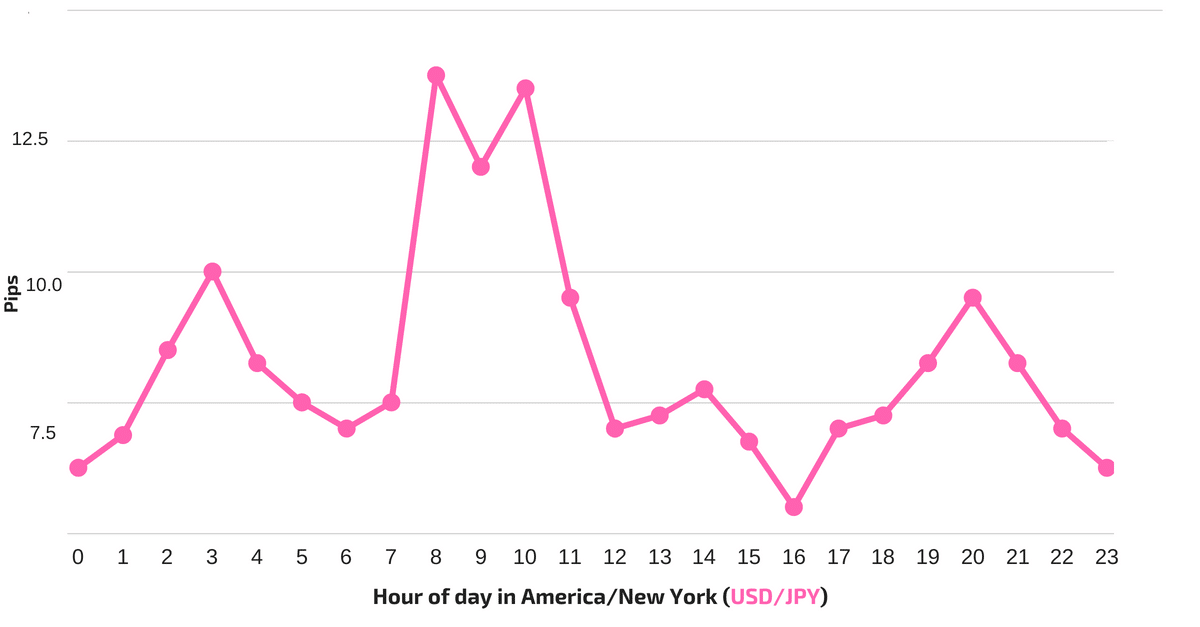

It is a given fact that the Japanese Yen is more volatile than its European counterparts. Currencies are not all the same after all. Below is the average hourly change in USD/JPY from 2005 to 2015.

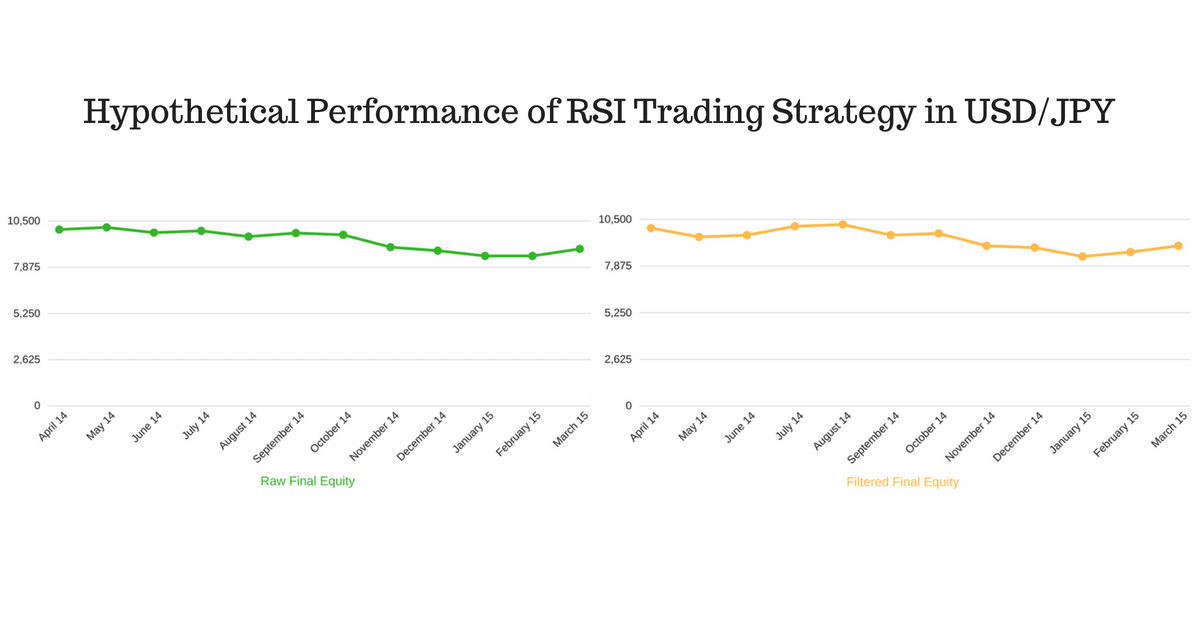

A simulation with the same filter using USDJPY has been examined and it came with very average results.

Time filters worked well on the currency pair of GBP/USD and EUR/USD.

It is suggested that both of these currency pairs work best from 2:00 p.m. to 6:00 p.m. time window.

Although it may work on European currencies, data suggests this window does not work well with Asian currencies.

The USD/JPY, AUD/USD, and NZD/USD did not show any improvements using different time windows. If this is true, then what strategy can you use?

Strategy to Use

When trading European currencies, you can trade when the market is not active. Based on the given data, for the past 10 years, trading European currency from 2:00 p.m. to 6:00 p.m. (Eastern Time) showed that traders found success on range trading.

Asian currencies “off hours” are flipped and the times where they experience less volatility is during their off market hours.

What to Remember?

Trading ranges typically occur when the price of an asset moves between support and resistance areas. The strategy above works best when the market is not active.

Range trading can make multiple winning trades before it gives way for a breakout.

The markets spend far more of their time range trading than they ever do moving in trends, so learning how to find profits within a range is crucial.

In the final analysis, having good money management techniques and applying the best leverage while trading in the best market conditions can bring significant trading profits.

NOTE: Statistics are derived from FXCM Inc. accounts excluding Eligible Contract Participants, Clearing Accounts, Money Managers, Hong Kong, and Japan subsidiaries from 4/1/2014 to 3/31/2015 across 15 most traded currency pairs.

“The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge.”

– Paul Tudor Jones