Traders have always benefited from massive jumps in asset prices, especially during volatile market conditions.

A popular way to enjoy such jumps is using gap trading strategies. Gaps are areas on a technical analysis chart where the price of an asset moves sharply up or down.

During gaps, there is little or no trading during the volatile periods. Because of this, the chart of the asset shows a gap in the normal price pattern. You can interpret the gaps and exploit them for profits.

In this post we go through why gaps occur and how you can use them to make profitable trades.

NOTE: You can get your free Gap Trading Strategies PDF Download below.

Table of Contents

What is a Gap?

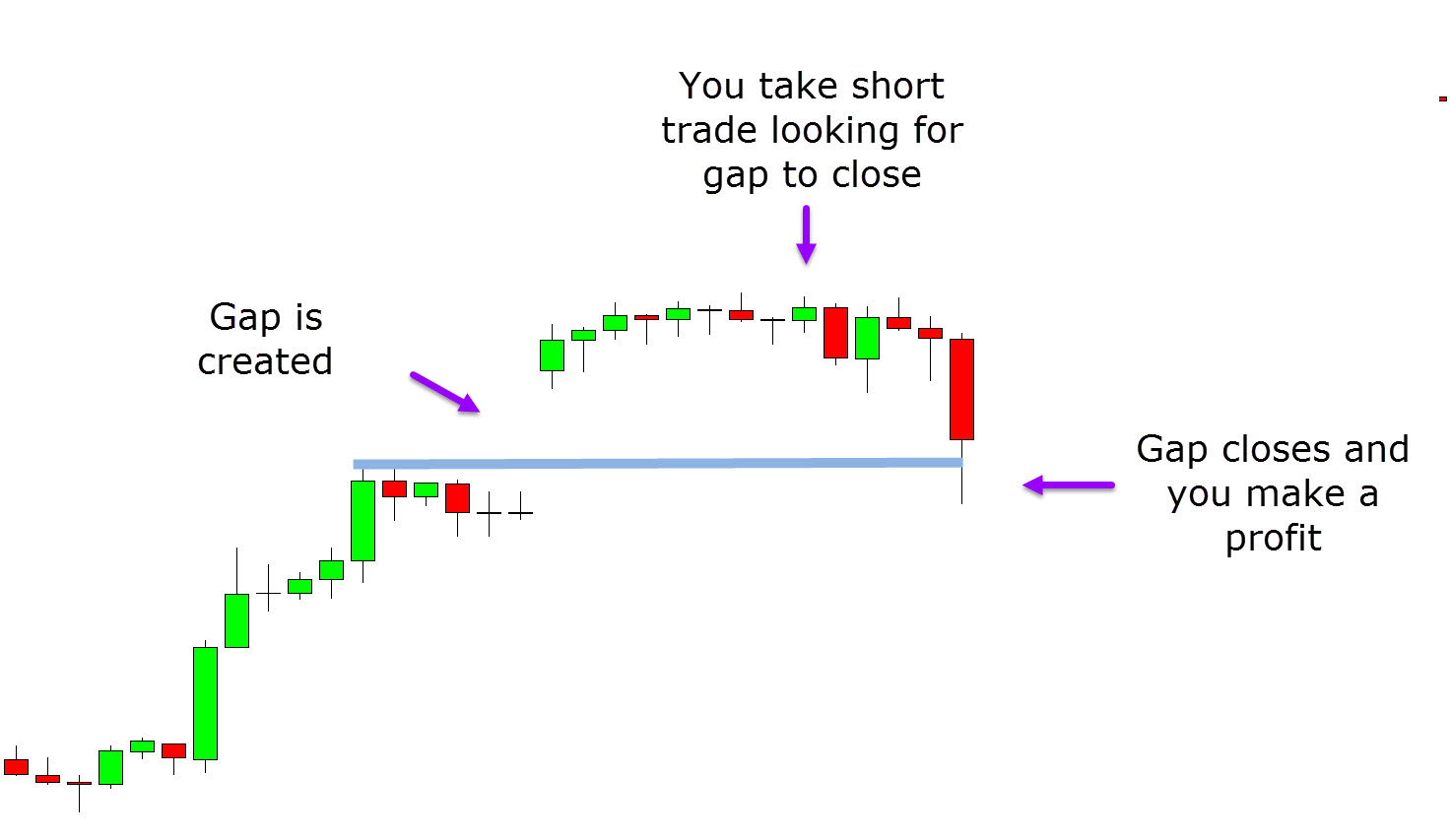

A gap is an area of discontinuity in the chart of an asset where the price of the asset either falls or rises from the close of the previous day with no trading taking place in between.

Gaps usually occur when there is fresh news or a big announcement that leads to changes in market fundamentals during hours when markets are closed.

When such news spreads, there is a flood of buyers or sellers that can quickly change the price.

The quick influx of buyers or sellers will then result in the price of a security opening significantly higher or lower than the closing price the previous day.

Based on the type of gap, it could signal either the beginning of a new trend or the reversal of a previous one.

Do Gaps Always Get Filled?

The simple answer to this questions is no, not all gaps get filled, however over 90% of gaps do eventually get filled.

The problem you will have if you are making trades thinking that a gap will get filled every single time is that even if it does it can take a very long time.

Whilst most gaps will be filled quickly, some gaps will not be filled for months or even years.

If you are looking to make trades aiming for the gap to fill, then you need to keep in mind that not all gaps will fill and some of them will take a very long time. You will need to cut your losses and not let them turn into large losing trades just like any other strategy.

What is Overnight Gap Trading?

Overnight gap trading is where there is a dramatic rise or fall in the price of an asset during closed trading hours.

Having your trading position open with a large gap against you is a very real risk you take on when you hold trading positions whilst the market it closed.

When the market is closed your money is exposed and when trading on margin you are exposed to a margin call as well.

With overnight gap trading, drastic news action such as economic data in the forex markets and earnings calls in the stock market can have large affects and shake prices dramatically.

Some markets, like Forex trade around the clock during the week. This means Forex will experience far less gaps other than when there is periods of extreme volatility or when reopening a new week.

What are the Best Markets for Gap Trading?

The best gap trading markets include the Forex, stock, and commodities markets.

In the case of Forex, the markets operate around the clock 24 hours a day during the weekdays. However, the markets are closed on weekends. During the weekends, prices of currency pairs can be exposed to dramatic movements.

In the case of the stock market they have set trading hours and sessions. After trading hours earnings calls or a big announcement from a company can drive the price of an equity higher or lower, making it another big market for gap trading.

Other markets that you will see a lot of gaps play out with is stock indices markets that have different trading hours.

How to Trade Gaps Successfully

There are several ways to leverage gaps in the market to your advantage.

Some traders buy or sell an asset when the technical or fundamental analysis favors a gap on the following trading day.

Others traders will look for the gap to fill and profit from price either moving into the gap or away from it.

Trading for the Gap

One way to trade the gap is to buy a stock or asset looking for the gap to be created.

This is normally done with individual stocks where you can buy the stock looking for a large announcement or positive news when the markets are closed that will lead to a large gap in your favor the next day.

Another method is to buy or sell into illiquid or highly liquid positions at the start of a price movement with the hopes of a continued trend and explosive movement.

For example, you might buy a currency pair when it is gapping up rapidly on low liquidity with no significant resistance overhead.

Trading for the Gap to be Filled

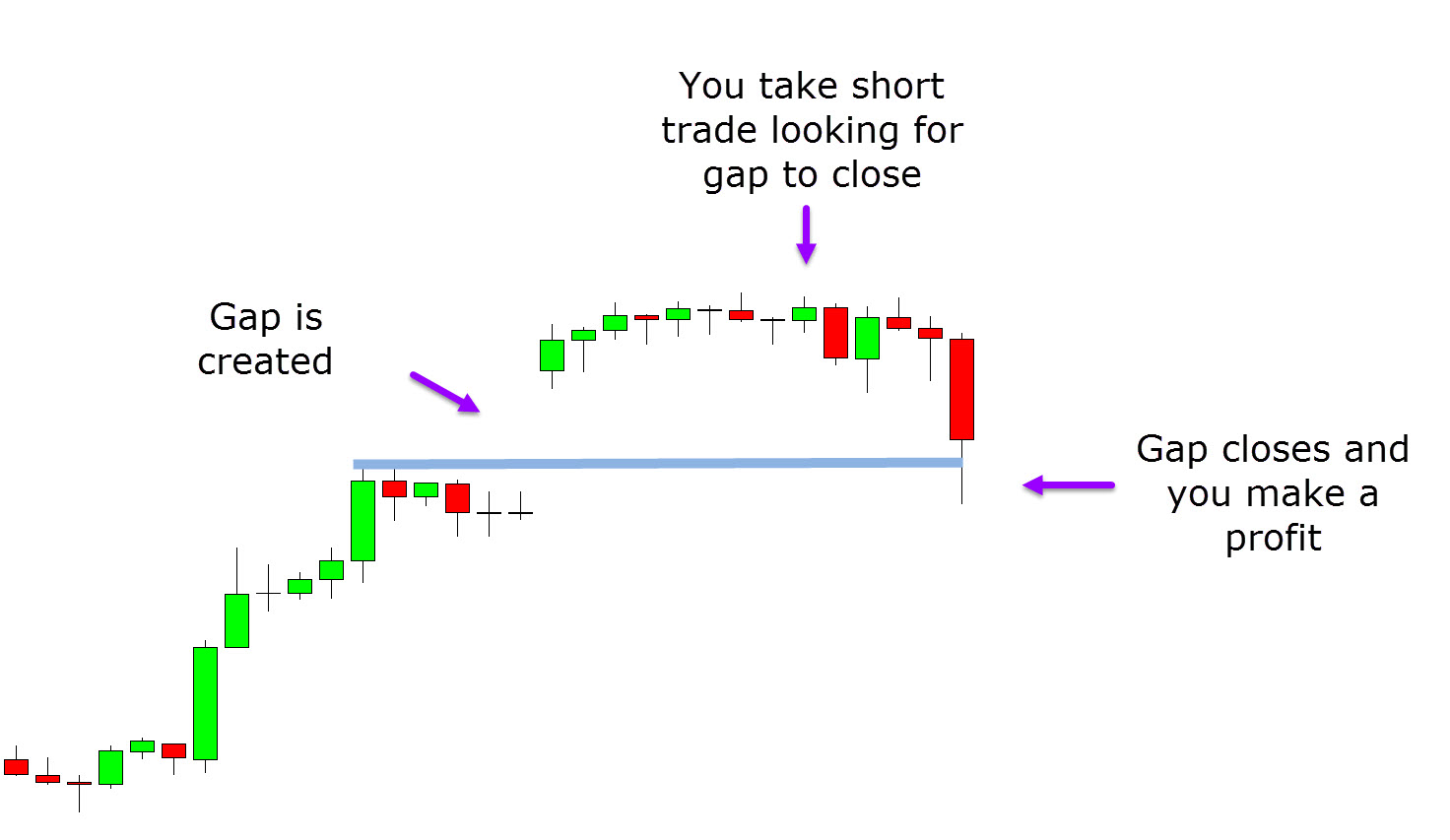

This strategy is more common in Forex and other markets like Gold or indices CFD markets.

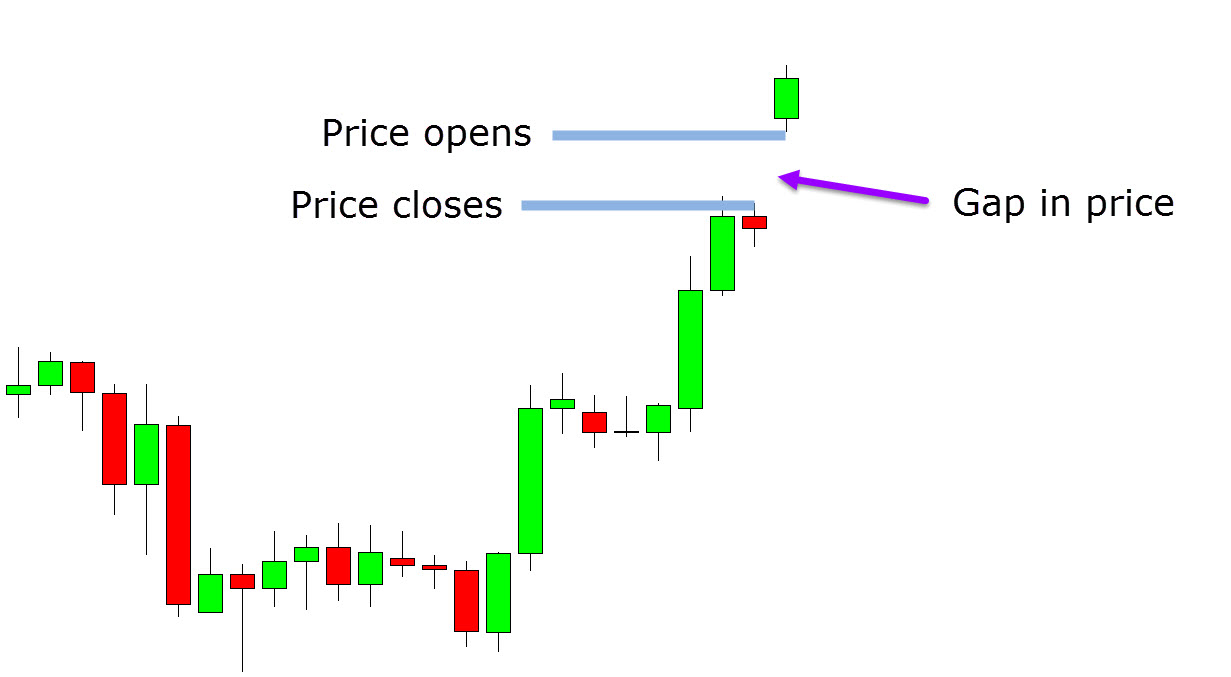

With this gap trading strategy you are not looking for a gap to be created, but waiting until one is created.

Once you see a gap you are making a trade and looking for the gap to be filled.

We know that gaps fill 90% of the time, so this is a popular trading strategy.

Using the Gap as Support or Resistance

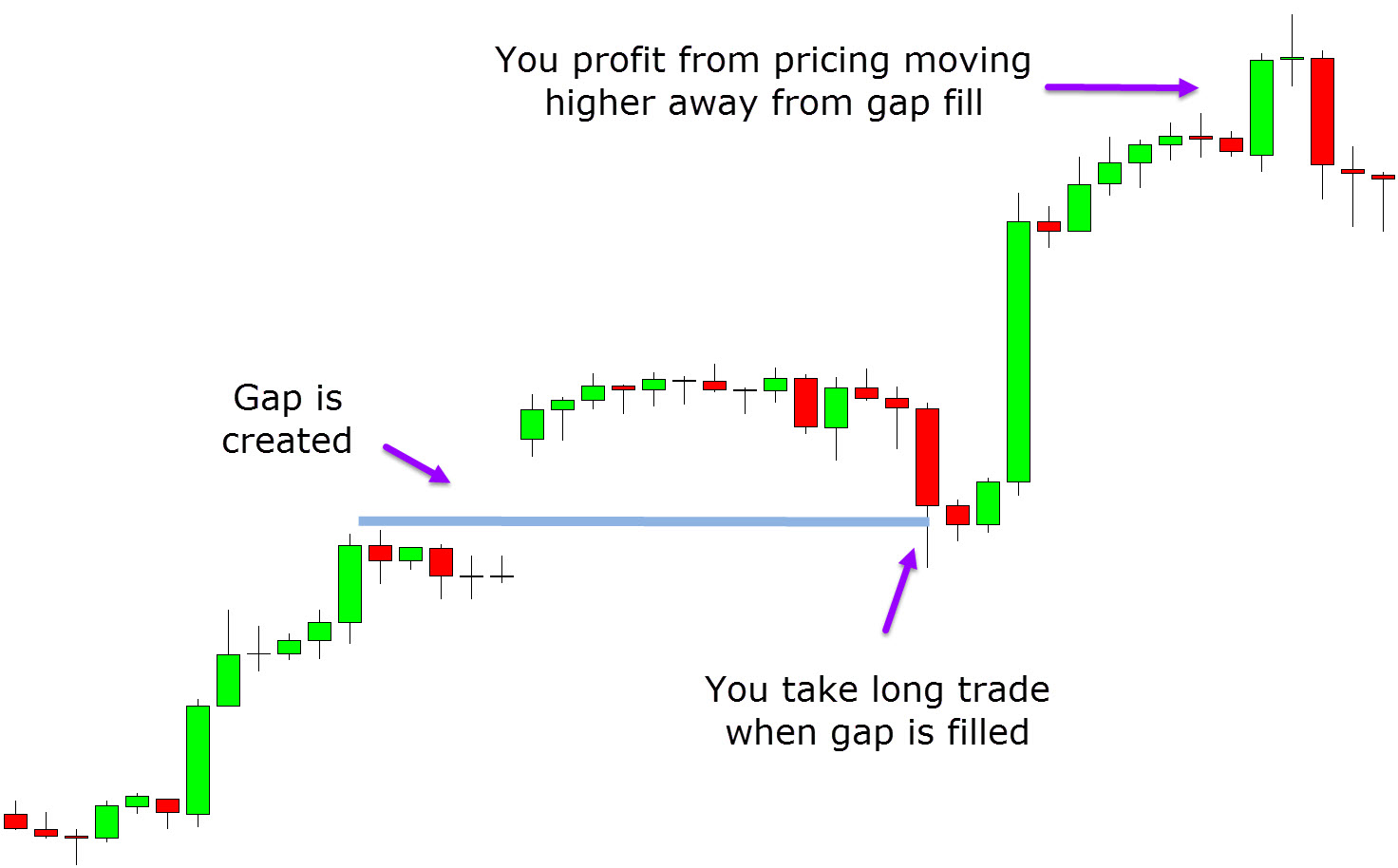

One of the other very popular trading strategies is looking to use the gap as a support or resistance level.

When price does move in and close the gap it will often bounce away and act as an area of supply or demand.

An example of this would be waiting to find a gap, waiting for it to close and then making a reversal trade looking for price to move away from the gap.

Simple Gap Trading Strategies

As we just discussed one of the simplest trading strategies is trading a reversal when the gap closes.

Checkout the example gap trade below.

First you notice that price created a gap and then it made a move higher. When you notice this you could be watching for price to rotate lower and close the gap.

When price does close the gap you could then be taking a long trade and looking to make a profit as price rejects the gap as a support level and moves back higher.