Have you ever noticed that price action will often bounce up and down between the same support and resistance levels multiple times?

This is price moving in a range and respecting the range high and low.

In today’s post we go through exactly what range trading is and how you can use simple strategies to start making high probability and profitable range trades.

Note: You can download your Free Range Trading Strategies PDF Below.

Table of Contents

What is Range Trading?

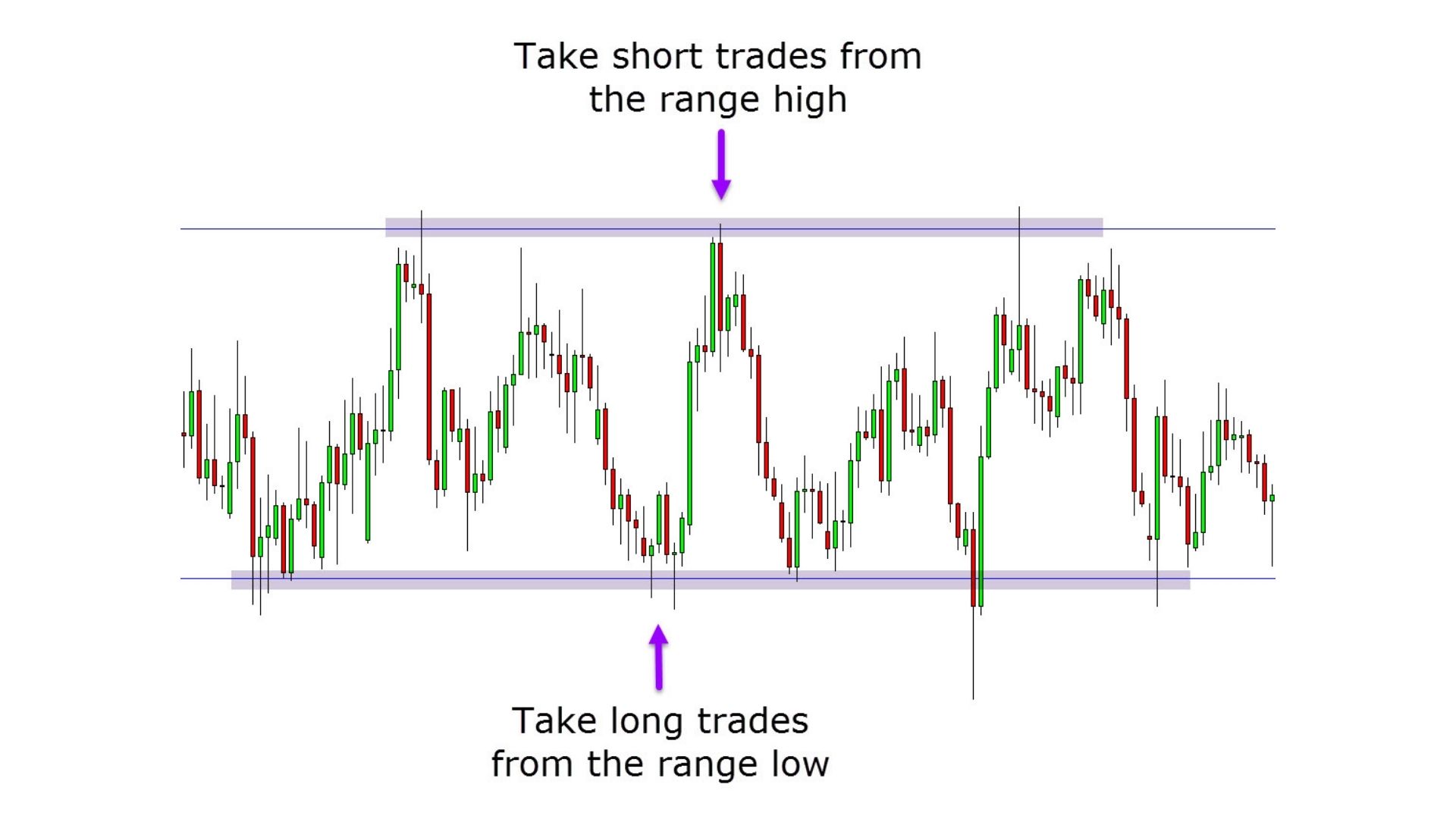

Range trading is where price is moving between a range high (resistance) and range low (support).

For a range to form we need to see price reject the same resistance and the same support level twice.

See the example below where price has respected the same range resistance and sold lower. It has also rejected the same range support and moved back higher.

If you use any form of technical analysis or price action trading, then it is incredibly important you learn how to identify and also trade within a range.

Price spends far more time moving within range patterns and trading sideways than it does in clear moving trends.

If you do not have the ability to make profitable range trades, then you will spend a long time on the sidelines waiting for other opportunities.

Being able to identify ranges will also help you understand the best entry points and help you with your trade management.

Why Would You Want to Range Trade?

If you don’t know how to identify a range and make profitable trades within them, then you will not only miss trading opportunities, but also face the risk of entering into higher risk trades.

When price is ranging it is a lot more likely to continue the sideways movement. This also increases the chance for price to whip around and stop you out early unless you have prepared for it.

Range trading can offer some of the simplest and easiest trading opportunities. The strategies we go through in this post can be used on all time frames and you can use them in all market types that are favorable to price action such as Forex, Gold, Indices etc.

Range Trading Versus Trend Trading

There is a clear difference between ranging and trending markets and a difference you need to be able to identify.

With a trending market you will be able to identify a series of swing points. For example, in a trend higher you will see a series of higher highs and higher lows.

As long as this pattern continues to form price will continue making higher highs and will not be contained like it is within a range.

You can use this knowledge to not only find and make trend trades, but also once in a profitable trade start to trail your stop loss as price continues to trend.

With a ranging market price is contained between two levels, the range support and resistance level.

Price is not making any new highs or any new lows. You need to keep this in mind when both finding trades and also looking for profit targets.

Profitable Range Trading Strategies

As we are about to go through, the two simplest range trading strategies are trading within the range and looking for the range to break.

Trading From the Range Highs and Lows

This is both the simplest and also most popular range trading strategy.

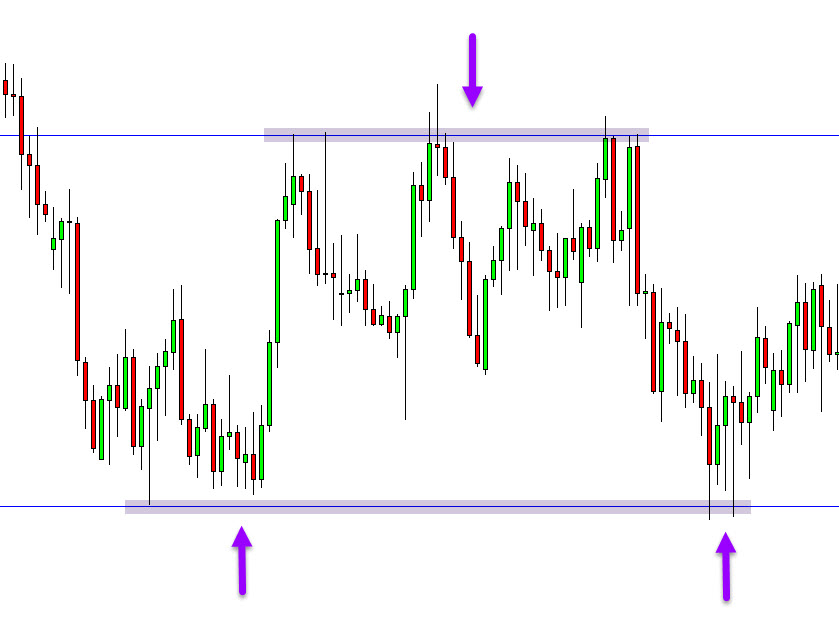

With this strategy you are first looking to identify that price has formed a clear range. For that you need to see that price has rejected the same range resistance and support at least twice.

Once you have identified that the range has formed you are then looking to make trades from the high and low.

With this strategy you are looking for the range to continue and for the support and resistance levels to continue holding.

The example below shows how you could take short trades from the range high and long trades from the range low.

Trading the Range Breakout

This is a more aggressive and also higher risk range trading strategy, but it also offers higher potential rewards.

When making trades from the range high or low, normally your profit potential will be capped to a degree. This is because you are normally aiming for price to make a move back to the other side of the range. For example, if you take a long trade from the range support, you would be targeting the range resistance.

With this strategy you are looking to take trades when price breaks out of the range. There is no cap on where price can move because it is moving out and away from the range.

The risk with this strategy is that the breakout quickly turns into a fakeout and you are stopped out.

Lastly

Range trading is not suited for everyone.

With that being said, you need to keep in mind that the markets spend far more time ranging than they do in clear trends.

If you don’t want to spend a lot of the time on the sidelines waiting for new trading opportunities, you need to be able to trade ranging markets.

If you are ready to start range trading, then the best thing you can do is download some free demo charts and test out your trading making sure to risk no real money until you are ready.

Note: You can download your Free Range Trading Strategies PDF Below.