The head and shoulders pattern is a popular reversal chart formation that can be used to identify and trade reversals.

This pattern can help you identify and trade when an uptrend has changed momentum and is now moving into a downtrend.

In this post we go through exactly what the head and shoulders pattern is, how to trade it and how you can use an indicator to quickly find it in MT4 and MT5.

Table of Contents

What is the Head and Shoulders Pattern?

The head and shoulders pattern is one of the most reliable trend reversal trading patterns as it shows you that an upward trend is about to end.

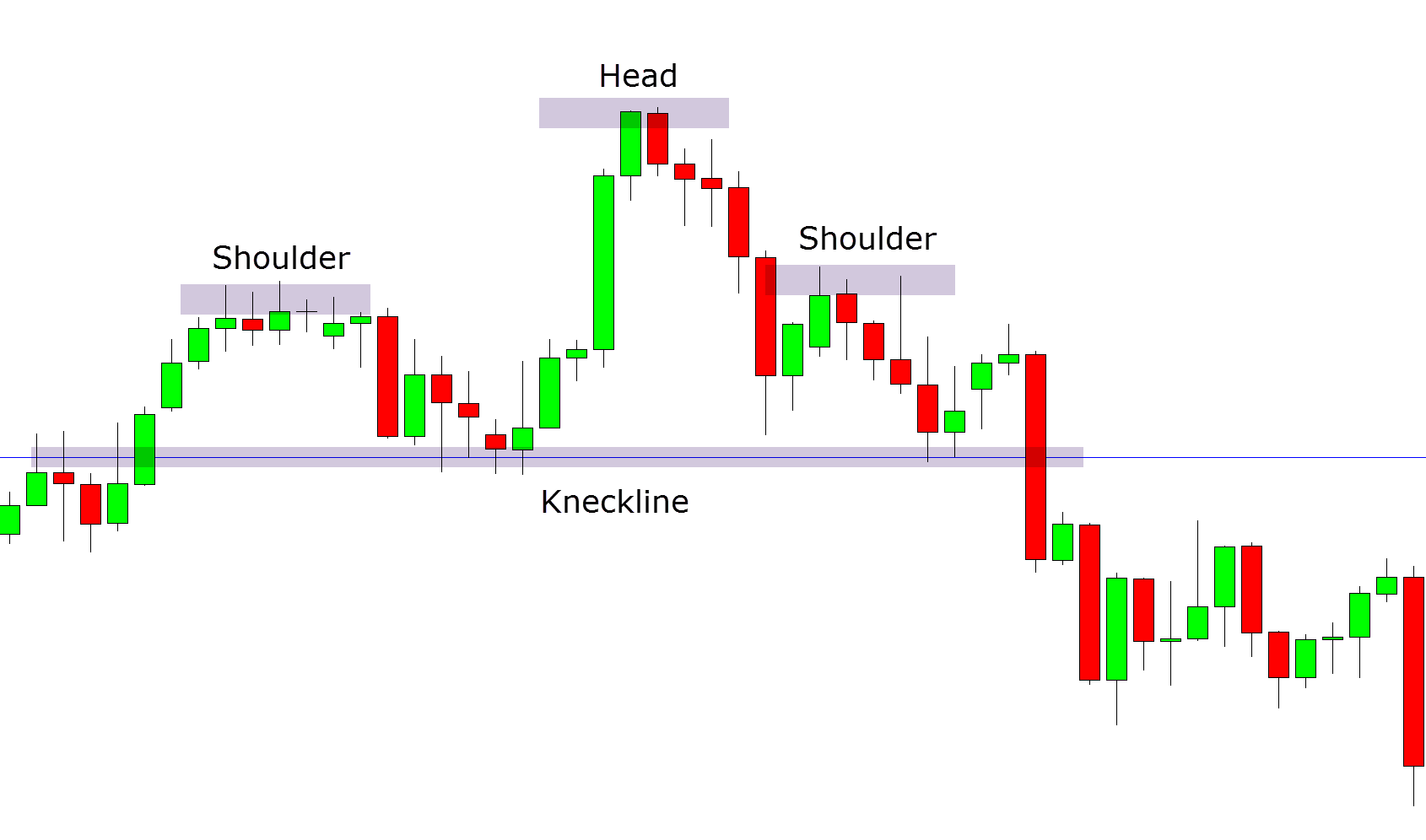

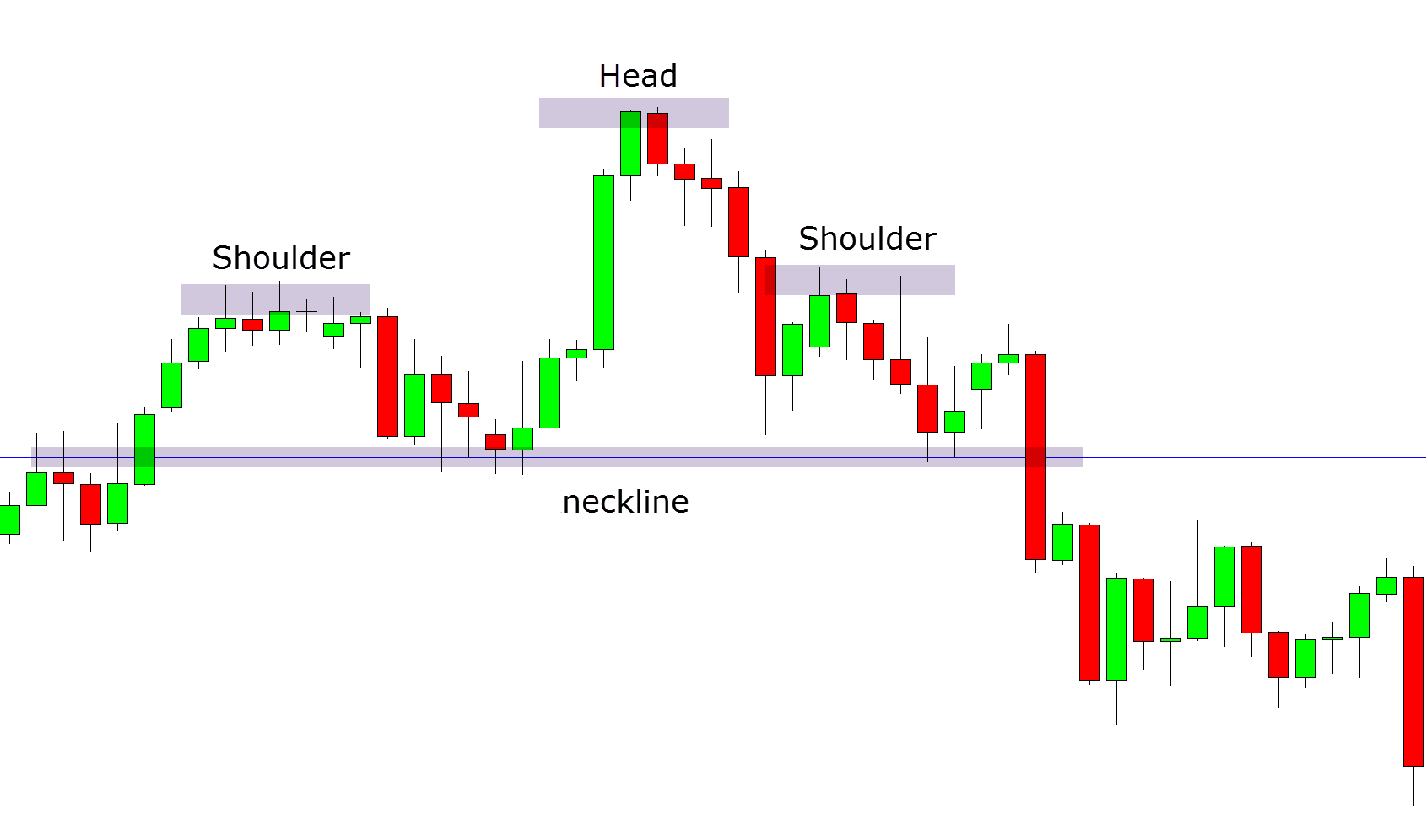

The head and shoulders is formed with three peaks. These peaks are created with two shoulders and the head.

Among the three peaks, the outside two shoulders have similar heights whilst the middle peak is the longest.

In Forex and other financial markets, a head and shoulders pattern shows you that the current price action trend is looking to turn from bullish to bearish. This can both help you identify the trend and also make high probability winning trades.

We also have the inverse head and shoulders, also called the ‘reverse head and shoulders’ pattern.

The reverse pattern has the same structure as the regular head and shoulders pattern but reversed or inversed.

The inverse head and shoulders is seen during a downtrend, and signals a trend reversal from bearish to bullish.

How to Identify the Head and Shoulders Pattern?

To identify the head and shoulders pattern on your chart, you must see the following;

- Identify that the trend of the overall market is rising higher. You can do this with the help of technical indicators and price action.

- Identify the two ‘shoulders’ as well as the head that is the peak in the middle. See the example below.

- Identify the neckline. This is crucial for the completion of the pattern and finding trades.

Using these three steps, you can identify the regular and also reverse head and shoulders pattern.

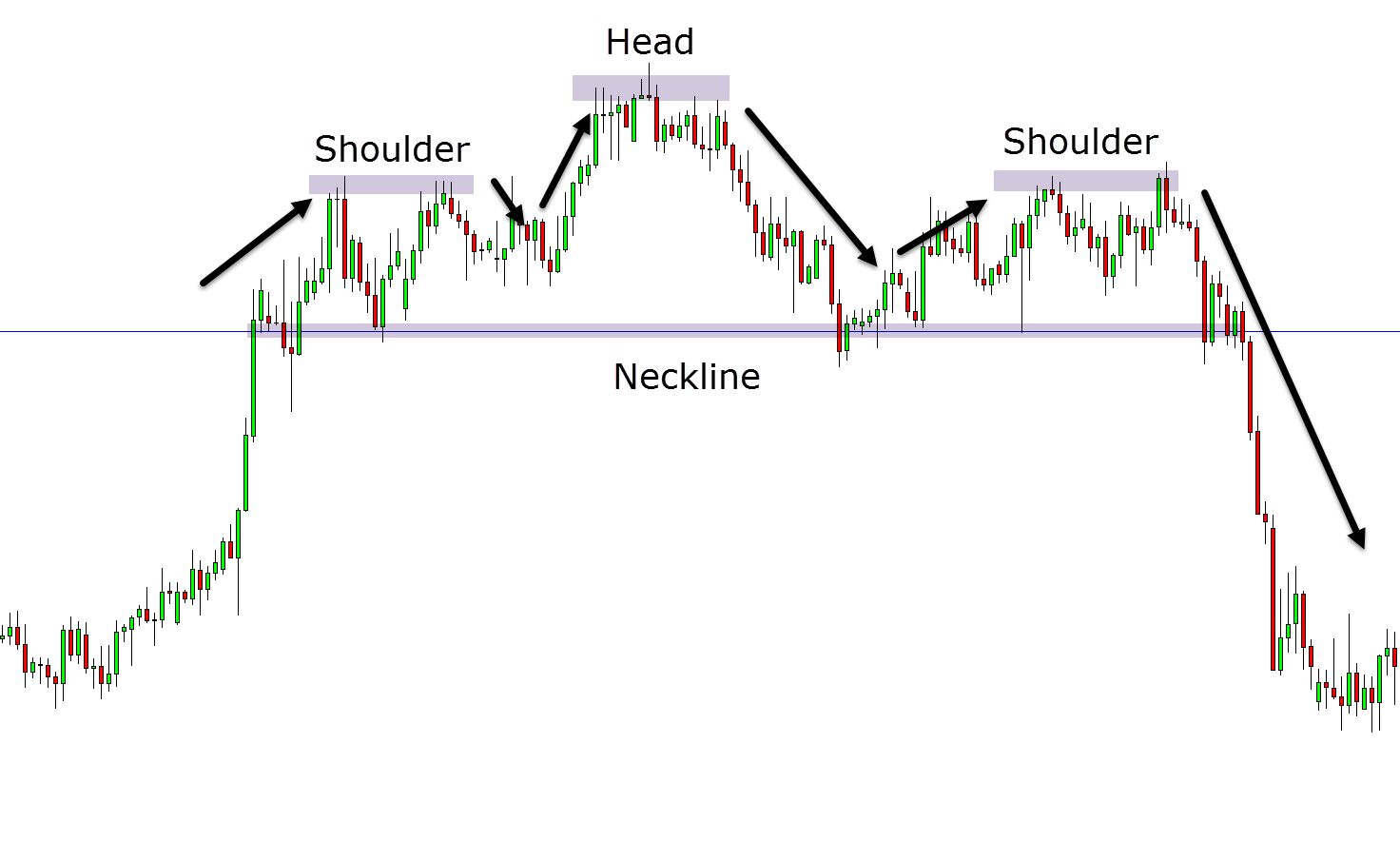

As a trader, it is best to wait for price action patterns to complete before making any moves.

The reason for this is because a pattern might not develop at all, or the partially developed pattern might not be completed later on.

It is best to watch partial patterns, but you shouldn’t trade until the pattern completes itself.

In the case of the head and shoulders pattern we are looking for price to breakdown lower and breach or move below the neckline.

With the inverse head and shoulders pattern we are waiting and watching for price to move higher above the neckline after the formation of the right shoulder.

How to Trade the Head and Shoulders Pattern

To accurately trade the head and shoulders pattern, you have to wait for the pattern to complete.

Trading an incomplete pattern can be dangerous as the pattern might not be completed in the future.

With the head and shoulders. trades shouldn’t be made until the pattern breaches the neckline.

When using the head and shoulders pattern, you should wait for the price action of the asset to slide lower below the neckline after price has formed the peak of the right shoulder.

When trading the inverse head and shoulders pattern, it is best to wait for price to move above the neckline after the right shoulder.

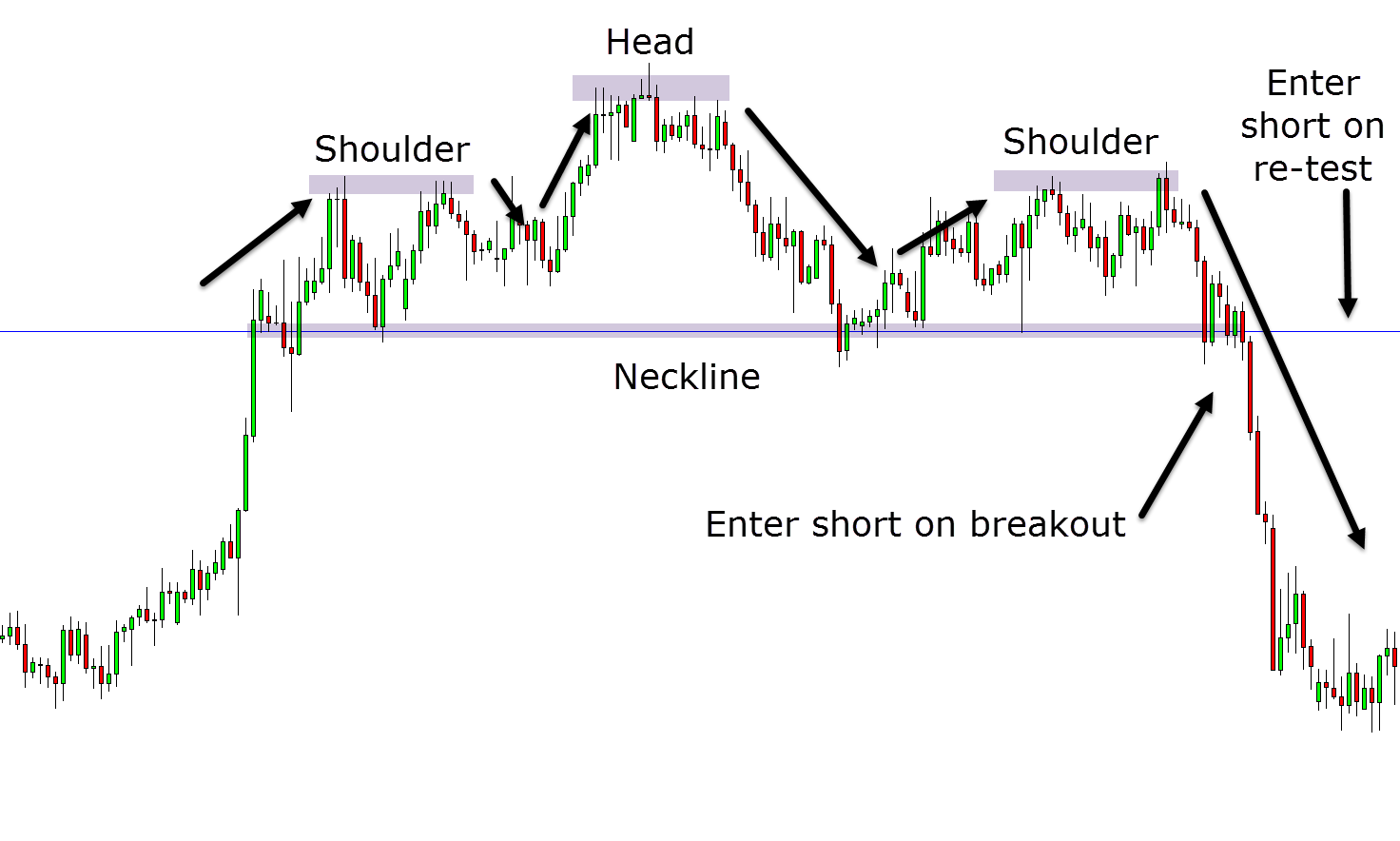

Whilst you are watching for the neckline to break you can prepare for your trade. You can plan the trade by writing down your entry points, stop loss point, profit targets, and other variables that could affect your profit and stop targets.

When the neckline breaks you can then launch a trade with two different methods.

The most aggressive method is to make a short trade as soon as price begins moving lower and breaking out of the neckline of the pattern. This is more aggressive as you run the risk of being faked out if the neckline holds as support.

The other method is to look for price to break the neckline and then look for short trades on a price action re-test, either on the same or smaller time frame.

Head and Shoulders Pattern Indicator for MT4 Download

With so many price action patterns and candlesticks, it can be hard to keep up and not miss out on any high quality trades.

This is where MT4 and MT5 indicators that can identify these patterns can come in handy and quickly alert you if a pattern has formed.

The PZ Head and Shoulders MT4 is a premium head and shoulders pattern indicator built for MT4 that also comes with a free demo.

This indicator generates clear trading signals, implements performance statistics, has customizable Fibonacci retracement levels, and various other features.

You can get the PZ MT4 Head and Shoulders Pattern Indicator Here

Head and Shoulders Pattern Indicator for MT5 Free Download

The Head and Shoulders 4.0 is an indicator built for MT5.

This is a premium MT5 indicator that you can try out with a free demo version.

Similar to the MT4 indicator, the Head and Shoulders 4.0 for MT5 offers a large range of features such as clear trading signals, performance statistics, customizable Fibonacci retracement levels and more.

You can get the head and shoulders MT5 indicator here.

Note: Don’t know how to install and use these indicators? Read How to Download, Install and Use MT4 and MT5 Indicators.

Lastly

You can find and trade the head and shoulders pattern in many different markets and on all time frames.

When you find a completed head and shoulders pattern you can use it to accurately make entries, set your stops and manage your profit targets. This is why this pattern is one of the most popular charting patterns in both the Forex and stock markets.