Price in the Forex and stock markets moves because of the imbalance of supply and demand. This imbalance is the order flow of buyers and sellers entering and leaving the markets and jostling for the best prices.

If you can learn to understand where these imbalances are in the markets and how the order flow structure is affected, you can begin to take advantage.

In this post we go through exactly what order flow trading is and how you can use it with simple price action trading strategies.

NOTE: You can get your free order flow trading strategies PDF below.

Table of Contents

What is Order Flow in Trading?

Order flow trading is a type of analysis similar to order block trading that allows you to see and anticipate where other traders and the big money are buying and selling.

Whilst there are different methods to analysing order flow in the markets such as using indicators, in this post we will concentrate on how you can read order flow using price action. We also go through how you can use this information to find and make high probability trades.

When using order flow to analyze the markets you can learn to read the volume of the buyers and sellers. This can help you to start understanding where the major supply and demand levels are. With this information you can start to enter your trades on the right side of the market more often than not.

Whilst indicators can quickly show you the percentage of buyers and sellers at any given time and some brokers will tell you the amount of buyers and sellers they have on their books, this does not help you predict the markets next movement. Order flow analysis is useless unless it can help you predict where price will move next and help you make high probability trades.

How to Use Order Flow in Your Trading

When using price action and technical analysis to find trades we are looking for the best areas in the market to enter. This is the same with order flow trading. We are looking for the spots where there is an imbalance in the order flow and where we can take advantage. We are looking for where the bulls or bears are about to take control and we can enter and make a profit.

Order flow analysis can be used to;

- Find where stop losses are being triggered.

- Find where the bulls or bears are likely to get trapped.

- Find big momentum moves.

- Find breakout trades.

- Find range trades.

- Find when momentum is running out and a reversal could be about to occur.

Order Flow and Price Action

The simplest way to find and trade with order flow analysis is price action.

Price action is using raw price action data to show us what buyers and sellers have done and are doing.

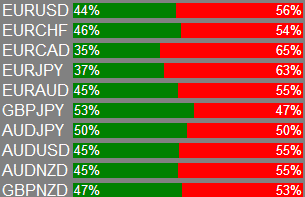

For example, see the chart below. We can see that there is an order flow tug of war going on.

Price is moving in a range and sideways move. As price moves higher and into the range resistance the order flow quickly changes. Here the bears take over and price moves back lower.

As price moves back into the range support area the order flow levels change again as the bulls jump in to overwhelm the bears and price moves back higher.

Individual Candlestick Analysis

You can analyze order flow from the smaller time frames right through to the highest. You can also look at it from an overall price action chart perspective or from individual candlesticks.

Using individual candlesticks will help you understand how you can look at and read price action to understand the order flow.

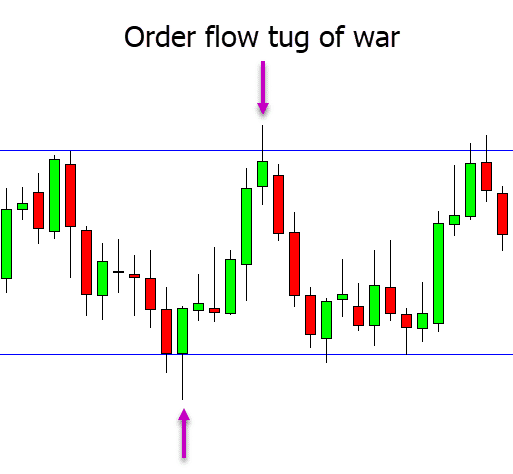

In the example below price has formed an outside bar or engulfing bar. This candlestick is formed with price first opening and then moving out higher.

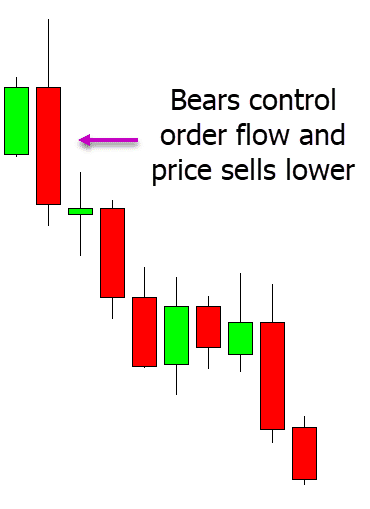

At this point the bears (sellers) jump in and overwhelm the bulls (buyers) changing the order flow dynamics. As price is pushed lower it closes below the previous candlestick and completes the engulfing bar. This strong change in order flow with the bears (sellers) taking over shows us that the dynamics have changed and the bears are now in control.

The second example below shows the same engulfing bar, but with a fuller picture.

As we know, the order flow changed with the bears gaining control. After price breaks the low of the engulfing bar the bears then move to push price lower.

Order Flow Trading Strategies

You can use order flow analysis in your price action trading to find many different types of potential trades. As we have already gone through you could use it to find trades with individual candlesticks and to find range trades. You could also use it to find breakout trades.

Order Flow Breakout Trades

Breakout trades are created from tension in the markets.

From an order flow perspective price is not moving higher or lower and both the buyers and sellers are in a stalemate.

Eventually however, one side will want to take control and take over the order flow.

Two things normally go into creating a high probability breakout trade.

The first is that price will have tested the support or resistance level it is looking to breakout of multiple times.

The second is that there will be a lot of stop losses around where the breakout is about to occur.

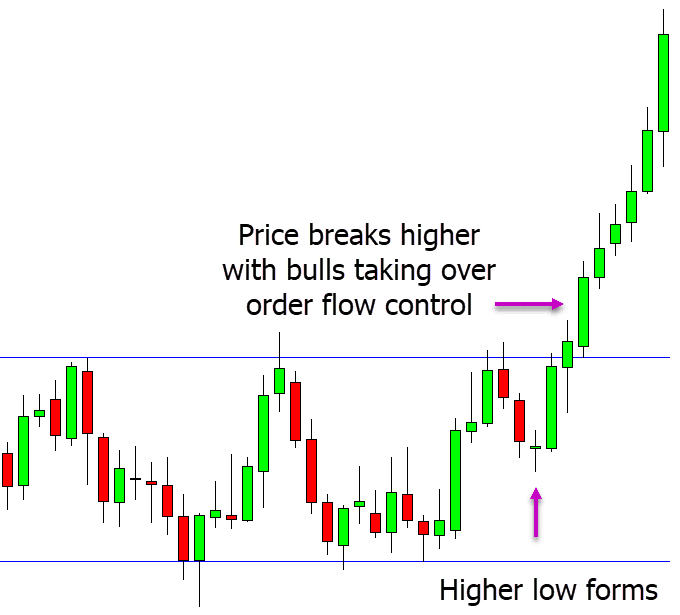

For example; in the chart below price makes a breakout higher. We first see a higher low form which is the first clue that the bulls are gaining control of the order flow because the bears could not take price back to the previous low.

Price then breaks the resistance level. Above this resistance is where a lot of the bears (sellers) are going to have their stop losses placed. Once these stop losses start getting triggered and the bears are forced to leave the market, the bulls gain full control over the order flow and price moves strongly higher.

Using a Order Flow Trading Indicator

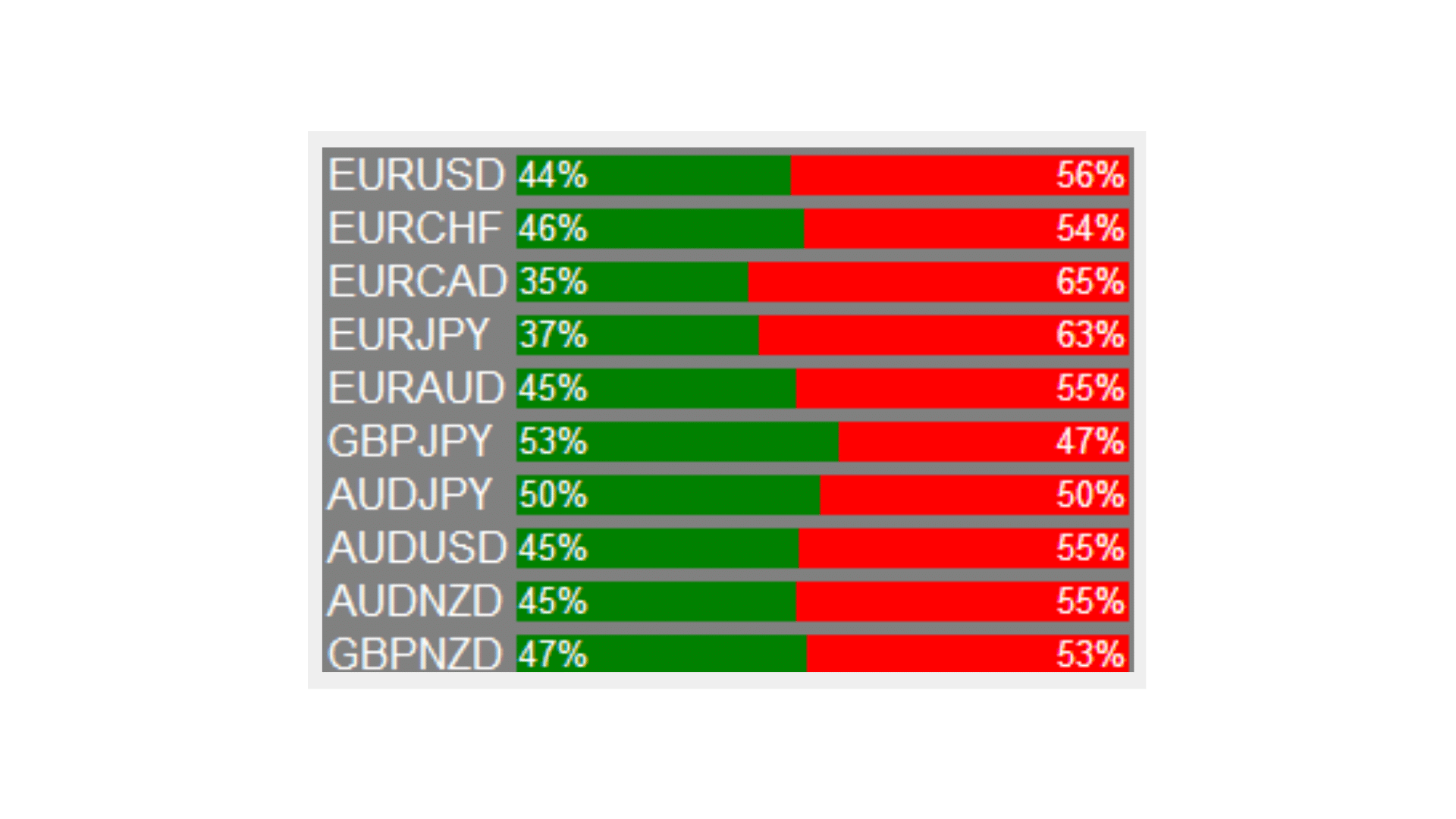

There are many different indicators you can use to try and read and analyze order flow.

One of these indicators is the MT4 order flow indicator.

This indicator shows you a percentage of buy and sell orders directly on your MetaTrader charts.

This is a premium indicator, but you can try a free demo version.

Get the Order Flow Indicator for MT4 Here.

NOTE: You can get your free order flow trading strategies PDF below.