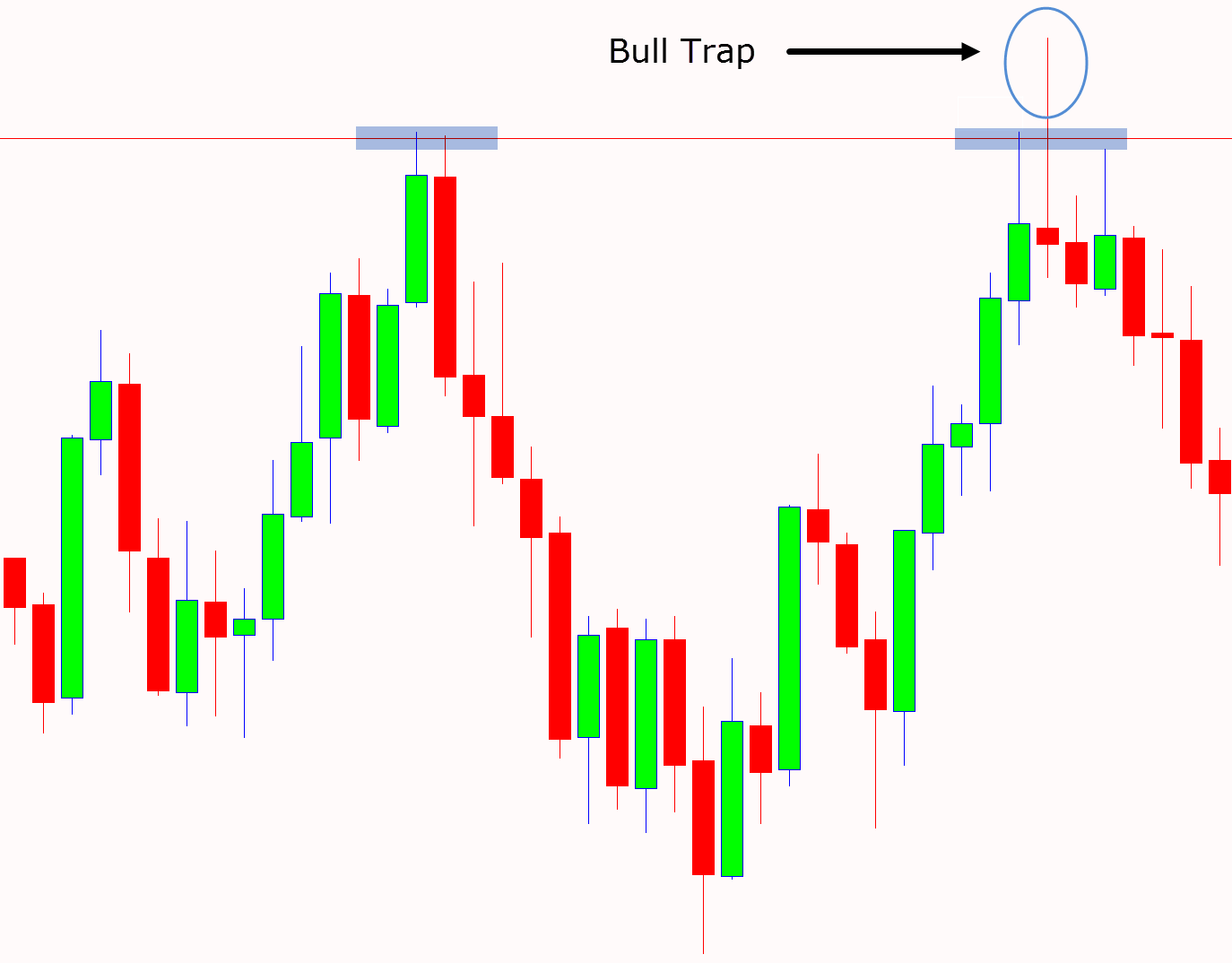

Have you ever entered a trade only for price to quickly snap back in the other direction? Chances are you were caught in a bear or bull trap.

In this trading guide you will learn exactly what the bear and bull trap is, how to not get caught in the trap and how you can use the trap in your own trading.

Table of Contents

Bull Trap vs Bear Trap Explained

The bear and bull trap are created by the major market players.

Have you ever noticed price will often move just above or just below a key support or resistance level and then quickly snap back in the other direction?

For example; price will be looking to breakout lower through a major support level, but after moving through the level it will quickly snap back in the other direction. This is a trap.

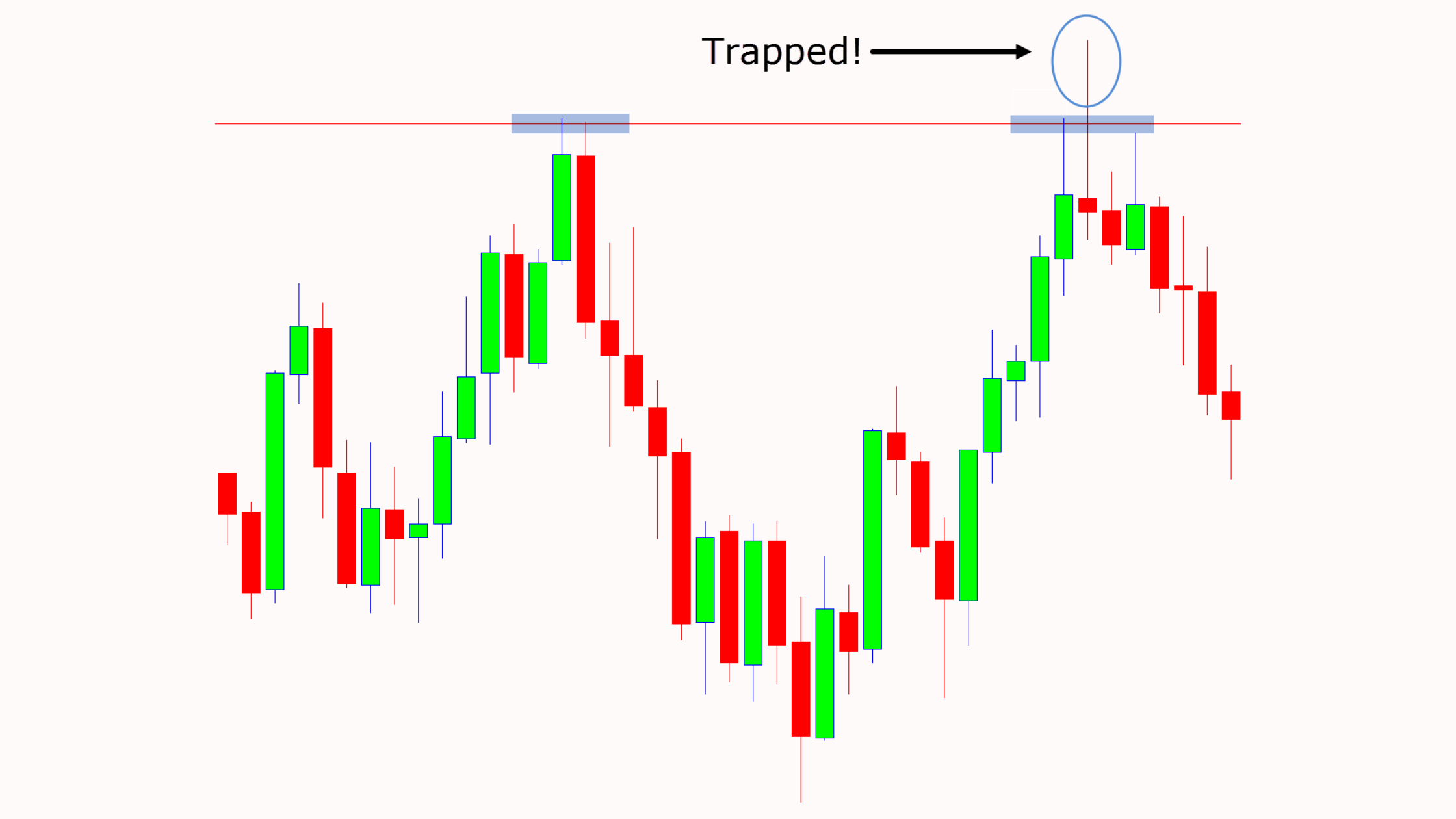

The example below shows a bull trap in play. The resistance was clear and once price started to break this level the bulls began to enter long trades. However, just as soon as price had broken higher, it snapped back lower, trapping the bulls in their long trades.

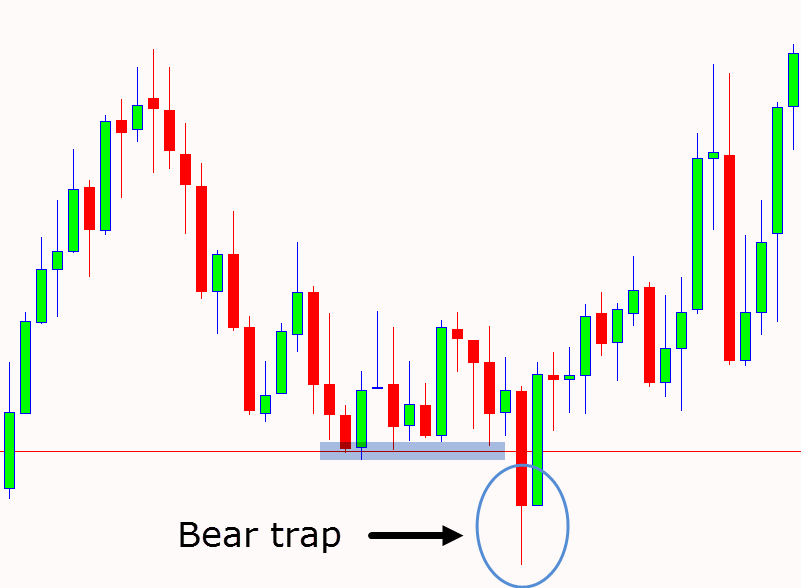

What is a Bear Trap?

The bear trap is most commonly experienced by those traders who look to make breakout trades through support levels.

Breakout traders will be looking to enter their trades as price breaks lower and through key levels such as major support areas, trendlines, or important moving averages.

Just as price looks to be successfully breaking these areas the bear will enter their short trades not knowing they are about to be trapped.

Price will quickly reverse back higher and leave the bear no option, but to either close their trade or have their stop loss hit.

As the bears stop loss orders begin to get eaten by the market the momentum will pick up and the trap will be completed with price moving back higher.

How to Identify a Bear Trap

To create the bear trap there is a level or area in the market that the trap will be created around. This can be an area such as a major moving average, but it is often a major support level.

As the first chart example shows below; these major support levels will regularly hold. This gives both the bulls and bears confidence when trading.

It also gives the breakout trader confidence when looking for their short trades that if the major level breaks, then price will continue lower with the breakout. This is important for the bear trap.

As the example bear trap shows below; price will at first begin to move lower and through the important support level.

The bear who is looking to go short will enter their short trade as price begins breaking lower.

Just as quickly as price started the move out of the support level it begins to reverse and the bear is trapped in their short trade they no longer want to be in.

What is a Bull Trap?

The bull trap is the trap that will catch out bulls looking for price to continue higher, often with breakout trades.

This trap is set up around key areas such as major moving averages and important resistance levels.

Bulls going long will be looking to enter their trades as price breaks higher. As price looks to be successfully making a new move higher, the bull will enter their long trades not knowing they are about to be trapped.

Just as quickly as price moves higher, it will quickly reverse back lower and leave the bull with no option, but to either close their trade or to have their stop loss hit.

As all the bulls who have been trapped have their stop loss orders executed by the market the momentum will pick up and the trap will be complete with price moving back lower.

How to Identify a Bull Trap

The bull trap is always created around an important market area or level.

This can be an area such as a major moving average, but it is often a major resistance level.

As the first chart example shows below; these major resistance levels regularly hold. This gives both the bulls and bears confidence when trading.

It also gives the breakout trader confidence when looking for their long trades that if the major resistance breaks, then price will continue higher and they will make a very profitable trade. This is important for the bull trap.

As the example bull trap shows below; price will at first begin to move higher and through the important resistance level. The bull who is looking to go long will then enter their trade as price begins breaking out higher.

Just as quickly as price started the move out of the resistance level it begins to reverse and the bull is trapped in their long trade they really no longer want to be in.

How to Trade Bear and Bull Traps

You don’t have to be the trader getting trapped in the Forex market.

Now that you understand exactly how the bear and bull traps work, it will go a long way to helping you avoid being trapped yourself. It will also help you to identify when a trap is being created and you will be able to take advantage by taking the correct side of the market.

The easiest way to trade bear and bull traps is to first identify the major market support and resistance levels.

When you see a trap has formed with price making a fake move out of one of these levels you can enter trades in the opposite direction.

For example; if you see price make a false break of a major support level you could then look to get long with the trap’s momentum.