Swing trading is one of the most popular forms of trading. You can do it on many different time frames and in many different markets. One of the best indicators to help you find and make swing trades is the moving average.

In this post we go through exactly what the best moving averages to use when swing trading are and how to use them to find high probability trades.

Table of Contents

What is Swing Trading?

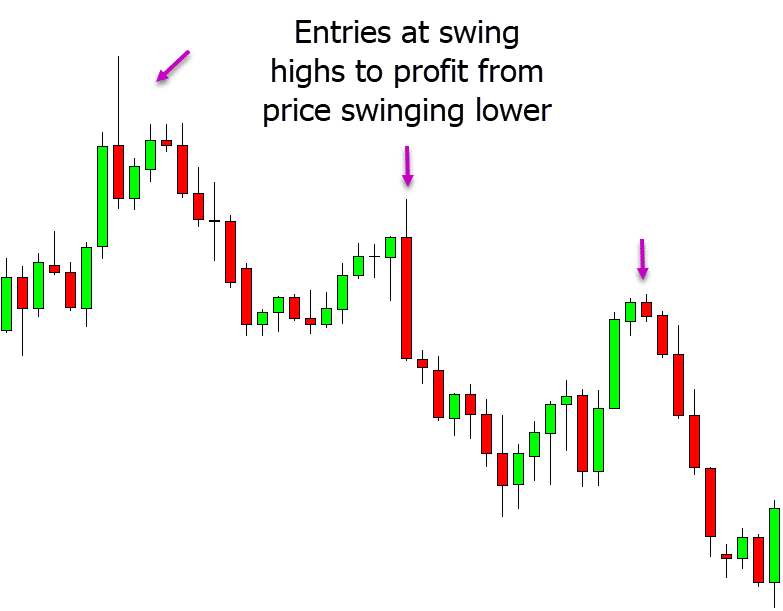

As a swing trader you are looking to make a profit from the swings both higher and lower in the markets.

You can make swing trades in many different markets and also on many different times frames.

Whilst swing trading is most often done inline with the obvious trend, you can also swing trade against the trend and even within a range.

The example below shows how you could make multiple swing trades. Price is in a trend lower. As with all trends, price makes rotations and swings back higher. As price makes these swings higher you could be looking for short trades to trade with the trend lower. You would then be looking to make a profit as price makes it’s next swing lower with the trend.

What are Moving Averages?

Moving averages are one of the most widely used and popular indicators by technical analysis traders in the financial markets. They are used in all different markets from Forex through to stock markets.

The most common use of a moving average is to smooth out the overall price action and identify the trend and momentum.

However, moving averages can be used in other ways such as dynamic support and resistance and to gauge if a trend is getting stronger.

The two most commonly used moving averages are;

#1: Exponential Moving Average: EMA

#2: Simple Moving Average: SMA

The most popular moving average in the Forex market is the EMA and that is what we will be using and focussing on in this post.

The Best Moving Averages for Swing Trading

The best moving average for you to swing trade is going to depend on the time frame you are using to trade and the length of time you want to hold your trades.

If you are a scalper and looking to get in and out of the markets quickly, then you need a faster reacting moving average like the 21 period moving average. The faster moving average will react more quickly to price and allow you to find more rapidly forming trades.

If you are a longer term swing trader, then you are going to be looking to use longer term and slower moving moving averages. One of the most popular of all moving averages is the 200 period moving average. This is because price will often respect it as a dynamic support and resistance level and it could give you a good indication of the overall trends direction.

21 Period Moving Average

Whilst you can use moving averages that are faster reacting than the 21 period, if you are using anything lower than the 21 period moving average to swing trade, then it is a bit like jumping at shadows.

The smaller the period you set with your moving average, the closer the moving average will be to the price action and the faster it will react.

The idea of a moving average is that it smooths out the overall price action information to give you an idea of the direction price is moving in.

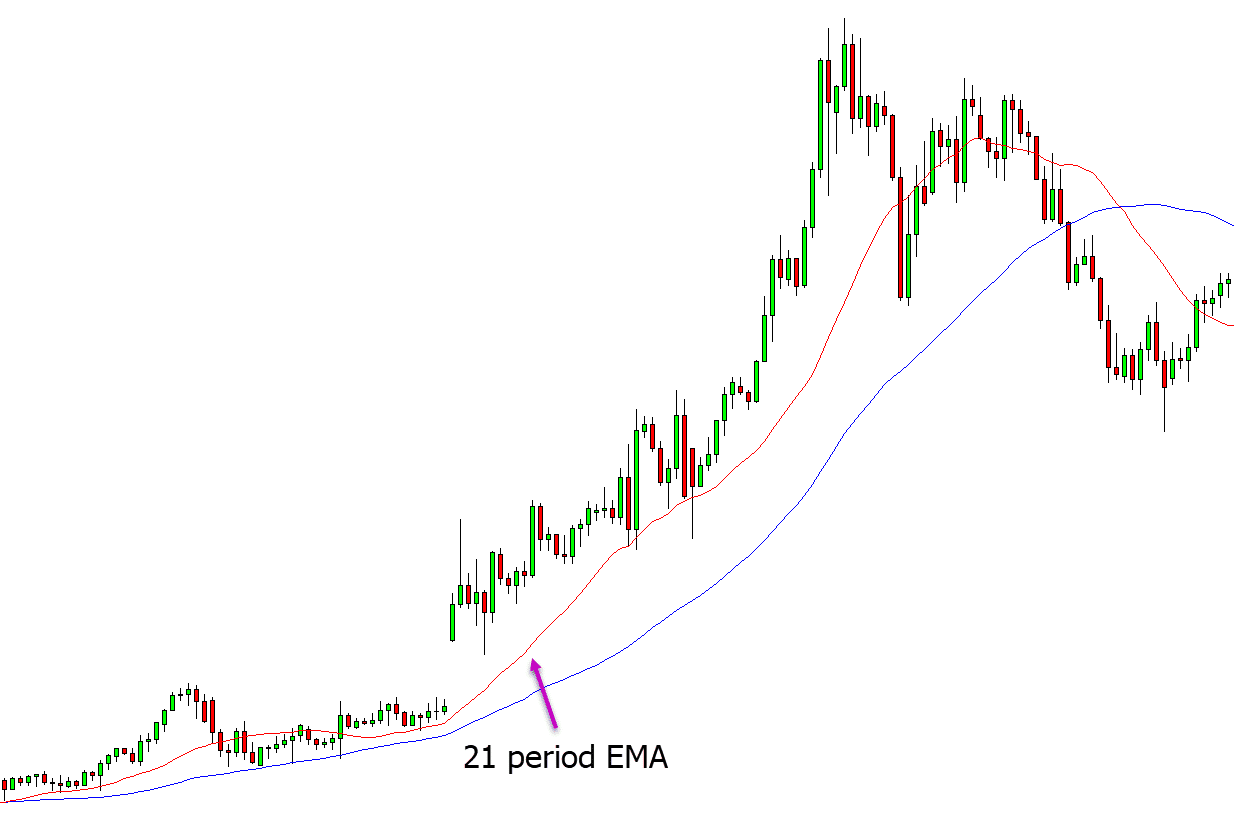

The 21 period EMA is a great moving average if you want to find many trading opportunities, but you are not looking to hold your trades for long periods of time.

50 Period Moving Average

This is one of the more popular moving averages and can be extremely useful for swing trading.

One of the best ways to use the 50 period moving average is to combine it with the faster moving 21 period moving average.

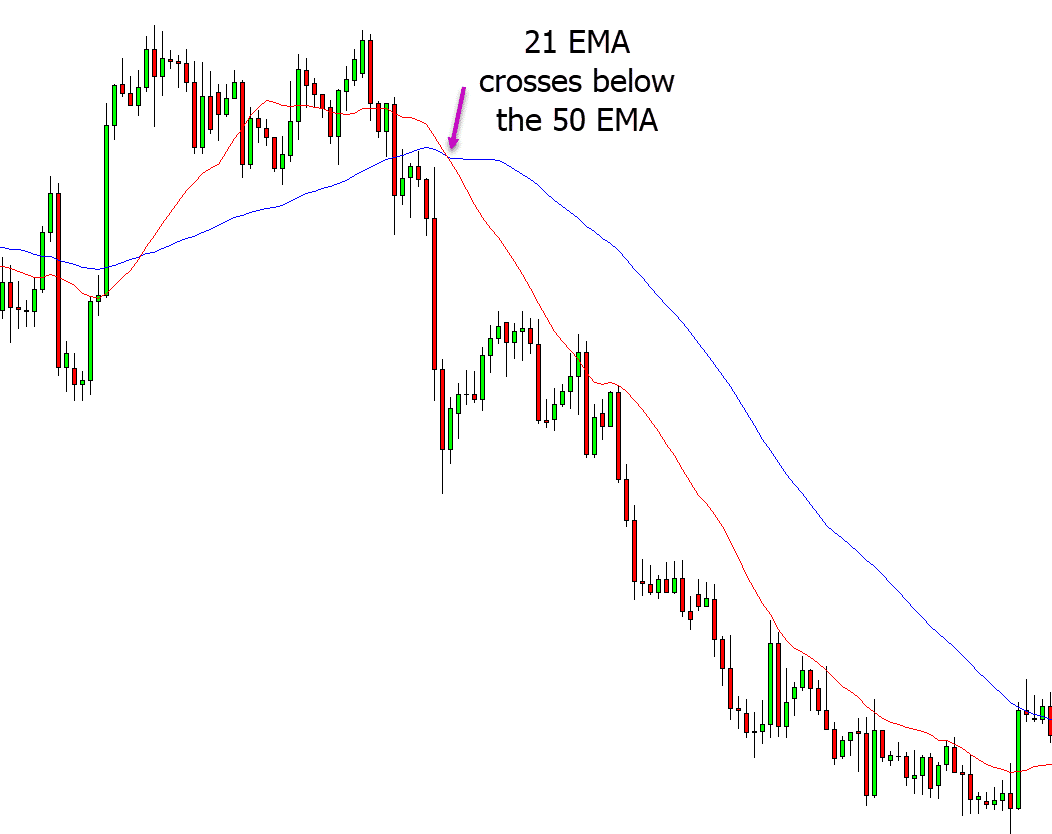

In the example below we have added both the 21 period and slower moving 50 period exponential moving averages to the chart.

With these moving averages we are looking to see when the 21 EMA moves above or below the 50 EMA.

In the example below the 21 EMA moves below the 50 EMA. When we then start to see these EMA’s widen we know that the trend lower is picking up steam and we can start to look for short trades with the new trend.

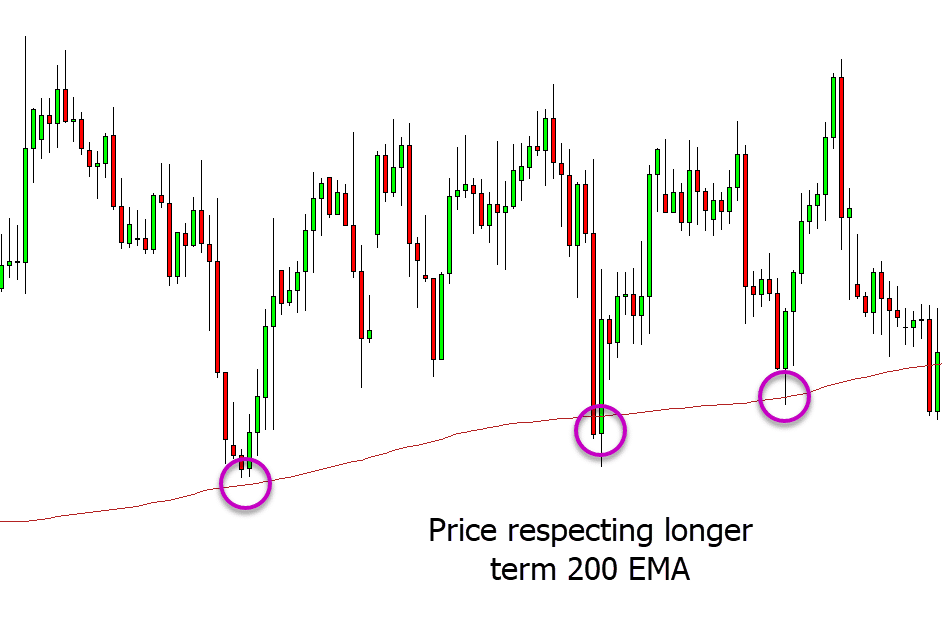

Longer Term 200 Period EMA

The 200 period is one of the most commonly used moving averages, especially by stock market and swing traders.

This is a much slower reacting moving average that will give you a greater look at what price action is doing over a longer period.

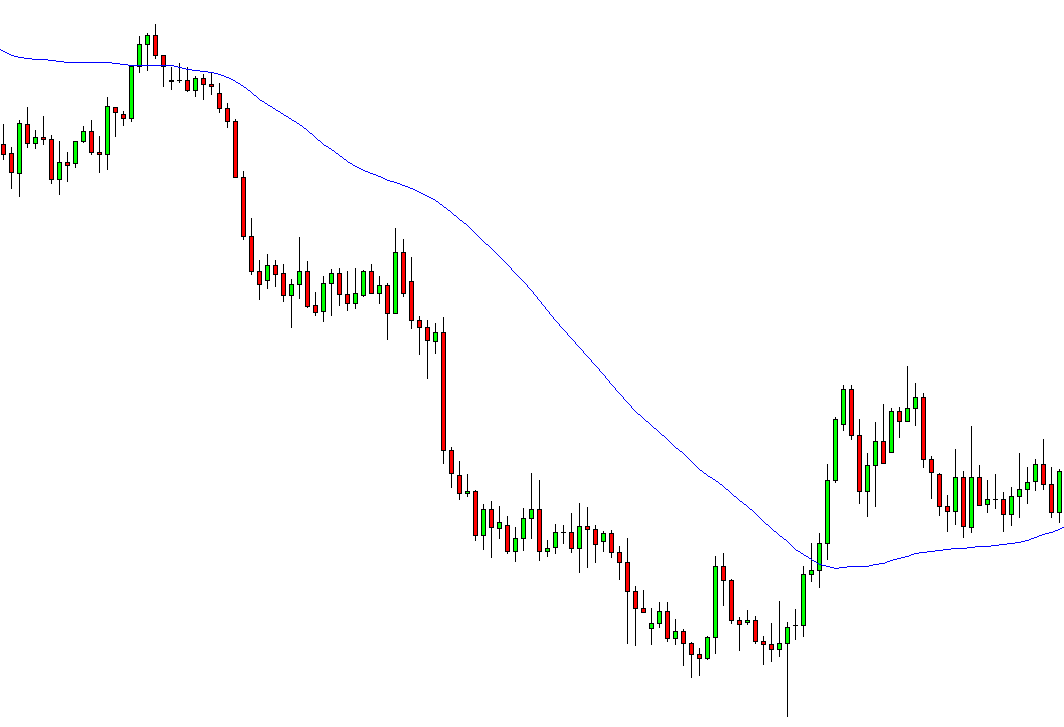

The 200 period moving average is very good at showing you the overall direction of a trend that price has been moving in.

This is the moving average you want to use if you like to hold your swing trades for longer periods of time and look to make much larger winning trades.

This moving average can also be used as dynamic support and resistance as price will often respect and bounce from it.

See the example below. As price trends higher it continually tests the 200 period moving average before moving back higher.

Lastly on Using Moving Averages When Swing Trading

Moving averages are one of the best indicators you can use when swing trading.

You can also add other indicators, price action analysis and trading tools with them to increase your odds of making winning trades.

These tools and analysis include using price action to find and confirm your trades. For example; using high probability Japanese candlesticks to enter trade setups.

You can also combine moving averages with other indicators such as the MACD or any of your other favourite indicators.