Positional trading can be one of the best ways to make large winning trades.

When making positional trades, you will often be holding your trades for long periods of time. This gives you the chance to catch long-running trends and also add to your winning trades as they keep moving in your favor.

This post goes through exactly what positional trading is and how you can use different strategies to start using it in your own trading.

NOTE: Get your free positional trading strategy PDF guide below.

Table of Contents

What is a Positional Trading Strategy?

Position trading is a longer-term trading strategy that allows you to capture profits by holding positions for months or years.

As a position trader, you are ignoring the very short-term price action movements and are taking a long-term view.

A lot of traders think of positional trading in the same way they do buy and hold investing. However, the main difference between the two is that you can both profit from price moving higher and lower with positional trading.

Because your hold time is longer with position trading, you have the ability to grab bigger gains. On the flip side, however, that also comes with more risk.

Position traders will normally use a blend of technical analysis and fundamental analysis, and as we discuss in this post, you can use many popular trading strategies to make position trades.

The Best Markets for Positional Trading

Some markets are more suited to position trading over others.

The most popular markets and assets suited to positional trading include; stocks, commodities, and major indexes.

Markets prone to large amounts of volatility, such as Forex and cryptocurrency, are not suited to position trading.

Because position trading is a much longer-term trading style, the best markets are where a trader can get a clear idea of the underlying value and the potential for any future increase or decline in the price.

Position Trading vs. Swing Trading

The major difference between swing trading and position trading is the length of time each trader is looking to hold their trades.

A position trader is looking to make long-running trades that they could hold for months or even many years. These trades could also be added to as they start to move in the trader’s favor.

A swing trader is looking to profit from the many swings, both higher and lower. This form of trading is most often done on far smaller time frames, and the trades are normally held from hours to days.

The Best Indicators for Positional Trading

Many of the popular indicators used for other forms of trading can also be applied when position trading; however some work better than others.

For example, longer-term moving averages are extremely useful, and so is the average true range for assessing a market and managing your trades.

Longer-term Moving Averages

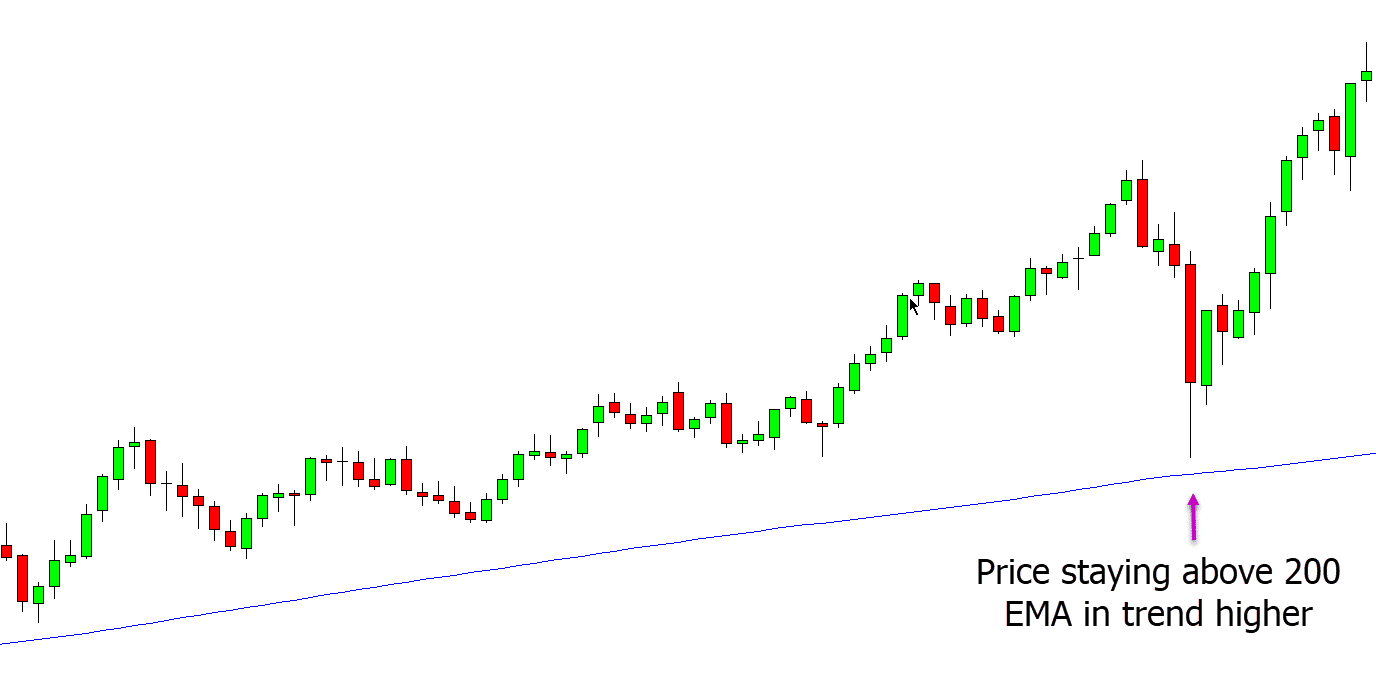

One of the most popular indicators for longer-term position traders is slower reacting moving averages. Of these, the most common of all is the 200 period moving average.

This moving average is watched by many market participants on the higher time frames because it shows a clear overall picture.

When using the 200 period moving average, you can see if the price is trading above or below it in a trend higher or lower.

You will also find that the 200 moving average will be dynamic support and resistance on the longer time frames. In the example below, we can see that price is trending higher above the 200 period moving averages. We can also see that each time price moves lower into this moving average, it finds support and bounces back higher in line with the trend.

Long Term Trading Strategies

Breakout Trading

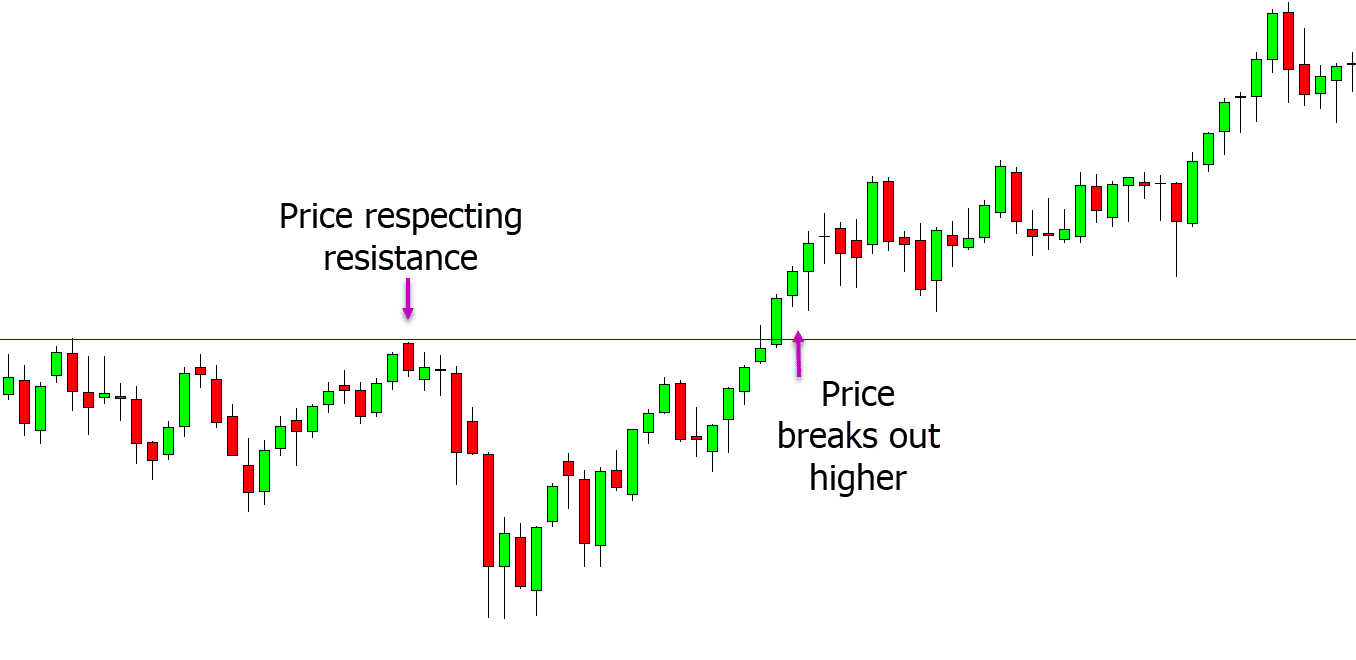

One of the most popular ways to make position trades is by getting in early to breakout trades.

If you can get in early into a breakout, you give yourself a chance to make a long-running and winning trade.

In the example below, we have a clear area where price has found resistance on multiple occasions.

When we see the third re-test, we could then take a long breakout trades if the price breaks through this area and ride the next long move higher.

Support and Resistance Trading

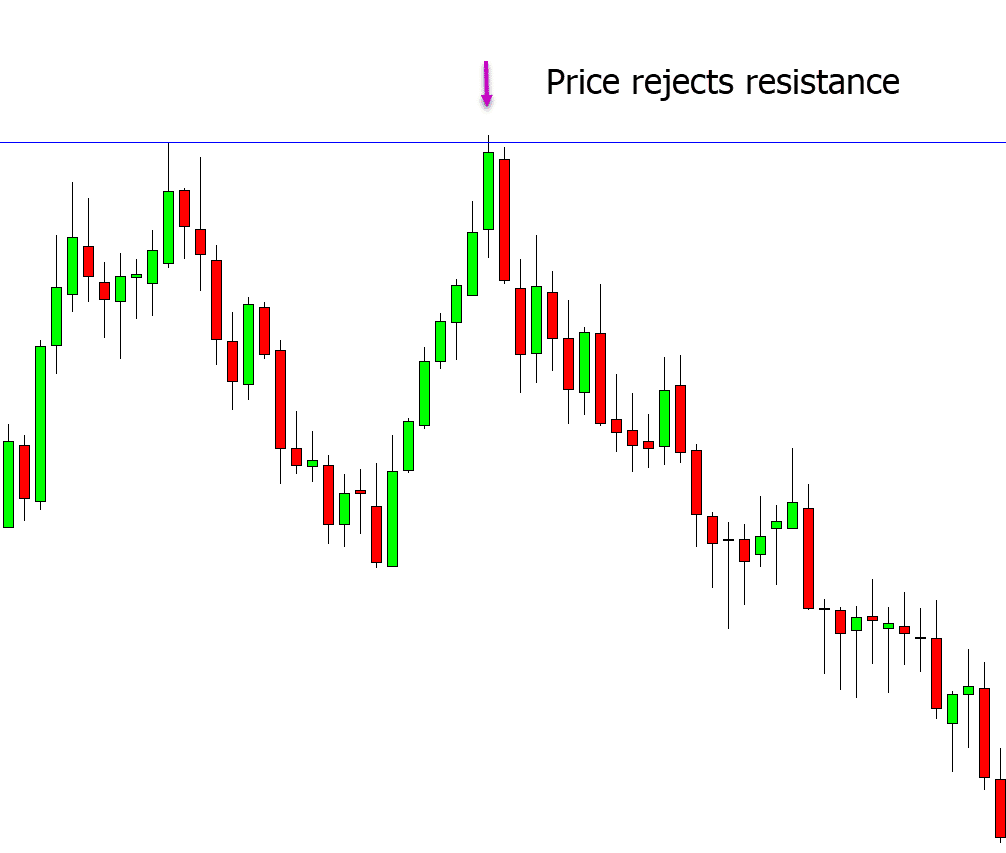

Support and resistance on the higher time frames such as the weekly and monthly charts can often be another very popular way to find high probability position trades.

In the example below, we can see price starts to reject an obvious resistance level.

When we see this rejection, we could look for potential short trades and profit from the next move lower.

Trend Trading

Using the clear trend can be one of the best ways to make long-running and winning trades when position trading.

If you give your stop enough room to move, then you can have the chance to make trades that last for a long time as the trend keeps rolling on in your favor.

When trend trading, you also can use a pyramid strategy to keep entering more positions and to make even further profits.

Fundamental Analysis

Most position traders will use some form of fundamental analysis to evaluate their trading.

Because position trading is most often carried out on markets such as stocks or major indexes, traders will use fundamental information to gain an insight into the assets’ value.

This information can help you know whether a stock is undervalued or overpriced, and you can then combine it with your technical analysis to fine-tune your entries.

Boosting Position Size Profits With a Pyramid Strategy

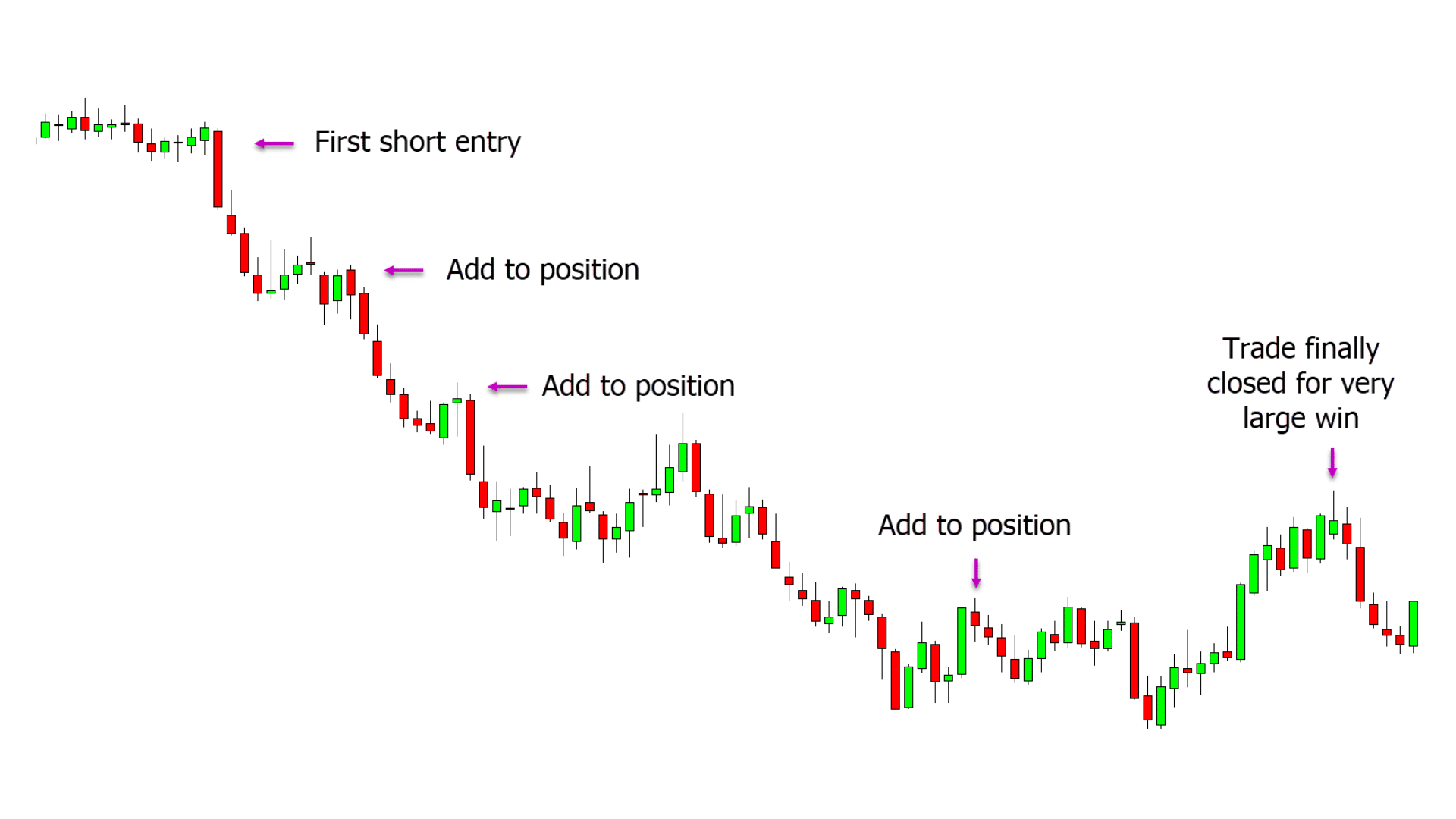

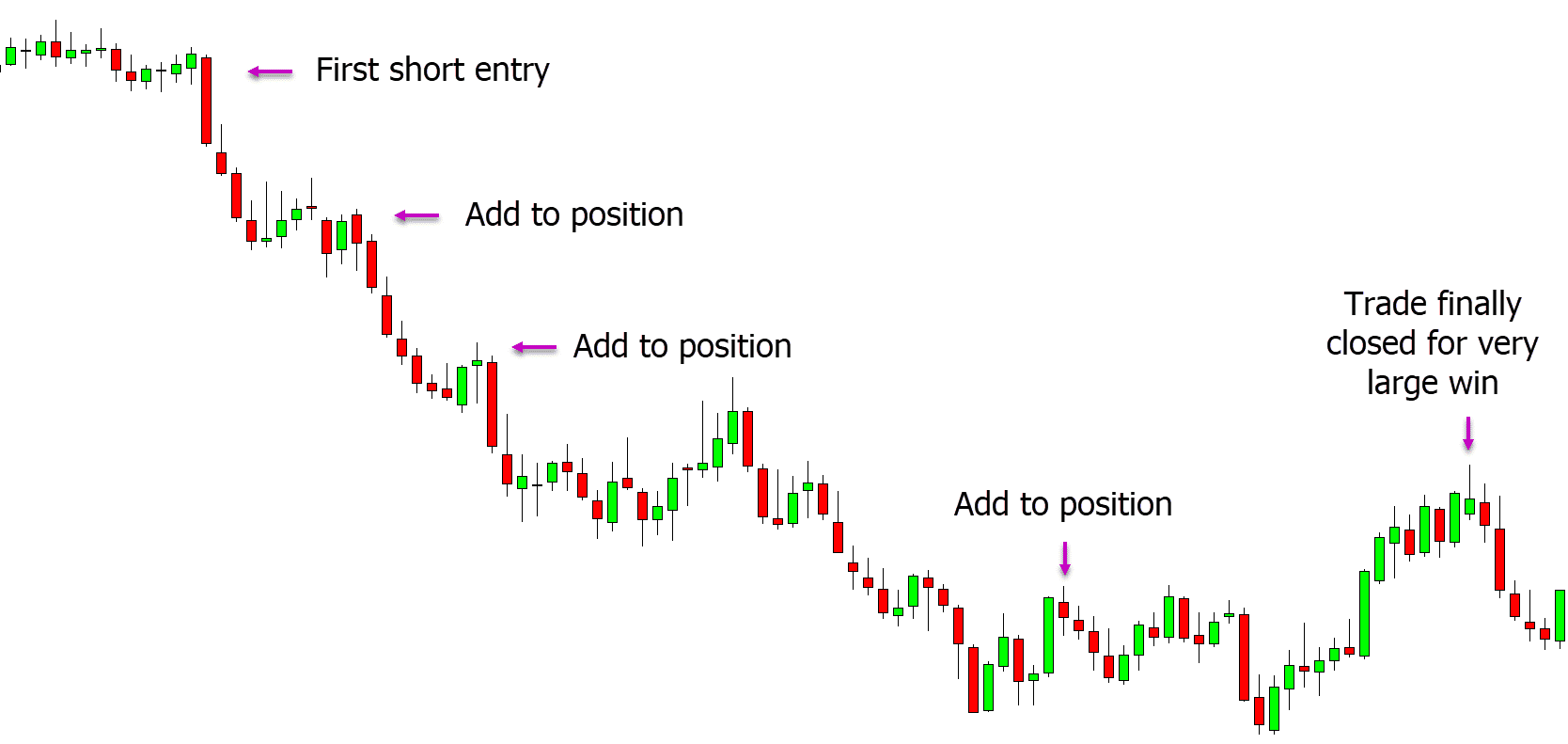

One way to boost your profits is by adding to your winning trades as they move in your favor. This is known as pyramiding.

With a pyramiding strategy, you are continually making new entries and looking to make even further profits as price gains in your direction.

If you use pyramiding correctly, you do not have any extra downside or risk, but it can boost your profits enormously. See the example below of how more and more short trades were entered as price continually moves lower before all trades are finally closed when the trend ends, and price moves back higher.

Position Trading Books

Position Trading: Buy Like a Trader and Hold Like an Investor – Tony Loton

This book on position size trading by Tony Loton is designed to show you what stocks to buy and when.

In this second edition version, you will learn how to use proper position sizing and also how to boost your profits by using a pyramiding strategy.

Another key point you will learn is how to use leverage to make bigger winning position trades effectively.

NOTE: Get your free positional trading strategy PDF guide below.