The Martingale trading strategy is a strategy that aims to ensure profitability over the long run. This is more of a money management method than a trading strategy, and you use it with many different systems or methods.

In this post, we go through exactly what the Martingale system is and how you can use it in your own trading.

NOTE: You can get your free Martingale trading strategies PDF guide below.

Table of Contents

What is the Martingale Trading Strategy?

The Martingale strategy goes all the way back to the 18th century. If you have enough money, it can almost guarantee success. It does this through the mathematics of probabilities.

The Martingale method was originally used in gambling and at casinos. Soon enough, betting minimums and maximums were introduced by the casinos, which reduced its success.

The basic idea behind the martingale system is that you double your bet or trade size every time you have a loser. As you continue losing, you continue doubling your trade sizes.

Eventually, after you continually double your bet or trade sizes, all you will need is one winner to get back to profits.

The major issue with this type of money management is that whilst you can eventually make money, you can suffer long losing streaks and need a huge reserve of cash to make it profitable.

A basic example of using the Martingale strategy is starting with risking $1. If that trade loses, you now risk $2. If that trade also loses, you next risk $4. This pattern goes on until you make a winner.

In this example, you risk $1, then $2, and finally $4. If you are only aiming for 1: RR – risk-reward (double the amount you lose on a potential trade), and you win the third trade, then you would be back in profit. You would have lost the $1 and $2 trades which resulted in a $3 loss, but after making a winner on the $4 trade, you are now $1 in front. You can then repeat the method all over again.

How to Use the Martingale Method

The biggest flaw in this system is how quickly your losses can mount as they are getting doubled every time.

The only way to make it work is to risk a tiny amount of money or have a huge reserve that you can use to get back to profitability finally.

For example, if you start off risking $100 per trade and lose six trades in a row, you would have already lost $6,300 and now would have to risk $6,400 on your next trade to get back to profitability. If you lose a seventh trade, you are now down $12,700 and have to risk $12,800 to make back your losses.

Many traders use this method, thinking that they can avoid long losing streaks, but even professional traders have losing streaks, so money management is so important.

The Best Markets to Use Martingale Methods

Some markets are far more suited to the Martingale strategy than others.

For example, the stock market can have stock prices drop to zero if a particular company goes bankrupt. This would see you lose your capital with no way to double up and get your money back.

Whereas stocks can drop to zero, it is highly improbable that a currency would drop to zero. At the same time, the Forex market can have huge swings higher and lower, but prices rarely, if ever, move to zero.

The other reason that people use the martingale in the Forex market is that you can use leverage, and there are a huge amount of markets and time frames to trade.

This gives you many opportunities to find high-quality trades to move back to profitability.

Martingale Trading Strategies

Because Martingale is a way to manage your money, you can use many different strategies.

The best strategies will be the ones that have clear rules and are simple to use.

For example, you could enter a long trade every time the 21 period moving averages crosses above the 50 periods moving average. This is a straightforward strategy, but one you could easily automate to use with the martingale method.

One crucial factor in the strategy you use when using this type of money management is that you are consistent and carry out the same strategy and rules each time. For example, if you only take half the profit on your winning trades or your winning trades have a small reward level, you will fail to move back into profitability even when you get your winning trades.

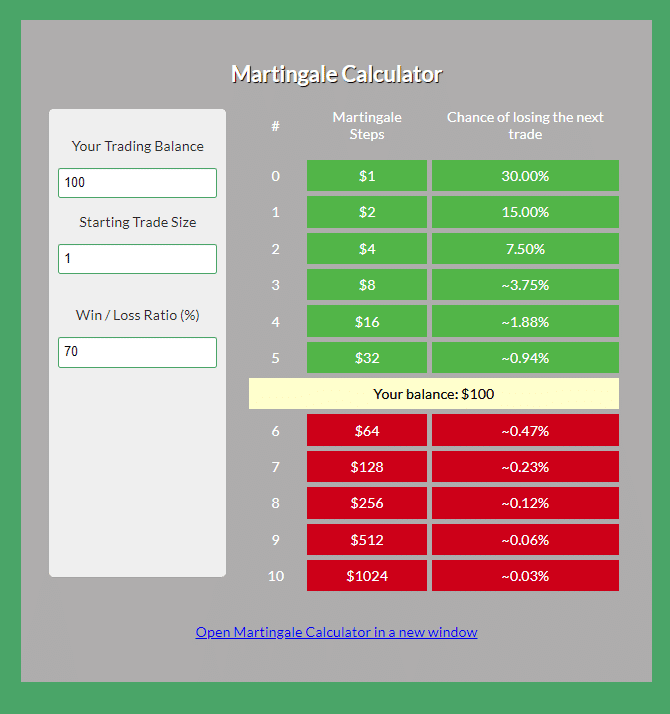

Martingale Calculator

If you want to quickly work out the potential profit and loss from using the Martingale strategy, then you can use a calculator that works it out for you.

This Martingale calculator will show you how you will progressively be risking if you hit a losing streak and how much you could end up making. The calculator considers your balance, your win rate, and how much you want to risk each trade when starting.

Anti Martingale Strategy

The opposite to the Martingale strategy is referred to as the ‘anti Martingale strategy.’

With this strategy, you are doing the exact opposite. Each time you have a loss, you reduce your next trades risk in half. Each time you have a win, you are doubling your risk.

The anti Martingale strategy aims to capitalize and make as much money from winning streaks, whilst minimizing how much you lose on a losing streak.

This method can increase how much profit you make when you hit a hot streak of winners.

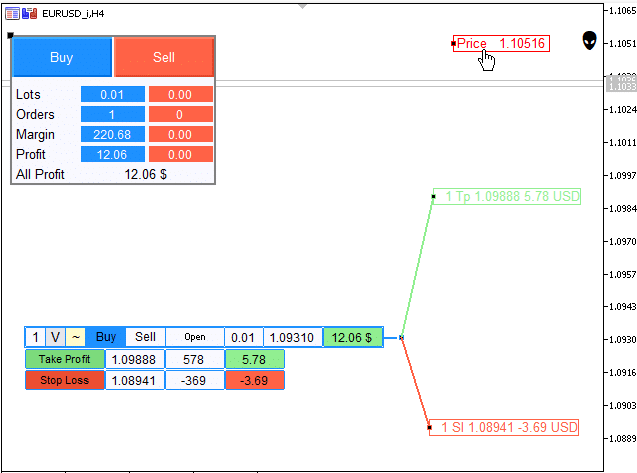

MT4 Martingale Indicator

With this Martingale indicator, you can quickly and easily calculate your potential profit and loss.

Once you have downloaded it onto your charts, you can use it quickly to work out the number of lots you should be trading, as well as superimposing your orders and other positions on your charts.

The handy feature of this indicator is that you can simulate where price moves to calculate your profit or loss. You will also be able to calculate the average price needed to make a profit or be back to breakeven.

You can get the MT4 Martingale indicator here.

MT5 Martingale Indicator

This MT5 Martingale indicator is from the same creator and has many of the same functions.

With this indicator, you can do the following;

- Create grids for both buy and sell orders.

- Calculate your potential profit and loss levels.

- Calculate the average price needed to move back to breakeven or into profit.

- You can use it on all time frames and markets supported by your broker.

- Quickly see margin used, profit and loss, and the number of orders.

You can get the MT5 Martingale indicator here.

Note: Don’t know how to install and use these indicators? Read How to Download, Install and Use MT4 and MT5 Indicators.