Your risk of ruin is a mathematical equation that tells you the chances you are of blowing your account over time. This is based on the amount you risk, your win loss percentage and your average risk reward per trade.

Why is this important for you to know and understand? If you have an unsustainable trading risk model it is just an amount of time before you end up blowing your account.

Table of Contents

What is a Risk of Ruin Trading Calculator?

The risk of ruin trading calculator is a very simple calculator that you can use to run different simulations.

You can use this calculator to see what your risk of drawdown and also ruin is based on different results.

For example; you can simulate higher or lower winning trade rates, how risking more affects the calculation or if you have a large or small average risk reward ratio.

One of the best risk of ruin calculators is found at ‘The Realistic Trader’ Here.

How to Use a Risk of Ruin Calculator

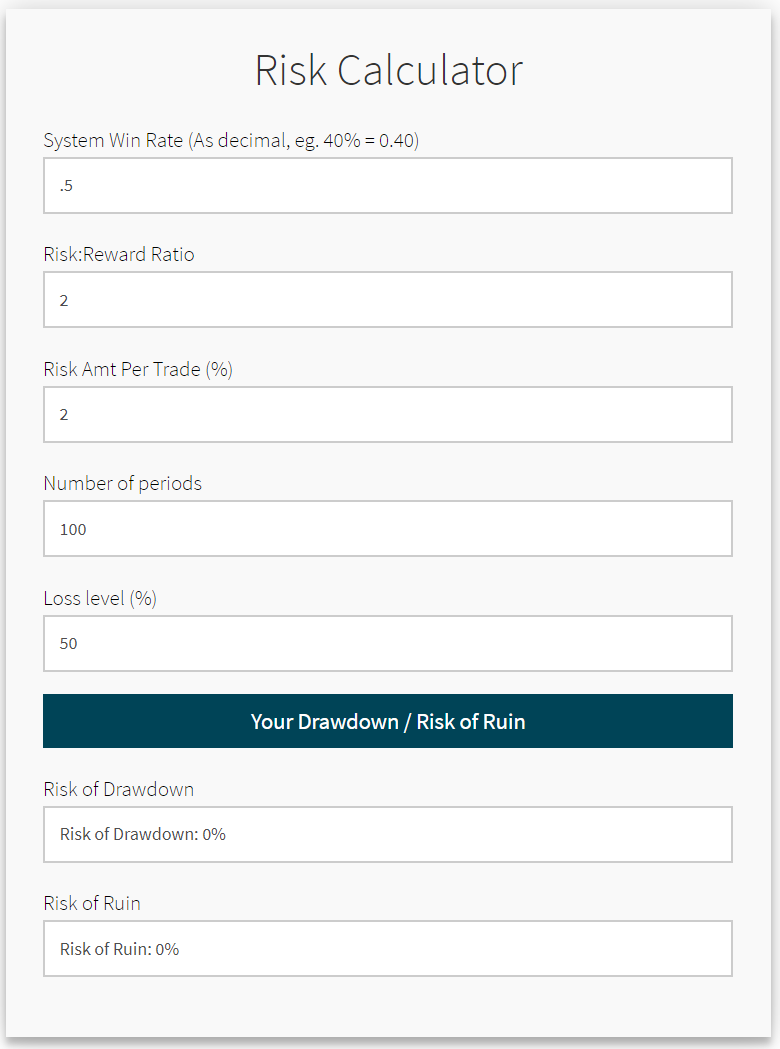

An example of how you could the risk of ruin calculator is below;

The calculator will ask you for the following;

- System win rate: Winning trades percentage. For example; average 60% winning trades = 0.6

- Risk reward ratio: Average risk reward on winning trades. For example; 2/1 = 2

- Risk amount %: How much of the account is risked per trade.

- Number of periods: How many periods to run simulation.

- Loss level %: Level where drawdown or risk of ruin is set for testing period.

In the first example image below I have used the inputs of a win rate of 50%, average risk reward 2/1, risking 2% of the account, a loss level of 50% and 100 periods.

I can see that the risk of drawdown and ruin is 0%.

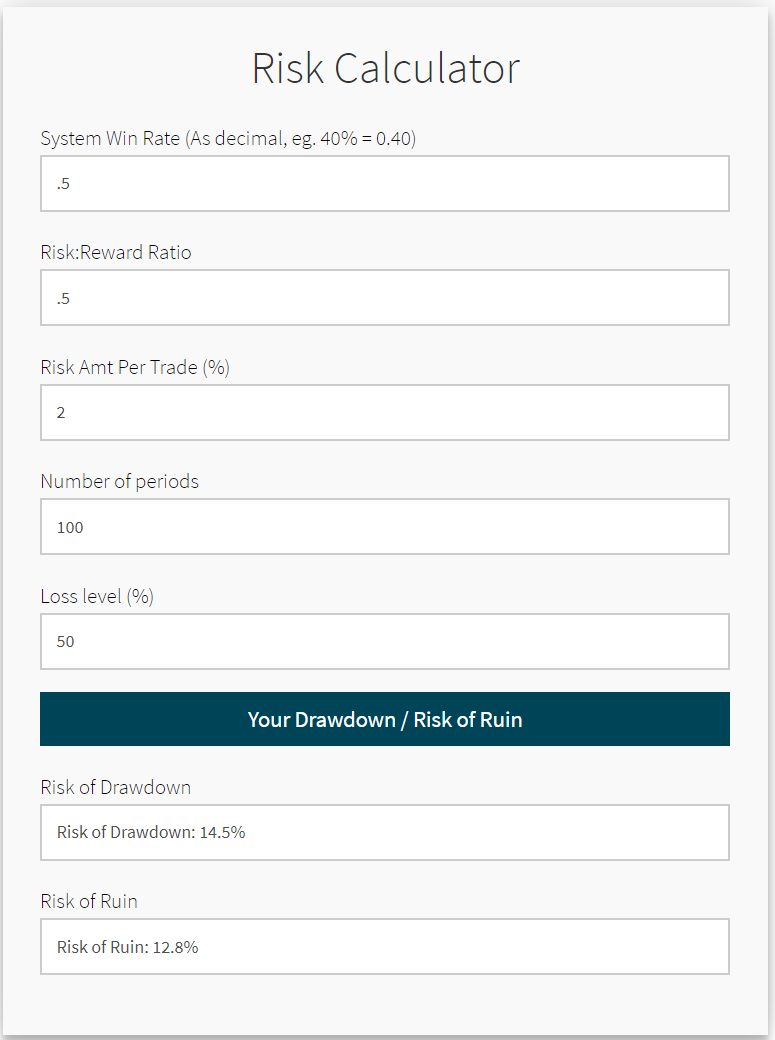

In the second example image below I slightly change these figures so that the win rate is 50%, average risk reward 0.5/1, risking 2% of the account a loss level of 50% and 100 periods.

This shows that I am now running at a risk of ruin of 12.8% and risk of drawdown of 14.5%.

Why is Risk Reward Analysis so Important?

One thing that the risk of drawdown and risk of ruin calculators show quite clearly is how important your average risk reward and position size is.

The higher your average reward when making winning trades, the more trades you can afford to lose and the longer you will stay profitable.

Of course this is great in theory and we need to keep in mind that risk reward is only as good as our win rate.

If we average high reward rates such as 5:1 on our winning trades, but continually lose 10 trades in a row, the high rewards will not matter as we will still lose money.

It is a fine balance and something that trading risk calculators can help you fine tune.

Risk Reward Probability Calculator

One of the simplest ways to workout your potential trades risk reward is by using a free calculator.

One of the easiest free risk reward calculators can be found at Forex central here.

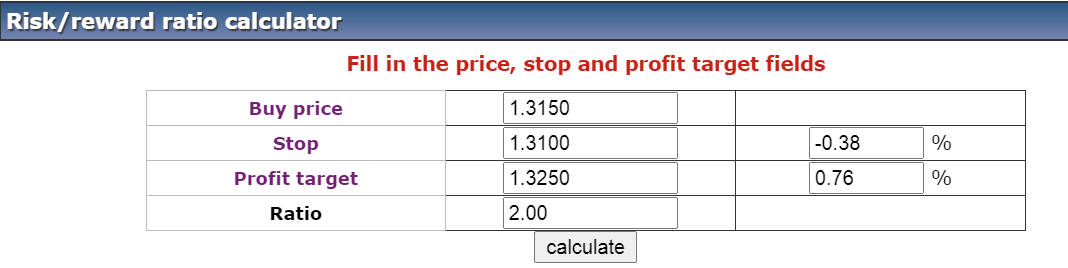

With this calculator all you have to do is enter in your entry, stop loss and where you want to take profit.

From there the calculator will tell you what the potential reward could be on a winning trade. See the example below;

This example scenario shows me that with these numbers I could have a potential 2 – 1 risk reward trade.

With this type of information and depending on your trading rules you could either adjust your profit target or pass on the trade.