Ever wanted a trading method where you could set your entry, stop loss and profit target and let the trade be? That is what set and forget trading is all about.

In this post, we go through what set and forget trading is and how you can start using it in your trading.

Table of Contents

Set and Forget Meaning

To set and forget means to set all your trading parameters up and then forget it.

When set and forget trading, you are setting your entry, stop loss point, and profit target all when you enter the trade. You are then letting the trade ride. Price will either hit your profit target, or it will hit your stop loss.

The key to set and forget trading is the trading strategies you use to find your trades and not touch the trade once you have entered.

In this post, we go through different strategies you can use to find these set and forget trades, but the key to this style of trading is leaving your trade alone. Price will either move into your profit target or your stop loss, but you will not be doing anything until it does.

Set and Forget Trading Strategy

To use a set and forget trading strategy, you have to be comfortable with the different order types you will be using.

Because you are entering the trade and then not touching it, you must know how to put stop losses and profit targets in your trading platform.

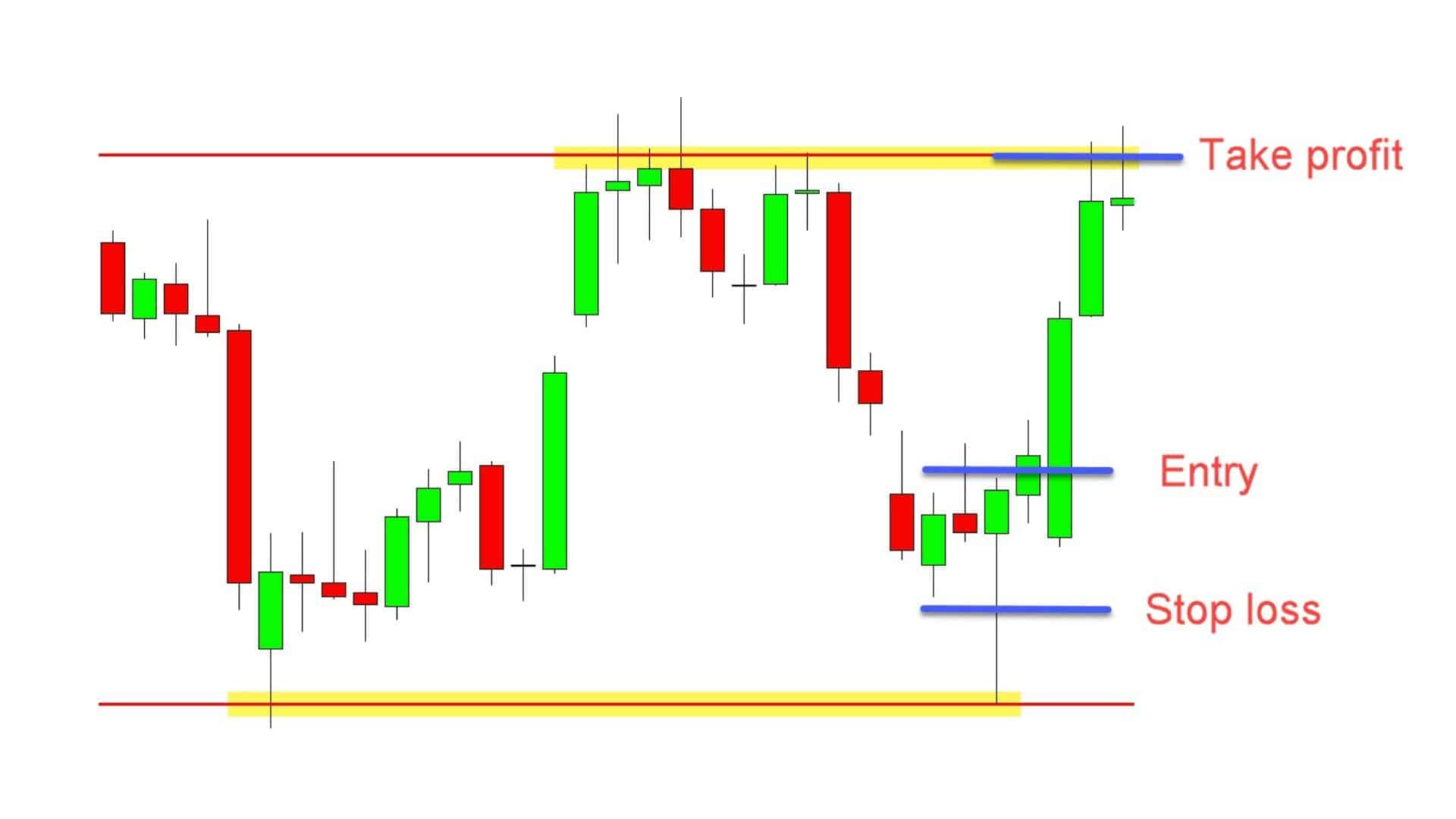

In the example chart below, we are using a set and forget trading strategy.

With this example, the price moves into a key support area and forms a bullish hammer pattern.

This could be our signal to look to make a long entry.

When the hammer pattern is confirmed by breaking higher, we could enter our trade. To make it a set and forget trade, we would then add our stop loss which could be below the hammer’s low, and our profit target, which could be at the recent resistance level.

After entering this trade and setting our stop loss and profit targets, we would let the price make its move.

If the price moves into our take profit order, the trade would automatically be closed for a profit.

On the flip side, if the price moves lower into our stop loss level, we would have the trade closed for a loss.

In this set and forget trade example, the price moves higher into our profit target, and we bank a profit.

How to Use Set and Forget in Your Trading

As mentioned, the key to this strategy is not touching or managing it once we have been entered.

That means that we will have losses at times. That is why it is crucial to have an excellent risk-to-reward ratio with these types of trades.

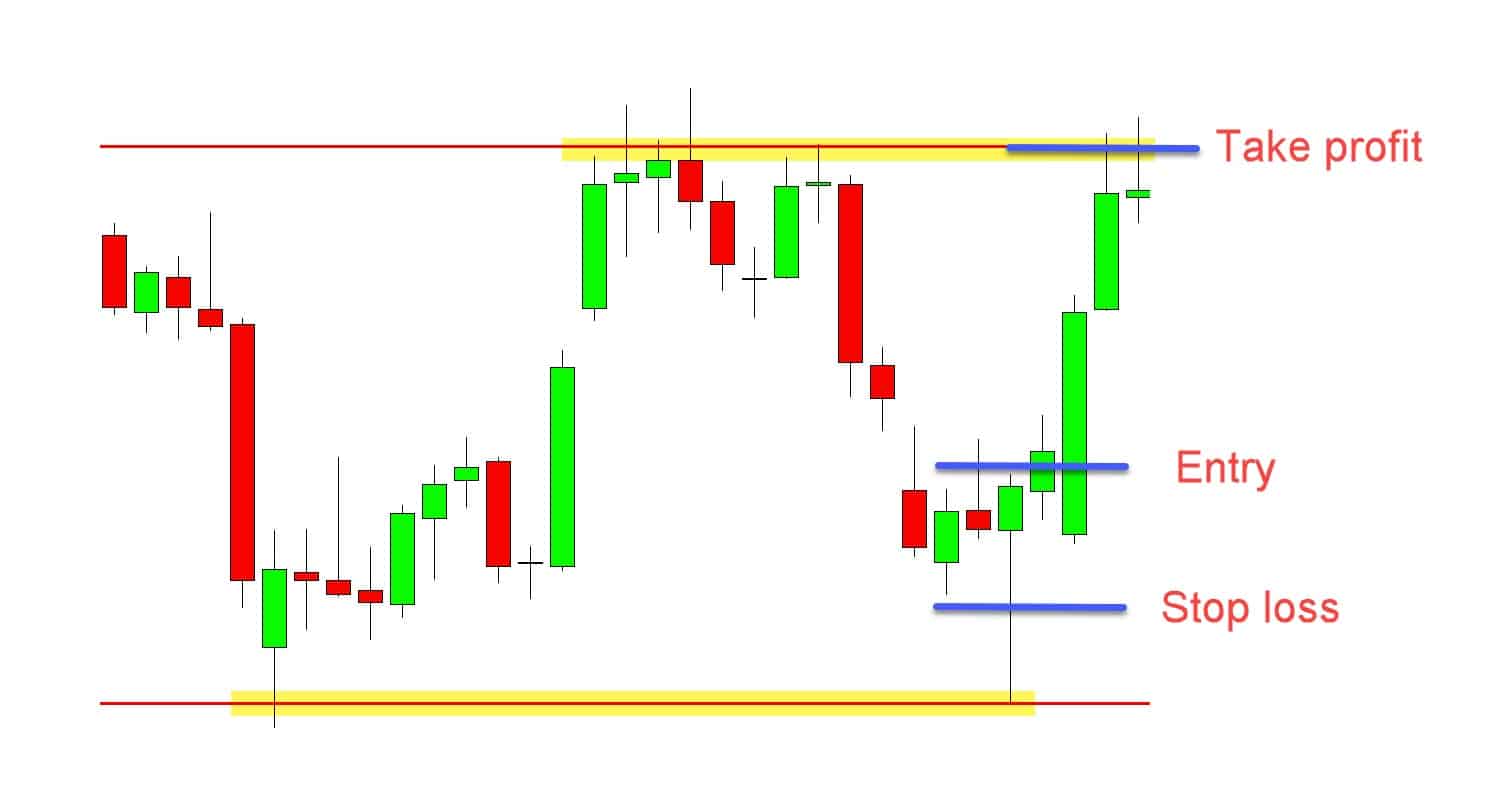

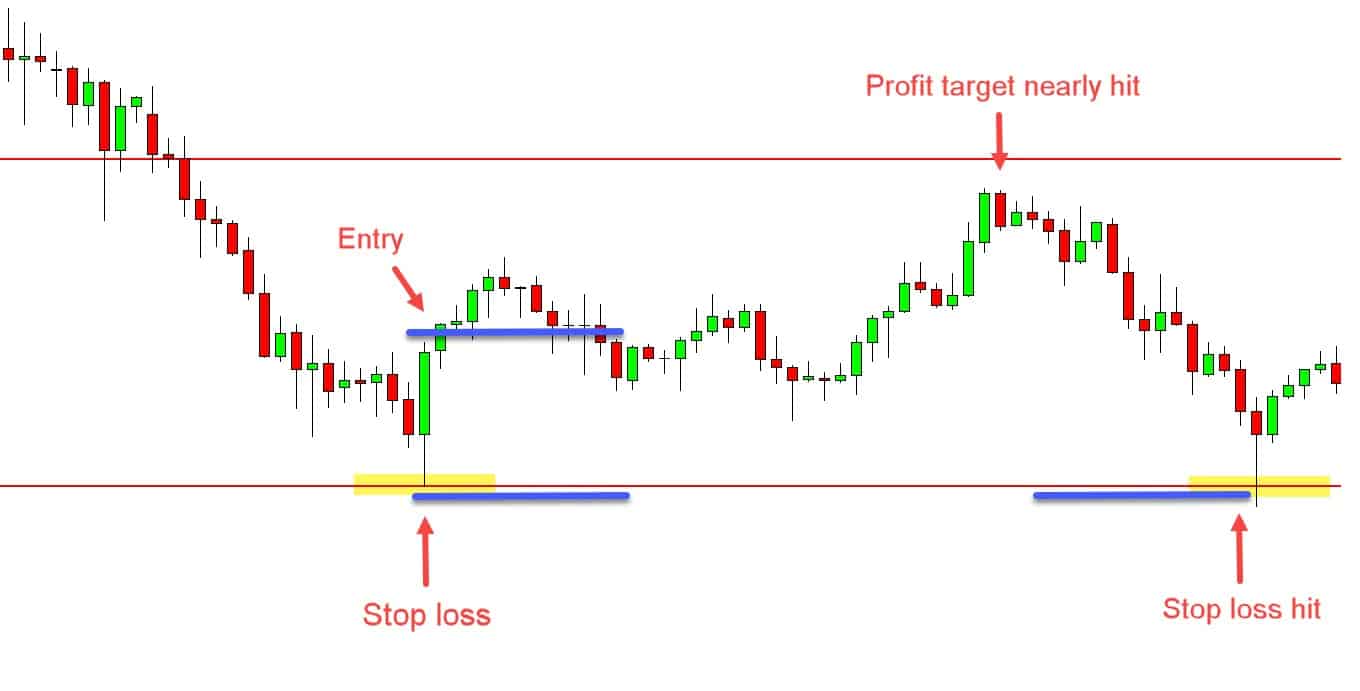

In the example below, we enter with a bullish engulfing bar. While the price moves higher in our favor, it does not quite make it to our profit target.

Price then swings lower and moves into our stop loss.

While in this example, we came close to booking a profit, ultimately, we would be stopped for a loss.

This can be one of the most frustrating things about this trading style for some traders. At times price will go very close to your profit target but turn and stop you out for a loss.

If you want to use the set and forget trading strategy, you have to be comfortable with this and let your trades ride.

Examples of Set and Forget Trading

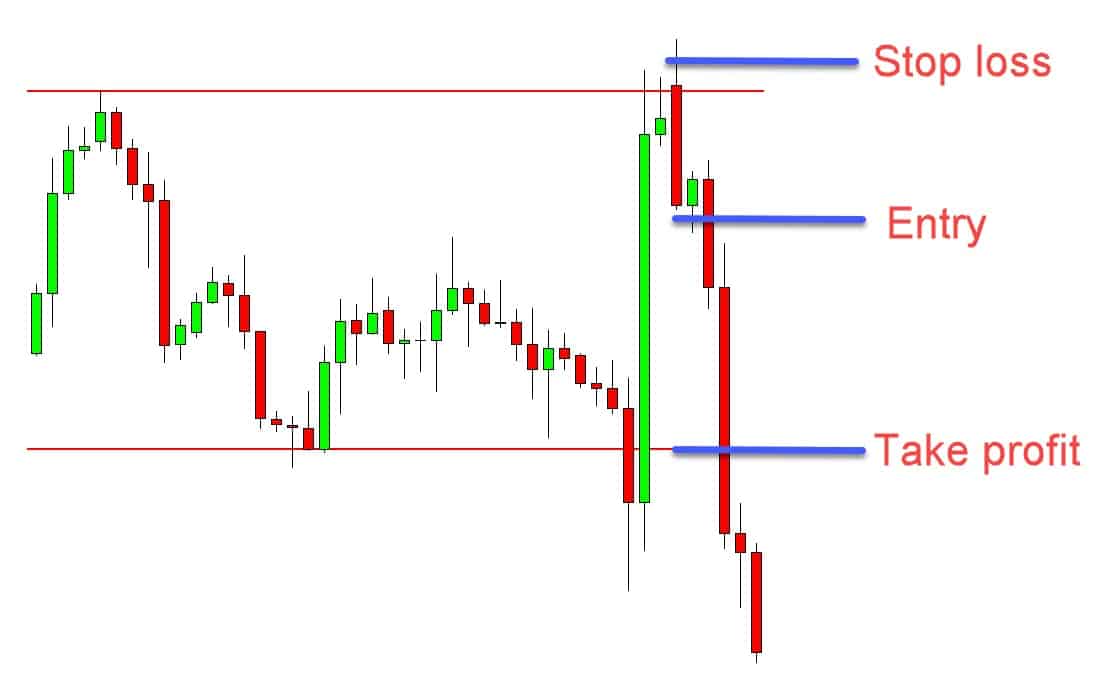

Below we have an example of a trading strategy using price action and support and resistance levels.

When the price moves higher and into the resistance level, we start to look for a potential short trade. When the price forms the bearish engulfing bar at this level, we would then look for a short trade.

When the price confirms the bearish engulfing bar by breaking lower, we would be entered into our short trade.

To make it a set and forget trade, we would set our stop loss and profit targets. The stop loss could be above the high of the engulfing bar and the profit target down at the recent support level.

In this example, the price moves in our favor, and we would have booked a nice profit when our profit target was hit, and the trade was closed.

Lastly

One of the most straightforward strategies you can use is the set and forget trading strategy.

This will suit traders who like to swing trade or use higher time frames such as the 4-hour and daily time frames.

Smaller time frames and scalping are not best suited to set and forget trading because you will typically only be in trades for short periods. On small time frames, it is also crucial to be quick at executing your trades, and trying to use set and forget can cost you trading opportunities.

As with all new trading strategies you are testing out, make sure to test this strategy on free demo charts first to ensure you are comfortable with it.