Crude oil trading presents significant opportunities for profit in almost any market condition due to its critical role in the global economy and political landscape.

The energy sector has seen a sharp increase in volatility in recent years, creating strong trends that can yield consistent returns through short-term swing trades and long-term investment strategies.

In this post, we discuss how to trade the Oil market and some of the best strategies for making trades.

What is the Oil Market

Many market participants miss out on the full potential of crude oil fluctuations, often because they haven’t mastered the unique dynamics of these markets or are unaware of the hidden pitfalls that can erode profits.

Not all energy-focused financial instruments are equal; some are more likely to deliver positive returns.

Trading in crude oil and energy markets demands specialized skills for consistent profitability.

Those looking to trade crude oil futures and its various derivatives must understand the factors that drive the commodity, the behavior of market participants, the long-term price history, and the physical differences between different oil grades.

Oil is a vital economic resource, providing the majority of energy for transportation and raw materials for manufacturing, making it the most heavily traded commodity in the world.

Due to its essential nature and the lengthy production process, consumers and suppliers are slow to adjust their consumption and production as prices fluctuate. This results in oil prices needing to move significantly to rebalance the market following disruptions, such as a drop in demand due to a pandemic or supply interruptions caused by war or economic sanctions.

Globally, oil prices are determined in a range of spot and futures markets for crude oil and related products, influenced by market participants, including producers, consumers, short-term speculators, and long-term investors.

How to Invest in Oil With Little Money

Crude oil is the most widely traded commodity in the world. These markets are known for their volatility, which attracts many traders.

During geopolitical or economic instability periods, oil prices can swing dramatically, creating opportunities for experienced traders.

One of the most popular ways to speculate on oil prices is through oil CFDs (Contracts for Difference). CFDs are derivative products that allow you to trade on the price movements of crude oil without purchasing the physical commodity at its spot price.

With CFD trading, you agree to exchange the difference in the asset’s value from when the position is opened to when it is closed. The recent volatility in the oil market can result in either profit or loss.

Trading crude oil CFDs involves using leverage, which means you only need to deposit a small percentage of the total trade value to open a position.

This leverage provides greater exposure to the oil market and can amplify profits, but it also increases risk, potentially leading to significant losses. Therefore, we strongly advise our clients to implement an effective risk management strategy when trading oil CFDs.

How to Trade Oil Futures

Futures trading is more complex than investing in oil stocks or funds and should be cautiously approached.

Futures allow producers to lock in the price of what they sell ahead of time and buyers to lock in their purchase price. An oil futures contract is an agreement between two parties to exchange a specific amount of oil at a predetermined price on a future date. When trading futures, you deal with the contract, not the oil or underlying commodity.

If oil prices rise, the contract may increase in value, allowing the owner to sell it for a profit. Conversely, if prices fall, the contract could lose value, resulting in a potential loss when selling.

The goal in futures trading is typically not to take possession of the physical oil. Instead, there’s usually an active market of buyers ready to purchase futures contracts. However, in the spring of 2020, during the onset of the COVID-19 pandemic, the oil futures market experienced a dramatic collapse.

Oil refineries reduced their purchasing, leading to a backlog of supply. Investors holding oil futures struggled to find buyers and began lowering prices to attract them. In April 2020, oil prices briefly turned negative, with the futures contract for West Texas crude oil dropping to minus $37.63 per barrel—meaning investors were willing to pay others to take the contracts off their hands.

Although oil futures have since recovered, surpassing $50 in December 2020, this incident is a cautionary tale. If you’re considering trading futures, it’s important to proceed carefully.

How to Trade Oil Options

Crude oil options are the most widely traded energy derivatives on the New York Mercantile Exchange (NYMEX), one of the global derivative markets.

These options are not directly tied to crude oil but are based on futures contracts. Thus, despite their name, crude oil options are options in the future.

NYMEX offers both American and European-style options. American options allow the holder to exercise the option before expiration, converting it into a futures contract.

For example, we are exercising an American crude oil call option, which results in a long position in the underlying crude oil futures contract, while exercising a put option results in a short futures position.

Options contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined strike price. The maximum loss for a crude oil option holder is limited to the premium paid, unlike the potentially more significant exposure futures contracts.

Futures contracts require more capital for the same level of exposure compared to options and lack the asymmetric return characteristics of options.

Unlike some crude oil futures contracts, oil options do not require physical delivery at expiration.

European-style oil options are cash-settled, meaning holders of in-the-money options receive a cash payout upon expiration. In contrast, NYMEX-traded crude oil futures require physical delivery at expiration. A trader short one futures contract must deliver 1,000 barrels of crude oil to a specified location, while a long position requires accepting delivery.

The initial margin requirement for futures is higher than the premium required for a comparable option, providing more leverage through option positions. For instance, if NYMEX requires $2,400 as the initial margin for one crude oil futures contract (representing 1,000 barrels), an option on that futures contract might cost $1.20 per barrel.

A trader could purchase two oil option contracts for $2,400 (2 x $1.20 x 1,000), representing 2,000 barrels of crude oil. However, the leverage inherent in options is reflected in their pricing.

Unlike crude oil futures, long call or put options do not require margin and are not subject to margin calls. This allows traders holding long option positions to withstand price fluctuations without needing to provide additional capital, as would be necessary for margined futures positions. Long option contracts help traders avoid the risk of a margin call.

How to Trade Oil on MetaTrader

Trading oil on MetaTrader (MT4 or MT5) involves several steps, from setting up your trading account to executing trades. Here’s a step-by-step guide:

1. Set Up a Trading Account

- Choose a Broker: Select a reputable broker that offers oil trading on MetaTrader platforms. Here, you can read about the broker we highly recommend who gives you free charts. The broker is regulated and provides access to oil CFDs (Contracts for Difference) or oil futures.

- Register and Fund Your Account: Sign up with the broker, complete the registration process, and deposit funds into your trading account.

2. Download and Install MetaTrader

- MetaTrader 4 or 5: Download and install MetaTrader 4 (MT4) or MetaTrader 5 (MT5) from your broker’s website or directly from the MetaTrader website.

- Login: Use the account credentials provided by your broker to log into MetaTrader.

3. Find Oil on MetaTrader

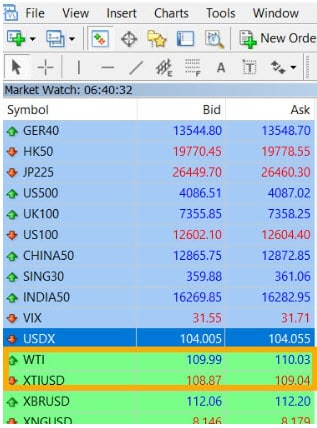

- Open the Market Watch Window: In MetaTrader, select the “View” menu and “Market Watch.” This window shows a list of available assets.

- Search for Oil: Scroll through the list or right-click in the Market Watch window and select “Symbols” or “Instruments” (depending on your platform version). Search for oil assets like “WTI” (West Texas Intermediate) or “Brent.”

- Add Oil to Market Watch: Select the oil asset you want to trade and click “Show” to add it to your Market Watch window.

4. Analyze the Market

- Use Charts: To open the price chart of an oil asset, drag it from the Market Watch window onto the chart area.

- Apply Technical Indicators: Use indicators like Moving Averages, RSI, MACD, or Bollinger Bands to analyze market trends and identify potential entry points.

- Fundamental Analysis: Keep an eye on news and events that affect oil prices, such as geopolitical tensions, OPEC meetings, and economic reports.

5. Place an Oil Trade

- Open the Order Window: Right-click on the oil chart or the asset in the Market Watch window and select “New Order.”

- Choose Order Type: Decide whether to place a market order (execute immediately at the current price) or a pending order (execute when the price reaches a specific level).

- Set Trade Parameters:

- Volume: Choose the trade size (lot size).

- Stop Loss and Take Profit: Set levels to automatically close the trade to limit losses or secure profits.

- Type of Trade: Choose whether to go long (buy) if you expect the price to rise or go short (sell) if you expect it to fall.

- Execute the Trade: Click “Buy” or “Sell” to open the trade.

6. Manage Your Trade

- Monitor the Trade: Keep an eye on your open position in the “Trade” tab of the Terminal window.

- Modify or Close the Trade: You can adjust the stop loss and take profit levels or close the trade manually by right-clicking on the open position and selecting “Close Order.”