What is a Stop Loss?

When trading a stop loss is an order you can use to limit your downside.

As the name suggests, the stop loss will close your trade and stop your losses.

Most stop losses are placed to activate automatically. This means that at the same time you enter your trade you will also add your stop loss. If price goes against you and into your stop loss, then your trade will automatically be closed by your broker.

Why Would You Want to Use a Stop Loss?

Profitable traders have one thing in common; they know how to cut their losses short when price is going against them and let their winners run when it goes for them.

Most unprofitable traders look at stop losses the completely wrong way. Instead of seeing it as a tool to keep their losses small, they see it as their trade being a failure.

When price goes into your stop loss level and your trade is cut short it means the trade idea did not workout and it is time to move to the next trade.

Using a stop loss this way will prevent you from holding on to trades that go onto be huge losers and take out huge chunks of your account.

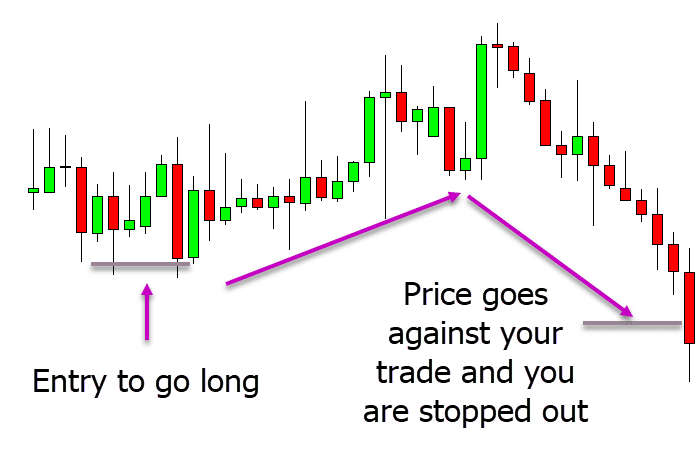

The chart below shows how you could use a stop loss. In this example you enter a trade to go long. Price goes against you and your trade is automatically closed for a small loss.

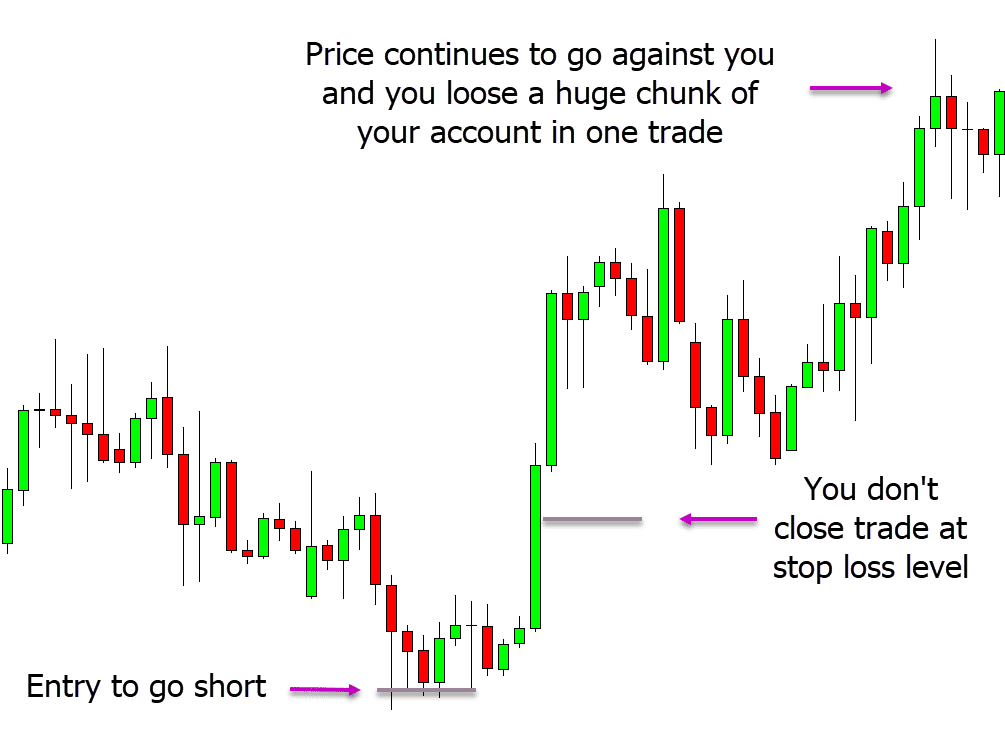

In the second example below a stop loss is not used. With this type of trade the trader is continually hoping that price will swing back in their direction. Instead of just cutting their losses short and moving to the next trade, they begin to now rely on hope instead.

As you can see from this example a trade to go short is entered. If a stop loss was used, then the trade could have been closed for a very small loss. Instead the trader holds the trade as price goes further and further against them and ends up losing a large chunk of their trading account.

Should You Ever Trade Without a Stop Loss?

Whilst some retail traders have wild ideas about not wanting to use stop losses because of their brokers stop hunting them, there really is no valid reason not to use a stop loss.

On far too many occasions the market will see incredible spikes where price will move hundreds of pips in seconds.

A stop loss is incredibly easy to put on, you can enter it at the same time as you are entering your trade and it could just be the thing that saves you from blowing your account.