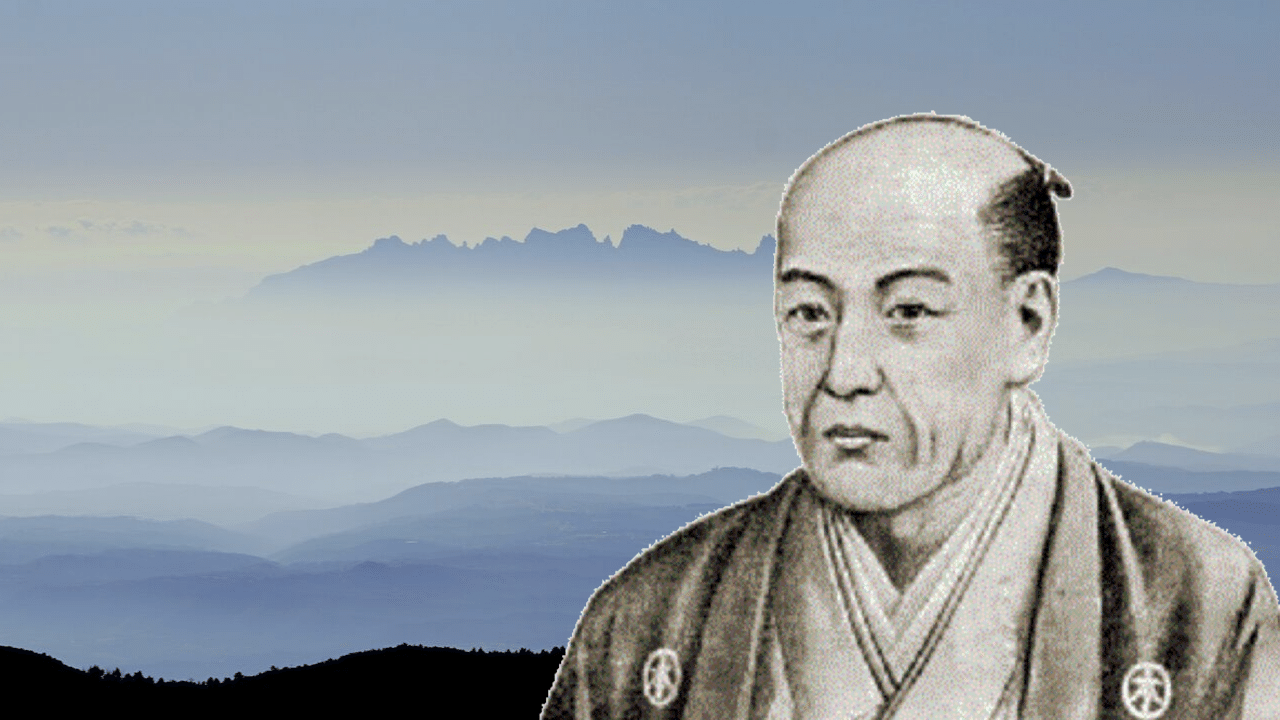

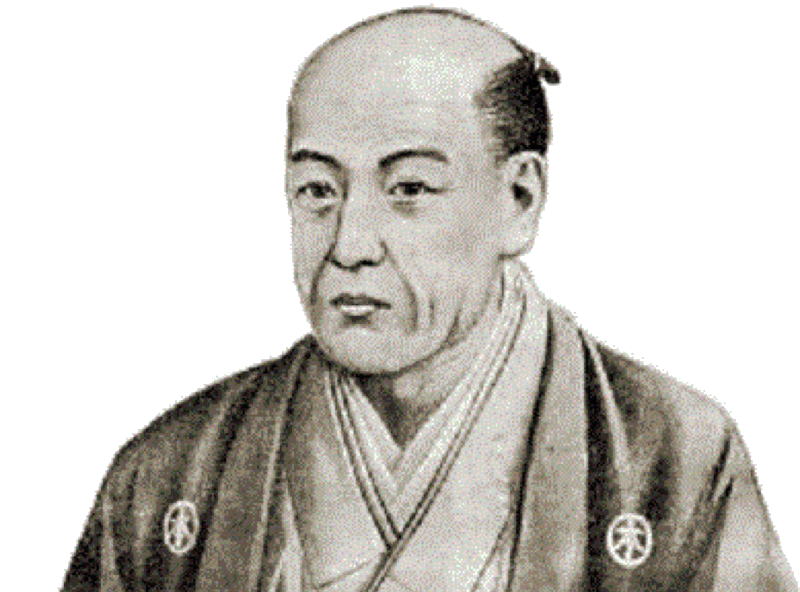

Munehisa Homma or Sokyu Homma was the man who invented the use of candlestick charts for finding and profiting from chart patterns.

A lot of people refer to Homma as the ‘father’ or ‘God’ of price action trading, technical analysis and the use of candlestick charts because it was he who masterminded the idea on how they could be used to find trading opportunities.

Table of Contents

Who Was Munehisa Homma?

Homma Munehisa was the son of a rice merchant that was already very wealthy before he was born.

Homma lived from 1724 until 1803, wrote multiple books on his trading techniques and is rumored to have a networth of over $100 billion in today’s dollars and in a good year made more than $10 billion dollars.

Homma was raised at an early age to take over the rice merchant operations and even given portions to control in his teenage years.

At the time the biggest exchange for rice was in Osaka. Because Homma lived in Sakata and the Osaka rice exchange was so far away, he began to trade his rice at the port in Sakata.

Homma went on to take over all of the rice operations on his fathers passing. He soon began trading at the much larger and far different rice exchange in Osaka.

Whilst in Sakata price was traded then and there at a set price, Osaka was a large city with far more traders and it allowed trading with coupons. This system was an early invention of what we know today as futures.

Instead of buying and selling on the spot, you could trade rice that was not actually there yet to be delivered.

The History of Candlestick Charts

At the same time Homma was working out how to trade coupons in the city of Osaka, he was also coming up with new ideas that would affect how we trade today.

When first trying to implement his new trading strategies Homma had one large issue.

Homma’s trading strategy used the price information of the previous day to see if price had moved up or down and the type of candlestick it had created.

The only issue was that Homma’s rice business was many miles away from the main city of Osaka. He was not able to personally travel to and from Osaka each day for the price information he needed.

This is when he came up with an ingenious idea of setting up a network of messengers 6km’s apart to send him up-to-date prices each and every day for him to plot on his charts.

With this information he could monitor the prices, his current positions and any new positions that may be forming.

Munehisa Homma Trading Strategy

One of the main reasons attributed to Homma’s phenomenal success is that he was one of the first to recognize the link behind why prices moved the way they did.

Homma was very quick to realise that the markets movements were based on trader psychology. He realised that the price was moving because traders were acting on fear and greed and not on logical thought processes like most assumed.

Homma was able to take this knowledge (and advantage over others) and create his trading system. He did this by meticulously plotting each day’s price information on parchment paper to create what we now know as candlesticks.

The information he had to create each of these candles was what he had been given from his messengers that he had set up in his network. This information included what price had opened and closed at, and the high and low price reached during the day.

Whilst other rice traders were not tracking prices, Homma was building his own price data and history. He was soon beginning to notice the same patterns repeat in the candlesticks when price was about to reverse. This was because of the trader psychology and traders behaving the same given very similar market situations.

Homma built on this information over time finding and creating many price action patterns that would repeat and he could use to profit from in the rice markets.

Homma did not just leave his study and trading there. He went on to look at the previous 100 years of price information he could find for the price of rice and if he could find any more patterns.

In these studies and trading he found patterns that had repeated time and again and how the market would move into trends for extended periods of time. He went onto name different market rules he created and market patterns he was using.

Homma referred to the markets as being in Yin or Yang. When the markets were rising in an uptrend price was in yang. If it was falling it was in yin. Interestingly he also noticed that for every yin or yang trend there was also a rotation. This is what we know today as a retracement or swing point within an existing trend where a lot of traders will look to enter the overall trend.

Munehisa Homma became such a success that he was recognized by the Japanese government of the time. Not only was he hired as a financial aid to the government, he was also awarded one of the most honored awards, the title of Samurai.

Sakata Rules

Homma has become well-known these days for the Sakata Rules.

In his books that are out of print today, Homma wrote about the principles for his trading techniques and strategies and in particular the Sakata Rules.

The Sakata Rules were the basis for his trading strategy and the same as what you would call your trading plan or trading rules.

Japanese culture at the time believed the number three to be divine or special. Why is this important? Because the Sakata rules consisted of; three gaps, three mountains, three rivers, three parallel lines, and three methods.

Homma Munehisa Books

Munehisa Homma most famous book is ‘The Fountain of Gold – The Three Monkey Record of Money” that he wrote in 1755.

In this book he discusses his strategies and how trader psychology and emotions affect the markets and how they are critical to success.

This book also discusses the yin and yang principle of bullish and bearish trends and the price action rotations within each.

Today there are other books by authors who look at Homma Munehisa, his life and the strategies he used to profit from the markets.

Lastly

Any trader that can make an equivalent of $10 billion dollars per year and $100 billion in their lifetime knows how the markets are thinking and how to capitalize.

Whilst it is clear that how Homma made his profits is extremely different to trading today, there are still a lot of comparisons and still a lot we can learn from looking at history.

People are still the same. Traders still behave due to the same fear and greed they did many years ago. They still buy and sell for the same reasons and markets still boom and bust for the same reasons.