The average true range is an indicator that highlights market volatility. It does this by showing you how much a Forex pair or asset has moved on average over a set time period.

You can use the average true range (ATR) in multiple scenarios in your trading including helping you find appropriate profit targets and where to set your stop loss to suit the market conditions.

NOTE: Download Your Free Average True Range PDF Below.

Table of Contents

What is the Average True Range

The average true range was created by J. Welles Wilder to measure volatility.

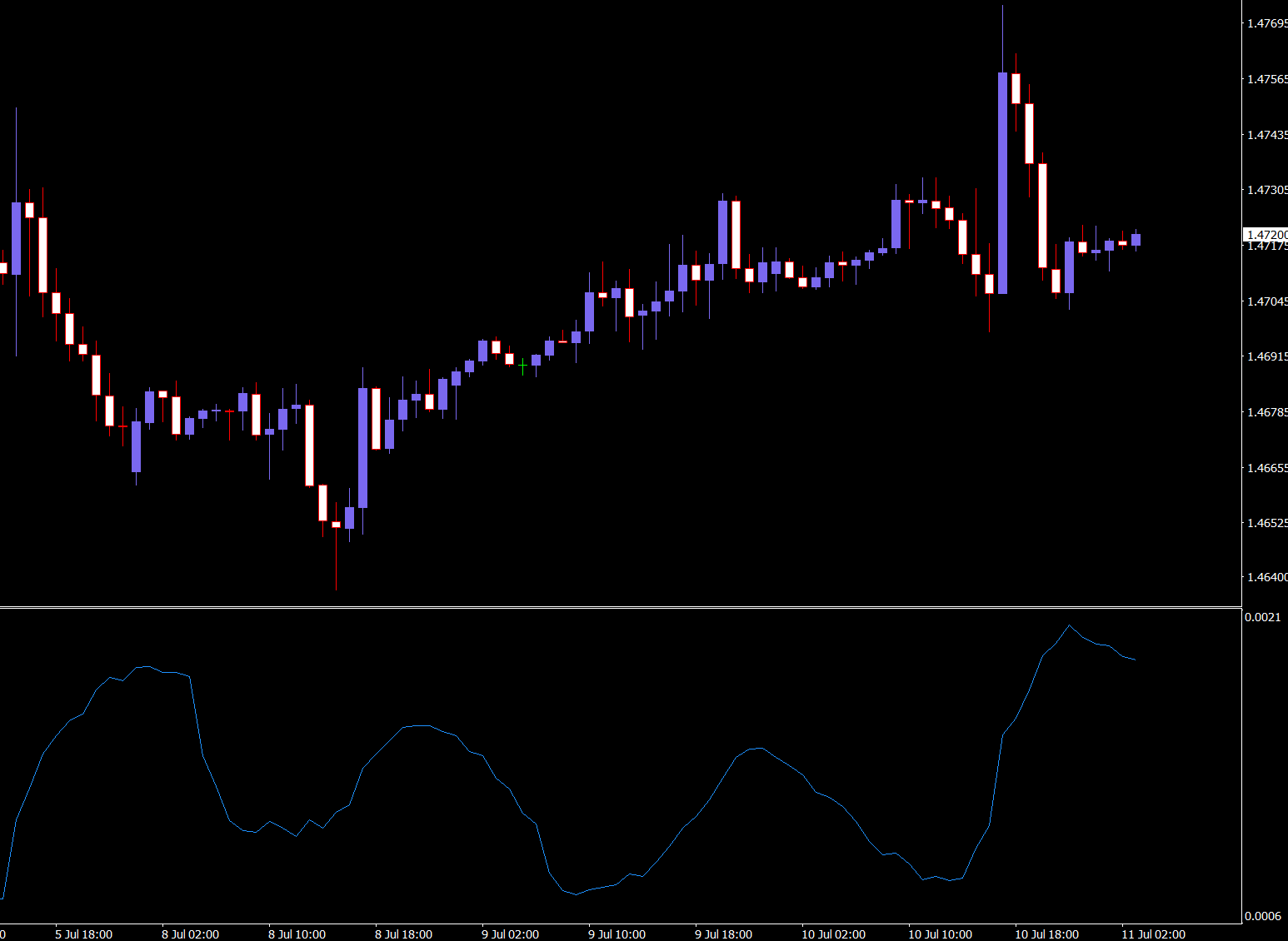

As price makes larger or smaller moves higher or lower the ATR becomes bigger or smaller indicating the asset volatility.

The ATR is shown in pip amounts for Forex or dollar amounts for other markets. For example; a reading of 0.50 would mean 50 pips in the Forex market.

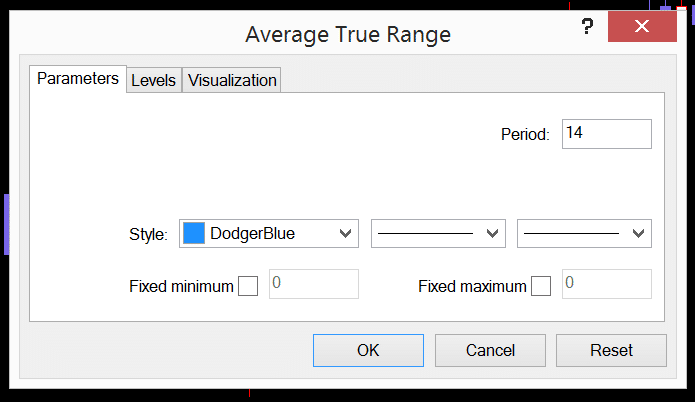

The standard setting for the ATR range is 14 and can be used on any time frame you choose.

As each new time frame closes the ATR is calculated. For example; on a daily chart the ATR is calculated at the close of the next daily time period.

These 14 time readings are then added together to show you a continuous line that will give you a quick indication of overall asset volatility.

The average true range cannot be compared from one market to another or one Forex pair to another. If an asset has a higher price, then it will have a larger ATR compared to a market or stock with a smaller price.

How to Calculate the ATR

To calculate the ATR range over a certain time period, the ‘true range’ is first calculated.

The true range is calculated by finding the greatest value of;

- Current high minus the current low.

- Current high minus the previous close.

- Current low minus the previous close.

After the true range is found over 14 periods, it is averaged to find the ‘average true range’.

If you are using the standard 14 day time period you can then use this information to calculate the ATR on a monthly, weekly, daily or intraday time frame.

How to Use the Average True Range on MT4 and MT5

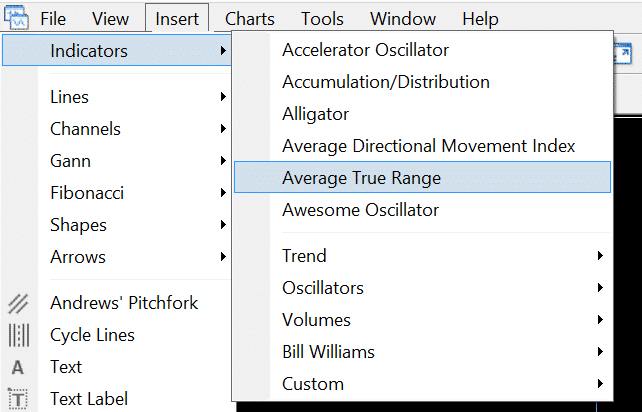

Setting up and using the ATR in your Metatrader charts is quick and simple.

To do this open your MT4 or MT5 charts.

Click; “Insert” >> “Indicators” >> “Average True Range”.

A box will then open with the standard settings that you can change to suit your needs. These include the color that the ATR will show in and the time period that the true range will average over.

How to use the ATR

Whilst the ATR is not an indicator you’re going to use to find new trade signals, it is an indicator that you can use to find better profit targets and stop loss areas.

The ATR will highlight the different market conditions and help you identify when they are changing allowing you to set larger stops or look for bigger profits.

Using the Average True Range for Profit Targets

A lot of traders are using a form of risk reward with their stop loss and profit targets. For example; risking 1 and looking for 2 reward.

The ATR can be used to help you identify potential profit targets and also work out if a trade entry is suitable.

If you find a potential trade that has a very large ATR, then you know price is more likely to make a large move. If you get your trade call correct you can use this information to set a larger target.

You can also use the ATR to spot trades that you should stay clear of because they have a small ATR and do not have a high chance of meeting your risk reward criteria.

Using the Average True Range for Stop Loss

The average true range is commonly used for setting a stop loss and also trailing a stop loss.

One strategy for using the ATR to set your stop loss is using a multiple of the average true range. For example; you may set your stop 2 x the ATR away from the current price.

You could also use this strategy for trailing your stop. If price moved in your favor and you were looking to lock in profits you could use a multiple of the ATR to trail your stop higher or lower behind the current price.

Conclusion

Whilst the ATR is not an indicator that will help you find trades or spot the market trend like a moving average, it can help you identify the recent volatility or lack thereof.

You can then use this information to your advantage by either passing on trades, or when a suitable trade is found, setting appropriate stops and targets.

The ATR is best used with your other tools and trading strategies including your price action trading systems.

Using the average true range this way you can identify the volatility and then read the charts to find high quality trade entries.

NOTE: Download Your Free Average True Range PDF Below.