The adaptive moving average was created and developed by the American financial theorist Perry J. Kaufman in the 1970s.

However; it wasn’t until much later in 1998 when Kaufman released his book; Trading Systems and Methods that the adaptive moving average became public and more widely used.

The difference between the adaptive moving average and normal moving averages is the adaptive takes into account the markets current volatility and not just the recent price movement.

Table of Contents

What is the Adaptive Moving Average?

Moving averages are the most widely used and popular technical analysis indicators in the markets today. They are most commonly used to find the markets predominant trend and potential reversal points.

The two most commonly used moving averages are the exponential and simple moving average.

Where the adaptive moving average is different is that not only does it take into account the recent price, but it also factors in the recent volatility, i,e. how much price has been moving.

This is crucial because when volatility is low price is not making large and free wheeling moves. It also increases the chance of your trade being whipsawed out for a loss.

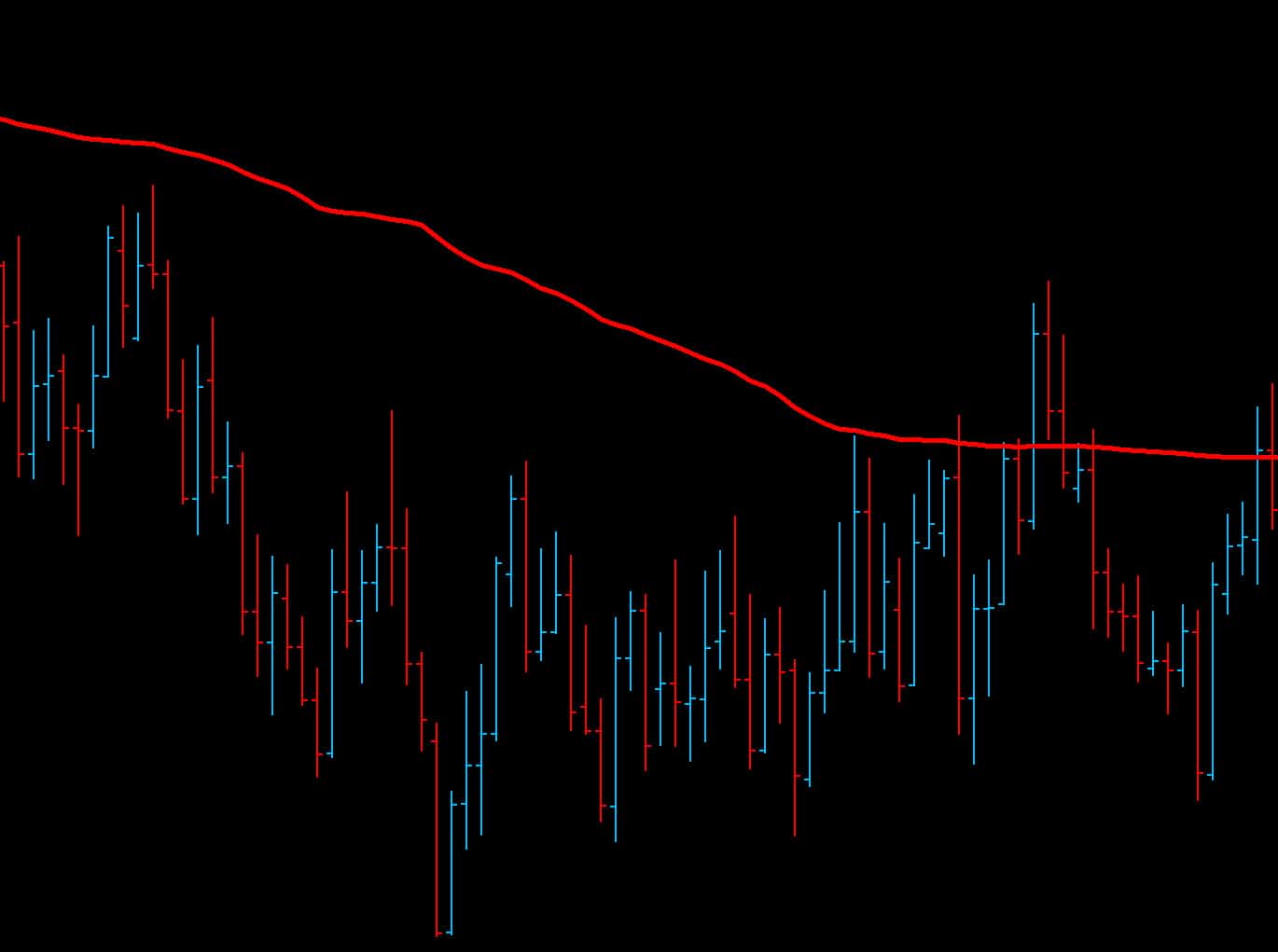

The Kaufman Adaptive Moving Average or KAMA will stay closer to the price action when the volatility is low because it is taking into account the moving average and volatility.

When volatility is high and price action is making large moves the KAMA will lag further behind giving you insight into what the market is doing (trending or stagnating).

Why is this so important for you as a trader? This can help you filter out a lot of the noise that comes with the normal moving average and identify the times when the market has made a quick false move or is not in a clear trend.

How the Adaptive Moving Average Works

The same way a moving average is continually calculated, the adaptive moving average uses the recent price action history to plot a level on your chart.

The only difference is that the KAMA is taking into account both the moving average and the volatility.

When this indicator is added to your chart you can use it to help you find trends, identify potential reversal trades and also spot when the market has made a false move.

The adaptive moving average is straightforward to use and once applied to your charts it has multiple parameters you can set to suit your trading style and time frames.

The default calculation for the KAMA that decides the amount of periods to calculate is 14, but you can change this just like you would with a moving average.

Trading With the ‘Kaufman’s Adaptive Moving Average’ – KAMA

The most popular use of this indicator is to identify existing trends so that a trader can find trading opportunities in the trends direction.

This is done in a very similar way to using a moving average. If looking to trade with the trend you are looking for the up and down slants in the KAMA.

If the adaptive moving average is moving clearly higher price is thought to be in an uptrend. If it is clearly moving lower it is in a downtrend.

You can also use it to identify when price action has moved into a range. When the KAMA begins to tighten and bunch, then you may look to use your other trading strategies to find possible range trading opportunities.

To use the KAMA to find potential reversal points in the markets you could use two KAMA levels.

This works the same way as a moving average crossover. One adaptive moving average period is higher than the other and you are looking for when they crossover indicating a loss of momentum and a potential change in direction.

You could also use the KAMA with your other trading strategies to increase your win rate. These strategies might include watching the MACD or using your candlestick pattern trading to find entry points.

Adaptive Moving Average Indicator MT4

NOTE: If you do not yet have the correct charts make sure you read about the best trading charts and the broker to use these indicators with here.

Adaptive Moving Average – AMA – Indicator for MetaTrader 4 (MQL5)

This is a very simple MT4 adaptive moving average indicator that is easy to download, install and use.

It also has a really nice benefit that the KAMA line changes depending on the trend.

You could use this for potential trading signals or trade management areas.

Read and Download the Adaptive Moving Average for MT4 Here

Kaufman Adaptive Moving Average (KAMA)

This indicator from ‘Best Metatrader Indicators’ will help you identify trending markets and when price has moved into a period of sideways consolidation.

This is a free indicator with no signup needed and you can get it below;

Read About and Download the KAMA Indicator Here

How to Use These Indicators on MT4 and MT5

Note: Don’t know how to install and use these indicators? Read How to Download, Install and Use MT4 and MT5 Indicators

Adaptive Moving Average Indicator MT5

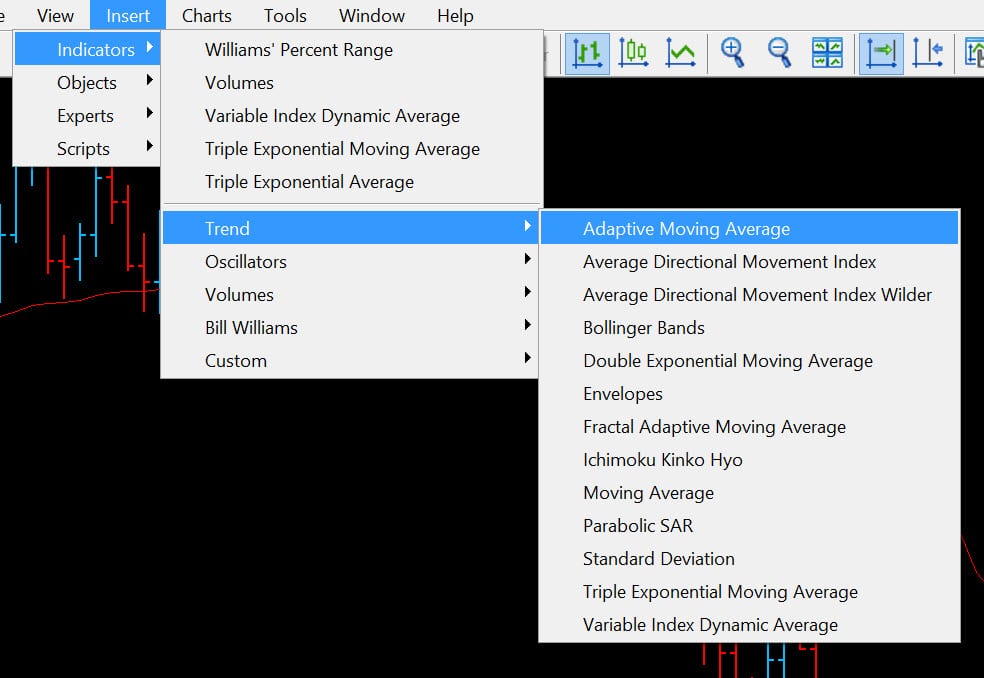

The best adaptive moving average indicator for MT5 is built right into the trading platform. You don’t have to source or download any other outside indicators.

To access and use this indicator simply;

- Open your MT5 Charts (You can get free MT5 charts here)

- Navigate to “Insert” > “Indicators” > “Trend” > “Adaptive Moving Average”.

- You will be presented with a set of parameters for you to set up such as the amount of periods to use.

- Once happy it “OK” and the adaptive moving average will be added to your chart.

Lastly

As with all indicators and other technical analysis strategies, the adaptive moving average is at its best when combined with other strategies.

You may consider testing it with the MACD, pivot points, breakouts and other price action trading strategies.