When trading and investing in the stock market, your goal is to buy the shares of a company at a low price and make a profit by selling them at a higher price. You have to be registered to trade stocks on an exchange, but you can easily buy and sell shares through a licensed broker who will charge you a fee. However, the vast majority of share trading in today’s world is carried out through online trading platforms.

In this in-depth guide, we explore the basics of the stock market, and how you can get started trading in stocks.

NOTE: You can get your free stock market basics PDF guide below.

Table of Contents

The Stock Market for Beginners

A company looking to raise capital can offer its shares to the public and list on a stock exchange. This is known as an IPO (initial public offering).

At the start, the price point of a share is set by the company itself. Once the shares have been floated on the stock exchange, the price is open to the public and can move higher or lower depending on supply and demand.

While a company can issue more shares, there is always a limited supply and a public record of the number of shares in circulation.

When a trader buys shares in a company, they become a part-owner of that company and gain any rights that come with those shares. This includes voting and dividend rights.

Stock Market Basics

When you own stock in a company, you own a slice of that company equal to the number of shares you own. For example, if you own 10 shares of stock XYZ and there are 100 shares in total, you own 10% of that company.

As discussed below, physically buying stocks is different from trading and speculating in stocks with products such as CFDs. With CFD’s, you don’t actually own any part of the company. You are only speculating on if the price will move higher or lower.

It is important to note that when buying and selling shares, you are not buying or selling them directly from the company. Usually, you’ll make your trades through a registered broker, and buy or sell shares to another stock investor.

What Determines Share Prices

The price of a companies stock can move higher for several different reasons, but in the end, it all comes down to supply and demand. If more people want to buy the shares, then the price will rise. If more people are trying to sell, then the price will fall.

Supply and Demand

There are many factors which affect supply and demand…

- Company Earnings: The financial welfare of a company plays a huge role in its share price. This calculation includes how much money the company is currently making, as well as how much they could make in the future.

- State of the Economy: When we are in strong bull markets, it can be easy to find strong stocks. When the economy takes a dive, finding stocks that remain positive becomes much more difficult.

- Interest rates: When interest rates increase, investors can easily monetize other investments. This takes money out of the stock market and will often cause them to stagnate or lose ground.

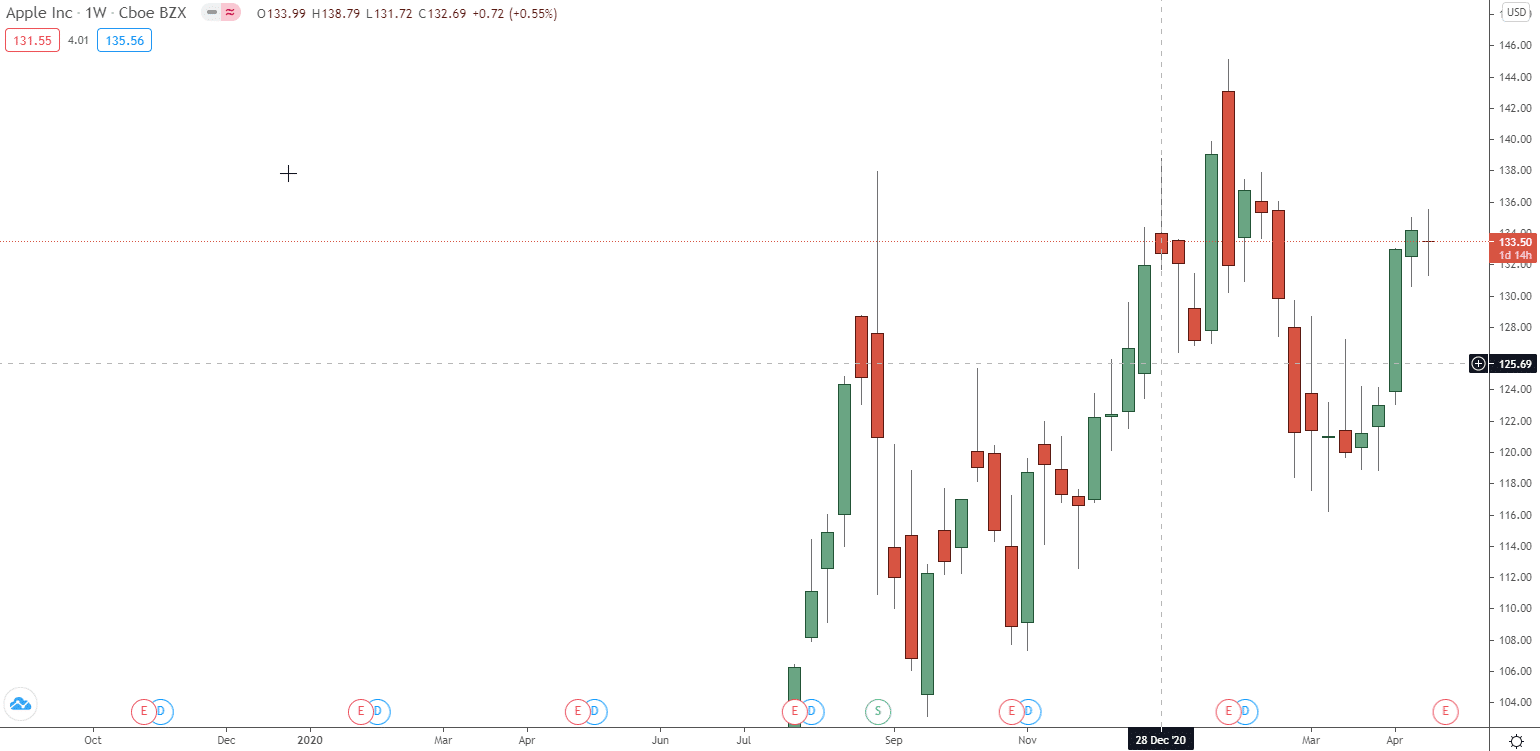

- Technical Analysis: Many investors are using technical analysis and chart patterns for both finding and managing their stock trades.

Buyers Fighting Sellers

After everything is taken into account, the price of a companies stock comes down to the laws of supply and demand.

There are millions of transactions from both buyers and sellers taking place in the market every day. The price of a company’s stock will move higher if more buyers are willing to pay higher and higher prices.

However, on the flip side, when the sellers move in and overwhelm the buyers, we can see price sell-off quickly and aggressively lower.

Understanding the Stock Market

It has been proven repeatedly that over long periods of time, the stock market can generate substantial returns that are hard to beat.

As we discuss in more depth below, not only can you make money from buying low and selling for a profit, but as a shareholder, you can also make money from dividends.

When many investors think of the stock market, they either think of day trading or what it would be like to find the next Facebook or Google before it takes off. However, to make solid profits over long periods of time, you do not need to take such large risks looking for the next big player.

Investing in companies that have proven long-term track records of profits can give you long-term capital gains while giving you an income every year from the company dividend.

Stock Market Indexes

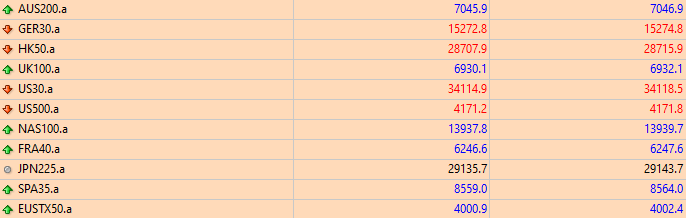

There are many thousands of stocks on many different stock exchanges worldwide. However, there are also stock market indexes.

Stock market indexes show you the price of a basket of stocks for certain indices. For example, when people talk about the Dow Jone, they are talking about the stock market index formed with the 30 largest US publicly traded companies.

There are many different stock market indexes all around the world. Whilst you may not be interested in trading them directly, they are often a good idea to keep an eye on if you are a stock trade because they can give you a quick idea of how an overall market or sector is doing.

Some of the biggest and most well know stock market indexes around the world include;

- S&P 500

- Nasdaq Composite

- Russell 2000

- FTSE Index

- Nikkei 225

- Dax Index

- CAC 40 Index

- CSI 300 Index

- Sensex

What is a Dividend?

Making profits through capital gain is a popular way to make money in the stock market. However, profiting from dividends can also be very lucrative.

A dividend is a payment to shareholders out of the company’s profit. These payments are normally made once or twice a year. Some larger companies will pay out quarterly dividends.

Typically, only the biggest and most profitable companies will pay out dividends, and they will publicly declare the amount of each dividend.

To be eligible for a dividend payment, you must be a fully paid stock owner by the ex-dividend date.

Profitable companies will regularly pay out their normal dividend when making profits, but they can also pay out special dividends. This is often the case if the company has made a larger than expected.

How to Invest in Stocks for Beginners With Little Money

There are two common ways traders and investors take part in the stock market. Whilst at first glance they seem very similar, they have very different pros and cons.

Buying and Owning Shares

The most common form of share investing is buying the shares outright. This means you own a slice of that company and all the rights that come with those shares, including potential dividends.

This type of trading normally involves no margin. That means if you buy $10,000 worth of stock, then you will need to front up the whole $10,000 at the time of settlement.

With this type of investing, you are looking to buy as cheap as possible and profit as the price rises.

Speculating on Shares With CFD’s

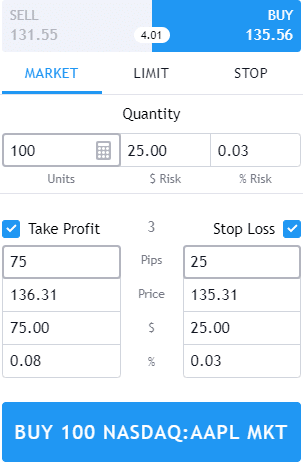

The other popular way to trade the share market is with products such as CFD’s.

With CFD’s, you do not actually own a part of the companies stock; you are only speculating and profiting from the price movements.

This type of trading does have its advantages and disadvantages.

With CFD’s, you will gain access to leverage. This means that you can take a trade and only have to front up part of the capital. For example, you could gain access to 30:1 leverage or, in some cases, more.

CFD trading will also be cheaper and allow you to start trading with a lot less capital because you do not have to front up the full investment.

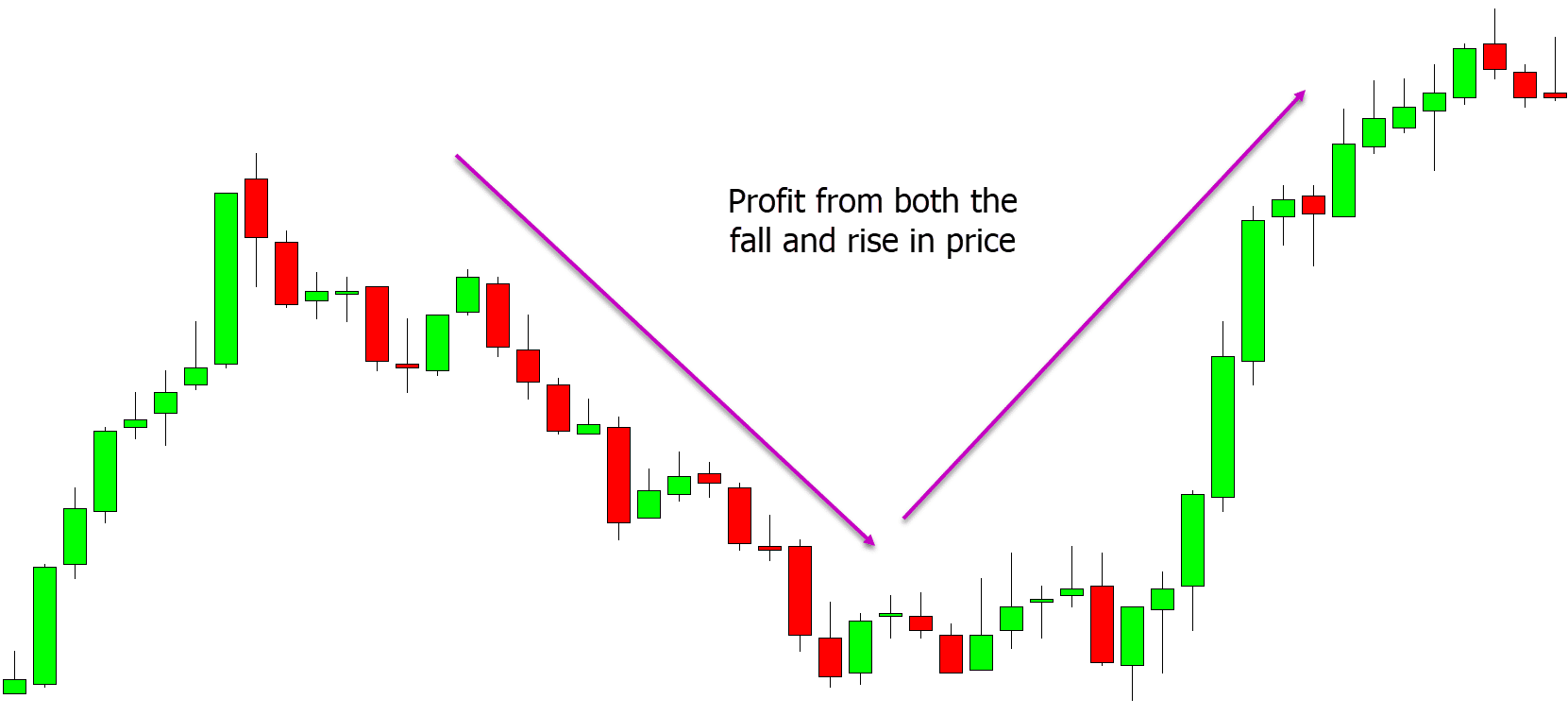

With CFD trading, you can also profit from price moving both higher and lower. If you think the price of a certain stock or stock index is going to fall, then you can make a short trade and make a profit from the price moving lower.

Choosing an Online Stock Broker

The type of stockbroker you choose to use will largely be dependent on the style of trading or investing you want to do.

If you want to own the shares physically, you will need a stockbroker like IG markets or CMC markets. These types of brokers allow you to buy the shares physically.

If you want to trade with leverage using products such as CFD’s and profit from price moving both higher and lower, you will need a CFD broker such as Pepperstone.

NOTE: You can get your free stock market basics PDF guide below.