Alongside the Forex market, Gold is one of the most popular markets for retail traders and speculators to trade. The reason for this is because Gold will often make large moves that lead to healthy profits.

In this post we go through exactly how you can trade the Gold market and some of the best trading strategies to use on both the higher and shorter time frames.

Note: You can get your free Gold trading strategies PDF guide download below.

Table of Contents

Gold Trading Basics

Gold is a very distinctive market and has some individual traits unlike other markets.

Over the years Gold has been considered a safe haven market. When everything else like the USD or stock markets are going through extremes, traders have often flocked to the Gold market which has seen it’s price increase.

For this reason Gold can tend to go on long sweeping trends higher that can last from weeks to months on end.

There are multiple ways you can trade and invest in Gold. Whilst one of the most common methods is using CFD’s, you can also physically buy Gold bars, trade options and also use futures contracts.

How Gold Works Within the Forex Market

Most of the Gold trading is done in a similar method to how Forex is traded.

Instead of physically buying Gold bars, most investors and traders are using contracts such as CFD’s.

With CFD’s you are not buying the physical asset, but instead you are purchasing a contract. This contract is a speculation on whether the price will go higher or lower on the underlying asset. For example; if you trade a CFD on Gold, you are not buying a Gold bar, but trading on whether the price of Gold will go higher or lower. You do not physically own any Gold.

Whilst Gold can be traded in other currencies, it is normally traded against the USD. This makes it a more standard price around the world. This is important to keep in mind because what the USD is doing will play a large role in how Gold is behaving and trading.

Because Gold is seen as a safe haven market because it is a physical product with a limited supply, traders and investors will always flock to it when others markets are becoming risky.

Keep in mind unlike a currency where more and more can just be printed, there is a set amount of Gold and it cannot be recreated.

XAUUSD (Gold) Trading Hours

A very large reason that retail traders and speculators love trading the Gold market is because it is open 24 hours a day and five days a week.

Unlike individual stock markets that are only available to trade during their set sessions, the Gold market is open all week.

Important note: many brokers will close or turn off their servers for one minute at the end of the day. They do this because during the period between when the market closes and reopens the volume becomes very thin. This can lead to large spikes and traders getting stopped out when they shouldn’t be.

Best Indicator for Gold Trading

There are endless amounts of indicators you can use to start trading the Gold market. However, what you will often find is the best indicators are the simplest and the ones that give you the cleanest trade ideas.

What you will also find is that as you start to add more and more indicators to your chart they will start to contradict each other. This can often lead to analysis paralysis where you simply don’t know what to do.

The three best indicators you can use to trade Gold are;

- The Average True Range

- Moving Averages

- Fibonacci Tool

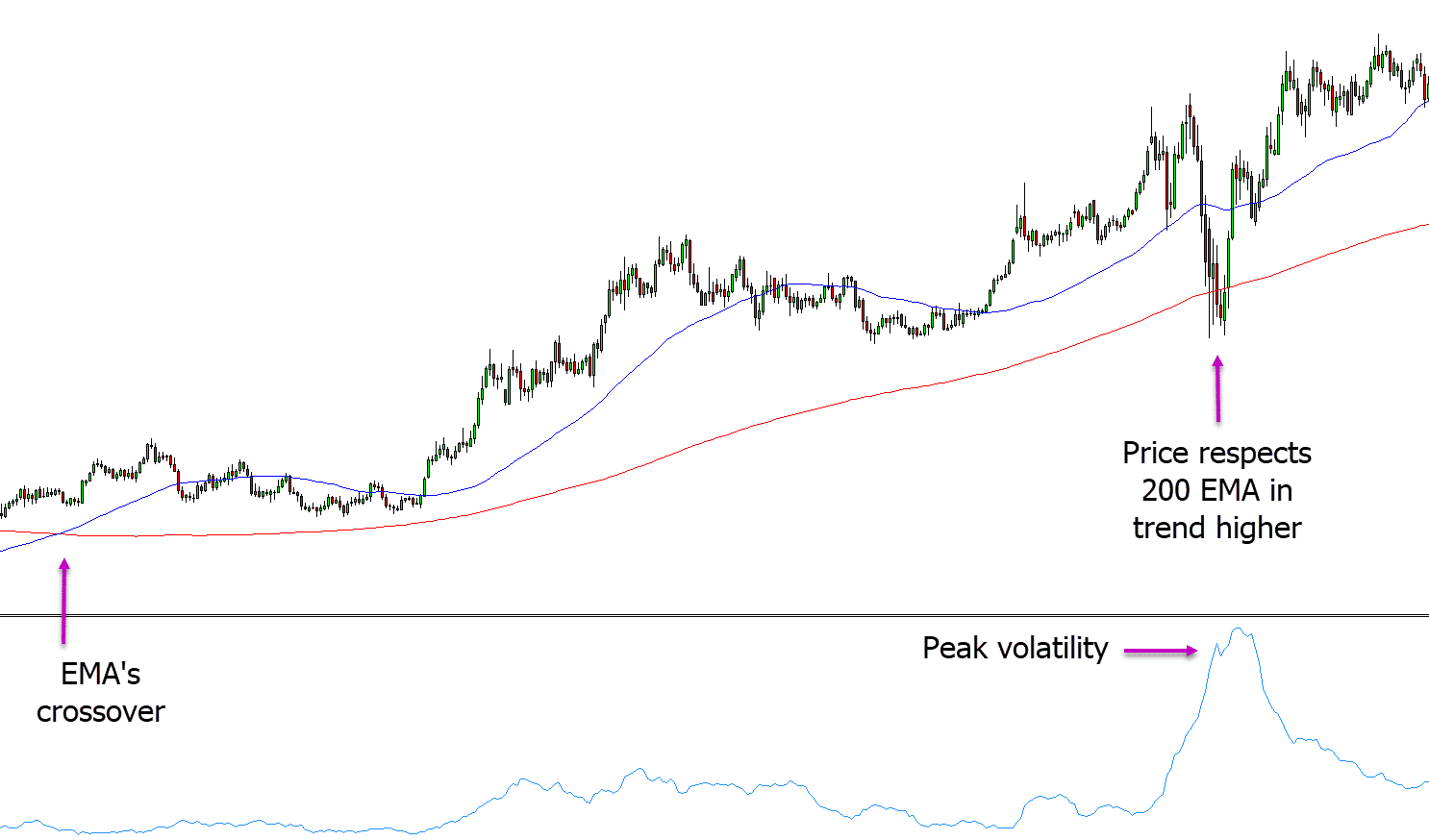

We discuss the Fibonacci tool below and how you can use it on smaller time frames, but in the example below we have added both moving averages and the average true range to the chart.

The average true range is showing us when volatility is picking up and when price is making bigger moves.

The two moving averages are showing us what trend price is making and we are also using them for dynamic support and resistance.

When we see the 50 period exponential moving average cross above the slower moving 200 period exponential moving average we know that price is looking to trend higher.

With this information we can start to look for long trades. In this example we notice that the ATR has started to spike with large volatility and price is respecting the 200 period EMA indicating a potential trade to go long.

Intraday Gold Trading Strategies

Gold can be traded on all of your time frames from the monthly chart right down to the one minute chart.

If you are looking to make intraday trades in the Gold market, then keep these things in mind;

Watch the News

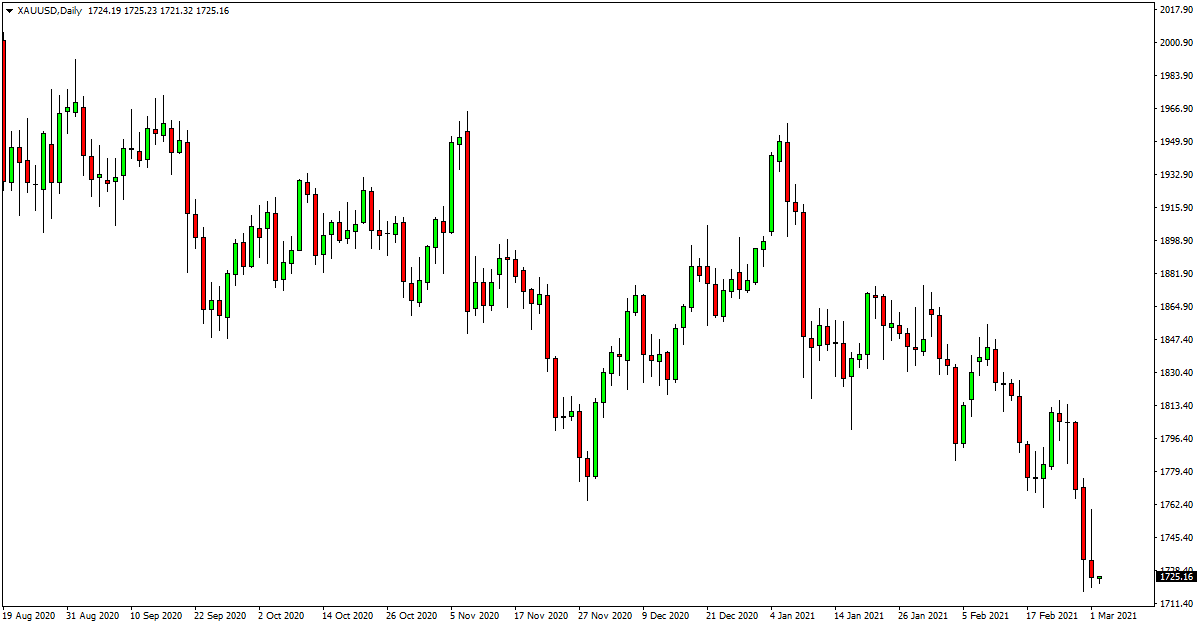

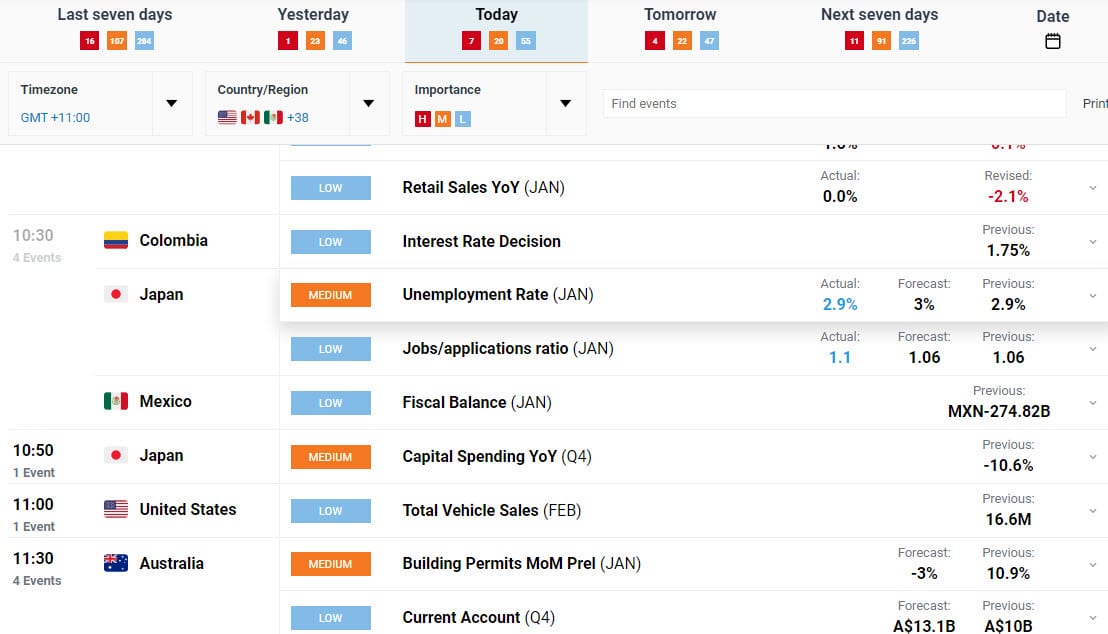

News and economic events can often play a large role in how the price of Gold moves.

If the markets move to a risk-off situation, then Gold will normally become a market that moves higher.

You can use the DailyFx economic calendar to keep an eye on important news announcements throughout the day.

Pick Your Time Frame

You don’t need to be trading every time frame to be profitable trading Gold.

If you are suited more to making a lot of trades, then you will be better of on much smaller time frames such as the five minute or fifteen minute charts.

If you prefer to make intraday swing trades, then you are going to be better off using time frames like the 1 hour chart.

Use Price Action and Technical Indicators

Just like picking your time frames carefully, you don’t need to add every indicator to your chart.

Find the indicators that are clean and help you the most and stick with them.

You can then combine these indicators with your price action and technical analysis to make high probability intraday trades.

Gold Scalping Trading Strategies

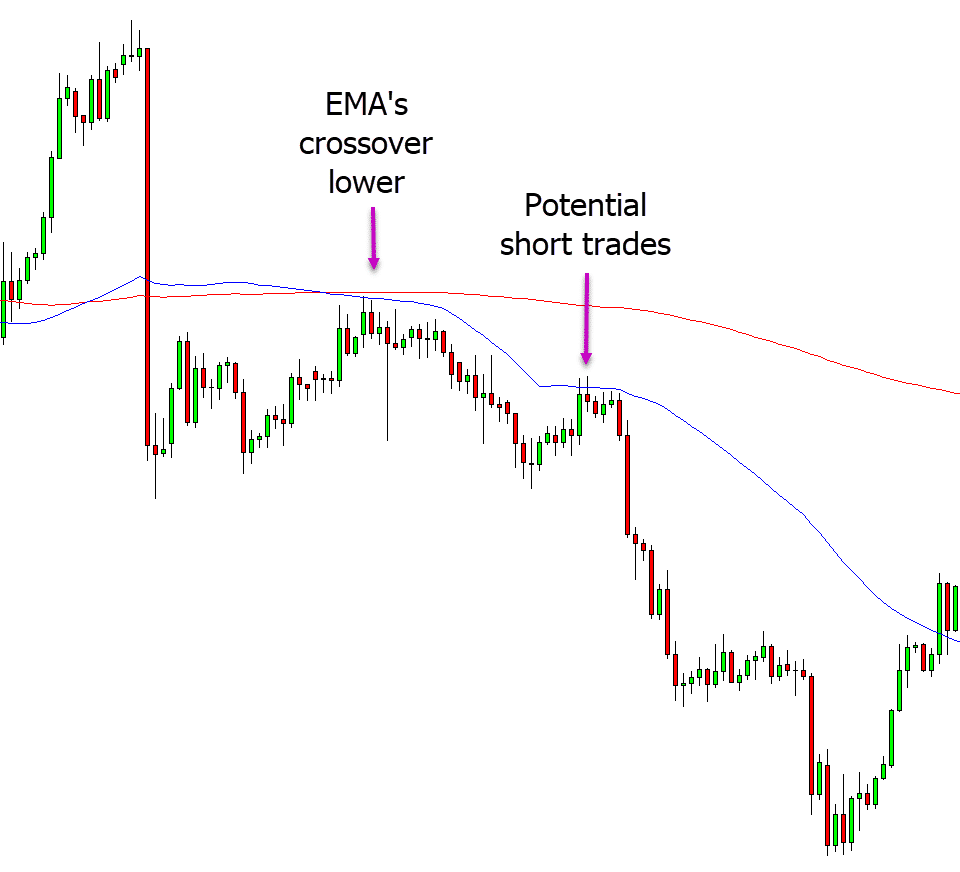

The first thing to remember if you want to scalp the Gold market is don’t fall into the trap of only looking for long trades.

When scalping on the smaller time frames you are going to see strong trends both higher and lower. You need to use these trends to your advantage and trade with the flow of the market.

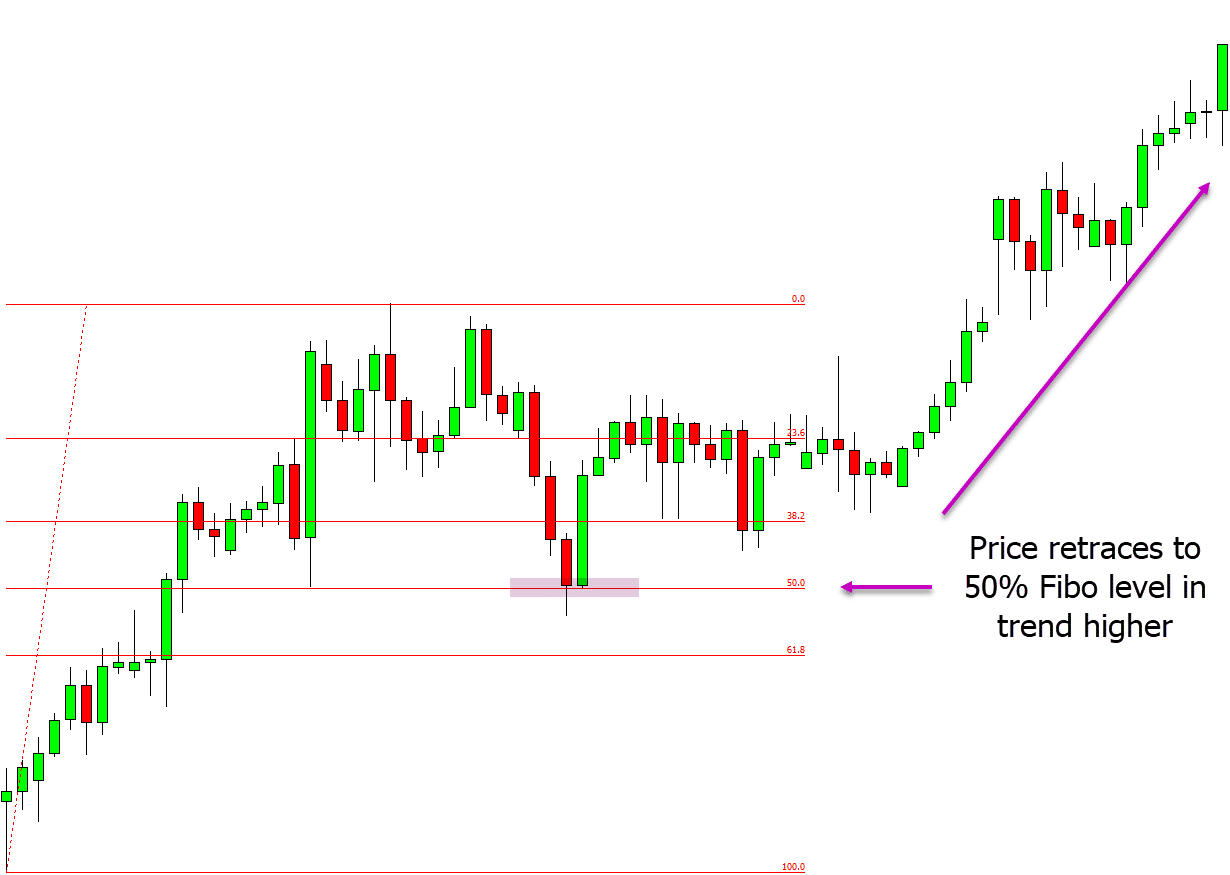

In the example below price is trending higher so we are looking for a long scalp trade.

To find a high probability entry we are using the Fibonacci indicator.

When price pulls back lower to the 50% Fibonacci level inline with the trend higher we could look to make a long trade and ride the next move higher in the trend.

Lastly – Gold Trading Tips

Whilst there are many ways for you to make profitable trades in the Gold market, there are some tips to keep in mind;

- Watch and monitor the important news events that could impact the price of Gold.

- The USD will often play a huge role in where the price of Gold moves.

- Keep your trading simple and don’t add too many indicators to your charts.

- If scalping, then trade with the obvious trend in your favour. Don’t fall into the trap of only looking for long trades.

- Brokers will often turn off their servers for a brief period during the daily changeover period between the daily close and open to avoid large spikes when the volume is very low. This is normal, but you need to be aware of it if you are looking to open a new trade or manage a trade you are already in.

Note: You can get your free Gold trading strategies PDF guide download below.