Candlestick patterns have become extremely popular for traders trying to gain an advantage by being able to read the live price action as it is forming.

The shooting star is one of these popular patterns because it reveals vital information.

In this post we go through exactly what the shooting star pattern is, how to identify it and how you can use it in your trading.

Table of Contents

What is a Shooting Star Pattern?

A shooting star pattern is a bearish candlestick that can be identified with a long upper shadow and little to almost no lower shadow (candle wick).

It also has a small real body that closes close to the low of the session.

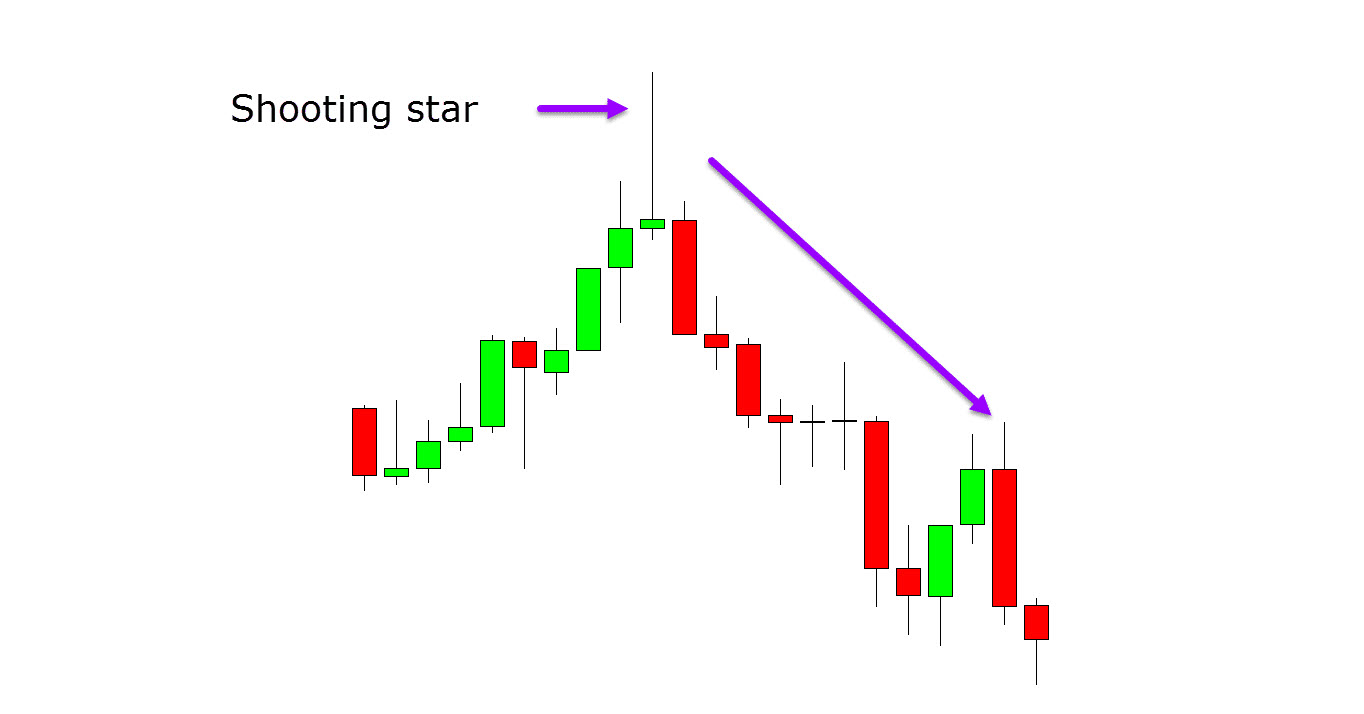

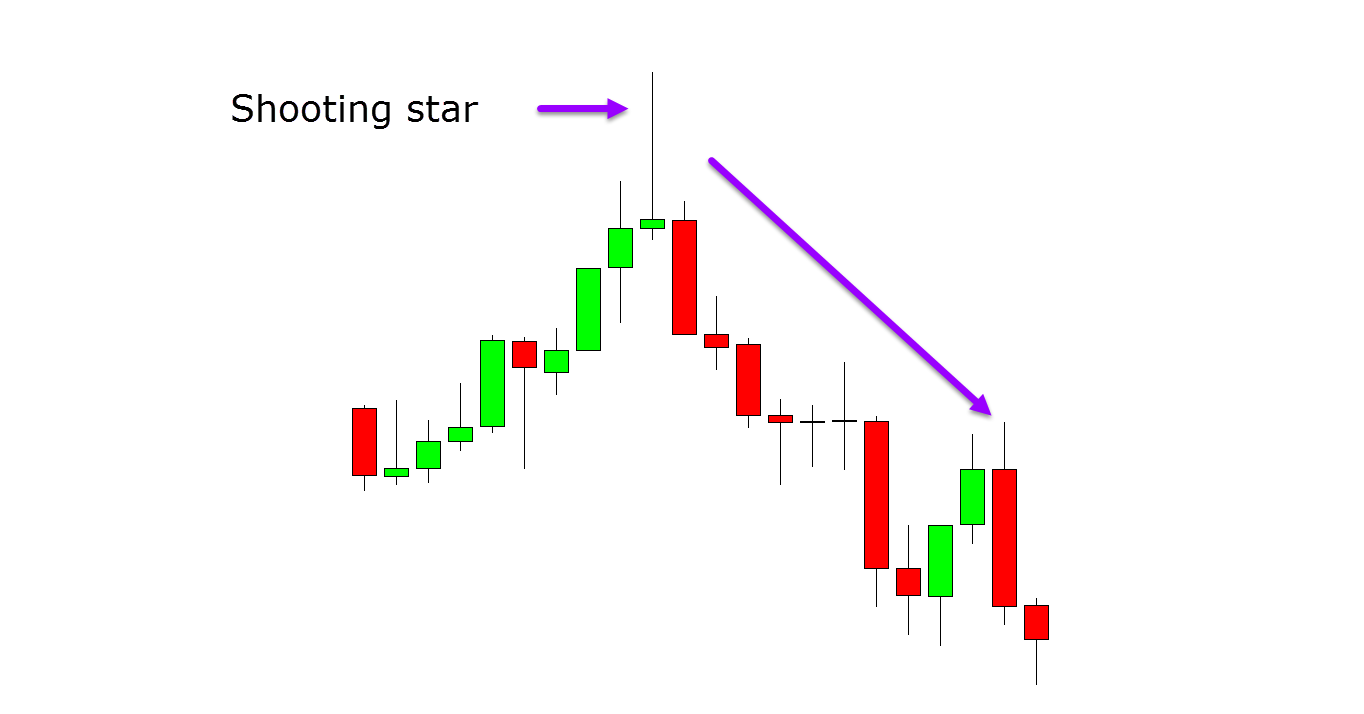

The shooting star pattern only appears after an upward swing in the price action. This is important because we need to see this pattern up at a swing high and not at a swing low.

As the example shows below; price makes a swing higher and then forms the shooting star.

How to Identify a Shooting Star Candlestick Pattern

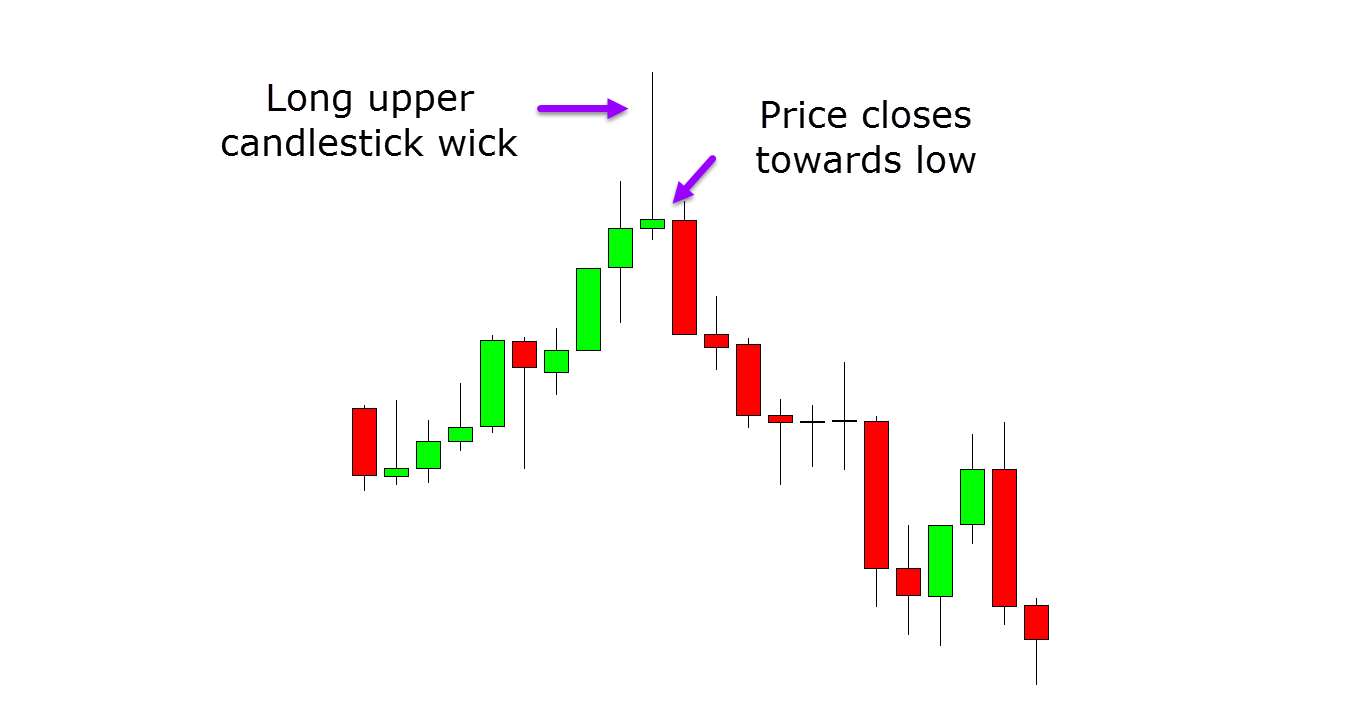

When identifying the shooting star candlestick pattern you need to see a long upper wick and a candle that has either a very small or no lower wick.

The body of the candlestick needs to be small showing that price has collapsed back lower. The color of the candle, or if price closes higher or lower does not matter.

It is crucial you identify this pattern after a swing higher in price action and not after a swing lower.

The reason this is so important is because the shooting star can sometimes be confused with the inverted hammer candlestick.

By themselves these candlestick looks the same, however they form at completely different areas which is what sets them apart.

Read about how to trade the hammer and inverted hammer pattern here.

What Does a Shooting Star Signal?

The price action of the shooting star is showing us that the bulls tried to push the price higher, but by the end of the session the bears had wiped away the gains and had sent price back lower.

This bearish rejection is showing us that a potential reversal back lower could soon be on the cards.

This is why we need to identify this pattern up at a swing high or after price has made a move higher. We need to see higher prices getting rejected for a new move back lower.

How to Trade the Shooting Star

Once you know how to find the shooting star pattern, there are simple trading strategies you can start using to enter trades.

The two most common trading strategies with the shooting star are making an entry as soon as the candle has finished forming and using confirmation.

A confirmation entry is when you are looking to make sure the candlestick pattern confirms itself.

With the shooting star you are looking to see that price moves below the low of the candle for your entry. You can use a sell stop entry to do this automatically.

Shooting Star Example

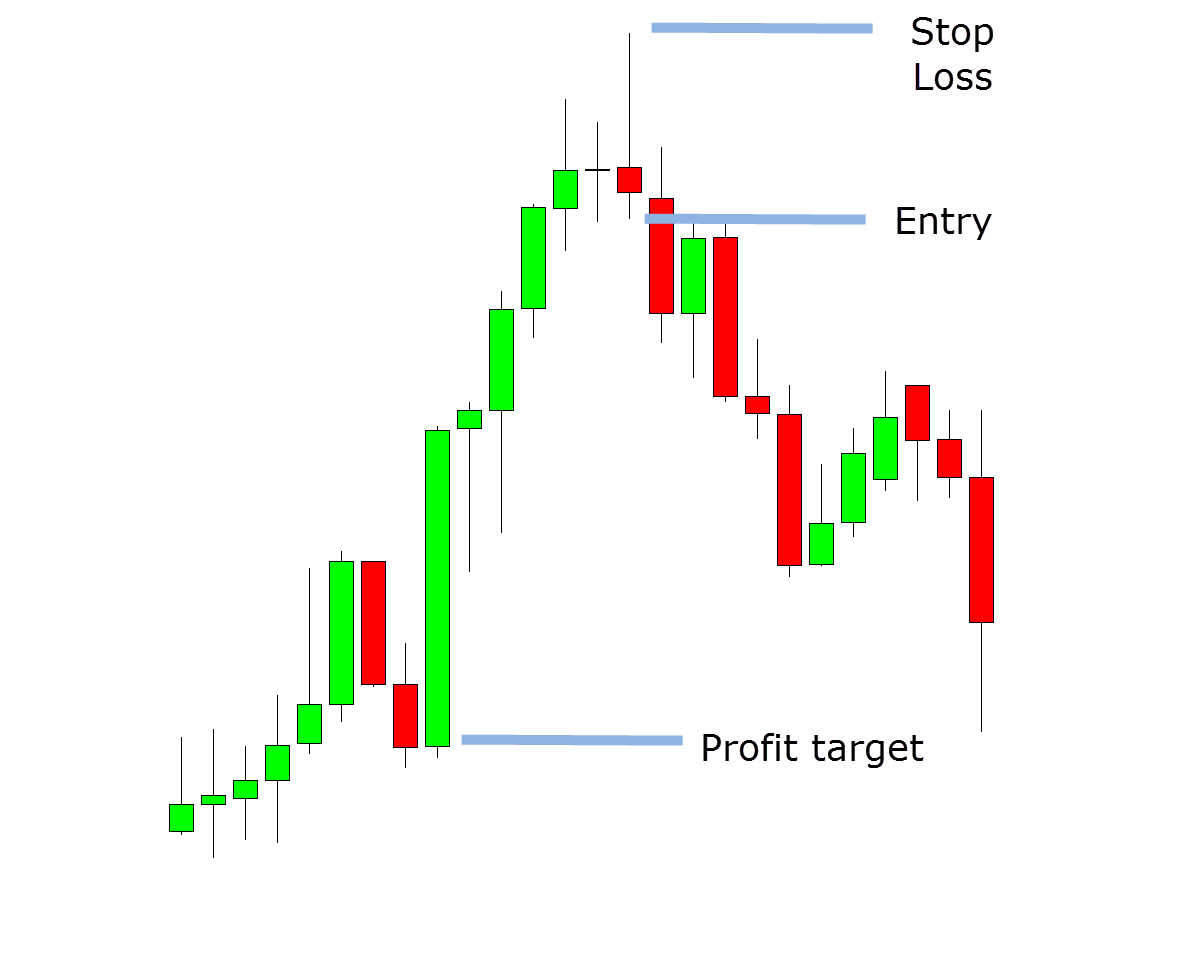

The example below shows how you could use this pattern to find and then make trades.

After price moves higher it forms a shooting star. You could either enter as soon as the candlestick finishes forming or, you could enter a short trade when price moves below the low of the shooting star.

You stop loss could go above the high of the shooting star and your target would be the recent swing low support area.

Using a Shooting Star Indicator in MT4

The shooting star indicator for MT4 is designed to identify the shooting star and hanging man patterns on your charts so you don’t miss any potential setups.

This indicator comes with a number of features, such as displaying five unidirectional candles, displaying a confirmation signal and giving you optional alerts.

This is a premium indicator, but you can try it for free with a trial.

Get the Shooting Star MT4 Indicator Here.

FAQ’s

What Does a Shooting Star Candlestick Mean?

It is a bearish reversal pattern that consists of one candle. The candlestick pattern is formed when the price of an asset is pushed higher and then rejected back lower in the same session. This leaves a large upper wick rejecting higher prices.

Is the Shooting Star Bullish or Bearish?

The shooting star is a bearish reversal signal that signals that the recent move higher may be about to come to an end with a new move lower.

How do You Trade a Shooting Star Pattern?

After identifying the shooting star pattern you can either enter a short trade when the candle has completed, or make a short trade when price moves below the low.

Your stop loss can go above the candlestick high and you can target the recent swing low support area.

Lastly

This pattern is best traded from areas of value and when you add other confluences to your trade.

The easiest way to do this is to make sure you are trading from major areas of resistance.

You can also use your other favorite trading indicators to confirm that price is looking to reverse.