If you want to become a profitable trader in the stock market, you must know the terminology that traders and brokers commonly use.

This post goes through the most common stock market terminology you will need to know to start trading stocks.

NOTE: You can get your free stock market terminology for beginners PDF guide download below.

Table of Contents

The Most Common Stock Market Terminology

Buy

To buy shares in a company.

Sell

To sell your shares that you own after making a profit or to try and minimize a loss.

Bid

The price you are willing to pay for a certain stock.

Ask

The ask price is the price people are looking to sell their stocks for.

Spread

The spread is the difference between the bid and ask price and often what you will be paying to your broker to make your trade.

Stock Symbol

The stock symbol represents the shortened symbol for the larger stock name.

Annual Report

Each publicly listed company will prepare an annual report for the market. This is a wide-ranging report showing cash holding, account management, and the company’s overall financials.

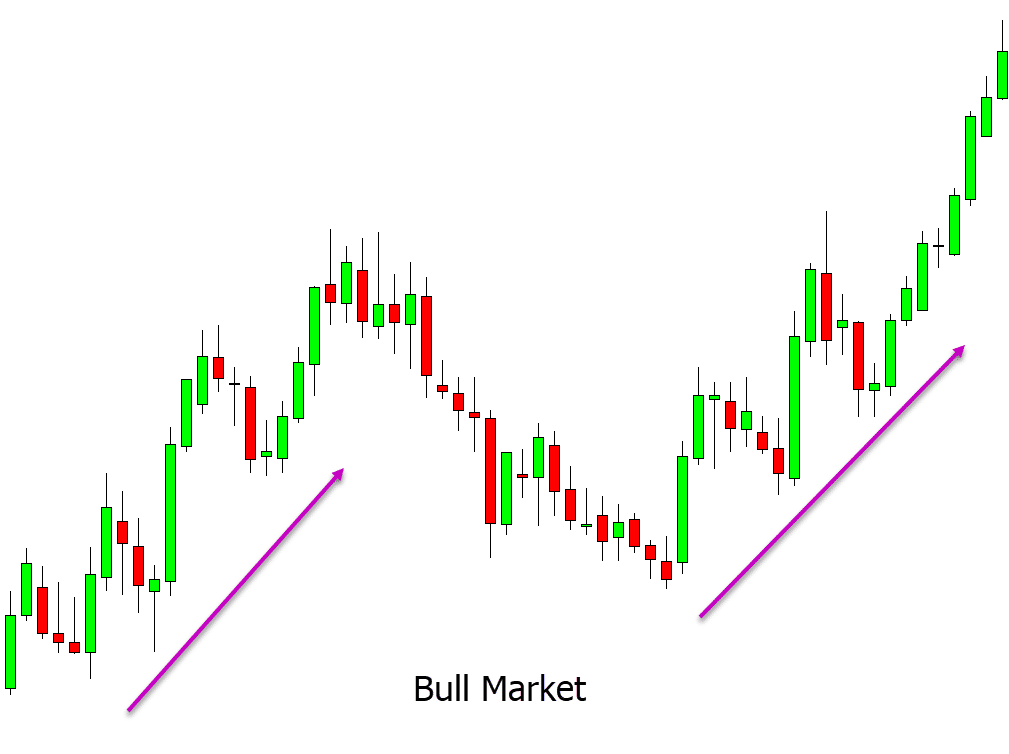

Bull

A bull is someone who is expecting prices to move higher. A bullish market is a market moving higher.

Bear

A bear is someone expecting the market to move lower. A bearish market is a market that is moving lower.

Blue Chip Stocks

Blue-chip stocks are the largest and most significant companies listed on the stock exchanges. These companies often make the largest profits and pay the biggest dividends. They are also normally the leaders of their industries.

Limit Order

When placing a buy limit order, you are placing an order below where the price currently is and then looking for the price to bounce higher once you have been entered.

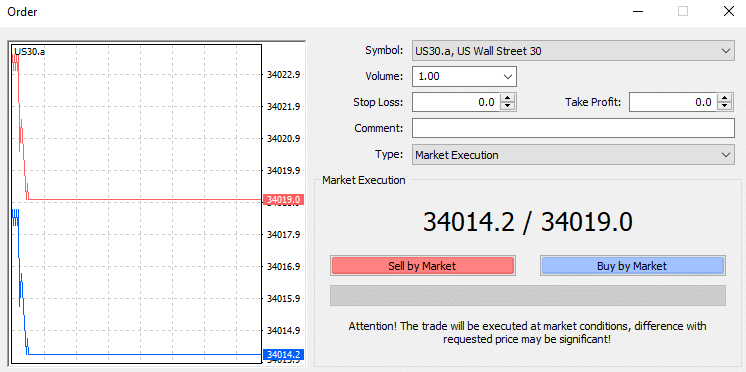

Market Order

A market order is a type of order that will enter you into a trade or exit you from your position as quickly as possible at the best available price on offer.

Volatility

Volatility is the amount prices are moving higher and lower. A highly volatile market is a market that sees large and fast swings higher and lower.

Averaging Down

Averaging down is a common strategy in the stock market where you continually buy more of a stock as the price moves lower. This makes your overall average entry price lower.

Capitalization

Capitalization is how much all of the company’s shares are worth overall.

Float

Float is the number of shares overall that can be publicly traded.

IPO

When a private company gets listed on the stock exchange and becomes a public company, it has an initial public offering or IPO.

Secondary Offering

When a company is looking to raise more money from the public, it can have a secondary offering.

Day Trading

Day trading refers to a certain style of trading where a trader is looking to enter and exit their trades before the market closes each day. A day trader is not holding their trades past the markets open.

Broker

When looking to trade the stock market, you will need to use a registered stockbroker who will buy and sell the stocks for you.

Portfolio

After you start to build up a few investments, it becomes known as a portfolio.

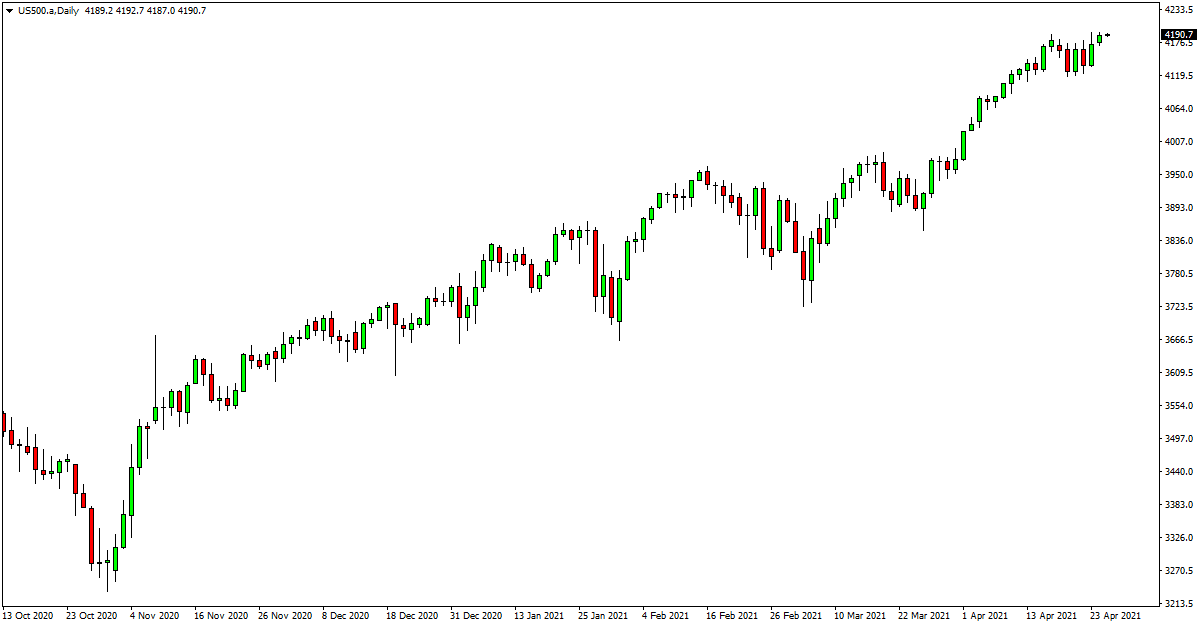

Index

An index is a benchmark normally designed to show you a certain sector or part of the economy. An example of a stock index is the Dow Jones formed with the 30 largest public companies listed on the US stock exchange. There are many stock indexes around the world, and there are indexes that show different parts of the economy. You can also trade on stock indexes.

Margin

When using margin, you borrow money to make larger investments.

Dividend

Companies that make large and regular profits will often pay out a portion of this as a dividend to their stockholders.

Execution

Execution refers to entering or exiting the market. For example, exiting your order to buy a certain stock.

Sector

A sector is a certain part of the economy or a group of related stocks.

Volume

How many shares get traded or a given time period is referred to as volume. When volume is large, then more shares are being trades compared to lower volume periods.

Yield

Yield is the measurement of what return you are receiving on your investment. This typically refers to the amount of dividend your stock is paying you each year and what percentage of profit you are collecting each year.

Lastly on Stock Market Terminology

Whilst this list goes through the most commonly used terms that you will run into in your stock trading, it is not exhaustive, and there are other terms you will come across.

These include less commonly used terms such as ‘dead cat bounce’ and ‘golden cross.’

This list, however, is a good starting point and will ensure you have the basics terms you need to start buying and selling in the stock market.

NOTE: You can get your free stock market terminology for beginners PDF guide download below.