With technical analysis, the prices of all financial instruments move in upward and downward waves. These waves can be used to determine the trend direction and determine when a trend is ready to change direction.

Wall Street veteran trader Bill Wolfe discovered the Wolfe Wave pattern as a natural pattern caused by an imbalance between buyers and sellers.

This trading guide takes an in-depth look at the Wolfe Wave pattern and how it can be used to time price reversals in any market.

NOTE: Want a full list of some of the best free MT4 and MT5 indicators you can use in your trading? You can get them below.

Table of Contents

What is the Wolfe Wave Pattern?

In technical analysis, the Wolfe Wave pattern is made of 5 alternating up and down waves used to identify high probability reversal signals. In this 5-wave price formation, there is a perfect symmetry between the first four waves.

According to Bill Wolfe, the 5-wave price formation can be encapsulated within a price channel. Based on the theory behind this advanced pattern, the first four waves stay trapped inside the price channel, whereas the fifth wave makes a false breakout, signaling that the prevailing trend might turn direction.

Independently, price channels only help traders know where the price is heading within the channel, but they fail to cast a light on where the breakout might happen. However, using price channels combined with the theory behind the Wolfe Wave pattern, traders can have more insights into predicting these breakouts.

Looking at the structure of the waves, the Wolfe Wave pattern can help traders forecast price reversals and accurate profit targets that are easy to project.

This naturally recurring pattern happens across all time frames, from the intraday charts to the daily and weekly time frames.

Wolfe Wave Trading Rules

Wolfe Wave looks similar to the Elliott Wave formation, but it follows different trading rules. While Elliott Wave requires the waves to follow certain Fibonacci ratios, the Wolfe Wave trading rules are easier to follow.

To recognize Wolfe Wave patterns, trades need to look at the following key rules:

- The price channel created by waves 1 and 2 must contain waves 3 and 4.

- Wave 1 and 2 should be equal in length with waves 3 and 4 (this is no hard rule).

- Wave 4 touches the channel trendline established by waves 1 and 2.

- Between wave points 1, 3, and 5, there are equal timing intervals. In other words, the time taken to complete one cycle from low to low (high to high) is approximately the same.

- Wave 5 always breaks above (below) the trendline that connects waves 1 and 3.

The Wolfe Wave pattern can be found both in an uptrend and a downtrend.

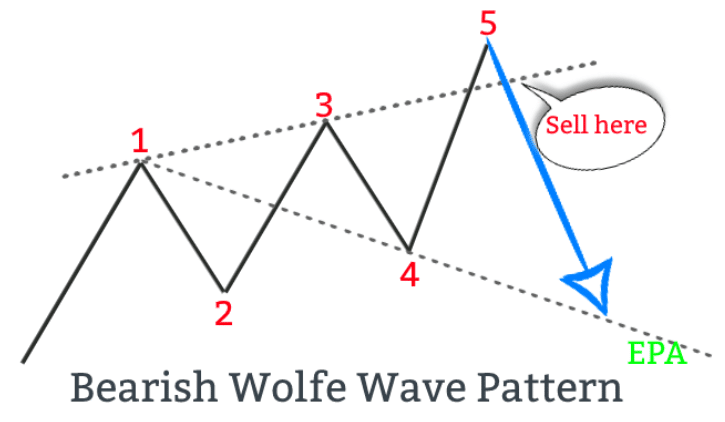

Bearish Wolfe Wave Pattern

The bearish Wolfe Wave pattern matches the price structure of an upward channel or the rising wedge pattern. As the name suggests, this pattern signals a trend reversal from bullish to bearish.

In the bearish Wolfe Wave pattern, waves 1, 3, and 5 are the endpoints of swing highs whereas, wave 2 and wave 4 are the endpoints of two successive higher lows.

To recognize a bearish Wolfe Wave pattern, traders need to look for the following criteria:

- Wave 2 is a swing low.

- Wave 3 is the new swing high of the first rally.

- Wave 1 is the swing high before wave 2, that wave 3 must surpass.

- Wave 4 is the swing low of the decline following wave 3.

- Wave 5 is a new swing high following wave 4 that breaks above the extended trendline that connects wave 1 and waves 3.

- Wave 5 high is the entry point for a ride to the estimated price arrival (EPA).

The figure below outlines the bearish Wolfe Wave pattern.

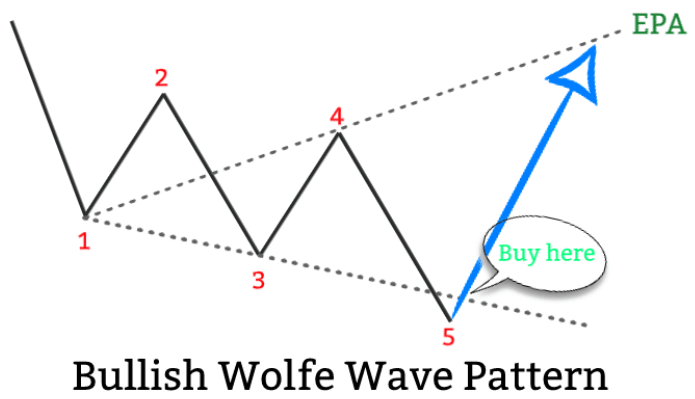

Bullish Wolfe Wave Pattern

The bullish Wolfe Wave pattern matches the price structure of a downward channel or the falling wedge pattern. As the name suggests, this pattern signals a trend reversal from bearish to bullish.

In the bullish Wolfe Wave pattern, waves 1, 3, and 5 are the endpoints of swing lows whereas, wave 2 and wave 4 are the endpoints of two successive lower highs.

To recognize a bullish Wolfe Wave pattern, traders need to look for the following criteria:

- Wave 2 is a swing high.

- Wave 3 is the new swing low of the first decline.

- Wave 1 is the swing low before wave 2, which wave 3 must surpass.

- Wave 4 is the swing high of the rally following wave 3.

- Wave 5 is a new swing low following wave 4 that breaks below the extended trendline that connects wave 1 and waves 3.

- Wave 5 low is the entry point for a ride to the estimated price arrival (EPA).

The figure below outlines the bullish Wolfe Wave pattern.

How to Trade the Wolfe Wave

Before traders can understand how to trade the Wolfe Wave, we need first to understand two additional concepts that are behind the Wolfe Wave theory, namely:

- The estimated time arrival (ETA),

- And the estimated price arrival (EPA).

The trendline formed by connecting waves 2 – 4, and the trendline formed by connecting waves 1 – 3 – 5 meet is called the estimated arrival time (ETA). At the same time, the line connecting wave 1 and wave 4 is called the estimated price arrival (EPA).

Based on the Wolfe Wave theory, ideally, the price is expected to reach the estimated price arrival (EPA) before the estimated time arrival (ETA).

In a Wolfe Wave pattern, the entry signal is triggered after the fifth wave breaks out of the channel and then reverses back inside the price channel. According to Wolfe Wave theory, the fifth wave of the pattern must be followed by a false breakout.

When the price reclaims the trendline connecting waves 1, 3, and 5, traders can hold the trade until the price touches the estimated price arrival (EPA). In other words, the estimated price arrival (EPA) is the profit target level.

When you correctly identify the Wolfe Wave setup, the endpoint of the fifth wave represents the ideal place to take a long or short position.

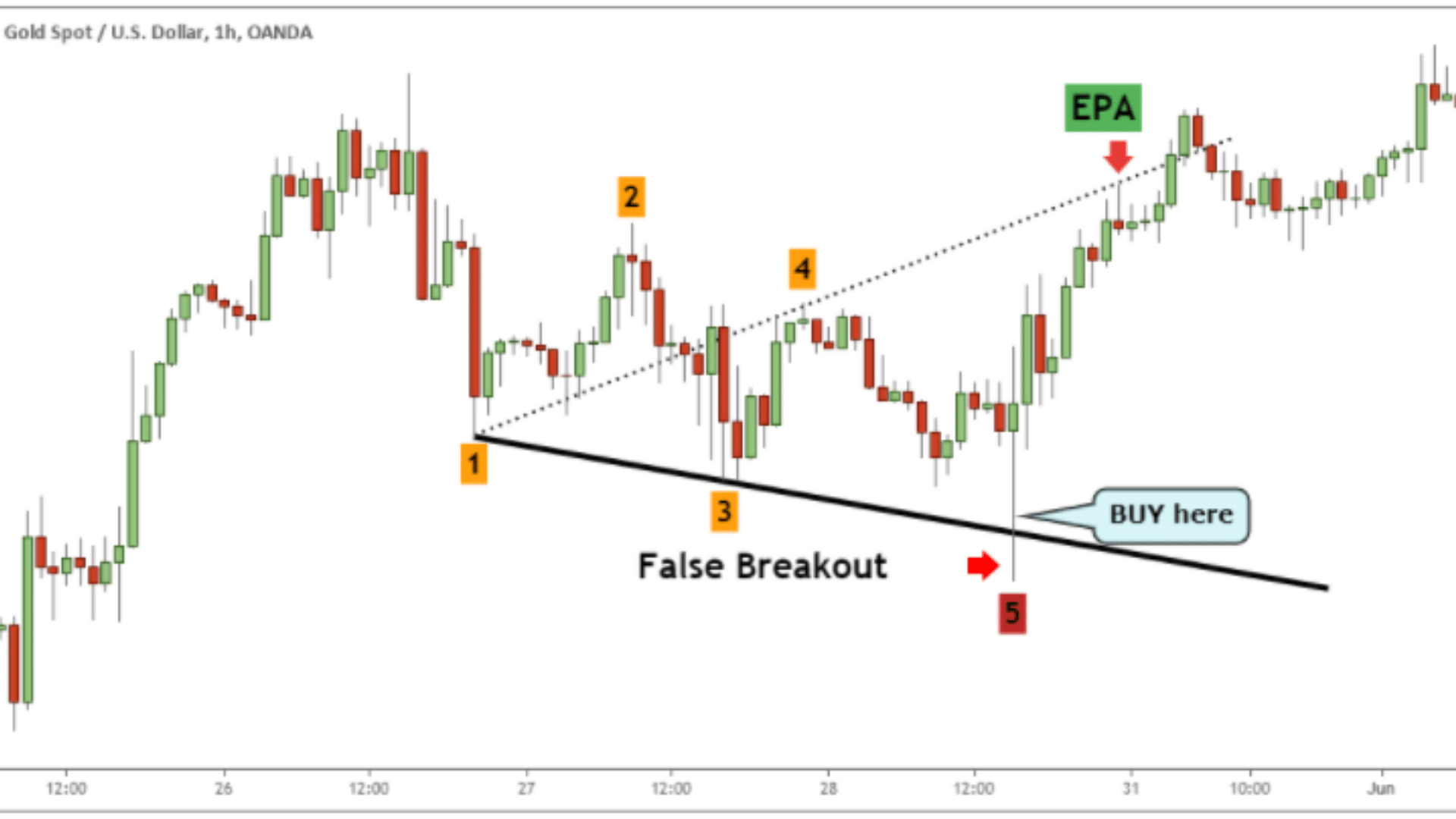

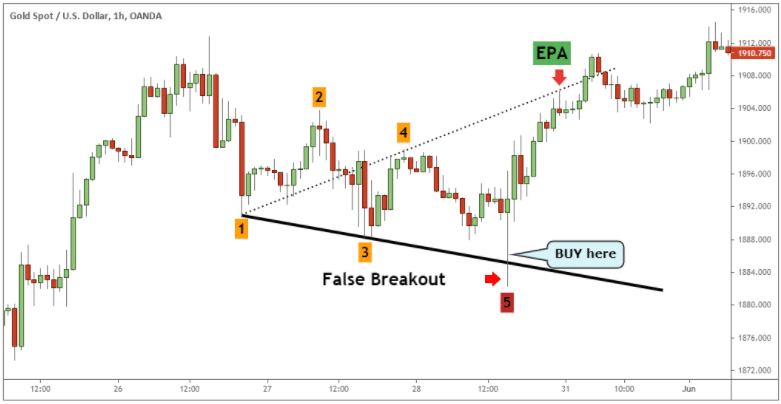

Below is an example of a bullish Wolfe Wave pattern at work.

Wolfe Wave Indicator for MT4

There is no built-in version of the Wolfe Wave indicator that comes as a default MT4 indicator. In this regard, traders need to rely on external sources to access the Wolfe Wave indicator.

The main feature of the Wolfe Wave indicator is that each wave is numbered accordingly, and the upper and lower trendlines are drawn automatically.

You can get the free Wolfe Wave indicator for MT4 here.

Wolfe Wave Indicator for MT5

Similarly to the MetaTrader 4 platform, there is no built-in version of the Wolfe Wave indicator that comes as a default MT5 technical indicator. In this regard, traders need to rely on external sources to access the Wolfe Wave indicator.

The Wolfe Wave indicator for MT5 will automatically identify the 5 wave price structures and draw the upper and lower trendlines. Additional functionalities include:

- Changing the colors for each wave

- Enable or disable the target

- Alert function

- Arrows for buy and sell signals

You can get the free Wolfe Wave indicator for MT5 here.

Note: Don’t know how to install and use these indicators? Read How to Download, Install and Use MT4 and MT5 Indicators.

Wolfe Wave Indicator Tradingview

Unfortunately, TradingView doesn’t provide a built-in version of the Wolfe Wave indicator. Traders will have to rely on what they can find inside the Public Library, where different versions of the Wolfe Wave indicator can be found.

You can get the free Wolfe Wave indicator for TradingView here.

This is a script designed to find entries for the Wolfe Wave pattern.

Wolfe Wave Pattern Scanner

The basic premise of the Wolfe Wave pattern scanner is to scan the entire market across multiple time frames and find good instances of the Wolfe Wave pattern. The automatic detection of the Wolfe Wave pattern is a handy tool that will help traders find more trading opportunities.

With the naked eyes, it’s tough to recognize all the instances this pattern shows up on your chart. An algorithm can filter out the patterns that don’t satisfy the Wolfe Wave trading rules much better than humans.

Additionally, with algorithms, human emotion will have much less effect on your overall performance.

Lastly

Traders interested in using the Wolfe Wave indicator need first to study the theory behind this pattern if they want maximum profit.

The Wolfe Wave pattern can be extremely profitable if used correctly because it gives traders the chance to participate in the market right from the start of a new trend.

Lastly, in terms of the risk to reward ratio, the Wolfe Wave pattern is very attractive as it offers traders the chance to risk a minimal amount of money, but the upside potential can be three or four times bigger.