Are you looking to profit from strong market moves? Momentum trading allows you to seize profitable opportunities by identifying markets and time frames with significant momentum. In this post, we will explore the essence of momentum trading and how it helps you discover high-probability trades.

Get ready to unlock the power of momentum and elevate your trading game!

Note: You can get your free Momentum Trading Strategies PDF download below.

Table of Contents

What is Momentum Trading?

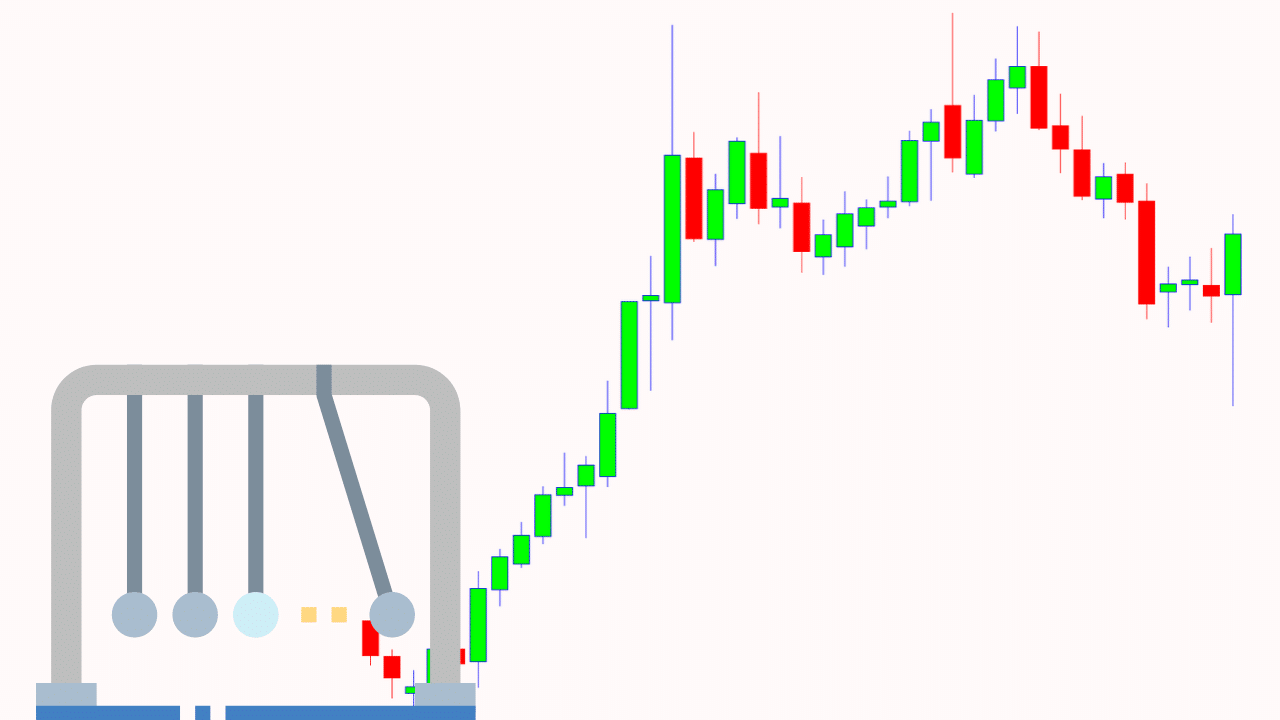

Momentum trading focuses on identifying markets that have experienced distinct upward or downward movements. In a momentum trade, the goal is to capitalize on a strong upward push in price. By buying during this momentum and selling as prices continue to rise, traders aim to profit from the prevailing trend.

Take a look at the chart example below, where price exhibits a robust upward movement.

In such cases, one could have sought to enter the trade with the prevailing momentum and profit from the ongoing price increase. Effective momentum strategies involve locating markets and time frames with clear short-term trends. Although there is always a risk of the trend reversing, trading in line with the trend and momentum often enhances the reliability of your trading setup.

Short-Term Momentum Trading

Many traders will use momentum trading to find short-term intraday day trades.

Many traders employ momentum trading to seek short-term intraday opportunities. This approach involves focusing on smaller time frames, like five minutes or 15 minutes. The appeal of this strategy lies in its ability to facilitate quick trade entry and exit, allowing trades to be closed before logging off your computer.

In contrast, trading higher time frames, such as four hours or daily charts, often entails holding trades for several days and incurring additional costs like rollover fees. By trading smaller time frames, such as the 15-minute charts, you gain access to a greater number of trading opportunities across various markets due to the faster-changing trends.

Momentum Breakout Strategy

Two of the simplest ways to find momentum trading setups are to look for momentum breakout trades or use an indicator.

There are two simple ways to identify momentum trading opportunities: by looking for momentum breakout trades or using indicators. A momentum breakout occurs when the price has already made a strong move in one direction and then consolidates, forming a box-like pattern. When the price breaks out of this pattern, momentum traders will trade in the direction of the breakout and ride the momentum.

Take a look at the example chart below, where the price initially rises, pauses to consolidate in a box, and then breaks out higher, continuing the momentum.

What is the Best Momentum Indicator?

One of the most favored indicators for identifying momentum trades is the moving average.

The moving average is popular because it can indicate the formation of trends and the strength of those trends. A common approach involves employing two moving averages in conjunction.

In the chart below, you can see the 50 EMA (exponential moving average) and the 200 EMA. When the 50 EMA crosses below the 200 EMA, it signals a downtrend in price.

Momentum Trading Setups Examples

Most traders want to get into the market at the best price. This is no different with momentum trading.

A common strategy used to do this is to wait and watch for price to pullback into a supply or demand zone within the momentum.

The first step to doing this is identifying when price is making a strong momentum move. The chart example below highlights this with a strong move lower.

After this, we are looking for a pullback higher so we can find a potential entry. As the example shows below price pulls back into the recent resistance level. This could be a possible entry level to go short with the momentum lower.

Lastly

Momentum trading can be highly profitable when done correctly. Many traders will use the strategies discussed in this post and add their other favorite tools and techniques to find high probability entry points.

These include strategies such as using Japanese Candlesticks, using price action clues to confirm breakouts or their other favorite indicators.

Remember: always test any new strategies, systems or indicators on free demos or virtual charts to make sure you are successful with them before ever risking real money.

Note: You can get your free Momentum Trading Strategies PDF download below.