As a trader, one of the best ways to stack the odds in your favor is to make trades that are in line with the trend.

This is because when you trade with the trend, you are making decisions based on the current direction of price movement. While this doesn’t ensure that the price will continue moving in that direction, it does increase your odds of making a profitable trade.

The other reason is that trends can last for long periods of time. In other markets (i.e. ranging markets), the price fluctuates quickly and often. A trend can make an extended move in one direction for a long period of time. This gives traders the opportunity to make far larger winning trades by placing a smaller stop loss.

NOTE: You can download your free trend line trading strategies PDF guide below.

Table of Contents

Does Trend Trading Work?

The simple answer to this question is yes. Trend trading is one of the most popular ways to trade all different kinds of markets from Forex through to stocks.

The reason why trend trading is so popular is because once you know how to do it correctly, then you can find trend trades in many different markets and on all time frames.

This allows you to find many different trading opportunities that have the ability to become very profitable trades.

What is a Trend Trader?

A trend trader is simply a trader who is looking to find the obvious trend either higher or lower and make large profits by riding the next wave in the market.

Whilst there are many different trend trading strategies you can use, in this lesson I am going to teach you a very simple strategy you can use to find trades in many different markets and time frames.

The most common mistake trend traders make is looking for trends in all markets and time frames. This is a huge tip: price spends far, far more time moving in range and sideways patterns than it does moving in clear trends.

If you are looking for trends in every market, then you will be making trend trades when there simply is no trend. Trends should be easy to spot. You should be able to flick to your chart and quickly say ‘price is clearly trending higher or lower’.

What is a Trend Trading Strategy?

Because trend trading is so popular and can be used in many different markets, there are many strategies that can be used. However, a lot of these strategies are overly complicated and don’t actually help you find or make trend trades.

As we go through in most of our lessons, the best strategies are nearly always the simplest.

This is also true for trend trading strategies. As we go through below; once you have found a clear-cut trend you don’t want to be overcomplicating things. You just need to find high probability trades and then ride that next wave that price makes higher or lower.

Simple Trend Following Strategy

The easiest way to find and identify a clear-cut trend is using price action.

When you move to your price action chart you should be able to quickly see if price is making an obvious move higher or lower. If you are struggling to find a clear move higher or lower, then the chances are there is no trend.

The other easy way to find trends and also when new trends are starting is looking at the swing highs and lows.

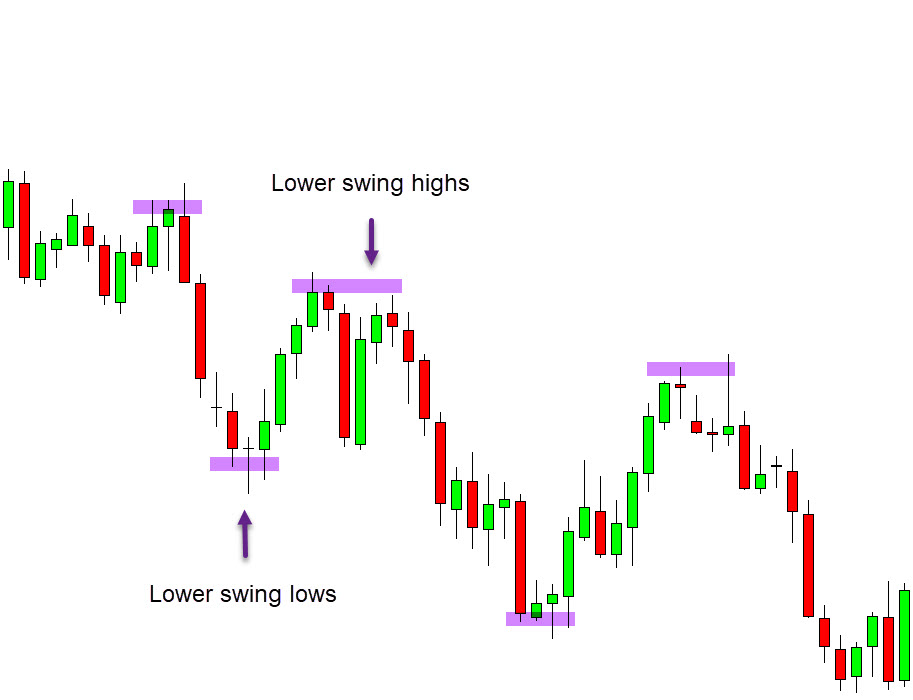

A trend will form a series of swing points. See the example chart below. Price is in a trend lower. With this trend we have a series of lower highs and also lower lows. This is like a step ladder with price ‘stepping’ lower.

Important point: Even in the strongest of trends price will always make these swing points and rotations. These swing points and pullbacks are also often the best times to find high probability trades.

Once you have found a clear-cut trend, then it becomes time to find a trade entry point.

There are many different ways you can do this, but using the swing points and support and resistance levels offer some of the highest probability entries.

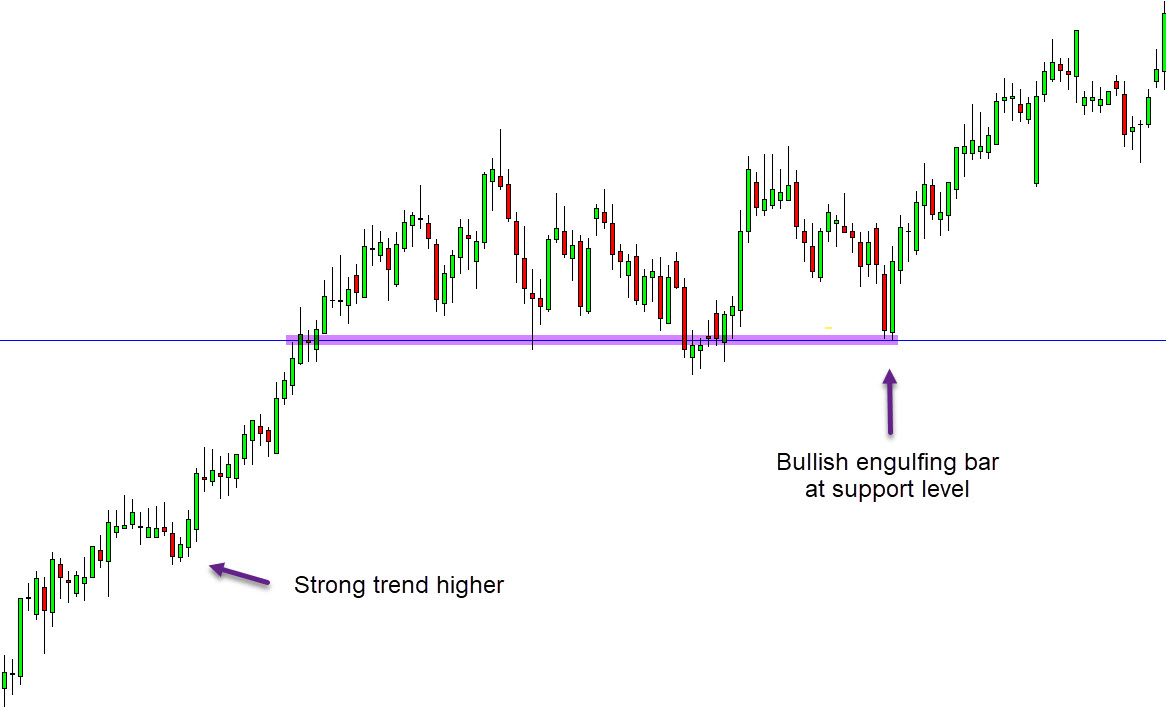

See the example below. Price action is first in a trend higher. When we see this we begin looking for a long trade. When price makes a rotation and swing lower into the support area we can then look to get long. We could take a long trade as soon as price hits this support area or we could increase our trades odds even further.

A way of increasing our odds would be to use candlestick patterns to confirm the trade entry. In this example below we have found the trend higher, price has moved back to the support and then it forms a large bullish engulfing bar that would confirm our long entry.

The Best Trend Trading Indicators

One of the most popular indicators used to find and make trend trades is the moving average.

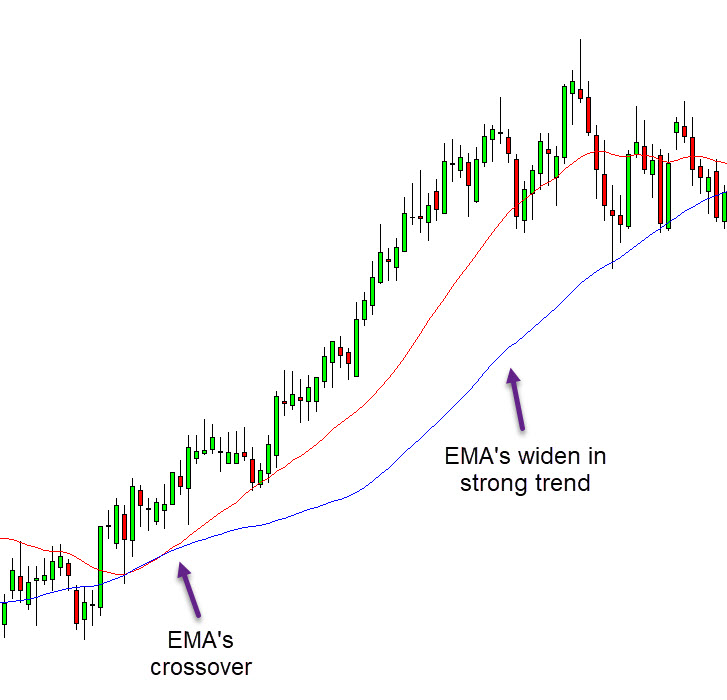

The best way to use the moving average when trend trading is using two moving averages and using the crossover. In the example below two exponential moving averages (EMA’s) are used. The first is the 50 period EMA and the second is the 21 period EMA.

When we see the faster moving 21 period EMA cross above the slower moving 50 period EMA we can see the trend changing to an uptrend.

The key with the crossover is looking for the two moving averages to widen. When the moving averages start to widen it shows us that the trend is very strong.

Read more about trend trading indicators here.

Lastly

Trend trading is hands down one of the simplest and also most popular trading strategies.

You can use trend trading in all of your favorite market types and on all time frames. It allows you to use smaller stop losses and gives you the chance to make very large running winning trades.

There are many different trend trading strategies you can use. The best thing you can do is get a free set of demo trading charts and start practicing to see what is your favorite.

NOTE: You can download your free trend line trading strategies PDF guide below.