Table of Contents

What is a Trailing Stop Loss?

A trailing stop loss is simply a stop loss that is continually trailed closer to the current price.

Many traders will employ a trailing stop loss to lock in profits as price moves higher or lower in their favor. Doing this gives the trade a chance to make a larger profit as the stop gets trailed along behind.

You can either manually trail you stop loss or have it automatically done for you.

In this post we look at how to use a trailing stop loss automatically in MT4 and MT5.

Many traders will manually trail their stop loss using strategies such as trailing the stop above or below a moving average or important price action swing points.

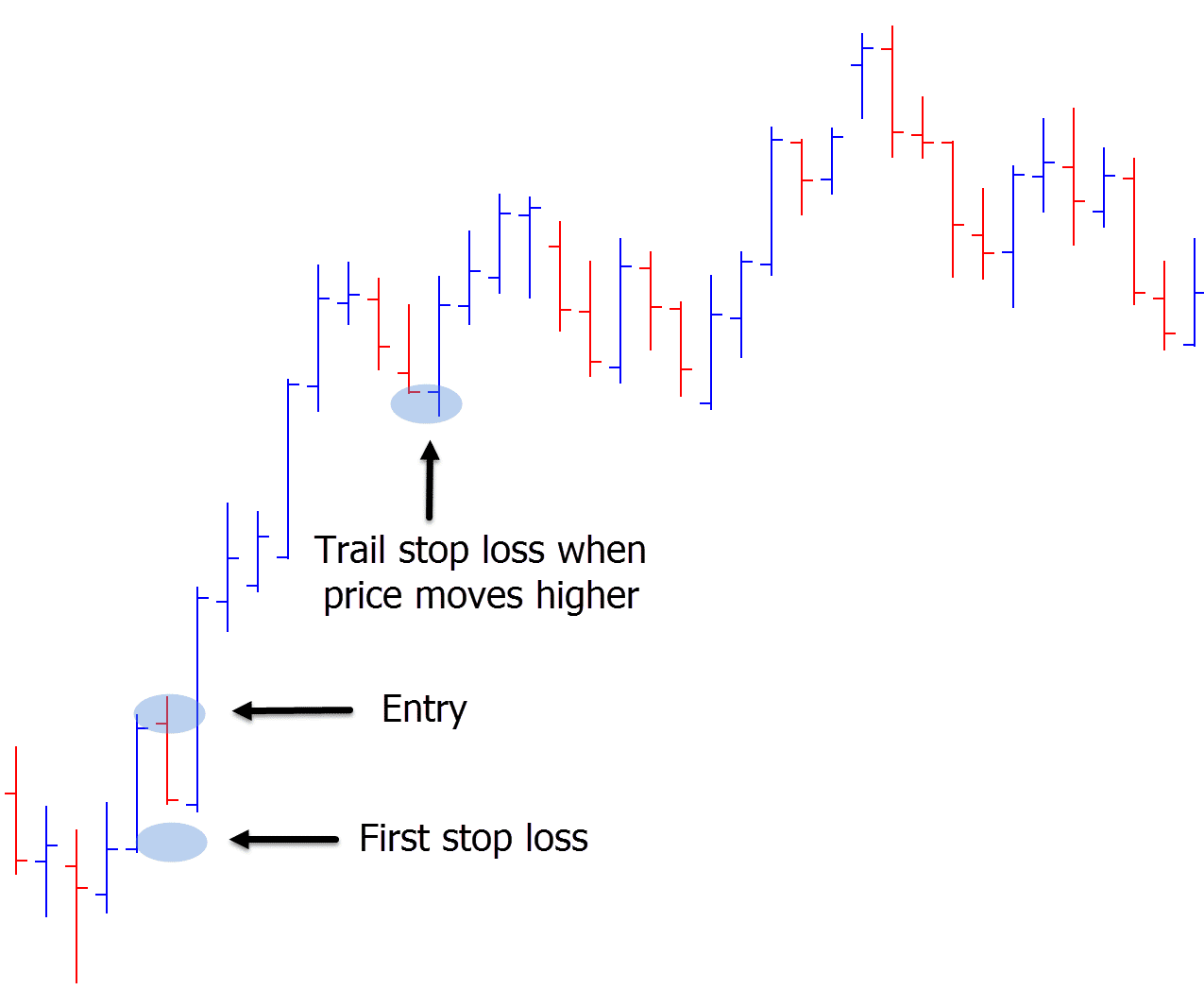

An example of a trailing stop loss is on the chart below.

First the entry to go long is made with the stop loss set a little way lower in case the trade fails.

In this example price moves higher and the stop loss is trailed to lock in profits as price continually moves higher.

Why Trail a Stop Loss?

Trailing a stop loss has both its advantages and disadvantages.

The biggest upside is that once price begins moving in your favor you are locking in your profits. You are also moving from a potentially losing trade into a trade that will make profits even if price moves against you.

The disadvantages of trailing your stop loss is the risk you will leave profits on the table.

As you trail your stop loss you are continually putting the stop closer to the current price. This increases the risk of being stopped out.

It is important to use a trailing stop in the market conditions that suit it best. This is often when price is making long running trending moves where you have the potential to capture a large running profit.

Whilst you can manually trail your stop loss by easily readjusting your stop in your charting platform, this post goes into how to automatically have your stop loss trailed.

Trailing Stop Loss MT4

Trailing your stop loss inside MT4 is very straightforward.

To set this up, open your MT4 charts.

NOTE: You can get the correct MT4 / MT5 Charts to Use a Trailing Stop Here.

Once you have an open trade that you would like to use a trailing stop loss on, navigate to your charts and select; “View” > “Terminal” and “Trade”.

Hover over the trade you would like to set up the trailing stop loss for and right click your mouse.

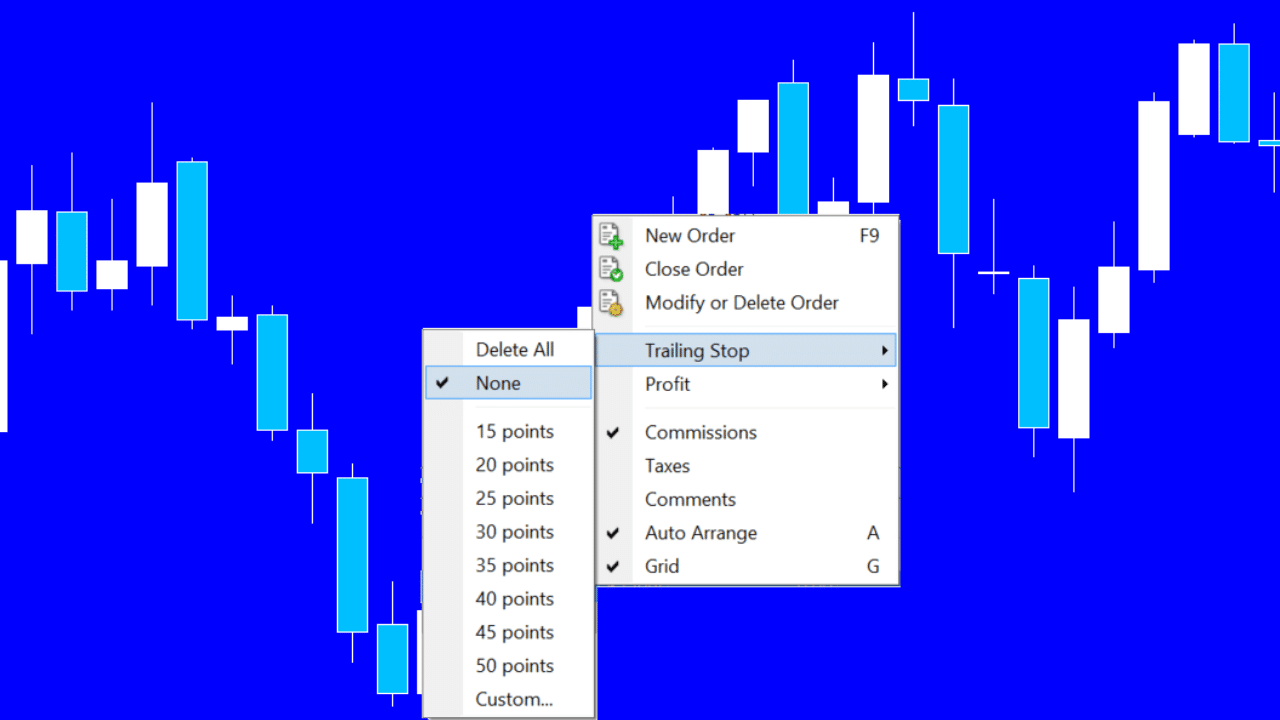

In the box that will pop up you will see the “Trailing Stop Loss” option. Select this and you will be presented with some options. See the image example below;

You can now set up your trailing stop loss by deciding how many points away you would like to trail your stop away from the price.

Trailing Stop Loss MT5

To use the automatic trailing stop loss in MT5 simply open your charts and then navigate to “view” > “Toolbox”.

Once this is open, hover over the trade order you would like to use the trailing stop loss with and right click with your mouse.

A box will open and one of the options will be “Trailing Stop Loss”.

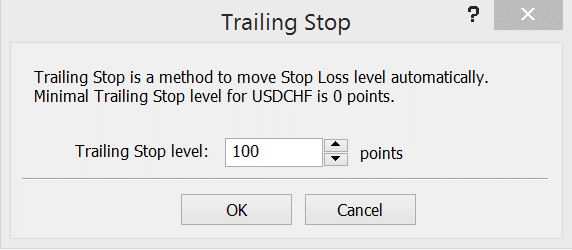

Once selected you can modify the stop loss to be trailed as far away as you like.

IMPORTANT NOTE: The trailing stop loss for both MT4 and MT5 is executed in the trading platform and not the server. This is very important because the trailing stop is not logged with your broker and it also means that for the trailing stop loss to activate the charting platform must be open and running.

How to Set Trailing Stop on iPhone and Android

As yet the only way to set a trailing stop loss is through the desktop terminal.

This is because of how the trailing stop loss is activated. As outlined above; because the trailing stop loss is executed on the trading platform and not on the server you will need to keep your trading platform running for it to work.

You can read more information on the Metatrader Trailing Stop Loss Function Here.

How to Move Stop Loss to Breakeven MT4

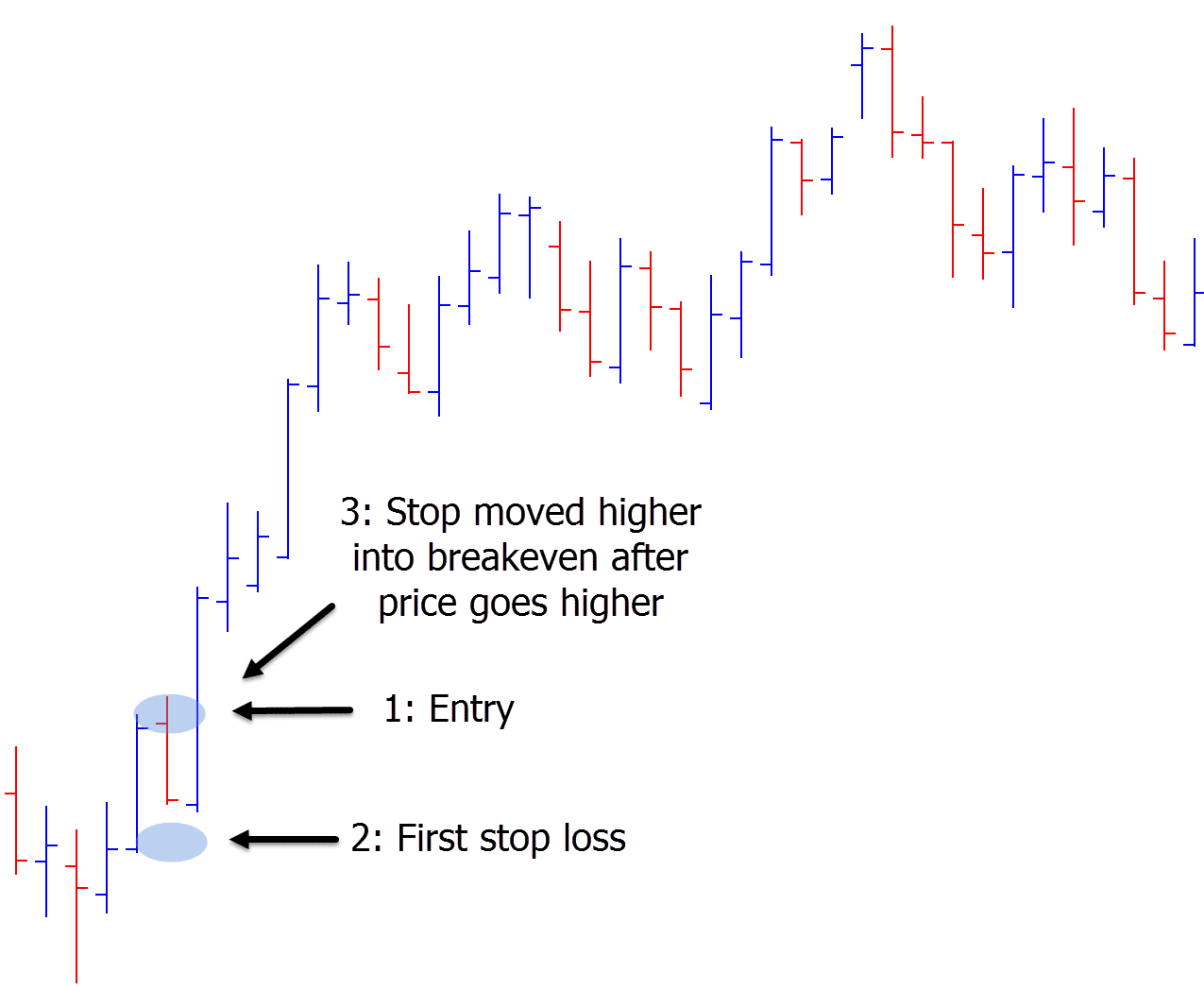

Another very common strategy is moving the stop loss into breakeven once price has moved in your favor.

This can be done manually once price reaches a certain price point or a price action level where you want to have protection in case price reverses.

Using a breakeven stop means that if price reverses you are stopped out at your entry point. You don’t make any money, but you also don’t lose any. It is a breakeven trade.

The difference between a trailing stop and a breakeven stop is the breakeven stop is only moved once into breakeven. It does not continually move higher or lower as price moves.

You can manually do this, but this obviously comes with some major drawbacks especially if price moves quickly and catches you out.

You can also use an expert advisor like the one at MQLTA that will automatically move your position into breakeven for you.