Forex trading is a process of speculating on the value of various currencies. Most traders don’t know that economic and geopolitical factors primarily cause fluctuations of exchange rates and can have a large impact on price movements.

In this post we look at what Fundamental analysis of the Forex market is and how you can use it in your own trading.

NOTE: You can get your free fundamental analysis of Forex markets PDF guide below.

Table of Contents

What is Fundamental Analysis in Forex?

Fundamental analysis analyses the forces that influence the economy, such as central bank interest rates, GDP indicators, production capacity, consumer confidence, employment, etc. Fundamental analysis can help to find a causal relationship in the past price movement and predict the future.

These are based on purely fundamental factors. Indicators such as macroeconomic statistics, interest rates, and the respective country’s political situation are used as a basis for information for trade decisions.

At its core, the fundamental analysis examines various economic indicators and political developments in any given economy, and based on that; conclusions are drawn about its future development.

The tasks of fundamental analysis include the research and analysis of price changes. Investors can take advantage of the data from fundamental analysis and use it to deduce future price developments.

Fundamental Analysis Forex Strategy

As we all know, the price of any asset is based on supply and demand. But if it’s the buyers or sellers in a better bargaining position, this is established by a few important fundamental aspects that help us determine if the predominant trend in the given currency pair is bullish or bearish.

The main price driver in a currency is the domestic economic growth and the central bank’s monetary policies.

Central banks are primarily responsible for the monetary policy of the respective country or currency area. A few of them have robust tools that ensure the well-being of a nation’s economy, with ‘key interest rate’ being one of the strongest tools.

The amount of the key interest rate is set by the central bank about ten times a year. Whether the key interest rate is high or low depends on the economic development of the country.

For (foreign) investors, the attractiveness of the investment or borrowing in the respective country is determined based on the interest rate. If there is an interest rate level of 3% in the US and an interest rate level of 1% in the EU, then an EU investor will invest his money in the US.

To do this, he has to sell EUR on the foreign exchange market and buy USD. EURUSD is falling.

In geopolitics, remember election nights like the Trump victory or Brexit (GBP lost 20% in a few hours compared to USD).

A nation’s fundamental situation essentially describes the overall strength of its currency. Although the release of these fundamental indicators often causes short-term fluctuations, they are particularly responsible for the long-term trends in the Forex market.

Forex Fundamental Analysis Tools

Fundamental analysis includes an assessment of the following factors that influence exchange rates.

- Indicators of economic growth (gross national product, industrial production, etc.)

- The trade balance of an economy

- Growth of the money supply in the domestic market

- Inflation and inflation expectations

- Interest rate level

- Solvency of the country and confidence in the national currency on the world market

- Speculative transactions on the foreign exchange market

- Degree of development of other sectors of the global financial market, for example, the securities market, which competes with the foreign exchange market.

Interest Rate Decisions

The development of interest rates within a currency area always has an impact on the foreign exchange market. If, for example, interest rates abroad are higher, investors will invest their money primarily there.

As a result, the demand for the respective currency automatically increases, which leads to an increase in prices. Conversely, the domestic currency will rise due to higher demand.

Other data, such as the foreign trade balance, inflation, or purchasing power parity, also influence exchange rates.

For example, a comparison of the data on imports and exports is possible based on the foreign trade balance. High imports lead to stronger demand for foreign currencies. In return, high exports weigh on the prices of the exporting country and cause prices to depreciate.

The Rate of Inflation

The CPI report is the most commonly used measure of inflation. The inflation rate can also be used to conclude the development of exchange rates. If domestic inflation is higher, domestic producers are at a price disadvantage. Goods abroad are becoming cheaper, which increases the number of imports.

This eventually results in increasing the demand for the currencies of foreign nations. On the other hand, if the inflation rate is lower than abroad, exports increase, and the local currency appreciates.

Labour Market Indicators

Employment indicators can be used to show the general well-being of an economy. The most important criteria are the number of jobs created or lost in any given timeframe. For the assessment of inflation, it is also important how quickly salaries rise.

Balance of Trade

This indicator gives us a clear picture of the nation’s trade deficit, i.e., the situation in which a greater number of products are imported than exported. The trade deficit means that the amount of money leaving the country exceeds the amount that comes into the country.

This situation should be considered negative as it directly contributes to the currency’s depreciation.

As a rule, trade imbalance plays a key role while performing fundamental analysis of any market. If the indicator of the foreign trade deficit for the country remains stable in the long term, this does not affect the price of the currency so significantly.

However, if the trade deficit exceeds market expectations, the price of the currency can change significantly.

Purchasing Power Parity

This indicator allows economic analysis to compare the standard of living and productivity between countries. If consumers receive more goods abroad for the same amount of money, this increases demand for the currency in question. This causes an increase in the exchange rate, which has an unfavorable effect on the domestic currency.

Gross Domestic Product (GDP)

Based on the GDP, the performance of an economy can be measured particularly extensively. Gross domestic product provides information on the number of goods and services produced during a year. Most traders focus their valuation on the two released estimates before the final GDP figures are announced.

If there is a significant impact between the first and second estimates, this can lead to significant volatility.

Best Forex Fundamental Analysis Sites

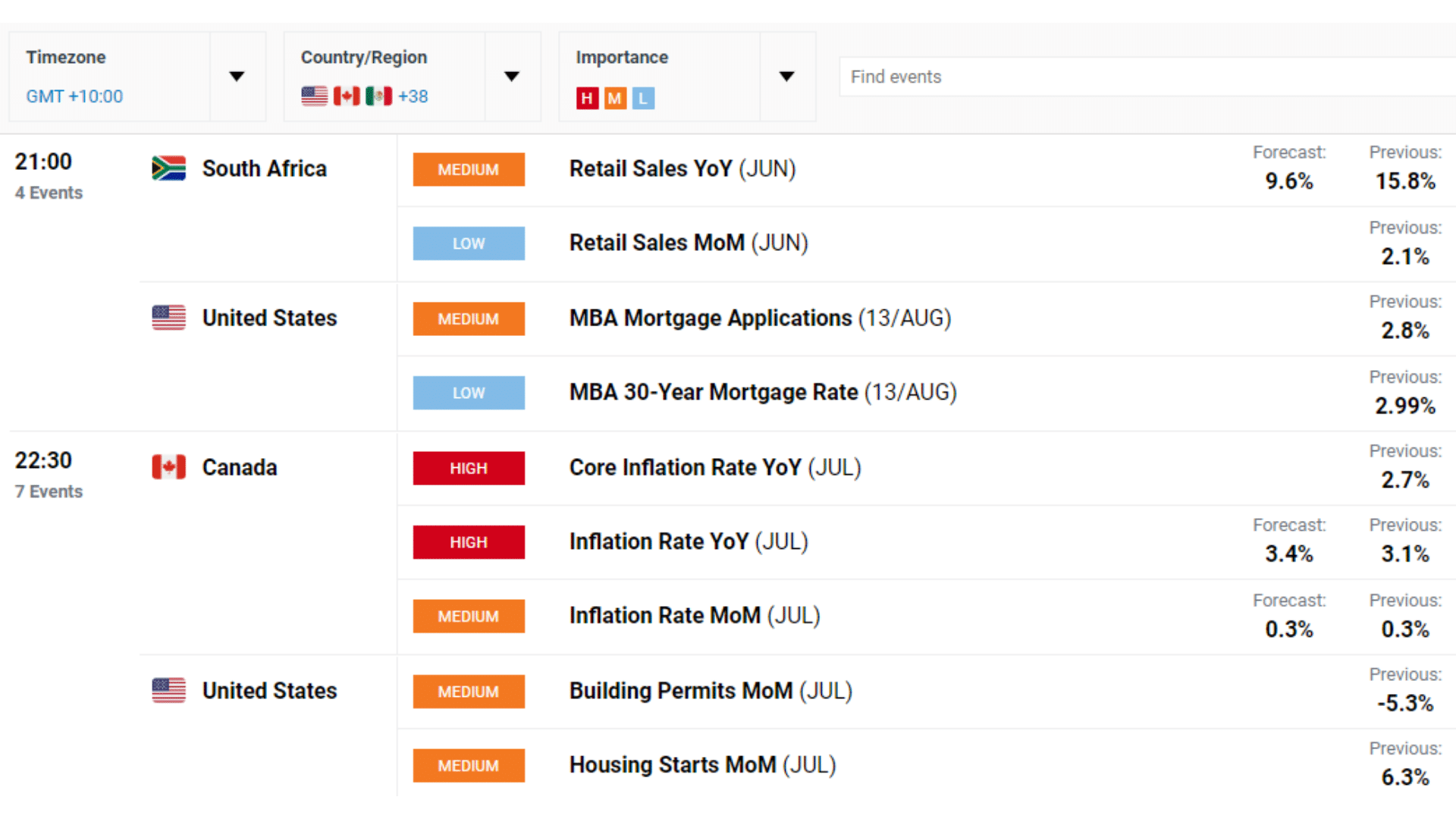

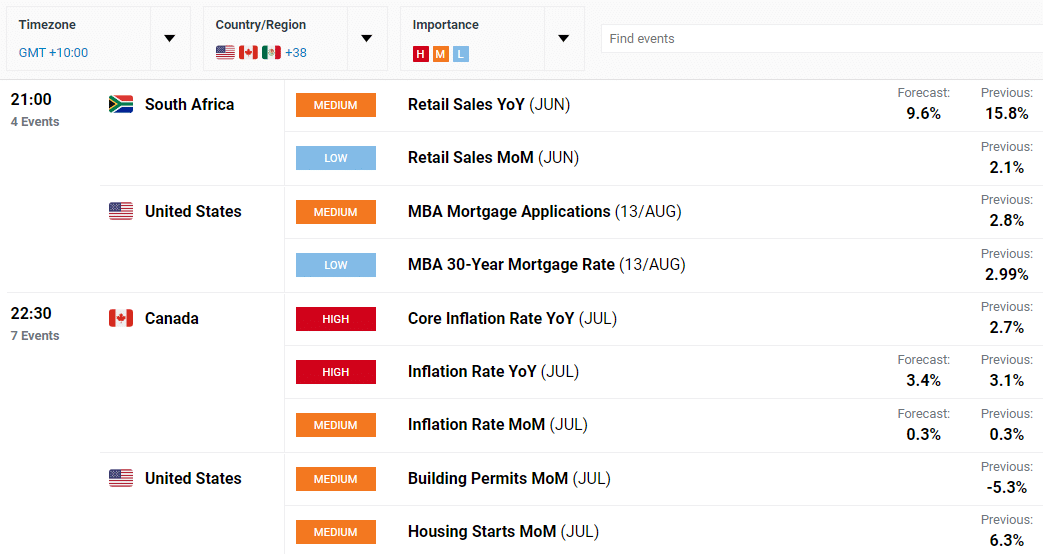

In practice, the first thing to do is to work with the economic calendar. This tool comprises all the publication dates of the most anticipated financial events in a calendar year.

Most well-known financial websites offer custom-made economic calendars and expert fundamental analyses of currency pairs based on those events. These expert analyses play an important role in determining how the market reacts when news is released.

Here are the best Forex fundamental analysis sites.

Bloomberg

This is one of the best financial websites. With Bloomberg, you get market-relevant information about politics, central banks, and economic performance. Select market-relevant content such as headlines on central banks, politics, and currencies.

Investing.com

Investing.com is an economic calendar that shows you which dates and events are coming up and are important for the Forex market. Most importantly, the calendar indicates the expected market impact of the scheduled events. This helps you plan your trades accordingly.

Google News

This tool allows you to search specifically for information about a currency or other terms.

For example, enter “USD”, “ECB”, or any other term. It gives you all the chronological and relevant details regarding your search. This is the best way to stay up to date with the Forex market developments.

Lastly

Fundamental analysis is based on identifying macroeconomic indicators and considering their impact on exchange rates at any given time.

The fundamental analysis websites we’ve mentioned in this article provide comprehensive data on various economic indicators that help you answer the question: What is the currency’s key interest rate level? How does the central bank influence the level of interest rates? Which political issues are significant? How stable is the economy?

Important indicators include the GDP, industrial production, employment data, interest rates, the consumer price index (CPI), and the government’s stability.

NOTE: You can get your free fundamental analysis of Forex markets PDF guide below.