Every trader wants a trading system that will lead to more profitable trades. However; having a concrete trading method is one thing, but if a trader does not know how to calculate their Forex position size correctly, then it will quickly lead to losses through risking more on one trade and less on another.

This will not only affect your pockets, but also your trades.

Even if you have a rock solid trading system, if you fail to position size correctly and use money management, then losing is just around the corner.

Money management and position size can be the difference between making profits or your account barely surviving.

What is Money Management in Forex?

Money management is all about managing your money and knowing how much of your account you should risk.

For example; if Mike risks 3% on his trade and then loses, it means that he would lose 3% of his overall trading account.

Market movements are unpredictable and anything can happen randomly at any time. A solid position size and money management technique can ensure that you still have money to trade with no matter what changes might affect the market.

Money management requires you to constantly monitor your positions and take necessary losses when they come.

Minimizing the losses through correct position sizes will ensure that you can stay in the game when you have losses, and capture the profits when the winners come. Every trading method must have time to play out with the help of your money management technique and if you over-risk on any one trade it could put a large dent in your account that is hard to come back from.

How to Work Out Forex Position Size

Forex position size plays a crucial role when it comes to trading and making sure you never overextend your account, or risk more than you should.

This point is often overlooked and not known by many traders. Basically, it refers to the size of a position or the amount that you are going to trade.

It is used to help determine how many units of a security you should trade, which helps control your risks and maximize returns.

By working out your position size, you can make bigger or smaller trades. Every trade will have a different size stop and will also often be in a different market or currency pair which can hugely affect the trade amount you should be entering.

This is not something you want to be guessing.

If you enter trades with any random amount and with the same size stop in different markets, then you are risking an awful amount of money and different percentage of your account on each trade.

To further understand this,

Examples:

If a trader enters a $25,000 trade with a 10 pip stop, then they are risking twice as much as an entry of $25,000 trade with a 5 pip stop.

However; and this is the key; whether the stop is 300 pips or 1 pip, a trader will be able to place a trade and risk the same percentage of their account.

This also ensures that even if you have a small account, you can place large stops.

You can have a small trading account and still enter trades with large stops on higher time frames because before entering your trades you are working out the correct amount to enter the trade with.

If you want to risk 3% each trade for example; then as you will see below, you can calculate the position size you need to enter a trade for any size stop.

If you just use the same trade size amount for every trade and every stop size, then your wins and losses will be greatly different and can really hurt your account.

Position Size Calculator

To make things easier and worry free, you can use a Position Size Calculator

The key to managing risk and avoiding account blowout is proper position sizing. With a few inputs in the calculator, you will find the approximate amount of currency units to buy or sell.

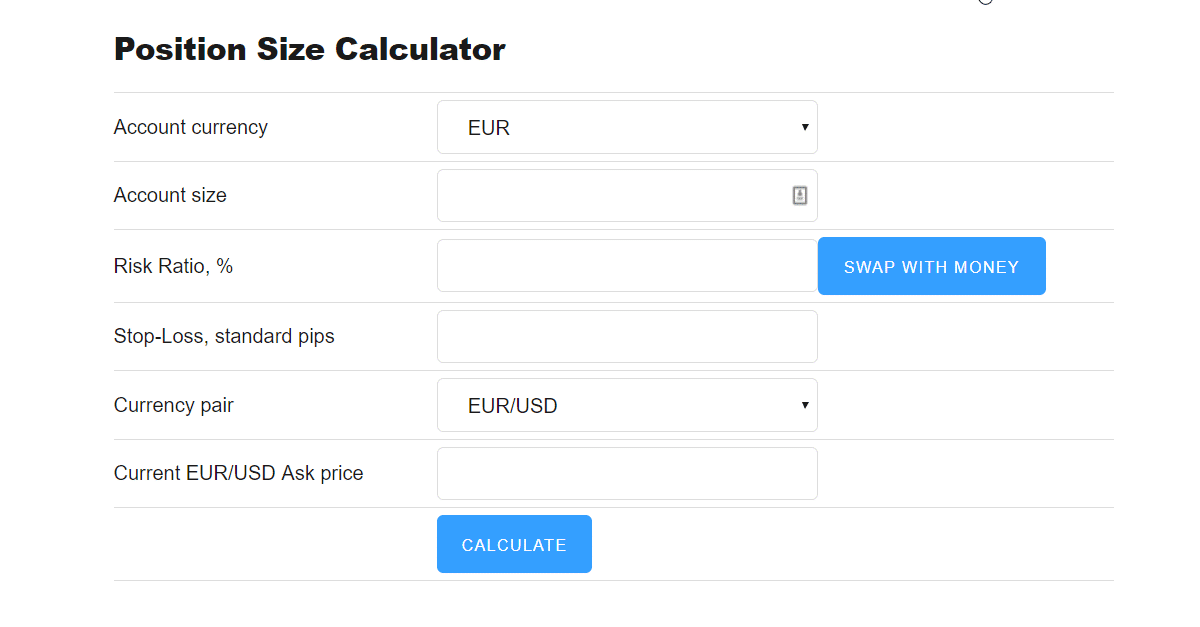

The calculator will ask you to fill in some key inputs relating to your trade such as; account currency (currency of your trading account EUR/USD/JPY/AUD etc., account size (your account size in $), risk ratio can either be % or $ (how much in % or $ you want to risk), stop loss in pips, currency pair price.

The results will show you the following: money (the amount you are risking on your trade), units and lots (how big the trade size is in units and lots). This is the amount you open a trade with.

Example:

The calculator shows you the following: Money: 600, Units: 300000, and Lots: 3.00 it basically means you will be opening a trade for 3.00 lots. One standard lot or contract is 100,000, so 3.00 lots of one standard lot is 300,000.

One of the most helpful free calculators is available at Forex position size calculator.

Forex Money Management Keys

One of the most commonly used money management methods is the fixed percentage method.

Basically, this method is all about risking the same percentage of your account on every trade no matter what your size stop is. The risk will stay the same whether you are trading on the minute, hour, or weekly chart and no matter what size your stop.

If you have a loss, the amount of money being risked will get smaller because the overall account size has gotten smaller, but the risk percentage remains the same. For example; if you started with a $1,000 account and were risking 3% and lost, you are now risking 3% of $970.

One thing to keep in mind is that when you start losing trades, the harder it becomes to get the balance back to where it was. The simple math behind this is the same as we have just been through above. 3% of $1,000 is more than 3% of $970. As your account gets smaller, so does the value of the 3%. On the flip side; as you win the value of the 3% increases.

What to do?

If you ask any successful traders out there about the most important factor of trading, the majority of those seasoned traders will tell you that it is all about proper money management and knowing your risk per trade.

The huge reason for this is because by using the fixed percentage money management and position size, a trader can still stay in the game even after a losing streak because the risk is fixed and the amount being risked in real dollars gets smaller.

Staying in the game to trade another day is key. With no account, the you cannot trade.

The best strategy in the world won’t help you if you don’t take care of your risks, stop loss, or even aggressive trading.

By understanding these points, you already have a large edge over the majority of traders who want to become more profitable in the market.