There is one rule the market always follows. No matter how strong a trend higher or lower is, price will always have swings. For example; if price is in a strong trend higher, price will still make swings back lower before continuing on with the trend.

As a swing trader you can take advantage of these swings by making entries at the best areas and profiting from the next swing in the market.

In this post we go through exactly what swing trading is and how you can use it to find profitable trades.

Note: You can download your Free Swing Trading Strategies PDF Below.

Table of Contents

What is Swing Trading?

When swing trading you are looking to profit from the next swing higher or lower in the market.

Whilst a lot of swing traders will be using higher time frames such as the 4 hour time frame and above, you don’t have to be using higher time frames to be a swing trader.

Swing trading is trading the ‘swings’ and you can do this on any time frame.

The other misconception is that swing trading can only be done in trending markets.

Whilst a trending market is a lot more favorable to swing trading, you can still use a range to swing trade from the range highs and lows.

As a swing trader your goal is to find profitable trades and ride the next swing or wave in the market.

See the example chart below. Price is in a clear uptrend. You don’t want to enter at the top of the trend so you wait for price to make a swing lower where you can then enter a long trade.

You can then profit as price swings back higher inline with the strong trend.

What are the Advantages of Swing Trading?

Swing trading is definitely not for everyone.

Unlike scalping or breakout trading you will have to have more patience and you will not have as many trading opportunities.

Swing trading however can offer you the ability to find very high probability trade setups.

It can also offer you the chance to enter large reward trades.

These trades will often be with the trend. Because the trend can at times continue running for long periods of time you can be making swing trades that run in your favor for long periods giving you very large risk reward winning trades.

Swing trading can also be carried out on many different time frames and as long as the market or Forex pairs is liquid, then it is suitable for swing trading.

Swing Trading Basics

Swing trading is one of the most simple and basic forms of trading.

At its simplest you are looking to make a trade from one swing point and ride the wave higher or lower for a profit.

For an example see the chart below. Price is in a trend lower. As a swing trader you are looking for price to make a swing high within this trend to give you a chance to make a short trade.

When price makes a swing high you can enter this short trade and start riding the wave back lower.

Swing Trading Simplified

The two most common questions with swing trading are;

#1: How to identify a trend?

#2: How to identify a swing point?

Whilst there are many different methods and strategies to do both of these things, the simplest is using a moving average crossover.

Using a moving average crossover such as the 50 EMA and 200 EMA crossover will show you when a trend has begun and also how strong the trend is.

You can also use the 200 EMA (exponential moving average) as a dynamic support or resistance level to find swing highs and swing lows.

The chart below is an example of how you might do this.

First the shorter period 50 EMA crosses above the longer term 200 period EMA showing us there is a new trend higher.

The EMA’s also begin to widen showing us that the trend higher is getting stronger.

Using the 200 EMA we can then look for the times that price pulls back lower to test the longer term moving average and makes a swing low to get long inline with this trend higher.

Profitable Swing Trading Strategies

The other simple swing trading strategy that involves no indicators and uses only raw price action is looking for swing highs or lows at key support and resistance levels.

This is an extremely popular strategy because of how often this pattern continues to repeat itself time and time again.

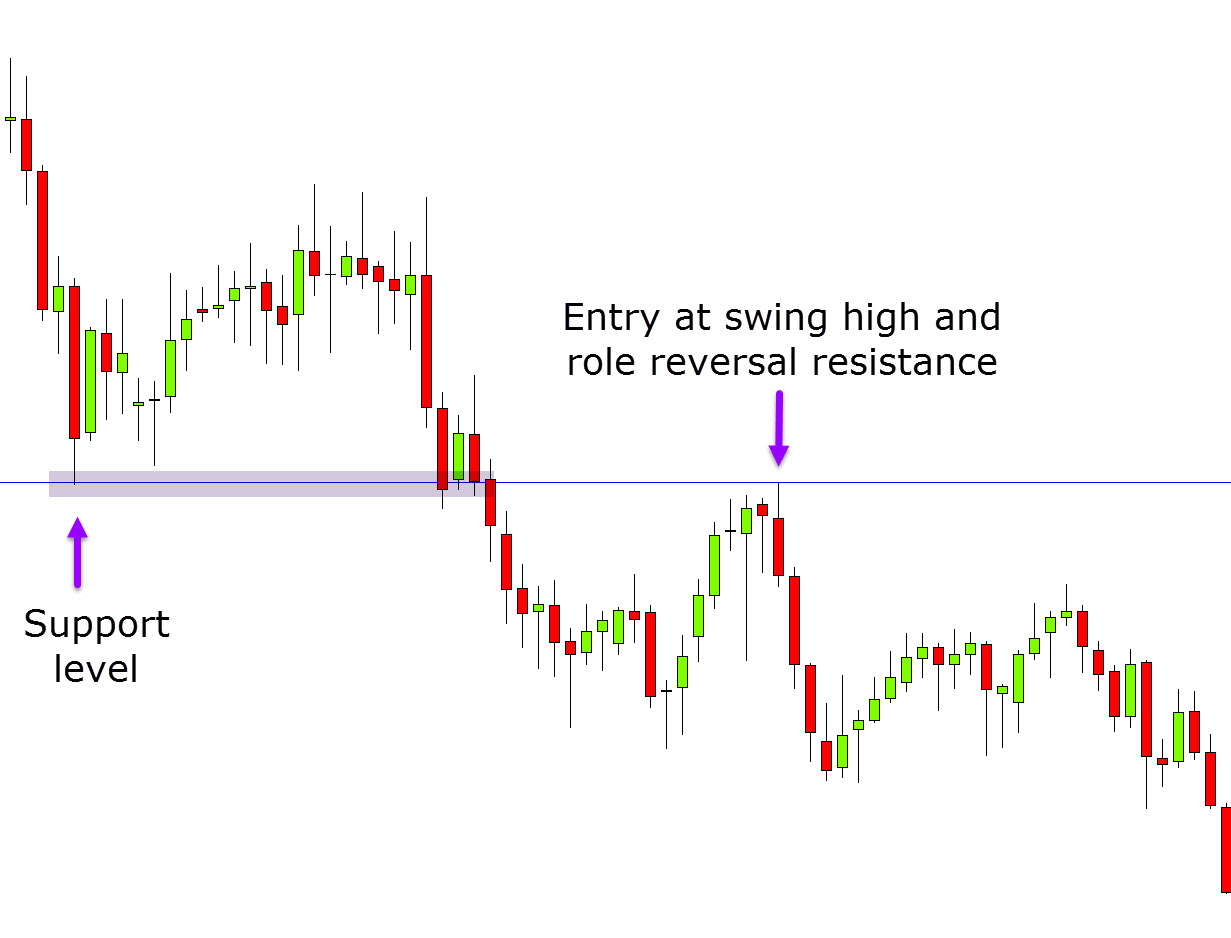

The chart below shows how this pattern works.

First you see that price is in a trend lower and has found a support level. You then see price breakout lower and through this level.

When price makes a swing higher you are looking to see if this old support level will act as a new role reversal and swing high resistance level. This is the level you will look for potential short trades.

How to Master Swing Trading

Swing trading is not suited to all traders and it is definitely not going to be mastered in a weekend of back testing.

This strategy will take a lot more work than using indicators or a strategy that is more automated.

With that said, if you want to trade higher time frames, find high probability trades and make trades that have the chance to be very high reward, then swing trading is for you.

If you want to start testing out swing trading strategies, then the best thing to do is download some free demo trading charts and test out different methods, markets and time frames to see what works best for you.

Note: You can download your Free Swing Trading Strategies PDF Below.