Forex is a global, decentralized market used to trade different currencies from around the world. This market is responsible for determining the foreign exchange rates for every major currency.

Due to the global reach of trade, commerce, and finance, these markets tend to be among the world’s largest and most liquid markets.

This post will explore how the news can affect the forex markets and the trading strategies that you can apply to profit from price movements in forex.

NOTE: You can get your free Forex news trading strategy PDF guide below.

Table of Contents

How Does News Affect Forex?

One of the benefits of trading in the forex markets is that traders can trade 24 hours a day, five days a week. This is second only to cryptocurrencies that are available 24/7.

All markets, be they stocks, commodities, forex, or cryptocurrencies, can be affected by external events. Whether it is the policy decisions of the Chinese government, a natural disaster, or a terrorist attack, recent decades have demonstrated time and time again that world events have an impact on the direction of the markets.

This sensitivity to external events is particularly prevalent in the forex markets.

These markets respond not only to U.S. economic data such as interest rates or NFP numbers but also to news worldwide.

There are 8 major currency pairs available to be traded at almost every well-established brokerage. These currencies range from the U.S. dollar to the Japanese yen and the Swiss franc.

That means that there are at least 8 countries whose economic data will have a bearing on the forex market.

Therefore, traders are practically guaranteed that there is always some economic data scheduled for release that they can use to inform their trading. Indeed, up to 7 pieces of data are released every weekday that forex traders can use.

This abundance of data and constant news releases are why the news more significantly influences the forex markets. Let’s look at an example of how some of this news can affect the forex markets.

Assume that a trader wakes up to the news that the Reserve Bank of New Zealand (New Zealand’s central bank) is taking a more hawkish or aggressive stance on interest rates in New Zealand. The Governor of the Reserve Bank of New Zealand has issued a statement detailing that they will not be cutting interest rates as expected and there will instead be a slight increase in rates.

Since interest rates directly impact the value of a currency, this news will be relevant for forex traders.

Cuts in interest rates devalue a country’s currency.

The unexpected news that there will be no cuts in the interest rates can therefore be expected to increase the value of the New Zealand dollar. Forex traders would use this news to inform their trading decisions for any trades concerning the New Zealand dollar in the hours/days following the news.

High Impact News Forex

There are certain news releases in the forex market that are referred to as high-impact news.

As the name suggests, these news releases tend to have the highest impact on the forex markets, and so traders are well-advised to take notice of them when released.

Examples of high-impact news are data releases such as;

- Unemployment numbers or consumer price index (CPI) releases.

- Meetings at central banks and news relating to a country’s gross domestic product.

- Government interest rate decisions.

Trading After News Release

The most important news releases will be the ones that relate to central bank meetings.

Central banks have a mandate to control inflation and maintain the value of a nation’s currency. To do this, they have several tools at their disposal.

One of these tools is the ability to control interest rates. Interest rates set by central banks have a direct impact on the value of a nation’s currency. Traders, therefore, keep a watchful eye on central bank meetings to determine whether there will be any change in interest rates in the future.

Forex traders are notorious for rigorously analyzing the monthly statements issued by central banks and have been known to send markets into a spin if the slightest hint of interest rates is cut.

Unemployment data is released in several different ways depending on the jurisdiction that you are in.

In the United States, the highest impact release is inarguably the US Non-Farm Payrolls. These reports detail the change in the number of employed people over the previous month with the exclusion of those employed in the farming industry. The US Bureau of Labor Statistics releases it on the first Friday of the month.

It is relevant to forex traders because the US Federal Reserve takes this data into account each month when determining its interest rate policy.

If there is high unemployment, the Federal Reserve will likely cut interest rates to stimulate employment in the economy. This would mean that the value of the US dollar would fall, and so traders would enter short positions to benefit from this.

The Consumer Price Index (CPI) is a measure of inflation. It details the changes in prices of various goods and services in the economy.

If the prices of goods and services are rising, it is an indication that there is likely to be inflation. At the time of writing, there has been a lot of discussion around the price of lumber in the United States, with many commentators believing that the increase in the price of lumber is a forewarning for the coming inflation.

Again, there is a direct relationship between CPI data and interest rates as the Federal Reserve monitors these releases and takes the information into account when determining interest rates.

Lastly, we have the gross domestic product (GDP).

This data provides information on the annualized change in the inflation-adjusted value of goods and services produced in a country’s economy. To put it simply, it is a measure of the size and health of a country’s economy over a period of time. This is a comprehensive piece of data, and so it is difficult for central banks to make direct policy changes based purely on this information.

However, it remains a primary gauge of overall economic strength and therefore can not be ignored. Generally, if a country’s GDP is trending up, then it is likely that the economy is growing, which means that the central bank may increase interest rates. If interest rates go up, so does the value of the currency. All roads appear to lead back to interest rates.

Whilst these are the four main sources of high-impact news in the forex markets, the chaotic nature of the world around us means that there is always a chance that a black swan event may occur and cause markets to either fly up or crash down.

The U.S. President may decide to have an impromptu press conference and make nonchalant references to a trillion-dollar stimulus package that sends the U.S dollar soaring. Or, a pandemic could start.

Forex traders must always keep a watchful eye on current events as there is always a chance a new development could impact the currency they trade.

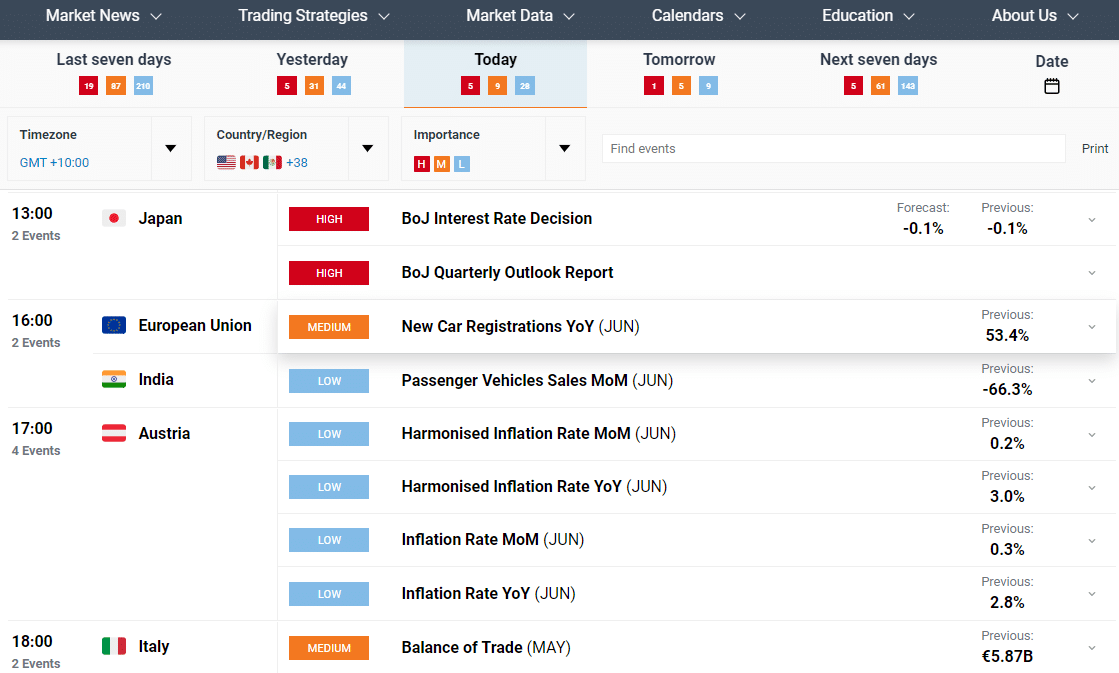

High Impact Forex News Calendar

Due to the number of relevant countries releasing data regularly, it can be difficult for traders to keep track of what is happening and when.

To help traders manage the release of high-impact news, several different calendars have been developed to keep track of important data or news releases.

Below you will find the links to three of the most reputable calendars available online.

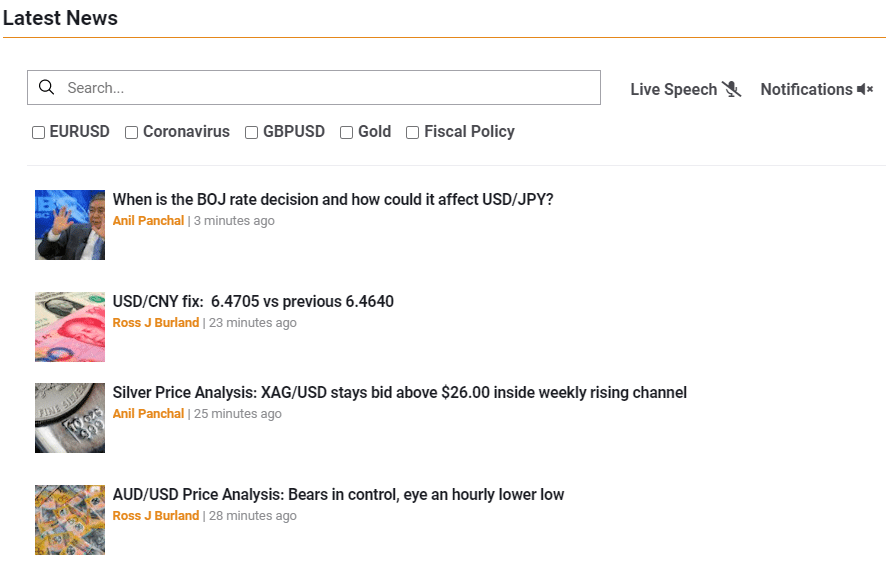

Forex News Live

As with the economic calendars above, there are many sources where you can find live news relevant to their trading.

Below you will find the links to three reputable sites where you can find live news related to the forex markets.

Forex News Trading Strategy

Trading the news comes with several advantages for traders. This is because traders are aware of exactly when they will be trading and can almost guarantee that there will be a price movement when they do trade.

As a result, the most common trading strategy in forex is for the trader to identify a currency in a period of consolidation or uncertainty before releasing a high-impact news item.

If there is a breakout because of the news release, traders can trade this movement in value of the currency. This can be done on intraday time frames such as the 1 hour time frame and below.

To use this strategy effectively, there are several things a trader must do.

Firstly, a trader needs to select relevant news to trade from. Not all news is suitable for forex trading. Generally, any of the news releases listed above should be suitable to trade on. The most important news will typically come out of the United States, so any news from there should also be considered.

Once a trader has determined which news release they will be trading, they should begin to analyze the chart of the currency they will trade. The grounding for price movements is often laid beforehand and so studying the chart will help a trader determine how best to trade the news.

Finally, traders should remember not to rush into opening a trade. It is tempting to open a position as soon as possible to make sure you capitalize on the momentum. This is a mistake; the momentum of the news typically can last over an hour. Traders should use this time to analyze the chart using their technical analysis techniques.

If the trader already has an open position before the news is released, it is recommended to think about closing the position until after this news release.

This can be irritating, especially if there is a loss on the current position, but it can be the best practice to minimize your risk. There is no way to know what the news release will reveal or how the market will react, and proper risk management is the key to success for any long-term trader.

Lastly

Trading in the forex markets may seem to be as simple as keeping an eye on interest rates and planning your strategy according to whether they are rising or falling.

In reality, trading is rarely such a straightforward practice. If it were, everyone would trade in the forex markets and make healthy profits for years to come.

The currency markets are particularly susceptible to short-term price movements triggered by the release of economic news from all over the world.

There are many factors beyond interest rates to be taken into account when trading in any market. The keys to success will always be continuing personal development and proper risk management.

Traders in the forex markets should always keep on top of current economic events and always practice trading these events on a practice account before putting real capital at risk.