When people think about investing, they think that they need a large amount of initial capital to start. While this may be the case for bonds, stocks, and even other investments, it is not the case for Forex trading because of leverage.

The Forex market is a lot more accessible because it gives you the ability to control much larger trading positions than your initial capital making it a favorite for many traders.

How? Using highly leveraged positions.

The statistics however are pretty clear; just because a trader can trade much larger positions, does not mean they should. The higher the leverage they use, the less profitable on average they become.

How Does Leverage Affect Your Forex Trading?

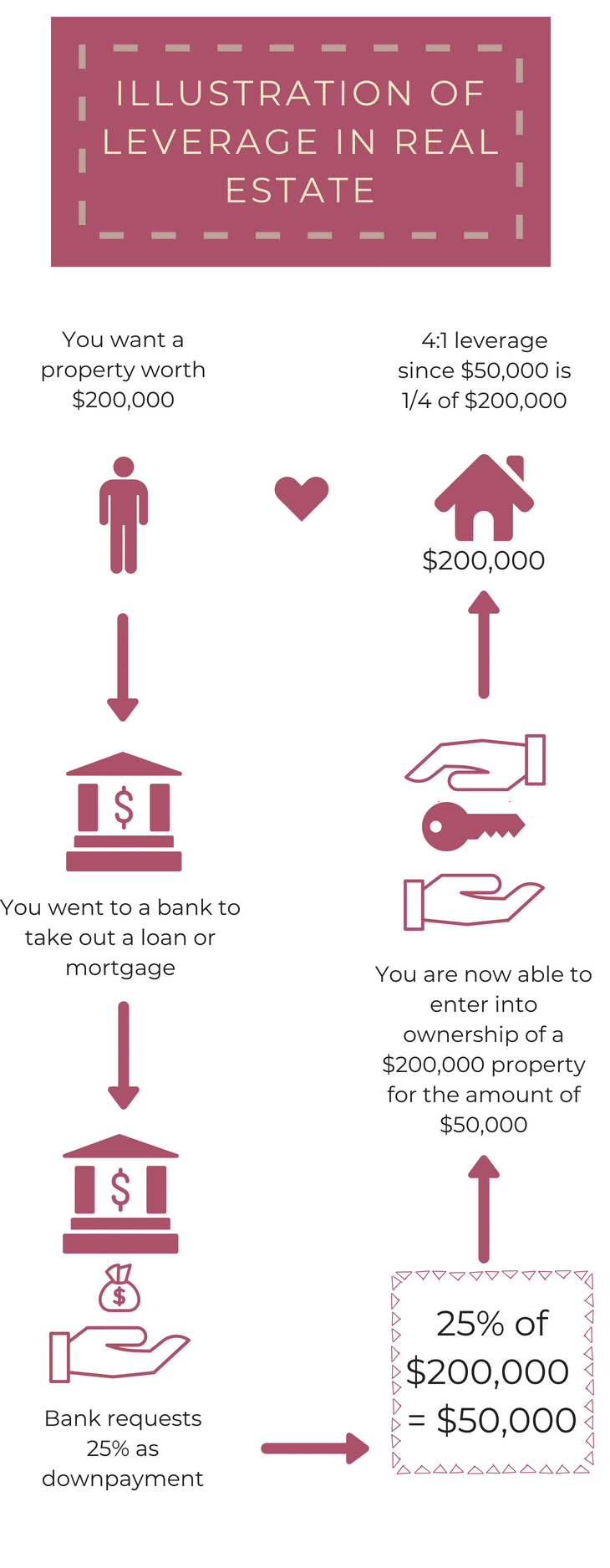

To understand leverage, we will use real estate as an illustration. Let’s say you want to purchase a property that is worth $200,000.

Share This Infographic on Your Own Site or Blog

How do I Use Leverage When Forex Trading?

You go to the bank to take out a loan or mortgage. Then the bank demands that you give them 25% of the property as a down payment for your loan. For a down payment of $50,000, you are now able to enter into ownership of a $200,000 property.

You bought the home at a leverage of 4:1 since $50,000 is one-fourth of $200,000.

After 12 months, the property market has appreciated by 50% and you decided to sell the property for $300,000. You made a profit of $100,000.

If however, you did not take out a loan and used only your $50,000 to purchase a small studio, the potential profit, and loss is very different.

After 12 months, your total profit after a 50% increase would have been only $25,000 compared to $100,000 when using leverage (bank loan).

Leverage is a double edge sword.

Leverage of 5:1 can bring greater profits than a leverage of 1:1. However; it can also bring bigger losses if prices do not go the way you expect and you do not use correct money management.

When learning to trade in the markets, traders are often initially attracted to the large potential gains they can make very quickly in a short amount of time. This can often be a trap.

Use a Forex Leverage Calculator

The wide availability of leverage is the reason why countless traders want to trade in the Forex market. Proper use of leverage can either bring great profits or unimaginable losses if misused.

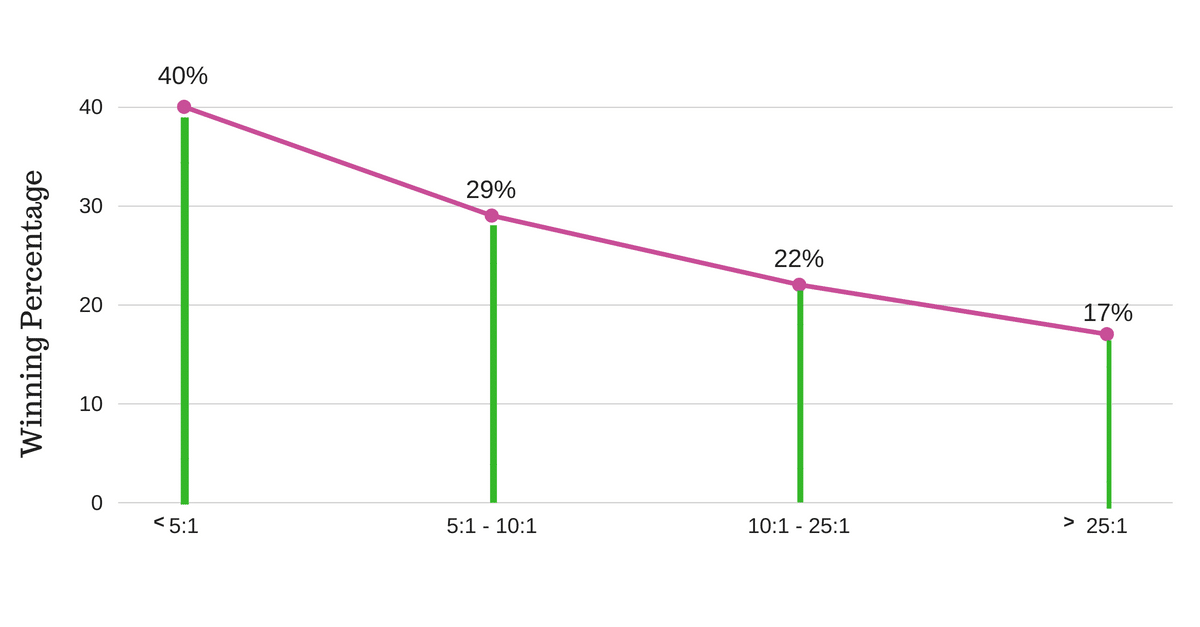

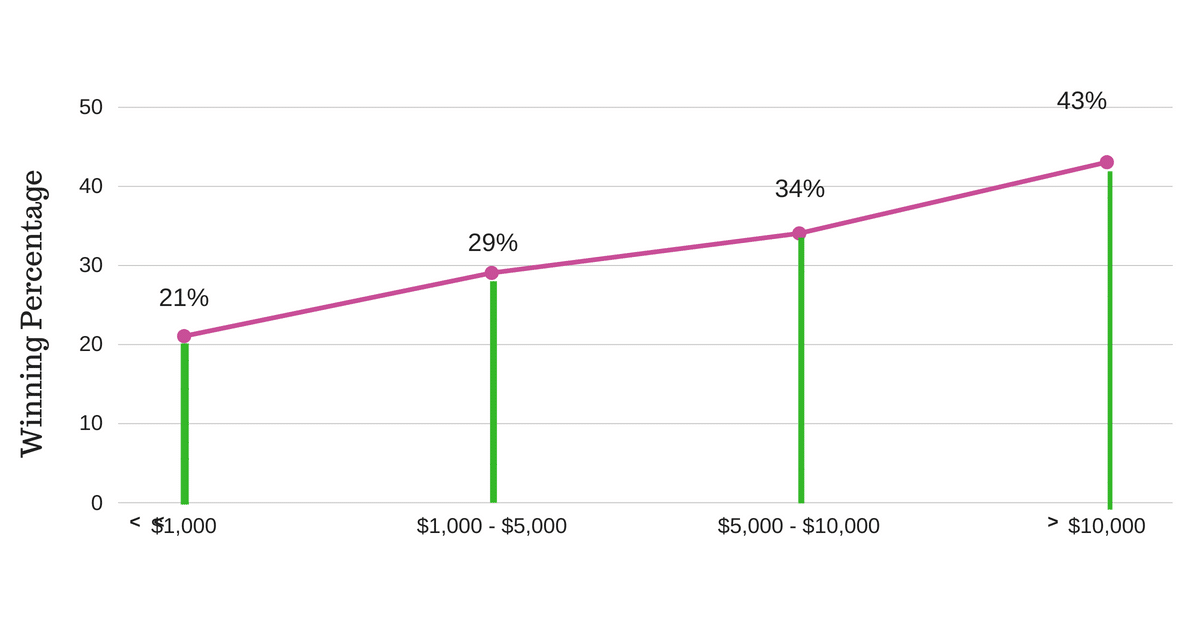

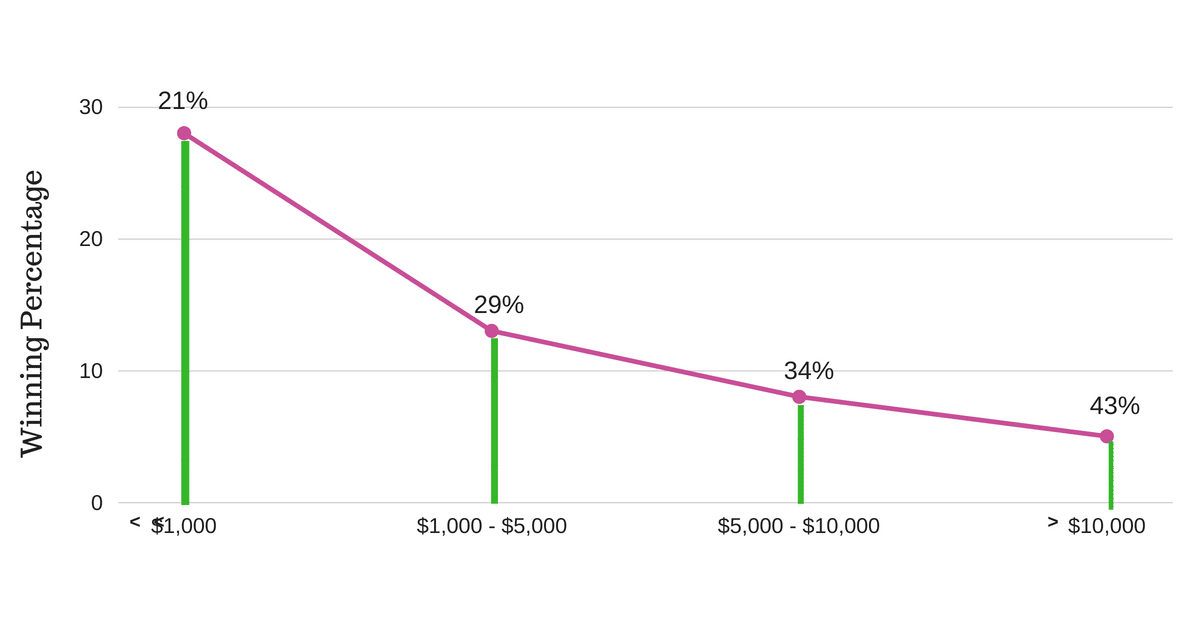

Take a look at this insight where 13 million real trades were conducted by traders from a major Forex broker’s trading platform.

Below is the data of profitable traders grouped by the use of their effective leverage.

Before we start, you’ll need to understand the concept of effective leverage. Effective leverage is the amount of equity that you use or is associated with the value of an open position.

To work this out you simply divide your account equity by your trade size. For example: if you have a $5,000 account and opened a position in EUR/AUD with 50,000 units, then the equation would be $50,000 divided by $5,000 = 10:1 effective leverage.

Looking at the graph above we can see that excessive leverage brings lesser profits than lower leverage does.

The data indicates that 40% of all traders who used effective leverage of 5:1 made a profit in the 12 month period, and the higher the leverage went, the less the profitability became.

A trader’s psychology plays a big role on whether they make profit or not.

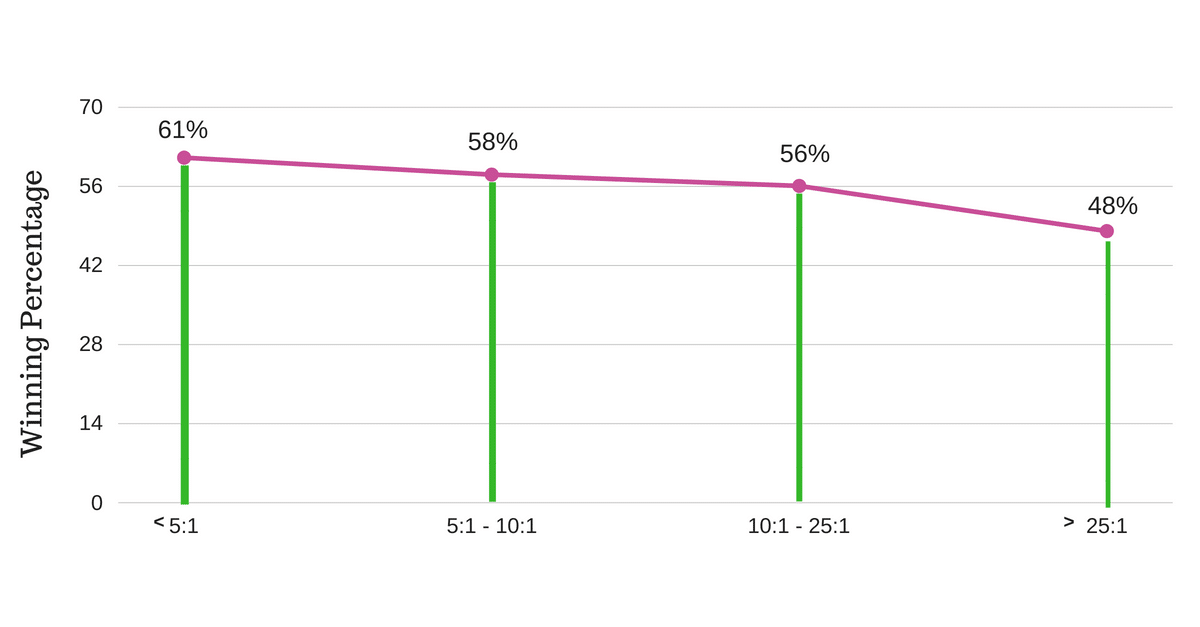

Here is an example of where excessive leverage would be a mistake on individual trades.

Leverage of 5:1 was profitable 61% of the time, whereas leverage of 25:1 was only profitable 48% of the time.

This is quite a big difference in profitability between average and excessive leverage. Excessive leverage can have harmful effects on a trader’s psychology and trading style.

In connection with a trader’s trading style, using excessive leverage brings smaller capital on every losing trade. If the trade goes against the trader, he might not have enough money to hold the position before it goes back into his favor.

From the psychological perspective, out sized positions can affect a trader’s rationality.

Forex Leverage Example

By using two inputs, you can change the way you use effective leverage. This is done by varying trade size and equity.

As an example: let’s say you opened an account of $10,000 in equity.

A leverage of 5:1 or 10:1 is recommended when opening positions not bigger than $50,000 and $100,000 at a time.

Another way of managing effective leverage is your equity. A clear link between the performance of a trader and their equity is quite obvious.

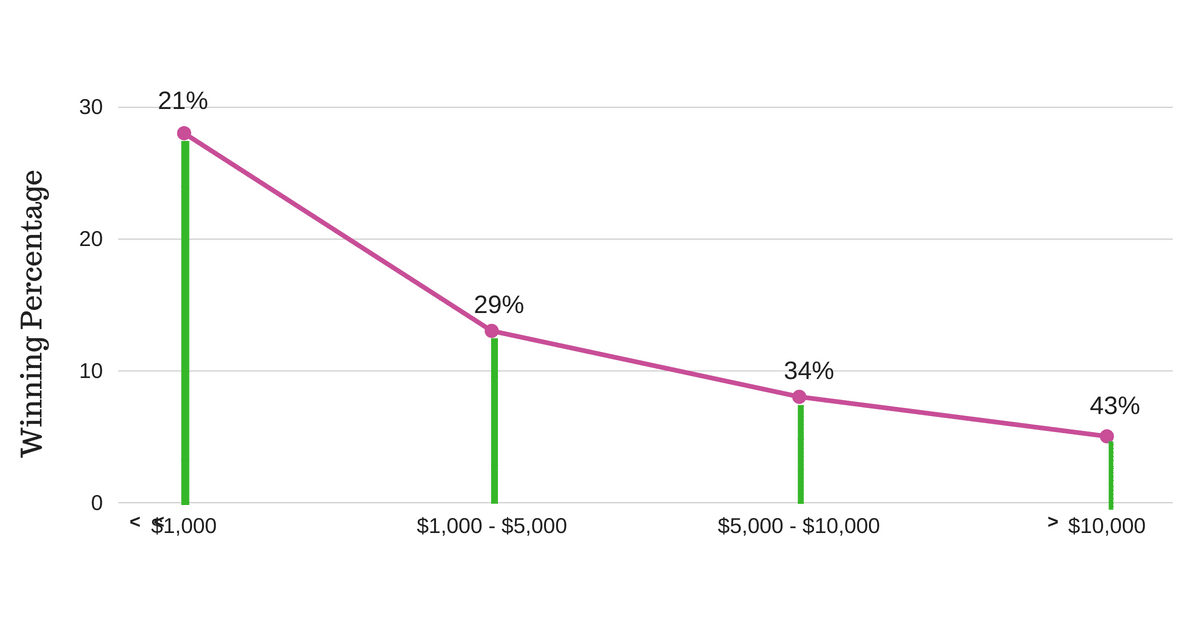

Below is the percentage of profitable traders grouped by their average trading equity.

21% of traders who had an account equity of $1,000 generated made a profit within 12 months.

Traders who had an average account size of $10,000 or more, were more than twice as likely to make profits with 43% making profits over 12 months.

The data above is related and quite similar to those on effective leverage.

Traders with smaller accounts are far more likely to use higher leverage, in turn taking riskier trades and blowing their accounts.

How Can I Manage Position Size and Equity Based on Risk?

The great benefit of managing risk is that it helps you avoid problems while maximizing opportunities. It is crucial you always risk an amount of capital that you are prepared to lose.

To further understand this, here’s an example.

Let’s say you open a position in the GBP/JPY with 50,000 units. Price moves from $1.3200 to $1.3300 which would be a total of 100 pips and each pip move is worth $10.

In this trade, your $50,000 units would have made a profit or loss of $1,000 ($10 x 100 pips).

Keeping Profit Target at Constant

Based on the data we have just been through, we know the ideal leverage to trade Forex is 10:1 or 5:1.

Let’s say that the GBP/JPY is at $1.15, your unit of $50,000 will turn into $57,500 ($50,000*$1.15).

Equity of 5,750 would be best to control this position. Using leverage above 10 could be very risky if you are not using correct money management.

A lot of traders will not have the luxury of having a large account, but you can still work out your correct trade, making it bigger or smaller using a Forex position size calculator.

Remember: Risk Management is Crucial

Risk management is the most important part of learning to trade successfully.

Minimize losses and maximize gains. Working out the leverage you are comfortable with and fits your trading account size is crucial.

If you are over-leveraged you can take on large losses you are not prepared for and end up chasing losses.

*Data source: Derived from FXCM Inc. accounts excluding Eligible Contract Participants, Clearing Accounts, Money Managers, Hong Kong, and Japan subsidiaries from 4/1/2014 to 3/31/2015 across all currency pairs.

Recap

Traders are attracted to the Forex market because of the ability it gives them to control bigger positions with small capital. Leverage can certainly give you larger profits, but it can also give you an awful amount of losses.

Make sure you manage your risk and control your losses so you can always trade another day.