The money management strategies you use in your trading can often make or break your account. If you let your account drawdown get too big, then you are going to find it very hard to get back to being profitable.

Drawdown is a crucial part of Forex trading and being able to control it will help you find trading success.

In this post we look at exactly what drawdown in your Forex trading is, how to calculate it and the three tips you can use to minimize it so you don’t blow your account.

Table of Contents

What is Drawdown in Forex Trading?

Drawdown in your Forex trading is the amount your account loses from it’s peak.

For example; if you had an account balance of $50,000, but you now only have $25,000, then you suffered a drawdown of $25,000.

Drawdown is a key measurement in your trading because if you let it get out of hand you can quickly put a large hole in your account. If this hole gets too big it can be hard to come back from and to move back to profitability.

How to Calculate Forex Drawdown

Forex drawdown is normally calculated from the account peak to the account trough or bottom.

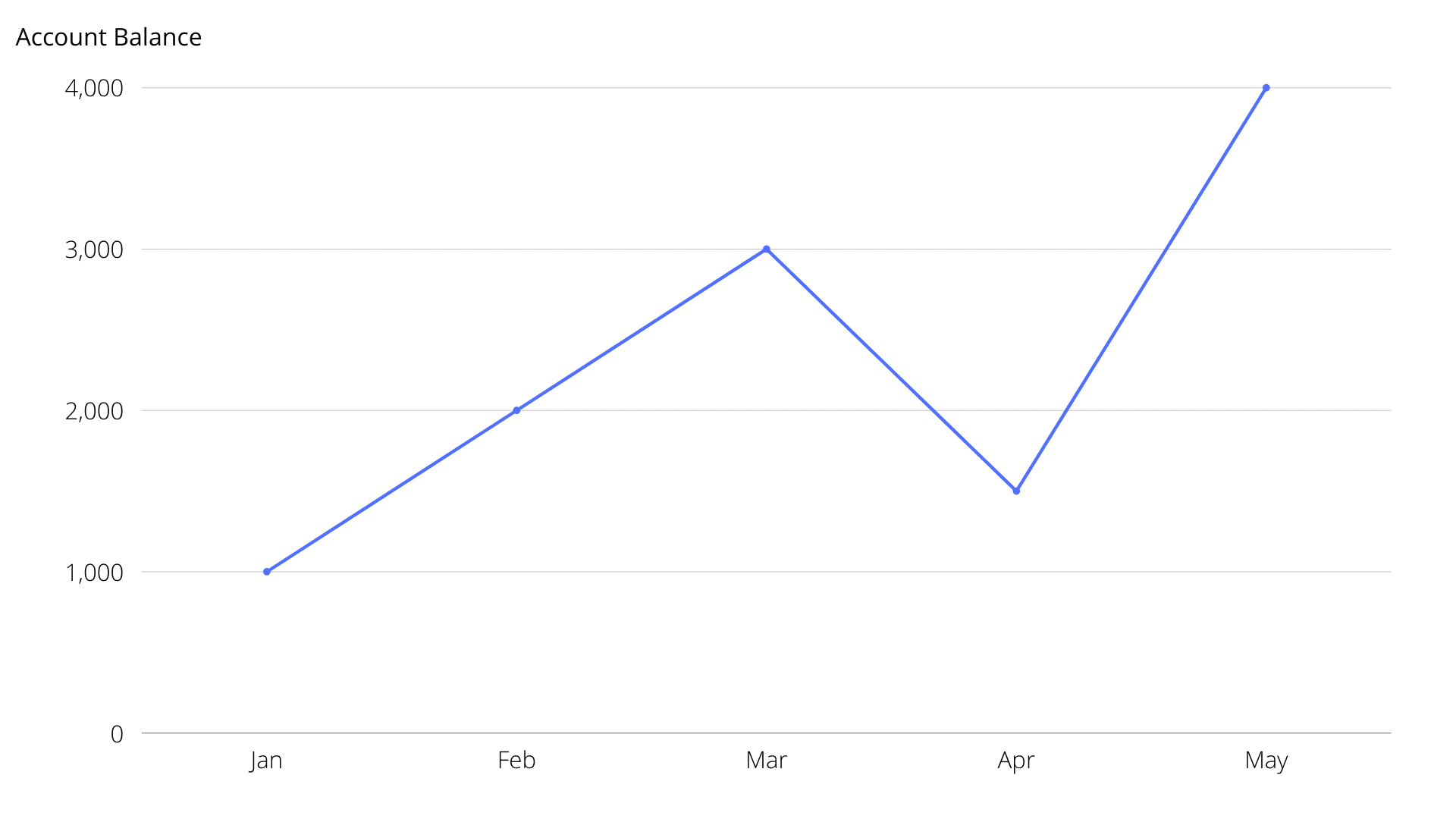

For example, see the image below. In this example the peak was $3,000 before the account suffered a drawdown to $1,500.

This drawdown amounts to losing 50% of the account.

Whilst it is fairly simple to manually calculate your account drawdown, there are some very handy calculators and tools that will automatically do this for you.

You can use tools like MyFxBook where you can connect your trading account and all of your trading history including your drawdown information will be automatically shown.

Using a Forex Drawdown Calculator

One of the easiest ways to calculate your drawdown is by using a calculator.

Trading Heroes has a drawdown calculator that can show you your potential maximum drawdown. This is calculated by taking into account your key trading statistics such as your win rate and how much you risk per trade.

Another very helpful tool that can help you from blowing your trading account is a risk of ruin calculator.

With the risk of ruin calculator you can see exactly what the likelihood is of you suffering a large account setback with different trading outcomes. For example, the results will be different depending on your risk amount, your reward per trade and how high your percentage win rate is.

What is an Acceptable Drawdown Level?

The acceptable level that you should let your account drawdown will vary between the different styles of traders. It will also vary between how comfortable each trader is with risk.

The trader who is scalping the markets, making many trades each session and risking 5% each trade is a lot more likely to see a large drawdown compared to the trader risking only 0.5% each trade and swing trading.

With that said, the scalper is also a lot more likely to be okay with taking on the higher risk knowing that it comes with the potential for higher rewards. The longer term swing trader is more likely to be conservative and looking to minimize any potential drawdown.

Another thing that will factor into the acceptable drawdown levels is the size of the account. The larger the account, the less percentage you need to risk each trade to still make good money. This means that drawdown on larger accounts will often be smaller because the amounts being risked are often smaller in percentage terms.

How to Reduce Your Drawdown

Traders normally lose money when trading Forex for the same reasons. It is also these same reasons that lead to large account drawdowns. If you can learn to minimize these errors, then you can start to reduce your drawdown.

#1: Minimize Your Account Risk

Often many traders are risking far too much of their accounts each trade. This is the simplest thing you can do right now to minimize your drawdown levels.

Obviously, the more you risk, the more you could profit. However, on the flip side; the more you could lose.

If you are making multiple trades each day, then there is no need to risk any more then 1% maximum of your account.

If you make three trades per day, that is 15 trades per week. That works out to be risking 15% of your account each week.

#2: Learn to Cut Your Losses

This is another very simple strategy that often is not followed. Just cutting your losses when you should can help your account drawdown massively.

Most traders know when they should be cutting their losses. They have either worked out a stop loss point before entering the trade or they know the logical point where they should exit.

The hard part is actually pulling the trigger and closing the trade whilst the loss is still small and has not blown out of proportion.

#3: Walk Away When Things Go Wrong

You don’t need to trade every day or every week for that matter. There will always be another trade to make.

If you experience a losing streak or a large account drawdown, take a break.

Take time to figure out what has gone wrong and turn the charts off for a while.

When you are ready to get back into it, ease back in on a demo account to re-test your strategy before risking real money again.

Learning to walk away and take a break can have a major impact on your trading. It can even help if you are making profits, just to freshen your mind and to stay sharp.