Breakout trading can offer you the opportunity to find and make very high reward trades that can be highly profitable.

Some of the most explosive and also profitable trades are breakout trades. The reason for this is because just before price breaks out of an area it is often tightly contained. When price eventually does breakout it can often then explode in a large move.

In this lesson we go through exactly what breakout trading is and how you can make high probability breakout trades.

NOTE: Get your free Breakout Trading Strategy Guide PDF Below.

Table of Contents

What is Breakout Trading?

When you are making a breakout trade you are looking for price to ‘break’ through a key level in the market.

The two most common levels traders will look for breakout trades are through support and resistance levels and through trendlines.

As a breakout trader you are looking to enter a trade when price breaks a key level and make a profit as price continues on with the break.

See the example breakout trade below. Price at first is contained and rejects the resistance level. The breakout trade comes when price breaks through the resistance level. This allows for long trades to be placed and profits to be made as price moves higher.

What are the Advantages of Breakout Trading?

Breakout trading can be done on all time frames and on nearly every market.

The best markets to make breakout trades are where there is a lot of market movement and volatility. This will give you a better chance of seeing price explode through a key market level.

When breakout trading you have uncapped profit potential. This means that unlike a strategy such as range trading where you are trading back into a support or resistance level, you are trading out of a support and resistance level. This allows you to make a trade that could run into a very large winning trade.

Whilst there are a lot of advantages to breakout trading, there are also some very real risks.

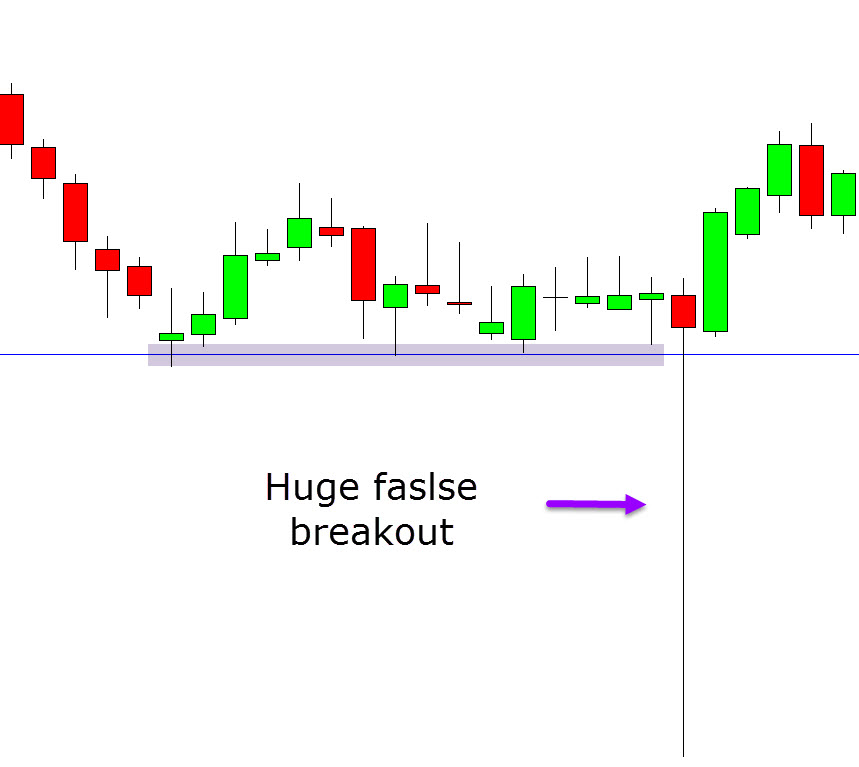

The example below shows exactly what happens when a breakout trade quickly turns into a fakeout. This happens when price attempts to breakout of a key level, but quickly snaps back and stops all of the breakout traders out.

The Basics of Finding a Breakout Trade

The most important thing to breakout trading and what new breakout traders often struggle with is first finding a major level.

You need to be able to first identify that the potential breakout level has been respected as a support or resistance level on multiple occasions.

This goes the same for trendlines.

See the example below. Before breaking out higher price had respected the obvious resistance level twice. This sets up a clear breakout trade when price moves up higher and looks to re-test the same level on a third occasion.

Simple Breakout Trades

Some of the best breakout trades are also the simplest.

Once you have found an obvious level that price has been contained within such as a key support or resistance level, then you can start looking for your breakout setups.

Intraday Breakout Trading Strategy

One of the most popular trading strategies is finding and making intraday breakout trades.

Intraday breakout trades can be both explosive and highly profitable.

The main thing you want to keep in mind when looking for intraday breakout trades is that you want to trade with the momentum on your side.

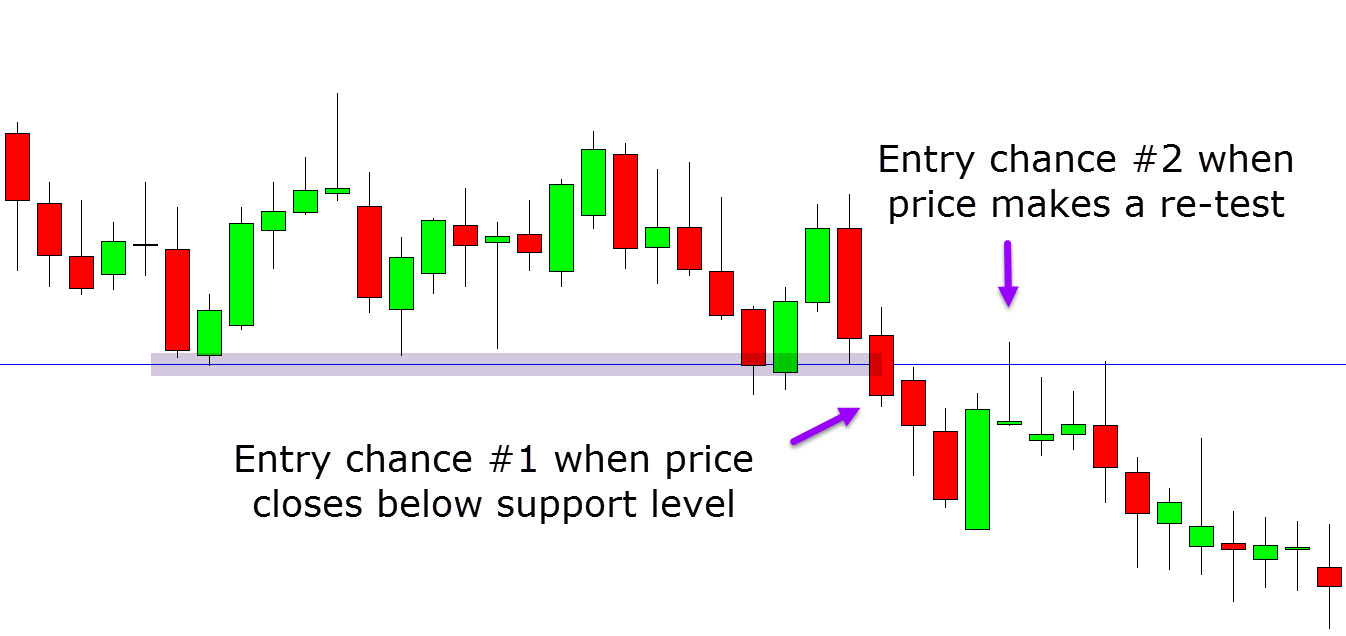

For example see the chart example below. Once you notice price has rejected an obvious support level on multiple occasions, then you can start looking for breakout trades lower.

The first chance to make a short breakout trade is when price makes a clean breakout.

If you missed this first trade you could take the second chance entry when price retests the old breakout area and it holds as a role reversal and new resistance level.

Example Breakout Trading Strategy

The same strategy used to find intraday breakouts can be used to trade breakouts on higher time frames.

These higher time frames can be as long term as you like, for example; daily, weekly or even the monthly time frame.

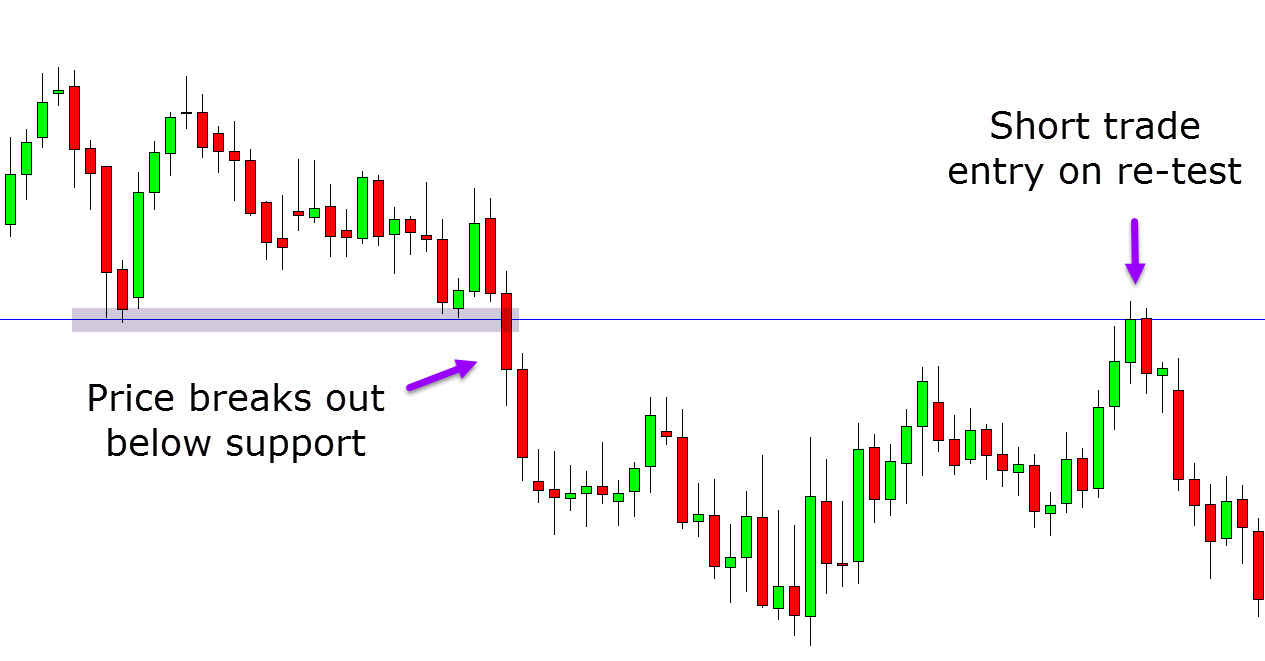

In the example below, price breaks and importantly closes out of the key support level. This is the first chance to take a short breakout trade.

After selling off lower price then makes a move back higher and retests the same old support level that price previously broke out of. This is a high probability level to look for new short trades as these levels will often hold as role reversal levels just like this level held as a new resistance level.

Lastly

Breakout trading can be fast paced, exciting and it can also offer you very high reward winning trades.

With that said, it can also come with a lot of risks if you have not practiced your chosen breakout strategy and mastered it.

There is a very real risk of making breakout trades that quickly turn into ‘fakeouts’ with you quickly being stopped out.

If you want to add breakout trading into your trading toolbox, then the best thing you can do is get a set of free demo trading charts and test out different breakout trading strategies to see what suits you the best.

NOTE: Get your free Breakout Trading Strategy Guide PDF Below.