Due to the increased availability for retail traders to trade Forex 24/5 access and the large amounts of leverage available on trading platforms, the forex markets are a favorite of retail traders across the globe. To be consistently successful, you will need to understand and use some fundamental Forex mathematics principles.

Despite the benefits that trading in the forex markets can bring, many new traders are scared away from the prospect of trading forex by the idea of having to contend with complex mathematical equations.

This post will look to demystify the topic of forex mathematics for individuals interested in breaking into the world of forex trading.

NOTE: You can get your free Forex mathematics PDF guide download here.

Table of Contents

Do You Need to be Good at Maths to be a Forex Trader?

Members of the financial community often note that investing is not the study of finance but rather the study of what people do with their money.

If you want to trade in the forex markets, then there is certainly no requirement for you to have had any formal mathematics training beyond what you would have received while attending high school.

The most essential skills when trading forex will be pattern recognition combined with a strong understanding of economics and monetary policy. That said, the most skilled traders will have some competence in mathematics.

For example, without any understanding of statistical analysis, it may be challenging to determine whether the pattern you observe has any trading value or is just the result of the noise generated by random price fluctuations.

Thankfully, all is not lost for those of you who do not have any grounding in these areas of mathematics.

Human beings have the remarkable ability to download knowledge directly into their brain through a process known as “reading”. Here are three books we recommend for those who would like to get started learning about the more advanced aspects of trading in the forex markets.

- Evidence-based technical analysis by David Aronson;

- Introduction to statistical learning by Gareth James;

- Technical analysis of the financial markets by John J Murphy.

How to Use Maths in Trading

Mathematics is used in many different aspects of trading, from calculating profits, losses, position-sizing, and even in the indicators themselves. Thankfully, technology has advanced to the point where most of these calculations can be done for you through the use of widely available software systems like indicators and online calculation tools.

While you may no longer need to do the majority of the calculations yourself, you will still be required to understand them enough to interpret the results and respond accordingly.

Understanding Pip Values

Many of you may already be familiar with the concept of “points” in the stock market where 1 point = 1 dollar. They are a metric used to measure price movements in specific stocks or indices. If you read that the S&P 500 has fallen 200 points, it means that the S&P has fallen by $200.

A “pip” is a similar metric to points and can be defined as the smallest possible increment of price movement in currency pairs. Pips may also sometimes be referred to as points, and the two terms can be used interchangeably.

They say to see is to understand, so let’s take a look at a few currency pairs to see what a pip is. Most currency pairs are displayed in five digits, with four of these digits existing behind a decimal point. The last digit of these five is the pip.

So, if the EUR/USD currency pair is currently 1.1722, then the “2” is the pip. It should be noted that JPY currency pairs do not consist of 5 digits, and there is usually more than 1 number in front of the decimal point. While JPY currency pairs consist of more digits, the last digit remains the pip.

In the EUR/USD currency pair detailed above, if the price moves up to 1.1752 from 1.1722, the price has just gone up by 20 pips. If it moves down to 1.1712, then it has fallen by 10 pips. Traders use these pips to assist them in calculating their profit and losses using straightforward calculations. To do this, all you need to know is the size of the position. Let’s take a look at this now.

Let’s assume that you currently hold a 100,000 EUR/USD position. In this position, a move of 20 pips would equal $200. You would multiply your position size by the number of pips increased (100,000 Euros x 0.0020 = 200) to calculate this.

Whether this ends up being a profit or a loss depends upon whether your position was long or short. If you happened to be in a short position when the price moved up by 20 pips, you would have lost $200. It’s not a catastrophic loss, but it’s enough to ruin anybody’s day. This is how profit or loss is calculated using pips and position sizes.

The EUR/USD pair is easy to calculate your profit and loss if you are a US-based trader. Since the USD is the counter currency in this particular pair, the price will accrue in dollars. However, the price does not always accrue in dollars, so there will usually be another step to calculate your profit/loss in your preferred currency. Let’s take a look at how to do this using the USD/CHF currency pair.

The profit and loss will be displayed in Swiss francs in this currency pair because the counter currency is CHF. Assume you have an open short position of 100,000, and the price suffers a 50 pip decline; that move represents a 500 CHF profit ( 100,000 x 0.0050 = 500).

If you wish to know how much that profit is in USD, the next question that will enter your mind is how much are 500 Swiss francs in dollars? To convert that 500 CHF profit to USD, you need to divide the 500 CHF by the USD/CHF rate.

While this is not a complicated calculation, there are plenty of online currency conversion calculators that can do this for you if you prefer to avoid doing the math yourself.

How to Use Position Sizing

Now you know that the size of your position is essential information when trying to calculate your profit/loss. The next question on most people’s minds would be, “how do I calculate my position size”?

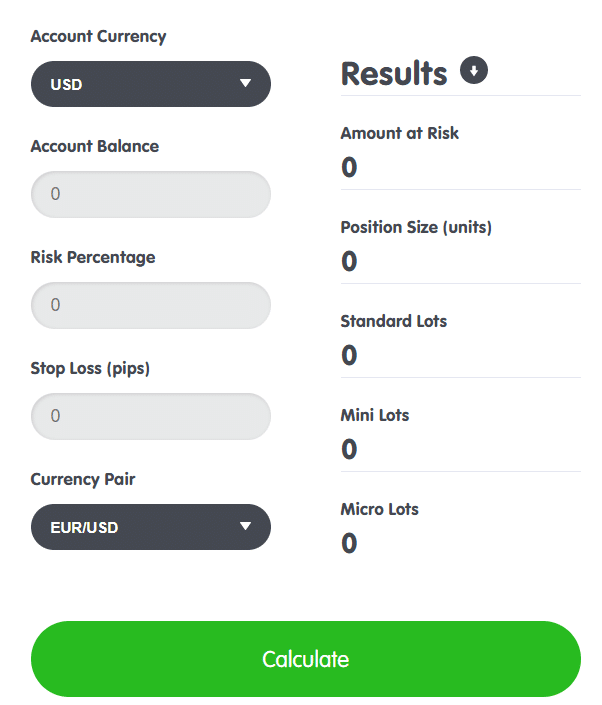

Your position size will determine the amount of risk you take on in specific trades, so traders must know how to calculate this before opening any positions.

There are no definite rules about how much risk you are recommended to take in any one trade. As a general guideline, it is recommended that conservative traders risk no more than 1% of their accounts on any one trade. More risk-tolerant traders may increase this limit to 5%.

It is strongly recommended that you keep your position sizes within these guidelines and not take too much risk.

As with the profit and loss calculations, there are position sizing calculators available online that you can utilize to calculate your position size depending on the amount of risk you are willing to take on. You can find one of these position size calculators here.

Understanding Margin and Leverage

One of the significant advantages of forex is the amount of leverage available in the forex markets. These levels are significantly higher than those found in other kinds of markets like the stock market.

While leverage can be a wonderfully helpful tool, it is a double-edged sword. It can propel your profits upward ten-fold, or it can wipe out your entire account within a day. As a result, traders who use their broker’s leveraging tools must be fully aware of the risks involved.

Leverage allows you to gain a larger amount of exposure to the market with smaller amounts of capital. It essentially magnifies your position to maximize the effect of price movements on your returns (or losses).

If you have 1:100 leverage, every $1 you invest is magnified to $100. So, if you invest $1 with 1:100 leverage and see a 10% return, you will gain $9 in profit with only $1 of your capital invested.

As you will know, the market doesn’t always move with you. If the market begins to move against you, your forex broker will have established ratios of margin balances to keep your positions open. If your account falls below those ratios, your broker will likely have reserved the right to close your positions and lock in your losses, even if only for a moment.

This means that when you use leverage, there is always a chance of losing the entire amount you invested.

Every broker will have its policies and regulations concerning its margin requirements. It is essential that you read through these policies and fully understand your broker’s margin policies.

Using the Best Risk to Reward Ratio

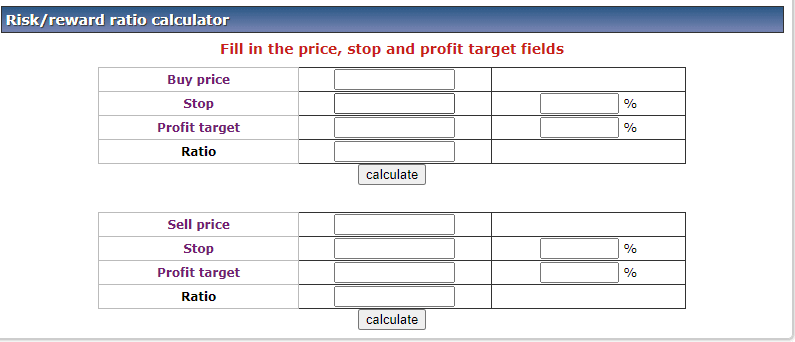

As the name suggests, your risk/reward ratio dictates how much money you stand to gain for every $1 that you put at risk. For example, if you have a risk/reward ratio of 1:5, that means you stand to make $5 for every $1 you put at risk.

It is difficult to say what “the best” risk/reward ratio is, and to do so, one needs to consider their win rate. To understand what this means, it is best to look at an example.

Assume you have a risk/reward ratio of 1:2 and your win rate is 20%. This means that for every 10 trades, you win 2. With a risk-reward ratio of 1:2, you will lose $1 on every loss and gain $2 on every win. If you have a win rate of just 20%, then after 10 trades, you can expect a net loss of $4.

As a general rule, a risk/reward ratio of 1:3 should be sufficient. However, you will need to consider other considerations, such as your win rate, to calculate the best risk/reward ratio for you.

Using a Forex Calculator

We have mentioned the use of online forex calculators throughout this post. You can use these calculators to do everything from calculating profits to accessing your risk. To run these calculations, especially your risk, you will need to input specific information into the calculator to perform the calculations.

For example, if you are interested in using a calculator to work out your risk/reward ratio, you can find a free calculator here. To make the calculations, you’ll have to enter your entry point, stop-loss point, and profit targets.

Lastly

After reading this post, I hope that you will realize that while there is some mathematics involved in trading forex, it is a far cry from the problems of higher-order mathematics that Einstein contended with.

With the development of the online tools and calculators available, it is easier than ever to navigate any calculations you may need to make.

The books mentioned above are strongly recommended for those interested in further developing their forex mathematics and trading knowledge.

NOTE: You can get your free Forex mathematics PDF guide download here.