Experience the excitement of scalping trading strategies, a thrilling way to participate in the markets.

With scalping, you can swiftly enter and exit trades, profiting from various market opportunities. In this blog post, we explore what scalping entails, help you determine if it suits your trading style, and provide practical guidance on incorporating it into your trading approach.

Get ready to elevate your trading skills and discover the art of scalping in a whole new way.

Note: You can download your free Scalping Trading Strategies PDF Below.

Table of Contents

What is Scalping?

Scalping is a trading approach that can be both advantageous and risky, offering the potential for generous rewards when executed correctly.

This method is particularly effective when used in shorter timeframes, such as the 5-minute or 1-minute charts.

With scalping, you aim to profit from even the smallest price movements, whether they are going up or down, and you can see returns in just a matter of minutes.

Furthermore, in markets like Forex, scalping allows you to enter and exit both long and short trades, taking advantage of extended trends.

By using simple and straightforward strategies, scalping offers lucrative opportunities for trading success.

Why Would You Want to Scalp Trade?

This method isn’t for everyone.

It often involves higher risk levels and more maintenance than other strategies.

The markets can change rapidly, so when you’re in a trade you need to pay attention to fluctuations.

Consider the following to see if scalping is for you:

Scalping is for you if you:

- Want quick trades and to know if you won or lost quickly.

- Are looking to make a high volume of trades.

- Don’t want to hold your trades overnight.

- Are happy with smaller pip gains.

Scalping is not for you if you:

- Don’t want to be jumping in and out of trades every few minutes.

- Are more suited to swing trading.

- Are not comfortable with riskier trading strategies.

Scalping vs Day Trading

Scalping is similar in many ways to day trading. With both strategies you will enter and exit a trade in the same session.

The main difference between scalping and day trading is that day traders will normally pick one or two trades to hold for the session. Day traders will often analyze their trades longer and will have a longer trade holding period.

Scalp traders are using much smaller time frames such as the 5 minute and 1 minute charts to quickly jump in and out of trades.

Scalpers are relying on making profits from very small price movements in a very quick time, whereas day traders can be holding their trades for hours with far bigger pip gains.

Best Indicators for Scalping

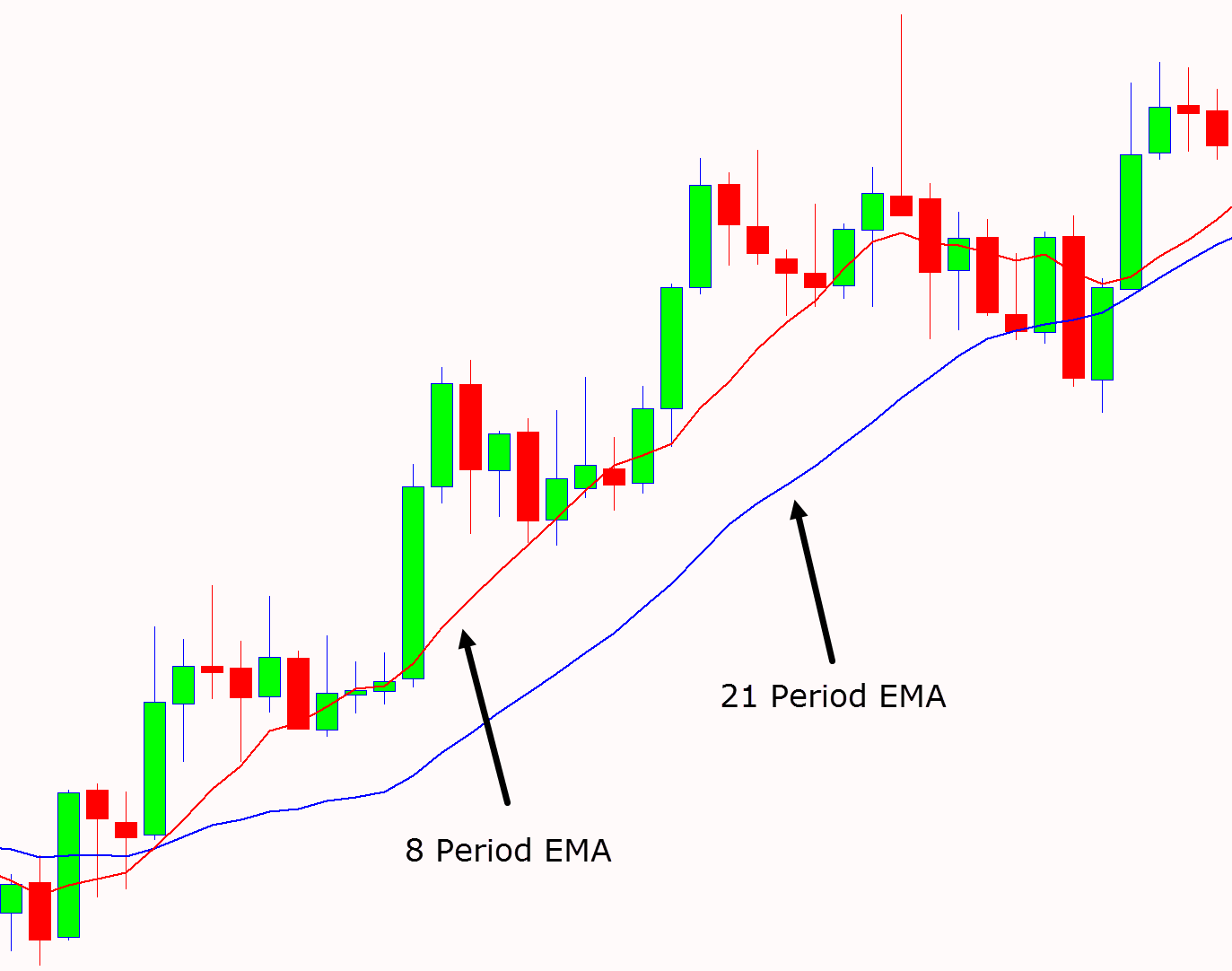

One of the best indicators to scalp the markets is the moving average, specifically the EMA.

Not only can EMA’s help you find trends in the markets, but by using two different EMA’s you can also identify the strength of a trend.

Learn about how to use EMA’s in your trading here.

The example below shows two EMA’s added to the chart. These EMA’s are the 21 and 8 period.

Often when swing trading you will use longer period moving averages like the 50 or 200 period. When scalping, you need shorter period EMA’s to find the rapidly changing momentum.

In the example below, the 8 period EMA has crossed the 21 period EMA. Price is strongly trending higher leading to potential bullish long scalping trades.

Profitable Forex Scalping Strategy

Many of the popular and successful scalping trading strategies have the several things in common.

You want to look for a scalping strategy that has:

- Small stops and tight risk management.

- Trades that have the potential to make big reward profits.

- Markets and Forex pairs with small spreads that don’t eat into your profits.

- Markets that have a lot of volatility and give plenty of trading opportunities.

- Most heavily traded Forex pairs that can often trend on smaller time frames for long periods.

The best scalping strategies will allow you to find many potential trading opportunities. This will give you the chance to make several trades and weed out the bad setups.

You should also be mindful of Forex pairs and other markets where there is a high cost to trade and high spreads. This will make it incredibly hard to be profitable when scalping.

However, will be using small stops, and the best strategies will allow you to find large risk reward winning trades that will cover your losses and make you profitable.

5 Minute Scalping Strategy

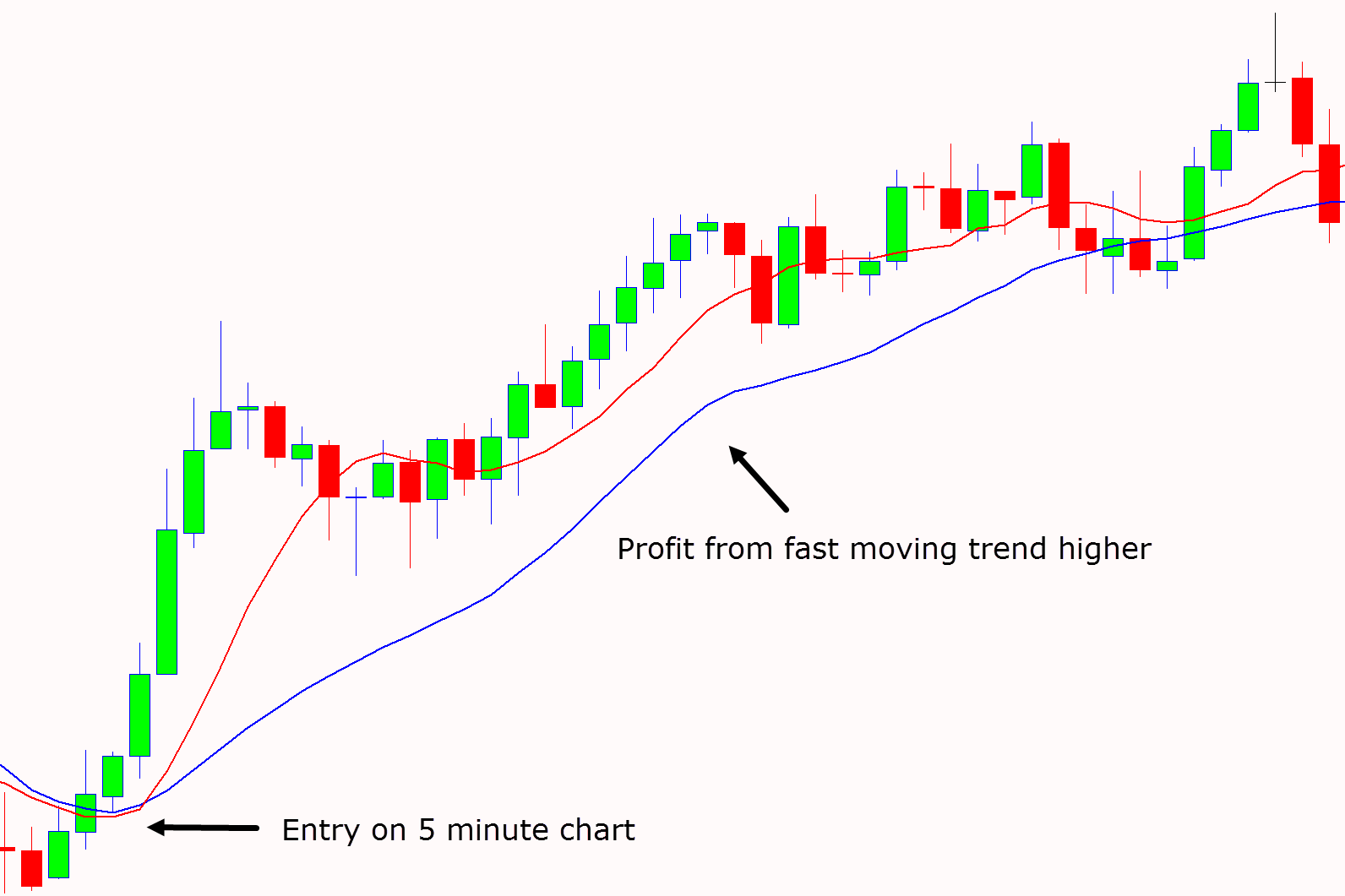

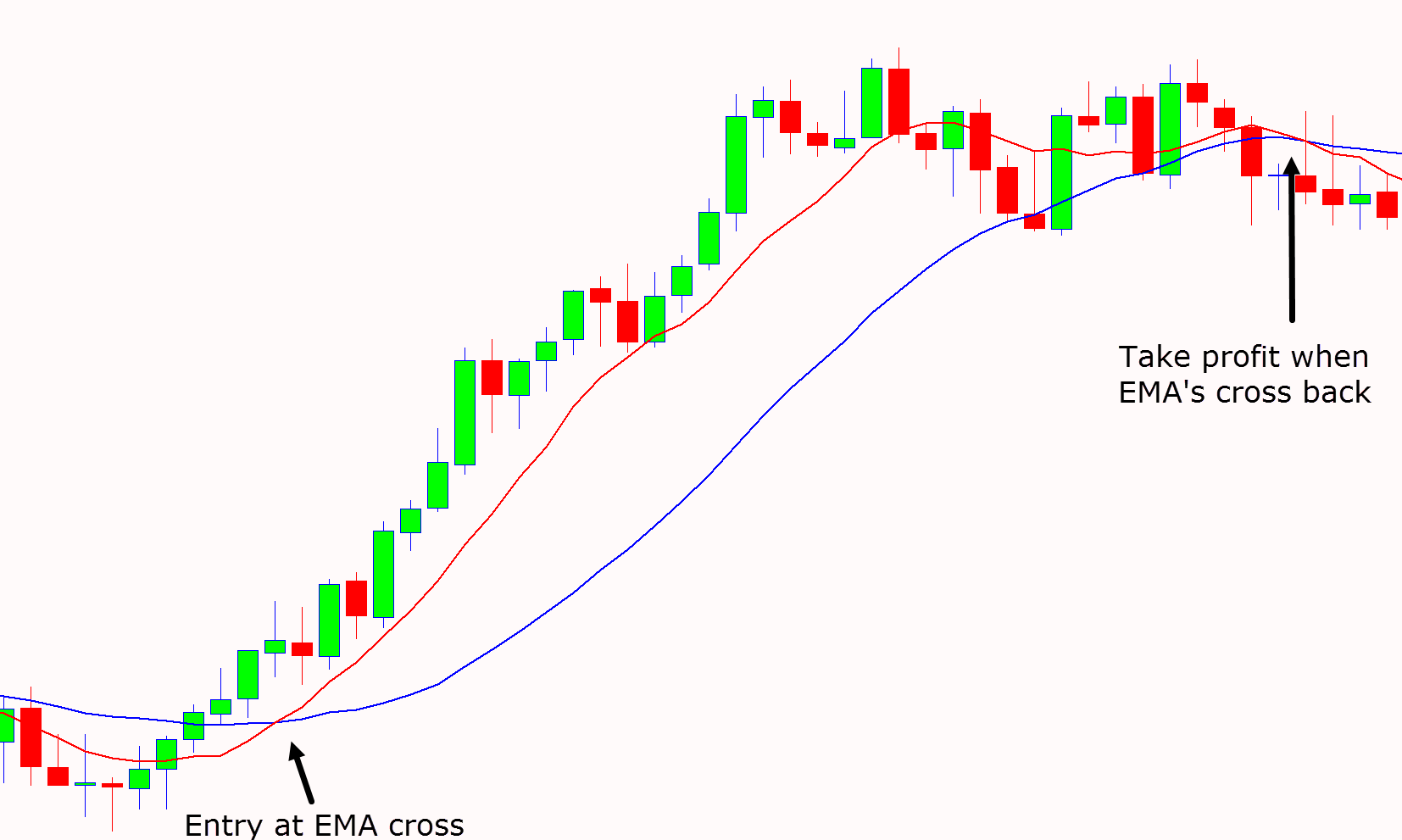

This 5 minute scalping strategy hinges on finding a strong trend with a moving average crossover.

When the 8 period moving average crosses the 21 period moving average and widens, we can begin looking for trades in the direction of the trend.

In the example below, the 8 period exponential moving average crosses above the 21 period moving average and starts a strong trend higher.

Trades can then be hunted using other confluences such as Japanese candlesticks to find entry points or major areas of supply and demand.

The stop loss can trail behind either the 8 or 21 period moving average depending on your risk tolerance.

1 Minute Scalping Strategy

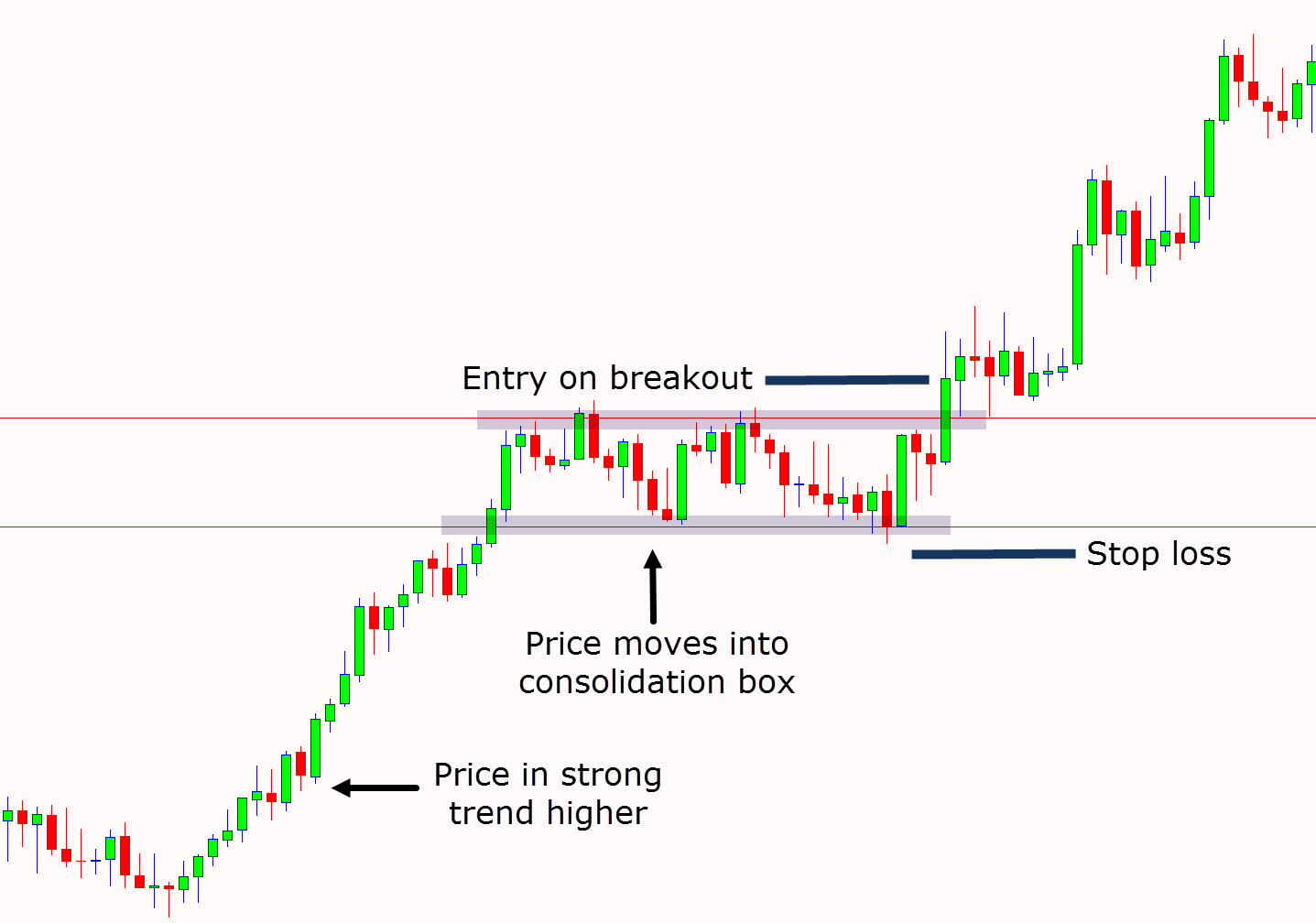

The key to this strategy is first identifying an obvious trend either higher or lower.

Once you have found a trend you are then looking for price to pause or consolidate.

In the example below you will see price trending higher before moving into a sideways consolidation pattern.

We could then look to play the breakout trade inline with the existing uptrend when price breaks through the resistance level.

Note: You can download your free Scalping Trading Strategies PDF Below.