Reversal trading can be one of the most profitable trading strategies you can use. You can make reversals in trending markets, ranging markets, and even against the trend.

You can use a reversal trading strategy in many different markets, including Forex, stocks, and cryptocurrency, and you can use it on all time frames.

In this post, we go through exactly what a reversal trading strategy is and how you can start using it in your own trading.

NOTE: You can get your free reversal trading strategy PDF guide below.

Table of Contents

What is a Reversal Trading Strategy?

When using a reversal trading strategy, you are looking to profit when the price reverses its direction. One point traders often get confused about when reversal trading is trying to pick the market top or bottom or looking for a trend to change.

Reversal trading can be done within a trend, within a range, and also against the trend.

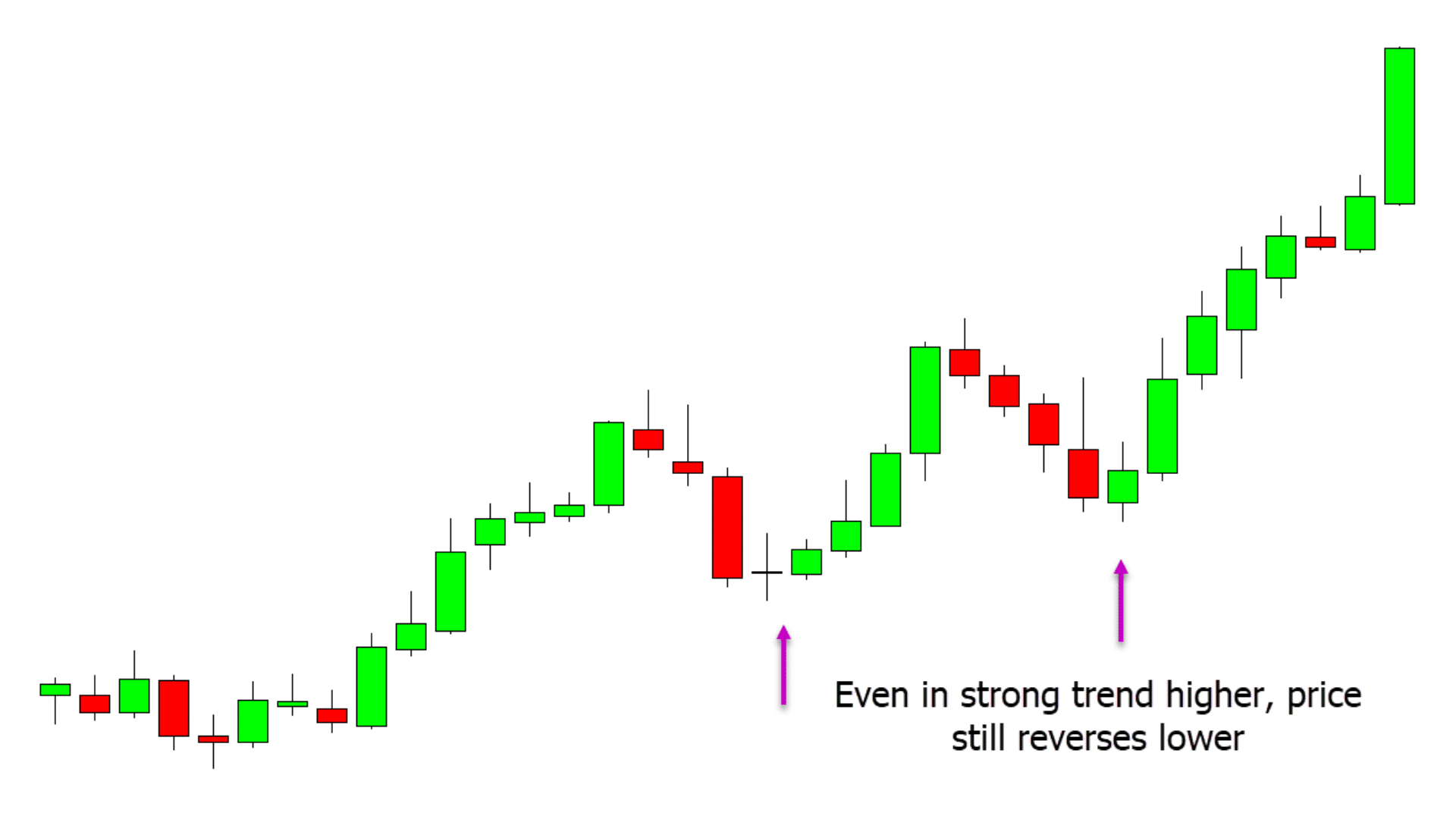

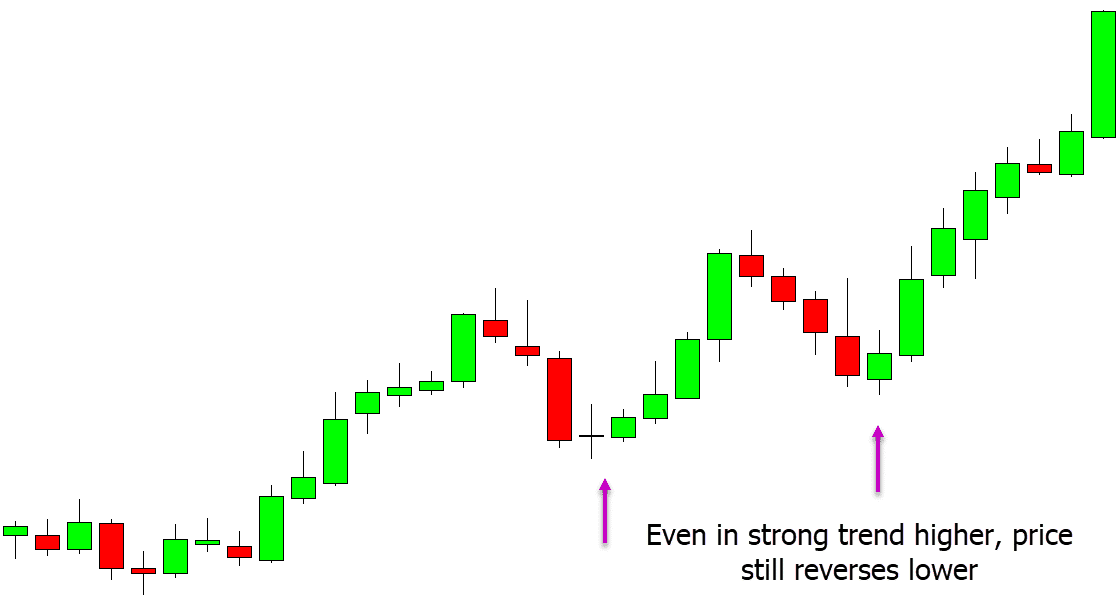

For example, if looking to make a reversal trade within a trend, you would be first looking to identify the overall trend. In the example below, price is making a clear trend higher with higher highs and higher lows.

To make a reversal trade within this trend higher, we wait until the price moves back lower into a value or important area. This is normally a support or resistance level. We are then entering long trades from the swing low and looking for price to reverse back higher in line with the trend’s direction.

How to Identify a Trend Reversal

You will often get the chance to make reversal trades when a trend is coming to an end.

Taking trades against the trend that is currently in place can be riskier, but it can also come with higher rewards. If you can catch onto a new trend when it is first starting, then you often have the chance to ride a large winning position.

Two common strategies to identify when a trend is about to reverse are the moving average crossover strategy and the 123 trend reversal.

123 Trend Reversal Pattern

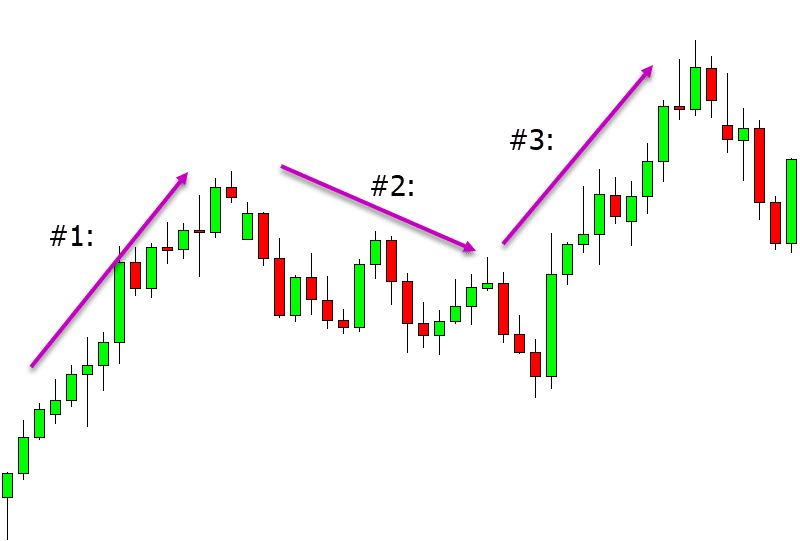

The 123 trend reversal pattern is a price action pattern that shows that the trend could change.

With this pattern, we have three distinct moves.

In the example below, we see a 123 trend reversal to the upside. After making a trend, lower price makes its first leg higher. This is followed by the second leg and swing lower. The reversal and pattern are complete when the price moves higher in the third leg, and it takes out the high of the first leg creating a new higher high and new short-term trend.

Intraday Reversal Trading Strategy

Reversal trading can be carried out on all time frames from the higher time frame charts, such as the daily chart, to the intraday time frames like the 30 minute and 15 minute charts.

The key when reversal trading on the intraday time frames is to use the major levels as a guide and if there is any clear momentum to trade with it and not against it.

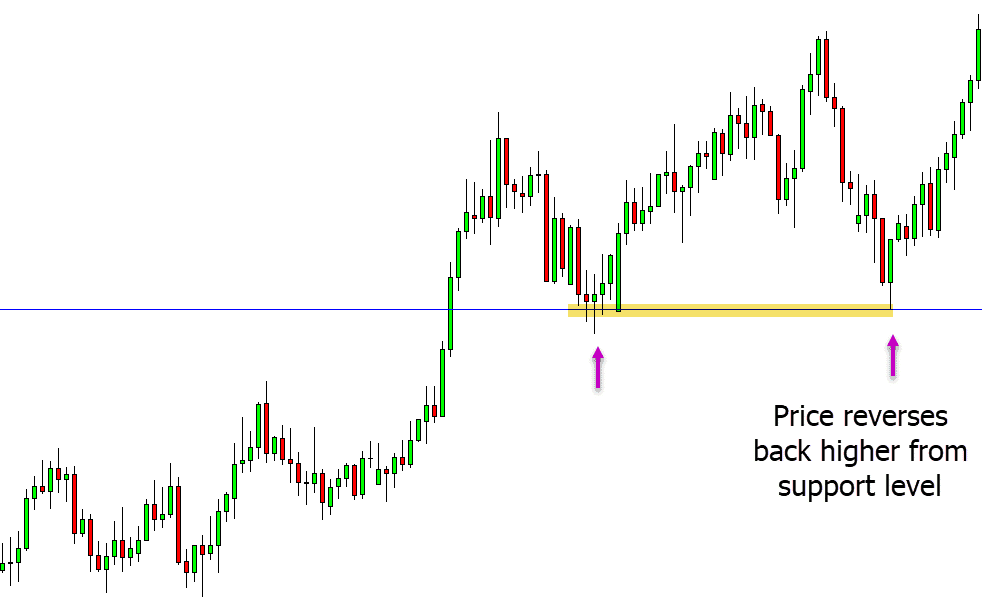

In the first example below, the prices momentum had been trend higher. With this in mind, we would be looking for long trades. When the price moves back lower into a clear support area, we could look to make long trades. We would then be looking for price to reverse back higher with the overall momentum.

In the second example, there is no clear momentum or trend in play. Because of that, we are looking at the clear support and resistance level for potential reversal trades.

When price moves lower and into the intraday’s range support level, we could start looking for potential long trades and to profit as price reverses back higher away from this support.

The Best Trend Reversal Indicators

Moving Averages

Moving averages are one of the most popular technical indicators that are used across all markets.

Moving averages are used to smooth out the overall price action and give you an idea of the market trend. They can also help you identify how strong a trend is and if that trend could be slowing or coming to an end.

When using multiple moving averages in your trading, you can use them to spot trend reversals and reversal trades.

MACD

Another prevalent indicator used across all market types for spotting new trends or momentum is the MACD.

The MACD shows the information from two different moving averages and how they are interacting.

The MACD shows as an oscillator on your chart, and it moves above and below 0. With this information, you can begin to spot new trends forming and when momentum is building for potential reversal trade setups.

Simple Reversal Trading Strategy

Using Fibonacci and Price Action

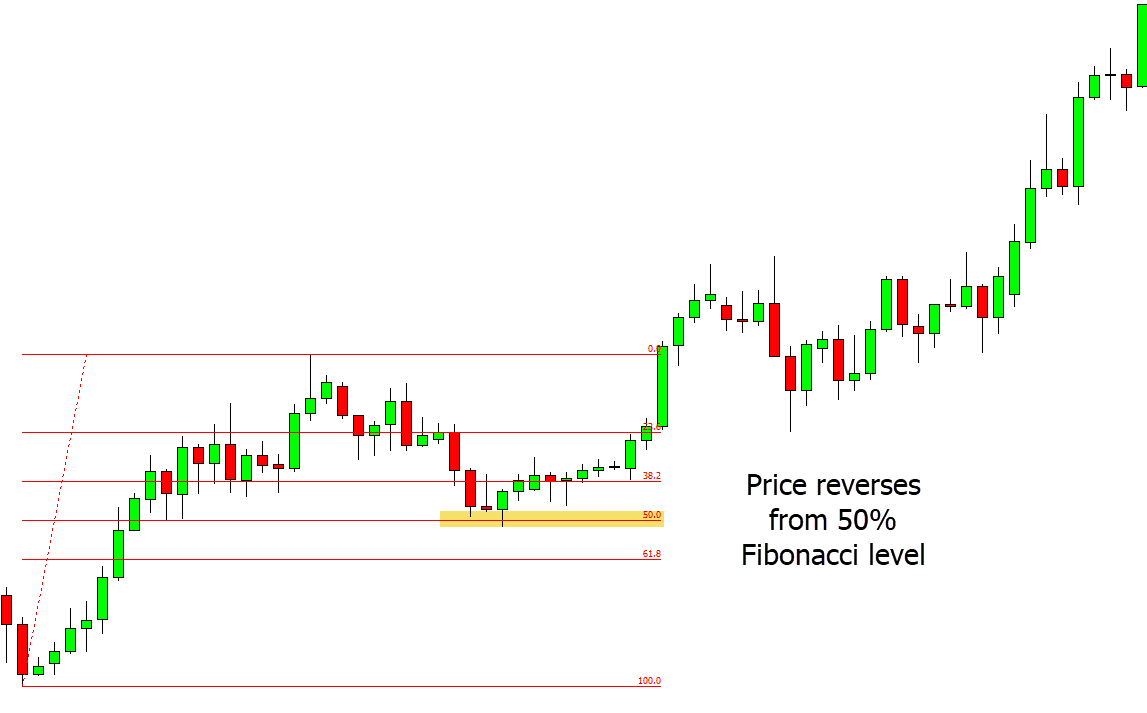

One of the simplest ways you can find high probability reversal trades on all of your different time frames is with the Fibonacci tool.

The Fibo can help you pinpoint when the price is likely to find support or resistance and could be about to make a new reversal.

In the example below, the price is in a trend higher. After the price pulls back lower, we see that it moves into the 50% Fibonacci level.

We could start to look for long reversal trades at this retracement level in line with the trend higher.

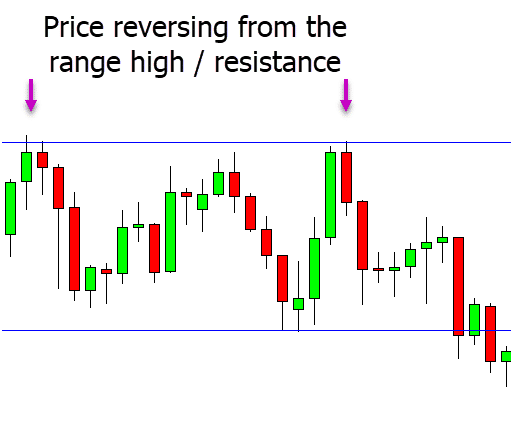

Range Reversal From Key Support and Resistance Levels

Range trading reversals is another strategy you can use on all of your time frames. You can use it to scalp if you are more suited to shorter time frames or swing trade with it if you prefer higher time frames.

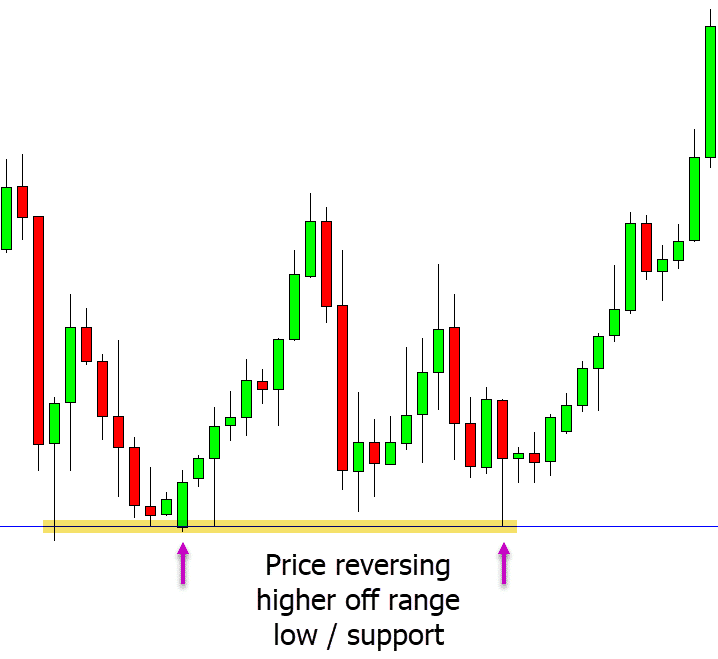

In the example below, we have a clear range support and resistance.

As the price moves into the range high resistance level, we could start to look for short trades and for the price to reject this resistance and reverse back lower. We could then be looking to make a profit as price reverses back into the range’s low and support level.

NOTE: You can get your free reversal trading strategy PDF guide below.