Simplicity is key in grid trading, but traders often mistakenly complicate the strategy. This post offers an in-depth explanation of what grid trading is, how it works, and how you can utilize it in your trading strategy.

Because this method can be automated, grid trading can still prove to be successful even with a limited understanding of technical analysis.

NOTE: You can get your free grid trading strategies PDF guide below.

Table of Contents

What is Grid Trading?

Grid trading is an investment strategy wherein an investor places multiple orders of purchase and sale above and below the current trading price. This process creates a grid of orders, from which the strategy derives its name. It is commonly used in markets like Forex and cryptocurrency where there are considerable fluctuations in price and minimal price jumps.

This system does not demand detailed technical indicators or analysis. Instead, traders will place buy and sell orders that form a grid.

Grid trading works best in conditions of price appreciation or depreciation, as opposed to a situation where price remains within a specific range. As the price rises, more of the buy orders will be filled, consequently increasing profit potential.

This approach is more complex in unpredictable markets where the price varies frequently. This could mean the orders are executed, followed by an unexpected price reversal, thus causing a loss. Even in choppy markets, it is still possible to switch buy orders to sell orders. However, the success rate will be lower compared to when the price is moving in one direction.

How to Grid Trade

It’s clear that grid trading has its share of advantages, from the minimal analysis required to its ease of automation and versatility across markets and time frames.

Despite its advantages, there are a number of risks to be aware of. Primarily, if the price rapidly reverses after entering a long grid trade, this can result in losses.

A similar situation can occur if the sell grid orders are triggered too soon. Another factor to consider is that the grid does not have a built-in feature to take profit; you need to determine your own stop loss and profit levels.

The first step to setting up a grid trade is to decide the size of the order as well as the intervals between orders.

Depending on the time frame, you may have multiple buy and sell orders over a range of intervals. In order to determine how much volatility to account for, you can use the Average True Range Indicator.

Furthermore, when constructing a grid, first decide if your goal is to profit from a trend or a range.

When looking to benefit from a trend, place buy orders above the current price, and place sell orders below. By adding long positions as the price increases, you can increase your likelihood of securing large profits.

Grid Trading Strategies

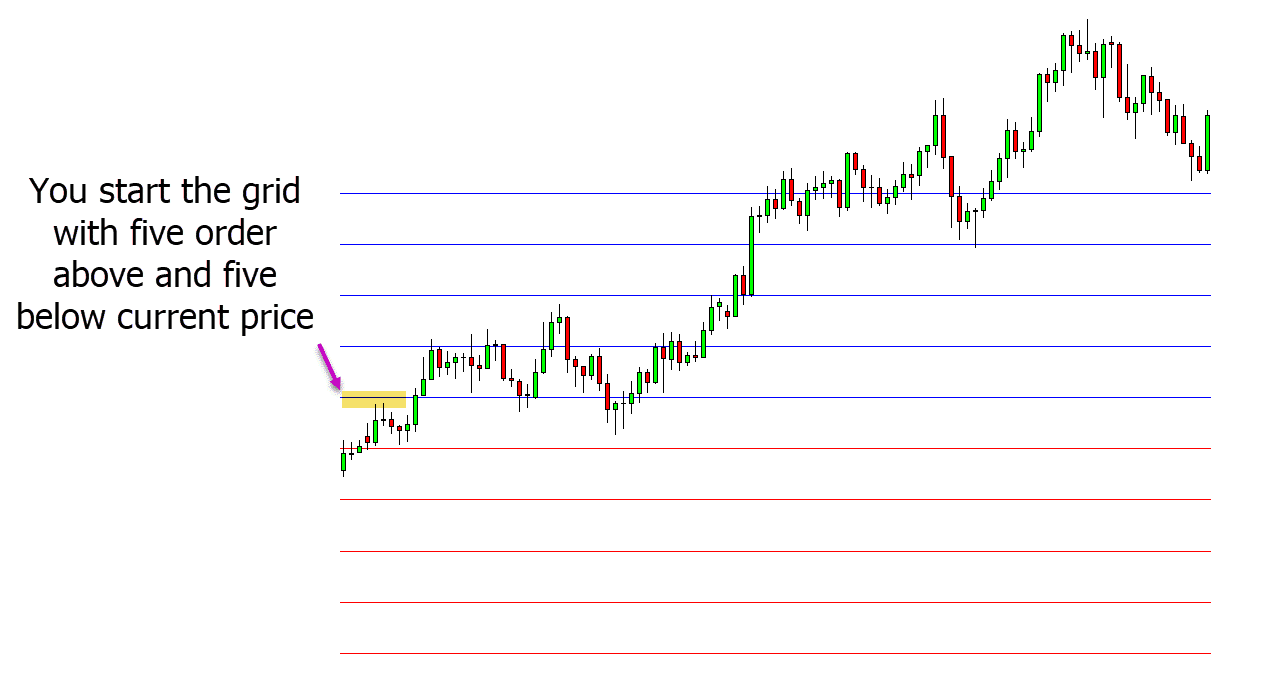

In the grid trading strategy example below, we have decided to use a trend trading grid strategy.

In the 1-hour chart below, buy and sell orders are spaced 25 pips apart.

As the cost increases, further trades are activated and long positions are added. Before proceeding, this trader should consider the target for stop loss and take profit.

A great choice for take profit would be 25 pips higher than the concluding long trade. A more ambitious approach would be to aim for one to two times the total length of the grid.

As the price shifts favorably and additional trades are made, a breakeven or trailing stop loss can be used to protect any profits made.

Using Grid Trading in a Trending Market

In grid trading, the goal is for all your orders to open in one direction. So if the market is heading clearly in one direction, it’s the ideal time for a grid trade. In order to profit and minimize losses, it is essential to identify how many orders the grid will have, as well as how much might be lost if the price starts to reverse.

The benefit of trend trading in markets such as Forex is that there are a many trends and timeframes to choose from.

To use a trend-based grid system, it is crucial to monitor indicators and price action details. This allows you to assess the current trend or to recognize possible upcoming trends. Additionally, it is essential to remember the guidelines for closing off other grid orders. For instance, if the price increases, you may want to consider shutting down orders against it.

MT4 and MT5 charts offer an uncomplicated way to set up a grid trading strategy by using indicators. For instance, the MT4 grid indicator includes horizontal lines above and below the price.

These can be personalized to fit your trading strategy and preferences.

It is important to note that the indicator only shows the grid lines on the chart without initiating any trades at the levels. Moreover, the distance between each grid level can be adjusted to find the best location for each order.

NOTE: You can get your free grid trading strategies PDF guide below.